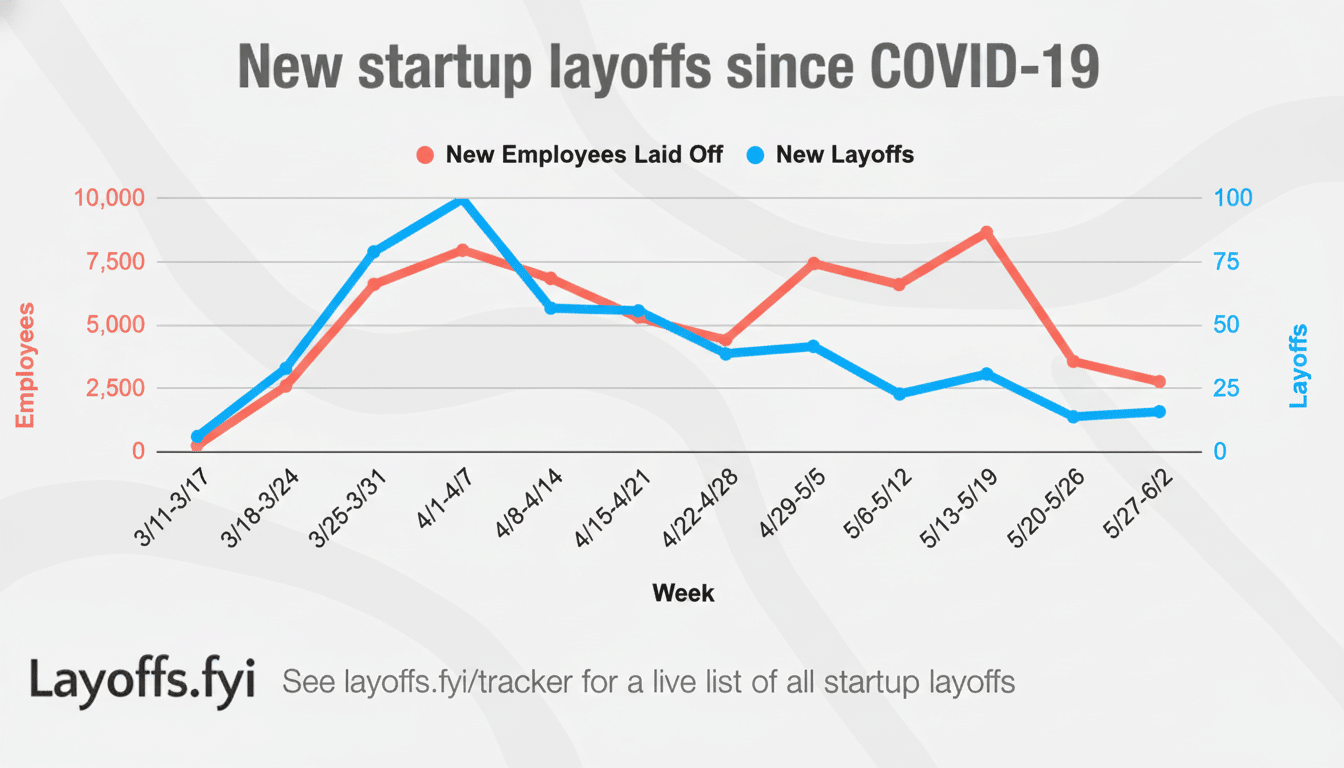

The new tech layoffs are speeding up as companies rebalance for A.I., streamline their go-to-market models, and confront a more constrained capital and export environment. Layoffs.fyi. Add it all up, and last year saw well over 150,000 tech job cuts across more than 500 companies, and the current cycle has already added tens of thousands more to the list (not counting a couple of weeks ago when we topped 16,000 in a single month). Tech remains one of the most active industries for job cuts, though, according to outplacement firm Challenger Gray & Christmas and other labor trackers, while certain A.I. and chip roles are still experiencing relatively strong hiring.

The big picture: where tech job cuts are clustering

Across the ecosystem, there are three converging themes where cuts cluster: automation in place of internal support and back-office work; portfolio pruning to fund A.I.-first bets; and margin repair in hardware, EVs, and ad-driven platforms. Both Gartner and IDC have signaled a budget shift toward A.I. infrastructure and cloud optimization, frequently to the detriment of legacy projects and duplicate teams.

- The big picture: where tech job cuts are clustering

- Big Tech and platforms adjust staffing amid AI pivot

- Semiconductors and hardware face cuts and reshuffling

- Enterprise software and cloud streamline for profitability

- Marketplaces and consumer internet reduce headcount

- EVs and transportation trim teams amid market slowdown

- Gaming media and creator tools see targeted layoffs

- Real estate and commerce firms announce job reductions

- Startups and shutdowns highlight venture market strain

- Why companies are cutting: common themes and factors

- What to watch next as AI reshapes tech labor markets

Big Tech and platforms adjust staffing amid AI pivot

Amazon has maintained multi-wave corporate layoffs, with more cuts reported in New York state filings and reorganized teams who sell devices and services for better coverage of accounts, according to Bloomberg. The company has emphasized selective hiring in A.I., while cutting elsewhere.

Google has made targeted cuts in its platforms and devices organization (Android, Pixel, and Chrome), removed more than 100 design roles in cloud, and rolled out a voluntary exit program across People Operations, The Information and CNBC reported. The company is redeploying headcount toward A.I. and infrastructure investment.

