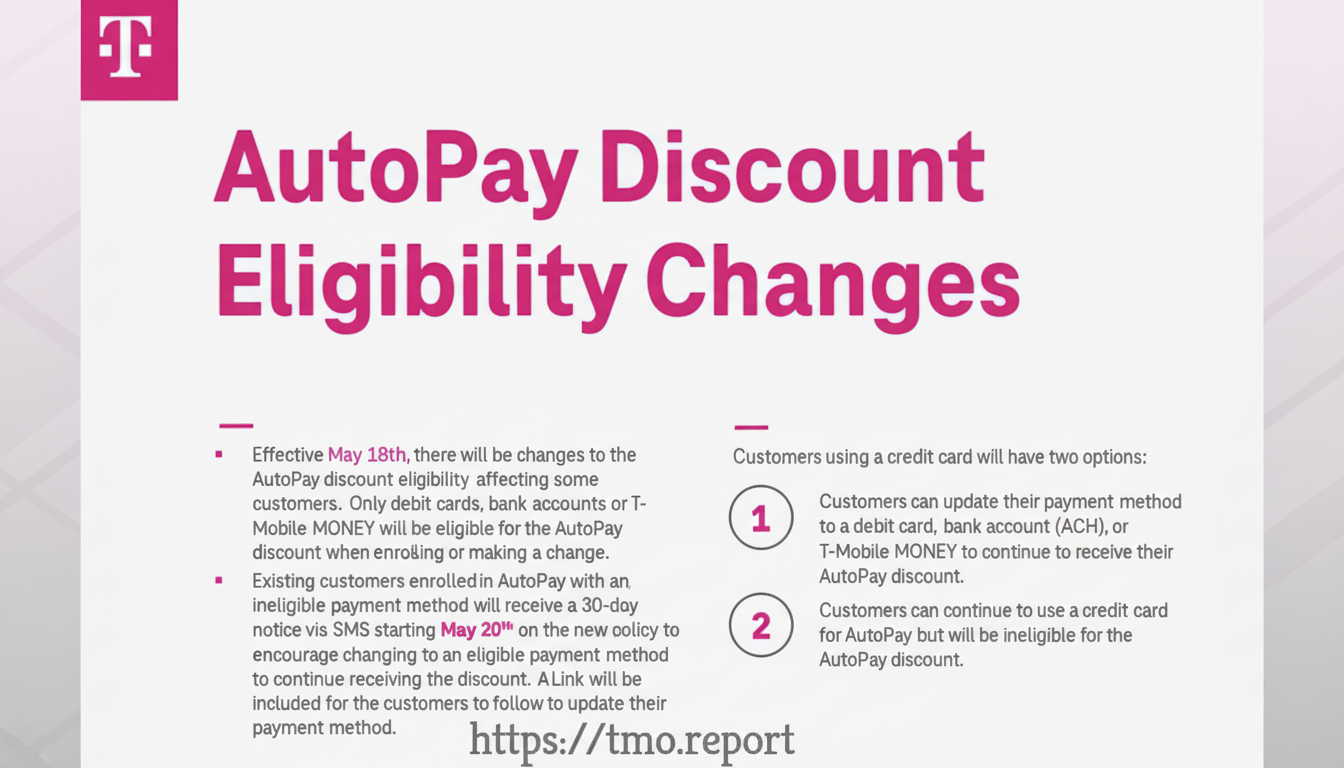

T-Mobile is closing a billing loophole that allowed some customers to stack its AutoPay discount with credit card rewards.

The company now cautions that if a bill is paid ahead of the due date with an ineligible means (most notably, a credit card), the $5-per-line AutoPay discount will be taken off on the subsequent cycle. Eligibility can be restored the next month by paying in full with an approved method, like a linked bank account or debit card.

- What changed for AutoPay and early credit card payments

- Why T-Mobile is squeezing discounts and closing loopholes

- How it compares to AT&T and Verizon AutoPay rules

- What it means for rewards and wireless bill insurance

- Examples and edge cases for early payments and AutoPay

- What customers should do now to keep the AutoPay discount

What changed for AutoPay and early credit card payments

For years, a subset of savvy subscribers arranged AutoPay with a bank account or debit card to receive the monthly discount, then paid the bill early using a credit card.

