Verizon’s long-held lead in total U.S. wireless subscribers is under real pressure. Fresh quarterly results show T-Mobile tightening the gap, and unless trends shift, the industry’s pecking order could flip sooner than many expected.

The growth gap narrows as T-Mobile adds more customers

In the latest quarter, T-Mobile reported 2.3 million net customer additions, including 1 million postpaid lines—traditionally the most prized segment for carriers. AT&T posted 405,000 postpaid net adds. Verizon, by contrast, shed about 7,000 postpaid phone subscribers, even as other parts of its business held up.

- The growth gap narrows as T-Mobile adds more customers

- Postpaid pain versus prepaid and fixed broadband gains

- Why T-Mobile’s growth engine continues to accelerate

- How Verizon aims to defend share and improve results

- Why the subscriber race matters beyond bragging rights

- What to watch next in the U.S. wireless market

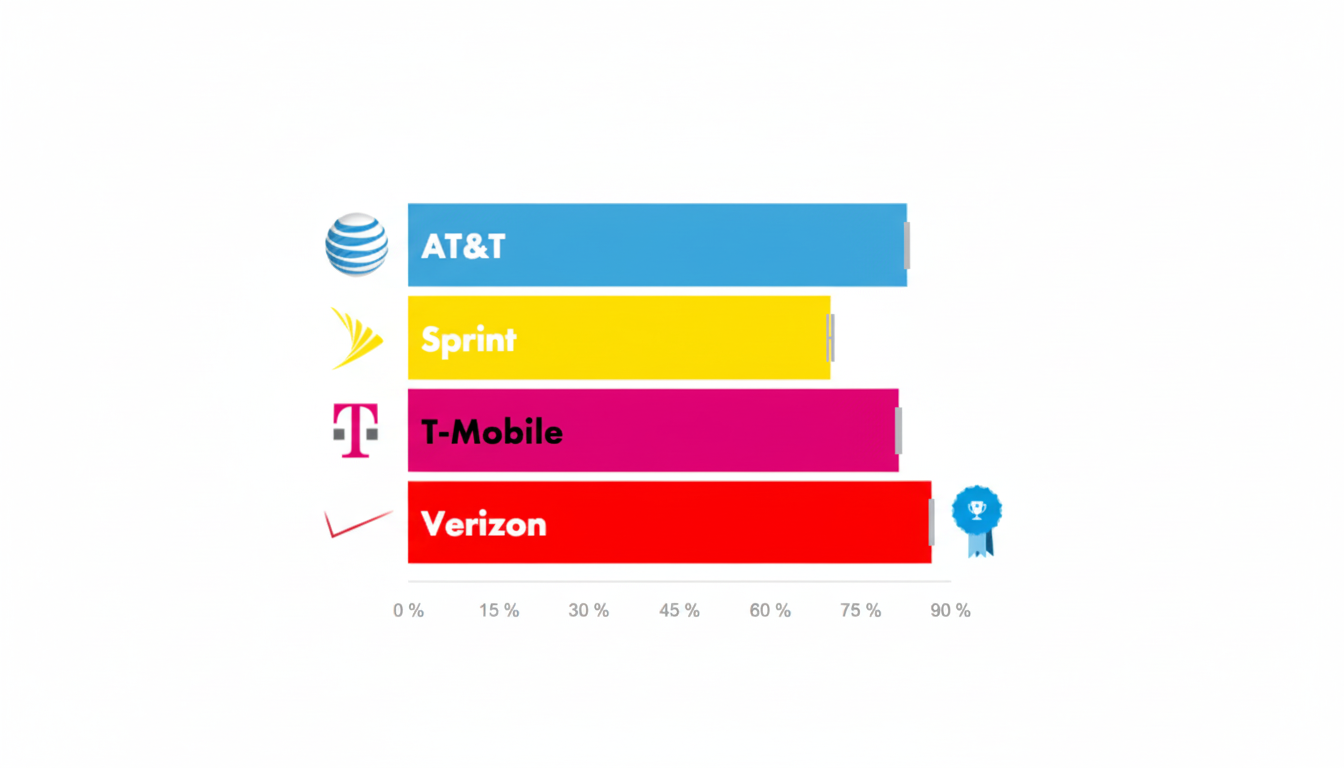

Big picture, the totals are converging. Industry estimates suggest Verizon sits near 146 million total connections, with T-Mobile around 140 million and AT&T roughly 120 million. At this pace, T-Mobile could match or surpass Verizon’s total subscriber count within the next year if momentum holds.

