T-Mobile remains the best pick for postpaid wireless, but that’s more indicative of the industry than it is a runaway advantage. Magenta has the edge on network metrics, but shifts in policy, baits and fees and perks have knocked this tier trifecta flat. If you sign up for a postpaid carrier today, you’re opting for the least-worst option more than obvious value.

Where T-Mobile Remains Ahead on 5G Speed and Coverage

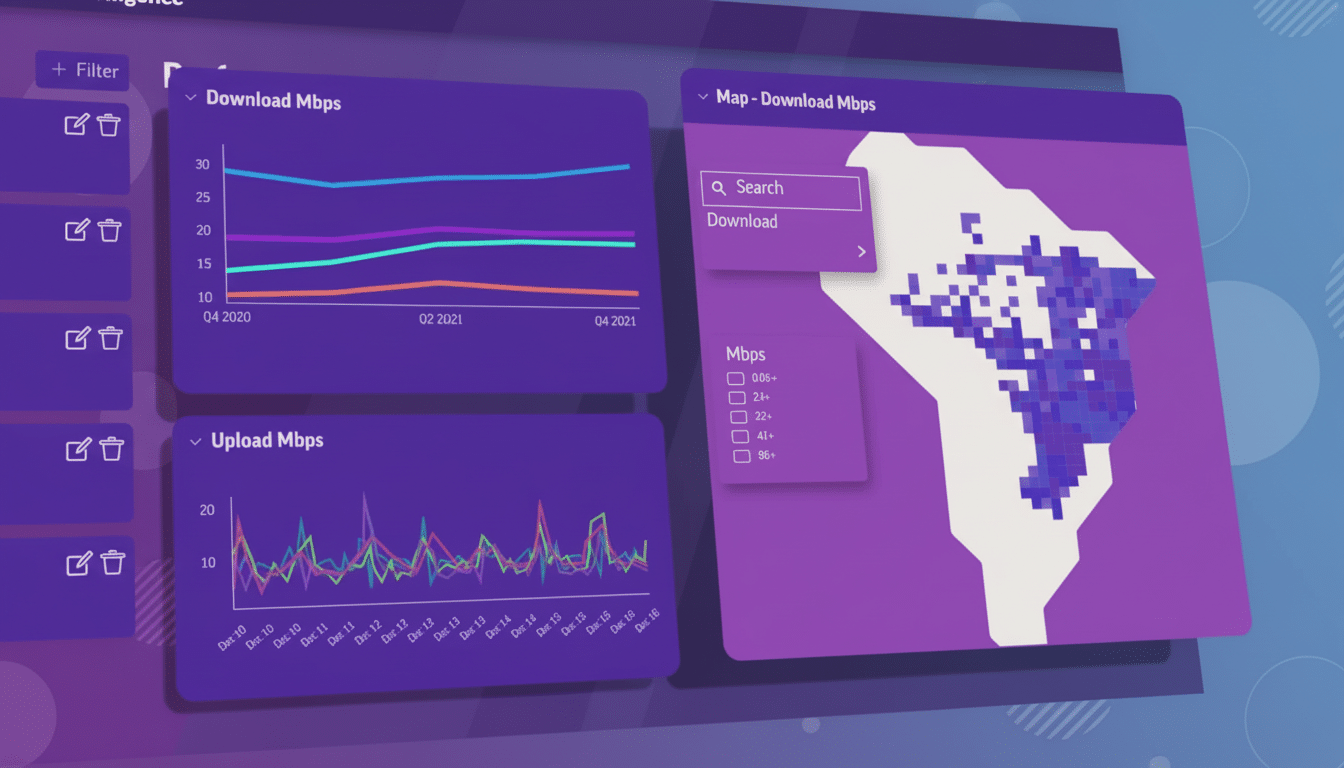

The clearest edge is performance. Independent testing companies consistently rank T-Mobile at or near the top for 5G speed and coverage across the country. Recent quarters of Ookla’s Speedtest Intelligence and Opensignal reports have the T-Mobile network beating rivals on median download speeds and 5G accessibility in most markets, though Verizon tends to take the reliability crowns in RootMetrics scoring. For regular consumers, that typically means quicker app updates, smoother video, and more reliable 5G connections in cities and suburbs.

