Hyundai’s advanced air mobility division, Supernal, is bracing for another management reshuffle as a number of senior executives leave the company and deepen uncertainty around its certification path and go-to-market plan for its electric air taxi program.

What Happened at Supernal Amid Executive Departures

The company has dismissed chief strategy officer Jaeyong Song and chief safety officer Tracy Lamb, according to people familiar with the matter. Lina Yang, who was chief of staff to the now-departed CEO Jaiwon Shin, is also out after she previously ran the startup’s work around intelligent systems.

Song’s exit is particularly notable. Before coming to work inside Supernal, he was the person in charge of guiding Hyundai Motor Group’s internal advanced air mobility program for two years, which means that between the corporate parent and the startup, he has perhaps an unprecedented vantage. Lamb, a retired airline captain and former global safety executive, brought decades of experience in developing safety management systems and overseeing aviation operations—skills critical to the type certification of any powered-lift aircraft.

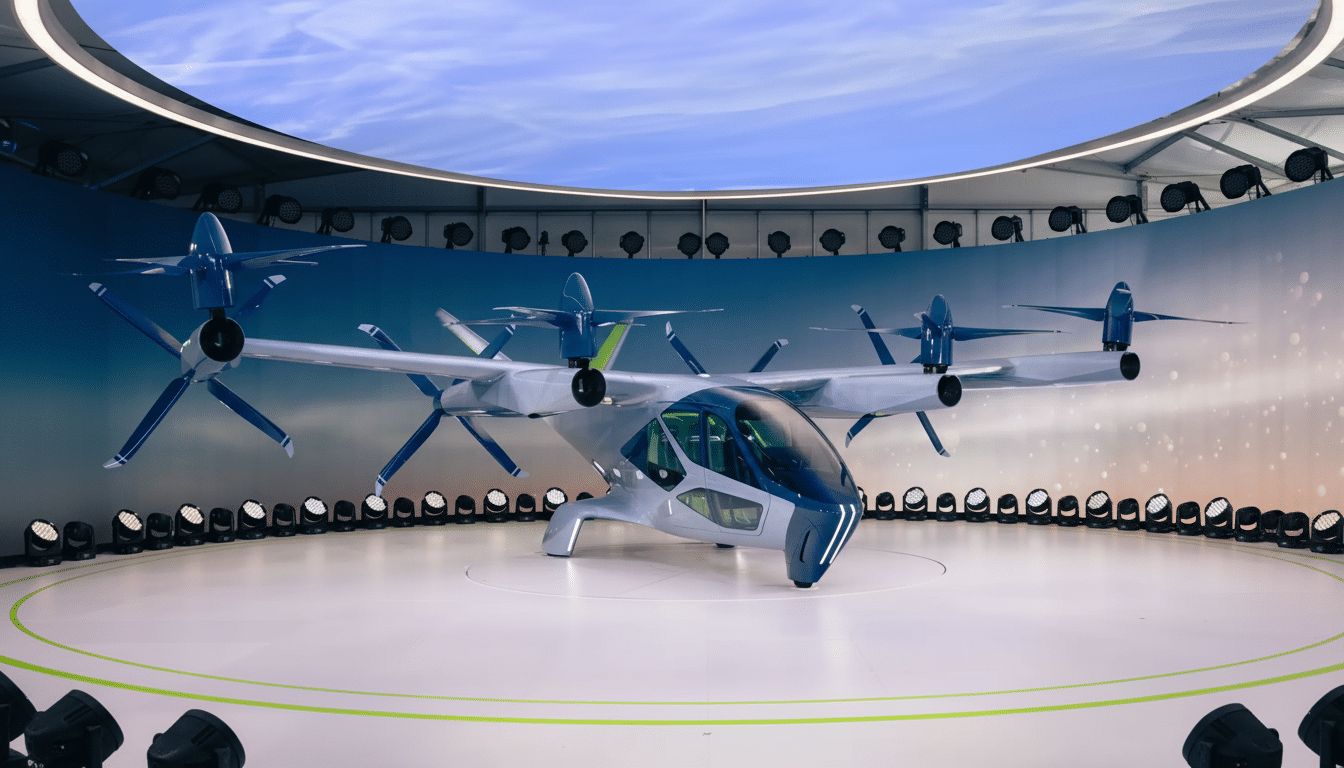

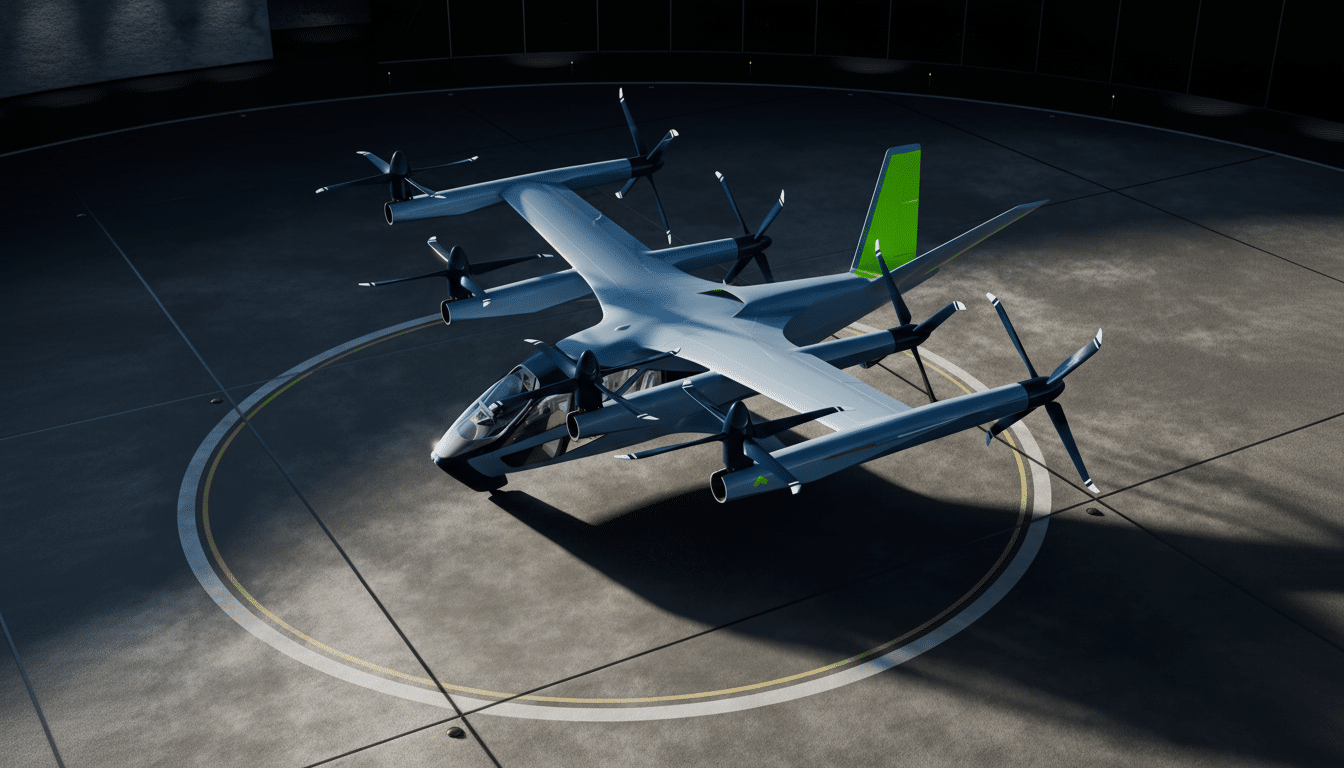

Supernal was founded in 2021 to bring Hyundai’s electric vertical takeoff and landing concept to market. It has since revealed its design known as SA-2, assembled a team across the United States, Europe and South Korea, and formed technology collaborations in avionics, batteries and digital services. Hyundai Motor Group says it is still committed to the AAM business, a multiyear effort that demands both aerospace rigor and automotive-grade manufacturing scale.

