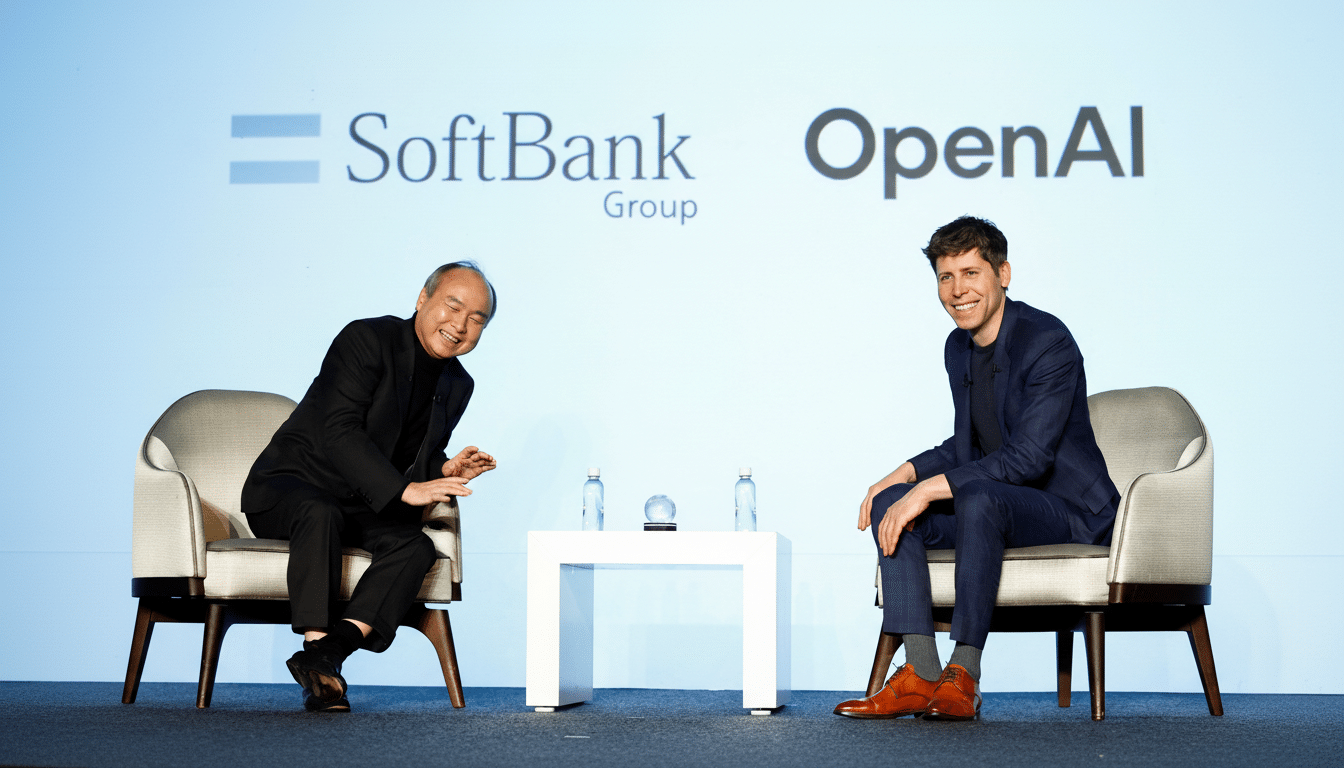

SoftBank and OpenAI have entered into an exclusive 50-50 joint venture where the former will lead commercialisation of OpenAI’s service offerings (which include code, model services, as well as full systems for supporting different end users and developers), while becoming the first customer.

The new organization, SB OAI Japan, will roll up OpenAI’s tools and distribute them in what the partners are calling “Crystal intelligence,” a bundled set ready to deploy for management, operations and productivity use cases.

The move extends SoftBank’s wager on generative AI while accelerating the increasingly circular nature of relationships in today’s AI market: investors are distribution partners, cloud or infrastructure buyers are anchor customers, and the revenue flows back around to fund balance sheets that initially paid for the models.

