Founders are increasingly declaring “refounding” moments to re-shift strategy, product, and culture — particularly as AI remakes markets. New actions taken by Airtable, Handshake, and Opendoor suggest that refounding is becoming an explicit, high-stakes reboot rather than a subtle pivot.

Unlike a traditional pivot, refounding goes all in on the original ambition with fresh tactics. Leaders are rewriting product architectures around AI, refreshing go-to-market motions, and resetting operating cadence to chase a larger, faster S-curve.

- What refounding really means for strategy, product, and culture

- When to consider refounding as growth stalls in the AI era

- How to pull off a refounding with product and GTM focus

- Risks and investor implications of a high-stakes refounding

- Examples and lessons from Airtable, Handshake, and Opendoor

- The takeaway for startups weighing a bold AI-era refounding

What refounding really means for strategy, product, and culture

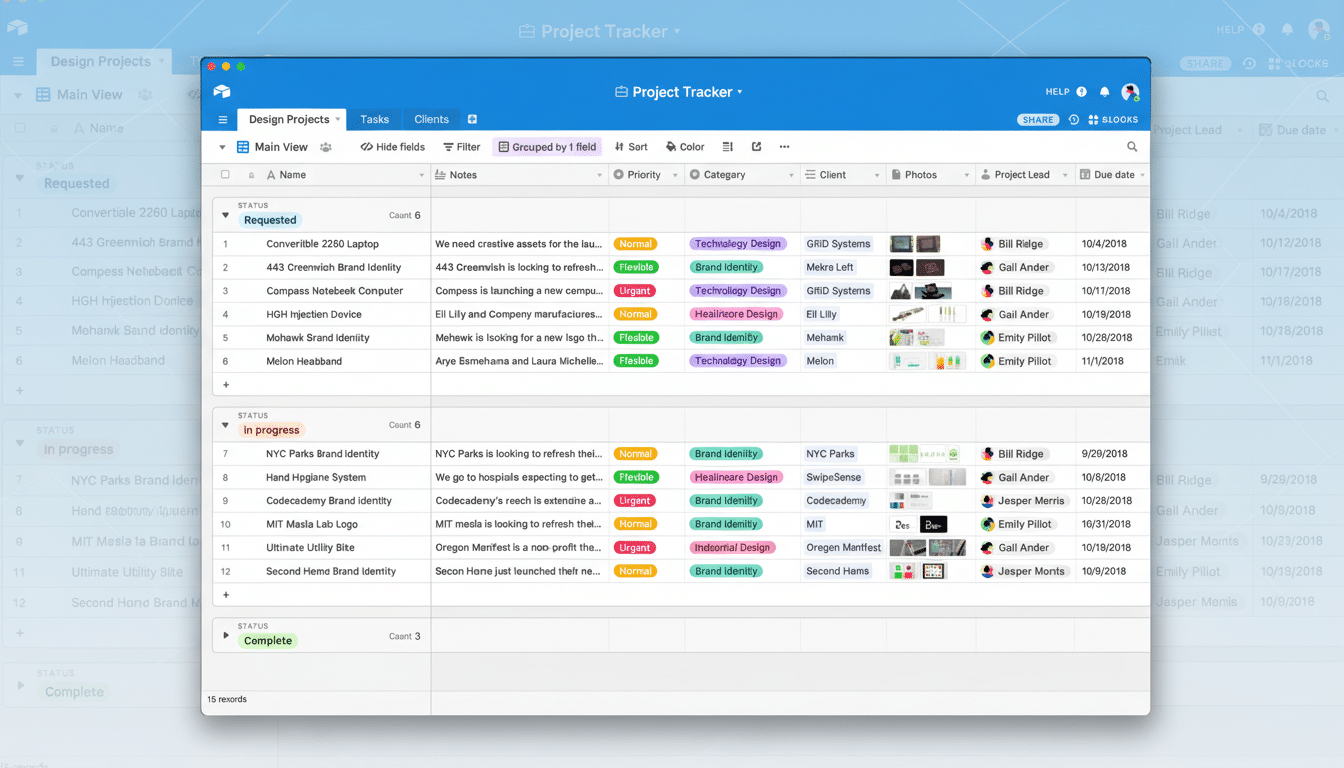

Refounding is a reboot of a business from zero. It usually begins with re-choosing the core customer and decision-maker, then rebuilding the product for the new workflow frontier — that today often means embedding generative AI into the system of record, not just adding features.