Why the Recent Executive Exits Have New Relevance Now

Leadership shake-ups are nothing new in aerospace programs, though losing a strategy leader and a safety leader at the same time is significant for an eVTOL developer on the cusp of some key certification thresholds. They help direct when to pick a supplier, go-to-market and deploy fleets; safety chiefs guide the system safety assessments, verification plans and operational rulemaking engaged with by regulators.

For Supernal, the biggest near-term risk is schedule friction. Switching a chief safety officer in midstream can hamper agreement on means of compliance, hazard analyses and conformity plans that drive the Federal Aviation Administration’s staged certification process. On the strategic side, a reset could set back commercial partnerships that are foundational to early revenue, including access agreements with airports, maintenance support and the pilot training pipeline.

Certification and Safety Stakes for Supernal’s eVTOL Program

The powered-lift framework is based on five phases ranging from receiving a type certificate to achieving operational approvals. The agency’s Innovate28 plan aims to support initial advanced air mobility operations as early as this decade for those manufacturers who jump those design, safety and production hurdles. In Europe, EASA’s SC-VTOL certification specification sets safety targets for new airspace designs with demanding reliability goals on critical systems.

Peers are making visible headway. Joby Aviation and Archer Aviation also possess Part 135 air carrier certificates, and both have said they finished the third of five stages in certification with the FAA. Lilium has published updated key approvals of its regulatory design with EASA, as it moves forward with its ducted-fan layout. Boeing-backed Wisk is chasing autonomy with more time to certification. All of these programs have “bought down” months to address design quality and safety engineering leadership as well as regulatory affairs to keep the must-keep-going momentum alive.

That same yardstick will be applied to Supernal’s safety program. That encompasses robust safety management systems, flight-test oversight and supplier qualification on such things as fly-by-wire controls, batteries and crashworthy structures. NASA’s AAM National Campaign and industry working groups have highlighted that the early operator safety culture—and who takes ownership of it—will influence public acceptance as much as technical performance.

Funding and Timeline Pressure Facing Supernal and Rivals

Advanced air mobility is still capital intensive. The Vertical Flight Society has recorded hundreds of eVTOL concepts worldwide, but few have managed to keep hold of their funding, gain certification traction and set production plans in stone. The developers will need several more billion in equity and debt to bridge certification, tooling and early fleet operations, according to Deloitte and other analysts.

Supernal’s edge is Hyundai’s manufacturing discipline, supply chain reach and balance sheet—all of which can bring down unit costs after an aircraft wins certification. The issue is one of sequencing: It’s arrangements first and then scale, but leadership churn can unsettle suppliers and municipalities attempting to weigh infrastructure commitments. At the same time, rivals are piling up partnerships—automotive manufacturing alliances, deals with the Department of Defense for airport networks and such—to de-risk market entry.

The broader eVTOL market is polarizing as certain programs fold or consolidate while others are able to land strategic investors.

That places a premium on clear milestones: design freeze, conformity article builds, for-credit testing with regulators, and production certification. Any uncertainty around ownership, leadership or schedule can ripple into greater capital costs.

What to Watch Next on Supernal’s Certification and Strategy

The key signals will be whom Supernal places in the roles overseeing safety and strategy, whether it publicly reiterates certification and service-entry goals, and how quickly it makes supplier and infrastructure announcements. Keep an eye out for updates on its FAA certification basis and G-1 issue papers, flight-test pacing, and any participation in NASA’s AAM campaigns that might show maturity to regulators and partners.

The immediate challenge for Hyundai Motor Group is to organize governance around Supernal and keep the engineering and certification machine humming along. In a market where credibility is built one milestone at a time, it won’t be long before we find out if this turbulence is just a passing downdraft—or something that pushes a course correction.