Tesla is testing a rental plan of its own through company showrooms, a shift that stands to push sales despite showing signs of slowing and open up a new revenue stream for the automaker. The initiative, which was first reported by Electrek, starts in Southern California, with locations in San Diego and Costa Mesa, but is expected to spread. Prices begin at about $60 a day, with minimum and maximum lengths of three days and seven days, respectively, and include free Supercharging and access to Tesla’s monitored Full Self-Driving capability during the rental. Customers who convert to a purchase within one week receive a $250 credit.

Why Tesla Is Renting Out Its Own Cars to Boost Sales

The action solves a crucial sales problem: it’s on the hook for cooling demand growth in EVs as well as its own resale values. Tesla’s year-over-year deliveries began to fall in early 2024 for the first time since the pandemic, and its share of the U.S. EV market has fallen from above 70% in 2020 to around 50% in 2024, according to Cox Automotive. Price reductions meant to defend share compressed margins and trained buyers to wait for bargains.

On the other hand, used EV prices plummeted through 2024. Rental colossus Hertz started selling off some 20,000 EVs — largely Tesla models — due to punitive repair costs and weaker residuals, company filings and earnings calls revealed. Tesla’s direct-to-consumer rental play effectively cuts out the middleman, keeps vehicles in the Tesla ecosystem and turns inventory into a try-before-you-buy funnel.