What SB OAI Japan Will Sell Through Crystal Intelligence

SB OAI Japan’s “Crystal intelligence” is a fusion of OpenAI’s enterprise solutions and local implementation, integration and support adapted for Japanese-language business workflow. According to SoftBank, the aim is to increase productivity and management efficiency with the joint venture providing model access, deployment support and continuous optimization for big businesses.

SoftBank plans to run the solution across its own business lines initially, pressure-testing it for product development and internal transformation before packaging those learnings up to other customers. The conglomerate claims its workforce “is actively using AI,” and it has already spawned 2.5 million custom instances of ChatGPT for use within the company — evidence, if you like, of how forcefully it is putting AI into day-to-day work.

Localization is a central promise. For Japanese businesses, that entails domain-specific terminology, precision in tone and honorifics, as well as adherence to the Act on the Protection of Personal Information. Look for the venture to focus on controlled rollouts, guarantees around handling data and paths into a legacy corporate IT system or data lake.

The New Circle of Money in AI: Investors to Distribution

The template reflects a larger industry trend. Microsoft’s multibillion-dollar partnership with OpenAI funnels workloads through Azure; Microsoft has said AI services provided significant lift to growth on the cloud service in recent quarters. Amazon invested as much as $4B into Anthropic, while also setting AWS as the exclusive compute provider to Anthropic. Google backed Anthropic and there is distribution via Google Cloud. All three — investments, infrastructure spend, and software sales — are interconnected in this model.

SoftBank is following a similar loop: investing in OpenAI, constructing new AI infrastructure, and using the joint venture to resell solutions powered by OpenAI — albeit as its first major purchaser. For investors, this can accelerate go-to-market and generate initial reference customers. For the market, it brings up questions of concentration risk, channel conflicts and whether these closed loops singularly limit platform neutrality for enterprises.

Why Japan Is the Battleground for Enterprise AI Adoption

Japan’s business world is ready for AI-heavy operational enhancements. Aging workforces, tight labor markets and legacy systems make automation necessary in customer care, documentation, supply chain planning and back-office workflows. Generative AI pilots are now being run among the big players in finance, telecom and manufacturing, and boards want measures of productivity gains rather than experimentation.

Localization is not just linguistic. Japan-based organizations may demand strict governance, granular access controls and a solid track record of vendor accountability — all of which can play into the hands of local delivery partners. More generally, by fronting OpenAI’s stack with on-the-ground integration and support, SB OAI Japan is setting itself up to be a full-service pipeline between global models and conservative IT environments.

Data Centers and Distribution Power for AI in Japan

SoftBank has announced big spending plans for AI compute and data center build-outs, in an effort to lock up capacity within Japan after a surge in demand for model training and inference outpaced local supply. This infrastructure push goes hand in hand with SB OAI Japan’s software-led approach, which could give enterprise customers lower-latency services and more transparent paths for data residency.

The enterprise also brings competitive and cooperative friction. OpenAI’s enterprise offering is already accessible through the global cloud partners that Japanese corporations have been purchasing AI from under existing cloud contracts. SB OAI Japan will have to make clear where it positions itself — local tuning, compliance guarantees, support SLAs, price pressure — or coexists with channels run by the hyperscalers.

What to Watch Next as SB OAI Japan Rolls Out AI Services

Key signs to watch include:

- Lighthouse early wins above and beyond SoftBank’s own portfolio

- Transparent metrics around productivity uplift

- Tangible development timelines in sectors such as financial services, manufacturing and public services

- Specifics on data management

- The model that’s selected

- Any promises about local inference to satisfy regulation and latency requirements

Should SB OAI Japan systematize internal adoption at SoftBank into standard, repeatable playbooks — and do so while showing clear ROI in its “customers’” businesses — it would confirm the belief that circular AI deals can create real enterprise value, not just head-turning valuations and locked-up revenue. So far the experiment is as much about distribution power and governance as it is about the models.