SpaceX is in talks to conduct a secondary share sale that would value the company at around $800 billion, reports the Wall Street Journal. That figure would be double a recent $400 billion valuation thrown around in private-market circles and, if successfully executed, would rocket SpaceX past OpenAI to become the most valuable private company in America.

The proposed transaction would not provide new capital for SpaceX, but would enable current stakeholders — including employees and early backers — to sell shares at a new clearing price. SpaceX declined to comment publicly, and the size of the tender and allocation among sellers were not immediately available.

What a Secondary Sale Means for SpaceX and Stakeholders

Secondaries are usually done as tender offers that establish a price range approved by the company, and a window around it for insiders to gain liquidity without diluting the rest of the shareholders. For a company as capital-intensive as SpaceX, the move is more confirmation of a strategy to fund operations with operating cash flow and customer prepayments and primary rounds when necessary — while also using secondaries to continue to keep talent invested in the success of the company and keep churn on its cap table orderly.

SpaceX at an $800 billion valuation would be closer to the market capitalizations of mega-cap public companies than late-stage unicorns. It also sets a benchmark for any future debt financings, compensation packages for employees, and potential partial spinoffs. Secondary prices may be thin and volatile, but in an IPO-lite market, they are increasingly becoming quasi price discovery.

Why Investors Are Paying Up for Launch and Starlink Scale

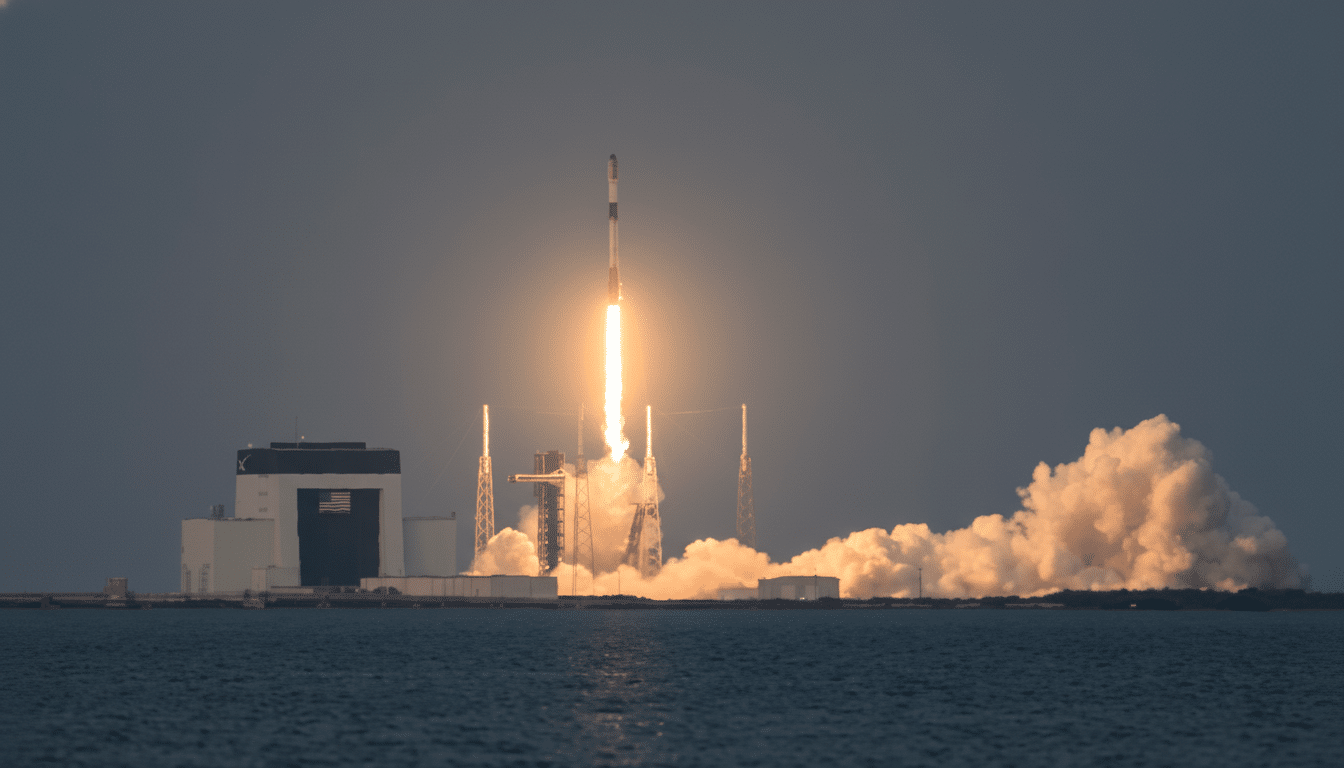

Two engines drive the thesis: launch dominance and Starlink’s scale as it operates. SpaceX has transformed access to orbit into a high-frequency, reusable service, a launch cadence that in 2023 represented nearly half of all global orbital missions based on independent launch trackers. Reusability shrinks per-unit costs, widens margins on commercial missions, and underpins the reliability required for national security — advantages that competitors have found hard to match.

The company added a recurring-revenue pillar in Starlink, its satellite broadband network. The company, in materials cited in press reports, said the service had over 8 million customers globally as of November, and SpaceX earlier disclosed that Starlink achieved cash-flow-positive operations. That operator base ranges from consumer, maritime, and aviation subscribers to enterprise and government users, with deployments in remote areas and conflict zones serving as a testament to the system’s resilience and strategic value.

The combination gives SpaceX an integrated stack few other aerospace companies have: a high-frequency launch vehicle family, a global LEO communications network, and a heavy-lift platform in development with Starship. NASA has selected SpaceX for crew transportation and the Human Landing System, and the U.S. Space Force under the National Security Space Launch program — both signs of institutional confidence in its technical and operational status.

How It Resets The Private Market Leaderboards

An $800 billion valuation would dwarf the roughly $500 billion private valuation that OpenAI commanded among various news outlets, and put SpaceX much farther ahead than other AI- (and semiconductor-)adjacent high-flyers. The step-up demonstrates the brew by which private companies are able to garner public-scale valuations — without being subject to quarterly scrutiny over earnings, helped by deep-pocketed crossover funds, sovereign capital, and corporate strategics looking for a piece of scarce assets.

For employees and early backers, a big tender provides real liquidity following years of growth, which could lessen pressure for an IPO. For buyers, the calculus is that Starlink penetration, enterprise services, and Starship-enabled markets — from point-to-point logistics to space-based manufacturing — expand the total addressable market fast enough to justify premium multiples.

Open Questions, Key Risks, and Execution Dependencies

Important variables remain. The size of the secondary market, the ratio of institutional to strategic buyers, and any restrictions on transfers will determine how reflective that price will be. Execution risks are significant: Starship development and regulatory milestones, spectrum coordination and interference management for Starlink, and geopolitical constraints all affect cash needs and timing.

Then there is the governance side. SpaceX is highly managed, and that should speed up decisions, but also focuses key man risk. A secondary of this magnitude could also strengthen control if the company is able to cherry-pick who buys stock, which is often the case in these late-stage private rounds.

The Bottom Line on SpaceX’s Potential $800 Billion Valuation

If realized, at a valuation of around $800 billion, the transaction would be a milestone for private markets, and also validate SpaceX’s dual-flywheel approach in launch and satellite internet. It reflects investor conviction that the company’s infrastructure has shifted from experimental to crucial — and that commercializing space is not just a gamble on some far-off future but rather a cash-generating business with room to grow.