International usability is another strong card. T-Mobile includes talk, text, and a bucket of high-speed data in 200-plus countries with its mid- and top-tier plans, as well as in-flight Wi-Fi on most major United States airlines. Unless you’re a heavy traveler, you typically won’t have to deal with an additional roaming plan. Factor in hotspot allowances that keep pace with competing tiers and it’s still a plan that, on paper at least, seems customer-first.

There’s another small network advantage postpaid users are likely to notice more than prepaid customers — priority. On busy towers, T-Mobile’s postpaid plans have been known to suffer fewer slowdowns than MVNO lines. It’s not a perk you can screenshot, but when stadiums get packed and festivals jack up demand, it comes in handy.

Why the Postpaid Bar Feels So Low for Wireless Plans

The sheen has dulled. The un-carrier mojo of T-Mobile — no gotchas, no nickel-and-diming — has been stress-tested in the real world with policy changes. The company changed the pricing of some legacy plans and warned that it would no longer maintain a previous price pledge, actions that spurred anger among customers loyal to the service. It also adopted a stricter autopay rule, nudging subscribers to debit or bank payments in order to use discounts. Those moves were not unique — AT&T and Verizon have also nudged up the cost of legacy plans — but the contrast with T-Mobile’s long-standing message is why it stings.

Several security missteps have heightened the anxiousness. High-profile data breaches, including one that exposed tens of millions of records whose disclosure was reported by the company and covered widely in national outlets, created durability concerns about customer protections. T-Mobile says it has spent heavily on making amends, but the trust dent remains for some.

Then there’s the fine print in promotions. The richest phone deals today almost always require new lines and 24–36-month bill credits. It quietly locks you into a structure that turns device promos into multiyear service contracts by another name. It’s not exclusive to T-Mobile — this is an industrywide play — but it helps explain why postpaid today does not feel quite as generous as postpaid yesterday.

Postpaid Perks Versus Prepaid Value in Today’s Market

One reason the bar is low: prepaid wireless and MVNOs have closed much of the experience gap. Brands that piggyback on the big networks are now regularly including full 5G access, hotspot add-ons, and international options for less per month. Though they’re not as often able to keep up with postpaid priority in crowded locations, day-to-day experience can be remarkably comparable for a great deal of people.

Meanwhile, the sticker prices of the big three are coming together. After autopay rules, administrative fees, and streaming perk reshufflings, monthly bottom lines on equivalent postpaid tiers are often only a few dollars apart. Carriers are now relying on financing and trade-in credits to differentiate themselves, not the value of a base plan. Company filings demonstrate postpaid phone ARPU (average revenue per user) hanging around the high-$40s throughout the industry, and churn for leaders like T-Mobile has remained under 1% with inertia left standing alongside innovation.

If price-to-performance is your lodestar, prepaid and MVNOs can win straight up. Postpaid, where it continues to make sense, is when you just want it all: top-tier priority, wide roaming ground coverage, in-flight connectivity, and very easy access to the best trade-in deals.

Who Should Hang On to T-Mobile Postpaid Plans and Why

Three constituencies are particularly poised to gain:

- First, for travelers: If you fly or cross borders often, T-Mobile’s included roaming and in-flight Wi-Fi can still be very compelling.

- Second, deal-stackers: Households running more than one line and swapping between premium plans with frequent device upgrades are generally the ones who see the fattest long-term credits.

- Third, those with legacy plans: if you’re on an old plan with promotional free lines or included taxes and fees, your effective per-line cost can be tough to beat — and likely will be for the foreseeable future.

Everybody else can choose between coverage maps in their specific areas of living and working, looking at the real monthly total after all discounts and fees. If T-Mobile has the best coverage in your region, it probably remains the leader of the postpaid pack. But the win is narrower than it once was, and the options are better than ever.

The headline takeaway: T-Mobile still has the edge, mostly thanks to speed and travel perks, but the industry’s slow slide toward more expensive service that requires a longer commitment makes that edge feel like a victory by inches.

In a market as tight as this one, consumers should consider every line item — priority, roaming, fees, and promo terms — as part of the price. That’s the only way to find out if “best” still means better for you.