The balance was hitting zero before the automatic debit ran, which meant customers were keeping the discount and pocketing card rewards as well. T-Mobile has started to break that barrier. Customers making a partial or full early payment with an ineligible tender are receiving texts that say they will lose the AutoPay discount on their next bill.

And the policy resets for each billing cycle. If the subsequent month’s bill is paid fully with an eligible payment method, the discount reappears. Making early payments with a linked bank account or debit card will not harm the discount.

Why T-Mobile is squeezing discounts and closing loopholes

AutoPay discounts are intended to reduce the number of missed payments, lower collections risk and trim transaction costs. Credit card payments are subject to an interchange fee, normally around 2% of the transaction, while bank debits are far less expensive. The Consumer Financial Protection Bureau has said that most credit cards offer 1%–2% in cash back on general purchases, making it awfully hard for bill-payers not to use cards wherever they can. Shutting the loophole brings the promotion in line with T-Mobile’s cost structure.

There’s even a customer experience case to be made. Clarity of bills is always one of the top drivers of satisfaction in J.D. Power’s wireless studies. By enforcing one simple rule—valid method equals discount, invalid method equals no discount—the carrier removes ambiguity and confusion that might lead to support calls or churn.

How it compares to AT&T and Verizon AutoPay rules

T-Mobile’s move puts it in step with rivals that have also retooled their AutoPay terms. AT&T and Verizon limit their AutoPay discounts to methods of payment linked to your bank account or debit card, not credit cards. Its co-branded Visa card from Verizon is an exception, a structure that neutralizes fees while still maintaining the reward hook for loyal customers. Industry observers had long speculated that T-Mobile could follow a similar co-branded route, but there’s no word on any product from the company as of yet.

The bottom line is the same across the Big Three: discounts are more and more tied to lower-cost payment rails, not traditional credit card processing. Any outlier strategies that had previously slipped through are being decommissioned.

What it means for rewards and wireless bill insurance

For families that used credit cards for rewards or perks, the trade-off is more direct. For example, a family with four lines could lose $20 each month — or $240 in a year — if the AutoPay discount is eliminated. By contrast, a 2% cash-back card adds up to about $2.80 on a $140-a-month wireless bill, and how much you get back through rotating bonus categories can fluctuate widely. In the end, in many circumstances the locked-in discount trumps generic rewards.

One wrinkle: a handful of premium cards will provide cell phone protection if the monthly bill is paid using that specific card. That said, American Express and Mastercard World Elite issuers have different policies. Those customers who value that coverage now must decide whether to keep the AutoPay discount or the insurance benefits linked to card payment. Understanding the fine print — including deductibles, claim limits and covered incidents — is crucial to making a smart choice.

Examples and edge cases for early payments and AutoPay

And if you divide payments — for example, paying half early with a credit card and allowing AutoPay to pull the rest — the discount will also be eliminated because an ineligible method touched the bill that month. If, on the other hand, you are scheduled for a bill payment from your linked bank account, and the balance due is zero on the day of AutoPay, then that discount remains in place.

With multi-line accounts with multiple users, if one member uses an ineligible early payment, it can put the F&F in danger across all users in that account depending on how billing is set up. Users should check who has access to payments and what is being stored.

What customers should do now to keep the AutoPay discount

Review your stored payment methods and verify that the default for AutoPay is a bank account or a debit card. Do not pay with a credit card in advance or make a down payment. If you got a text that your discount will be lost next cycle, keep in mind to pay the bill due on the 22nd of this month with an eligible method only in order to give their programming system 30 days to reset.

For those straddling the line between reward and protection perks, do the math annually and compare that to the $5 per line you’re paying in premiums. In most situations, particularly for families, the lower ongoing price is more of a win. As carriers adopt similar rules, wiggle room for stacking discounts with credit card rewards is thinning — and so too is the margin of error.