How the Program Works for Tesla’s Showroom Rentals

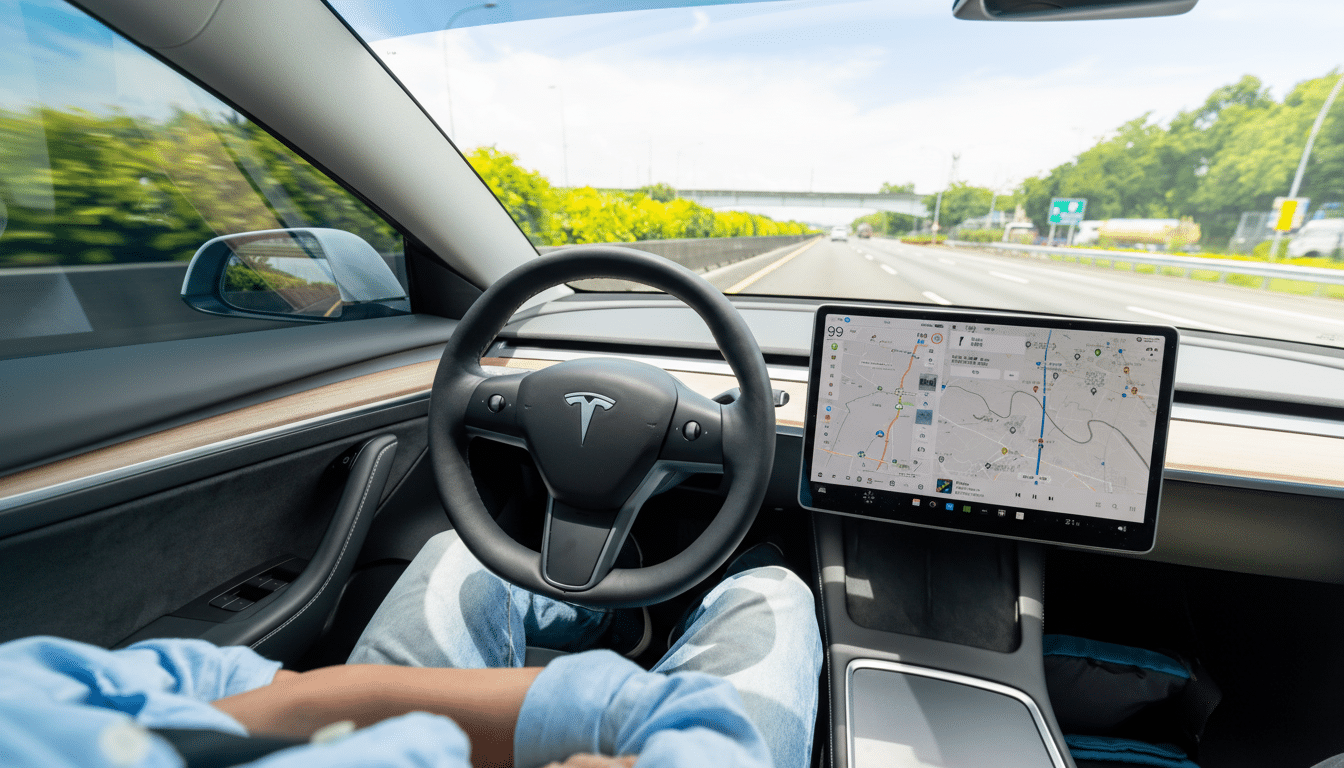

Tesla is serving short-term rentals directly from certain showrooms, and the cost varies between the models. The package is designed to scrape off friction: free Supercharging removes fuel anxiety; supervised Full Self-Driving allows renters to try out a flagship feature; and a post-rental purchase credit nudges conversion. By expanding the opportunity for a test drive from an hour or two to a multiday smörgåsbord — commuting, charging, parking and everything in between — Tesla can highlight everyday perks that spec sheets don’t communicate.

From an operational perspective, the three-to-seven-day time frame also makes sense. It also makes fleet management simpler, minimizes mechanical wear-and-tear relative to traditional high-turnover rentals, and stabilizes utilization rates. For Tesla, the data produced — where people drive, charge patterns and adoption of features — could help direct product development, as well as set prices and choose locations for showrooms without relying on third-party rental partners.

A Bid to Shore Up Demand and Residuals for Tesla

Rentals give Tesla a new top-of-funnel channel at a time when buyer math has become convoluted.

Eligibility for the clean vehicle tax credit has varied by model and battery-sourcing rules, while insurance and repair costs for electric vehicles are another widespread consumer concern. And for those concerned about being tethered to charging, a low-friction rental allows shoppers to test both charging availability and total cost of operation as well as safety features in their everyday routines before signing on the dotted line.

And there’s a residual value aspect to keep in mind. If Tesla can keep more of its vehicles within its own walled rental garden, it may be able to dampen depreciation by controlling supply drips onto the used market instead of dumping off entire fleets en masse. Secondary-market dynamics are smoother, supporting lease values (and hence monthly payment affordability — critical for demand). Analysts from S&P Global Mobility and J.D. Power have noted that residuals and incentives are now more driving in the decision-making process of consumers with respect to EVs than they were in previous years.

Risks and Industry Context for Tesla’s Rental Strategy

Running a rental fleet is not easy. Utilization, insurance, collision repair cycle times and customer screening all affect profitability — pain points that helped nudge Hertz to unwind part of its EV bet. Tesla has vertical integration on its side: direct retail, proprietary charging, over-the-air diagnostics and a powerful brand pull. But if resale values drop further or repair costs remain high, the rentals could squeeze margins instead of easing them.

Competition is intensifying as well. A range of rivals from Hyundai–Kia to Ford are stretching appealing EVs even farther with snazzy financing and dealer-backed test-drive programs. Broader sector uncertainty — along with price volatility in Tesla over the last two years — has been doing that, too, while some shoppers grow more cautious. Turning rental curiosity into purchases will depend on stable pricing, robust financing offers and clear total-cost-of-ownership messaging.

What to Watch Next as Tesla Expands Showroom Rentals

Key signals will be how quickly Tesla extends the program to other regions outside of Southern California, what models are available and whether it offers corporate or weekly subscriptions to help even out demand. Look for conversion metrics — what percentage of renters become buyers — and to any adjustments made to incentives. Also of note is the impact to used Tesla pricing and service capacity in regions where rentals are scaled.

If successful, showroom rentals could become a permanent pillar of Tesla’s retail strategy, mixing marketing and monetization. Otherwise it will look like a stopgap during tough sales. Either way, Tesla’s move underscores a new EV reality: The next frontier of growth will be driven less by novelty and more by the ease and practicality of ownership, the ability to access (versus own) a vehicle when necessary and disciplined economics.