Meta cut roles throughout the A.I. infrastructure groups as well, including FAIR, while also shrinking headcount in Reality Labs and applying a 5% performance-based reduction. Company communications suggest the twin intentions of running leaner and doubling down on next-generation A.I. products.

Salesforce said that it was making further cuts at its San Francisco headquarters after previously cutting in the Pacific Northwest and that actions were connected to moving toward A.I.-powered support and efficiency. As it retools around e-commerce and A.I.-driven efforts, ByteDance has also reduced staff in its Seattle-area operations.

Semiconductors and hardware face cuts and reshuffling

Intel announced broad cuts to its workforce as it restructures corporate and manufacturing departments worldwide, with more actions reported at key U.S. hubs, Bloomberg and other business outlets say. The moves also come as there has been heightened attention to foundry competitiveness and cost management.

Nvidia is laying off around 4% of its staff (some 1,400 roles) due to tougher export control constraints and has redeployed resources toward priority roadmaps. Lenovo said it will cut an additional 3% of its U.S. workforce as PC demand normalizes and the company invests in AI PCs. Industrial group ABB intends to cut around 5,600 jobs as it restructures its automation and EV charging businesses under a drive for competitiveness.

Enterprise software and cloud streamline for profitability

Atlassian has shed something like 150 roles in customer service and support, saying ticket volumes were down because of platform improvements. Paycom is cutting over 500 jobs with A.I. and automation deflating back-office workloads, but will offer severance and outplacement services to impacted workers.

Google’s cloud division cut more than 100 design positions and Salesforce trimmed the products and technology group, as companies continue to chase profits from slimmed-down ranks for A.I.-era products. TomTom is laying off about 10% of staff — around 300 positions — in a sales-and-support reorg that it announced alongside a major shift away from its devices- and hardware-focused roots into technologies. Addressing questions about why TomTom had been quick to rule out the idea of selling Telematics (formerly known as TomTom’s Automotive business), it declined to say but noted that there was already an intention to reduce headcount when it announced the deal.

Marketplaces and consumer internet reduce headcount

Fiverr intends to cull around 30% of its workforce in an effort to transform into an A.I.-native marketplace with fewer layers of management, according to The Wall Street Journal. Recruit Holdings is integrating Indeed with Glassdoor and will eliminate some 1,300 jobs at the combined company, targeting duplication in R&D and shared functions.

According to a report, Chegg is laying off some 248 employees, or about 22% of its workforce, as students become more reliant on A.I. tools than their traditional study buddies. Just Eat Takeaway will cut 450 jobs by automating and AI-ing manual customer service grunt work.

EVs and transportation trim teams amid market slowdown

Rivian has laid off some 200 workers (or about 1% to 2%) and is repositioning for a more affordable trim line in the midst of a broader EV market slump. General Motors has cut around 200 jobs at an electric vehicle plant as it matches investments and production with demand signals and cost targets.

Gaming media and creator tools see targeted layoffs

Meanwhile, Electronic Arts is apparently laying off 300–400 employees (roughly 100 at Respawn) to focus its cash on franchises where it can better see a return. Wondery, which is owned by Amazon, is cutting about 100 jobs as Amazon consolidates audio under Audible and shifts video podcasts within a creator service group.

Some creator and social startups have either pared back or gone out of business, underscoring how intense it has become to compete for attention and ad dollars. One venture-backed creator-collaging app has shut down, while companies focused on audio and writing tools have trimmed teams to extend runway and prioritize A.I. features.

Real estate and commerce firms announce job reductions

Opendoor reported roughly 450 job cuts in an SEC filing as it restructures after its partnership with Zillow. Several e-commerce enablement companies shed staff this year after falling short of their growth expectations, blaming elongated sales cycles and the need for a smaller go-to-market.

Startups and shutdowns highlight venture market strain

Windsurf, an A.I. coding startup bought by Cognition, laid off about 30 employees and made buyout offers to most of the rest as the acquirer prioritized IP over headcount. After a failed sale attempt, fintech Cushion shuts down and lays off staff. It’s been a rocky road for all things fintech these days. Other fintech and cybersecurity businesses also announced staff cuts between 20% and 40%, as venture funding remains selective and customers put pilot programs on hold.

Why companies are cutting: common themes and factors

Top causes mentioned. PosChengdu IGET / Getty Images. Financial conditions remain robust. Top causes cited in company filings and earnings calls—read: Q&A about the economy with Moody’s Mark Zandi—include A.I.-enhanced productivity gains, consolidation following M&A, export and trade limitations for semis, lower demand for EVs, and higher-for-longer capital costs. McKinsey’s research on A.I. adoption finds that support, sales, and developer tooling—places where a lot of these cuts are concentrated—are seeing rapid capability improvements.

What to watch next as AI reshapes tech labor markets

Key signals to monitor

- Ratio of A.I. and chip hires versus ops and support cuts

- Private equity take-privates that lead to synergy targets

- Export control impact on chip roadmaps

- Whether ad and consumer spending, including platforms, stabilizes

Note: As Layoffs.fyi, Reuters, Bloomberg, The Wall Street Journal, and company filings add new disclosures, this tracker will stay current on where headcount is falling — and where it is being redeployed as part of the A.I. pivot.