Postpaid pain versus prepaid and fixed broadband gains

Verizon’s quarter wasn’t uniformly weak. It grew prepaid by roughly 47,000 lines and continued to expand fixed wireless access broadband and enterprise services—areas that support revenue and cash flow. Value brands and wholesale channels also contribute, though not all of those lines appear in core postpaid phone tallies that Wall Street watches most closely.

Still, postpaid phone metrics carry outsized weight. Those customers churn less and spend more, so even modest declines can color investor perception. That’s where T-Mobile has been consistently out-executing—keeping churn low and stacking net adds while maintaining pricing power through premium plans.

Why T-Mobile’s growth engine continues to accelerate

T-Mobile’s growth engine is still running hot for a few reasons. Its early lead in mid-band 5G—boosted by spectrum gained in the Sprint merger—continues to translate into strong network experience scores from independent testers like Opensignal and Ookla. Faster average speeds and wide 5G availability have been powerful marketing assets.

The carrier also leans on aggressive trade-in offers, simple plan structures, and rapid expansion of FWA home internet into suburban and rural markets. That combination has created a steady funnel of switchers without leaning solely on deep discounts. And while leadership changes at both companies have made headlines, T-Mobile’s operating cadence hasn’t skipped a beat.

How Verizon aims to defend share and improve results

Can Verizon keep the lead? Verizon is not standing still. Its C-band 5G deployment is well underway, narrowing performance gaps in many markets. The company has emphasized quality over raw subscriber counts, pushing premium “build-your-own” plans, enterprise mobility, private networks, and FWA to diversify growth. It remains financially solid and has often topped earnings expectations even amid postpaid phone softness.

Where Verizon could move the needle next

- Recalibrate device promotions to better match rivals on switcher incentives

- Expand family and multi-line value to improve retention and ARPU

- Sharpen bundles across mobile and home internet for clearer savings

- Improve mid-band 5G consistency—especially indoors and along commuter corridors

Why the subscriber race matters beyond bragging rights

Being the largest carrier isn’t just a trophy; it reinforces momentum. Scale lowers acquisition costs, improves wholesale leverage, and amplifies marketing reach. If T-Mobile becomes No. 1 in total subscribers while already leading many 5G experience rankings, the optics could accelerate the flywheel further.

Wild cards that could reshape competitive dynamics

Cable MVNOs like Xfinity Mobile and Spectrum Mobile continue to siphon cost-conscious switchers, impacting all three national carriers. Device cycles ebb and flow, and any shift in handset subsidies or interest rates can quickly reshape churn dynamics. Regulatory scrutiny of promotions and spectrum use also factors into how aggressively the big carriers compete.

What to watch next in the U.S. wireless market

Keep an eye on postpaid phone net adds, not just headline customer numbers. Track churn trends, the mix of premium plan adoption, and FWA growth, which increasingly ties mobile and broadband narratives together. Third-party network studies from Opensignal, Ookla, and J.D. Power will continue to shape consumer perception—and with it, switching behavior.

- Postpaid phone net additions and overall churn rates

- Adoption of premium plans and associated ARPU trends

- FWA subscriber growth and broadband cross-sell momentum

- Independent network performance studies and rankings

Overall, although T-Mobile dominates the industry, Verizon has a bright future and the ability to reach first place. Specifically, the American company has valuable assets, extensive financial resources, and a developed infrastructure that is consistently being modernized. For this reason, the coming periods will show whether Verizon has the potential to convert all these advantages into consumer demand, or T-Mobile is preparing to become the world leader soon.