At the commercial level, this is some combination of new packaging and pricing, a rebuilt funnel favoring certain use cases, and crisper success metrics in place: net dollar retention, payback, attach rate. It’s an operating model that moves, too: more accountability; faster release cycles; and clear ownership of product, data, and go-to-market.

Culturally, refounding resets expectations. Handshake, for its part, tied its push to a hard return-to-office mandate in order to ramp up velocity. Airtable cast its AI-heavy overhaul as a second founding moment to unify teams around a larger mission.

When to consider refounding as growth stalls in the AI era

There are consistent trigger conditions. Sales effort increases but growth stalls. Net dollar retention slides to or below 100%. Sales cycles drag on while average contract values remain flat. Your roadmap is reactive — shipping incremental asks rather than category creation.

External shocks can add urgency. AI is resetting buyer expectations for all of software, turning “assistive” features into table stakes. Surveys from Gartner and IDC suggest budgets are starting to flow toward AI-native workflows — particularly those with demonstrable productivity increases. If you can’t be the system where AI is trained and gains value, you may turn into a thin interface on top of someone else’s thicket of data and models.

Refounding is also an answer to some hard financial facts. According to data from CB Insights, 38% fail as they run out of funds, 35% do so due to lack of market need. A refounding that crystallizes need and sharpens burn can buy runway and re-excite pull from the right customer segment.

How to pull off a refounding with product and GTM focus

Start with a crisp narrative. What’s the new core job to be done, who feels the acute pain, and why should your product be considered the indispensable workflow? Write a customer-, employee-, and investor-friendly one-page plan.

Recode the product from scratch. For software in the AI age, that means owning the data loop and instrumenting feedback for model improvement, as well as designing guardrails for safety and governance. Focus on a single (or a couple) of marquee workflows that present clear time-to-value.

Reset go-to-market with focus. Spin up a team for the new motion with unique quotas, enablement, and incentives. Retire calculator and novelty deals that take your eyes off upstream. Price based on outcomes, not seats (and prove ROI with reference customers as soon as possible).

Change how the company works. Transition into weekly operating reviews that track a few leading indicators — activation, usage depth, expansion, and gross margin. Incent updated behavior by updating comp. If speed is of the essence, do what it takes to bring teams together physically again — even if only temporarily — in order to compress feedback loops.

Replan capital. Pretend these are fresh allocations. Fund the new product and motion properly, put explicit stop-losses on legacy bets, and then communicate the plan to your board with milestones that de-risk technical, market, and revenue assumptions in order.

Risks and investor implications of a high-stakes refounding

Refounding is not a branding exercise; it is operational surgery. The greatest risks are cultural whiplash, confusion among customers, and a half-baked platform that burns money without building a defensible moat. To avoid that, make firm commitments — retire old SKUs on a schedule (and stick to it), sunset features nobody wants, publish and stick with a migration path.

Investors will underwrite clarity. A believable refounding thesis is a focused ICP, proof of unit economics for the new motion, and early lighthouse wins. Bridge or extension financing is doable if founders demonstrate a nested burn, definable milestones, and a path to durable gross margins.

Examples and lessons from Airtable, Handshake, and Opendoor

Airtable’s refounding was around the principle of AI as a native engine for building and automating workflows, rather than an add-on feature. Handshake’s decision underscored the human side — bringing startup speed and on-site collaboration back for bold goals. Opendoor’s message reaffirmed that even category creators have to re-architect when market structures and capital costs change.

In each of these cases, the pattern is clear: pick a sharper customer problem and rebuild the product around that with AI-native capabilities; then realign people and capital behind the new plan. Public statements matter, but execution — weekly proof of value and disciplined trade-offs — is what makes the refounding real.

The takeaway for startups weighing a bold AI-era refounding

If your startup’s growth engine is stalling and AI is rewriting the rules of your category, refounding may be the right call. Consider a fresh start with tough decisions, not a marketing rinse and repeat. The winners will be the companies that construct the new workflow in which their customers spend their time, their data, and their budgets.