If your next phone’s a little more expensive than you planned, blame memory. An increasingly tight supply of DRAM and flash storage, fueled in large part by demand from AI data centers, is sending component costs up while setting the stage for a widespread wave of higher smartphone prices. Several reports in the industry are citing increased initial pricing on latest flagships and heavier pressure at the budget level.

Why Memory Is So Expensive for Smartphones Right Now

The chips that make your phones and computers work are in high demand at companies running the AI algorithms, such as machine learning models from a type of algorithm known as deep neural networks. Gigantic data centers are soaking up record amounts of DRAM and NAND, and they can outbid the consumer electronics makers to ensure supply.

Companies like Samsung Electronics, SK hynix, Micron, Kioxia and Western Digital have shifted their focus to higher-margin memory, including high-bandwidth memory, which works on AI accelerators. That is taking wafer capacity from mobile-focused DRAM and NAND, which has tightened availability and pushed up contract prices across the board.

Meanwhile, smartphone makers are doing the same with their own memory requirements. On-device AI services, bigger cameras, and richer apps are pushing up base specs too; 12GB of RAM and a quarter terabyte of storage is now fairly standard at the top end. More bits per phone plus fewer bits on the market is a simple equation and it equates to higher prices.

Early Signals From the Next Flagships Point to Price Hikes

South Korean publication Aju News says that the Mi 17 Ultra will be the first major phone to feel the pinch, selling for roughly 10% more than what the Xiaomi 15 Ultra went on sale for. The same report also states that the next waves of flagship phones, among them the Galaxy S26 and iPhone 18 families, are on track for loftier starting prices as memory costs roll into bills of materials.

Separately, Aju News reports that Samsung has set sales targets for the Galaxy S26, Galaxy Z Flip 8, and Galaxy Z Fold 8 which are around 10% ahead of where the company’s current flagships stand, suggesting it is confident consumers will continue to buy as prices creep ever higher.

That would be a significant departure from the relative stability of premium phone MSRPs for the past few generations.

Budget Phones Face the Steepest Blow From Higher Costs

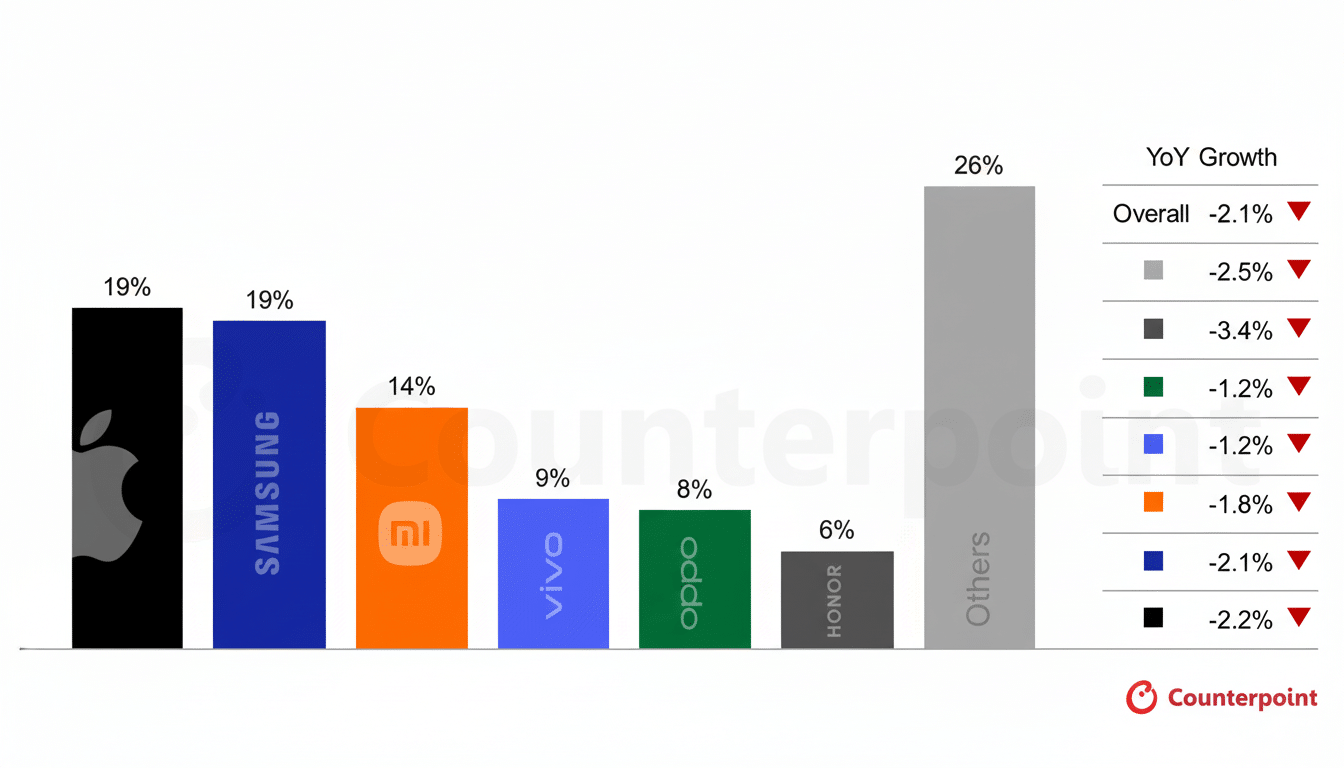

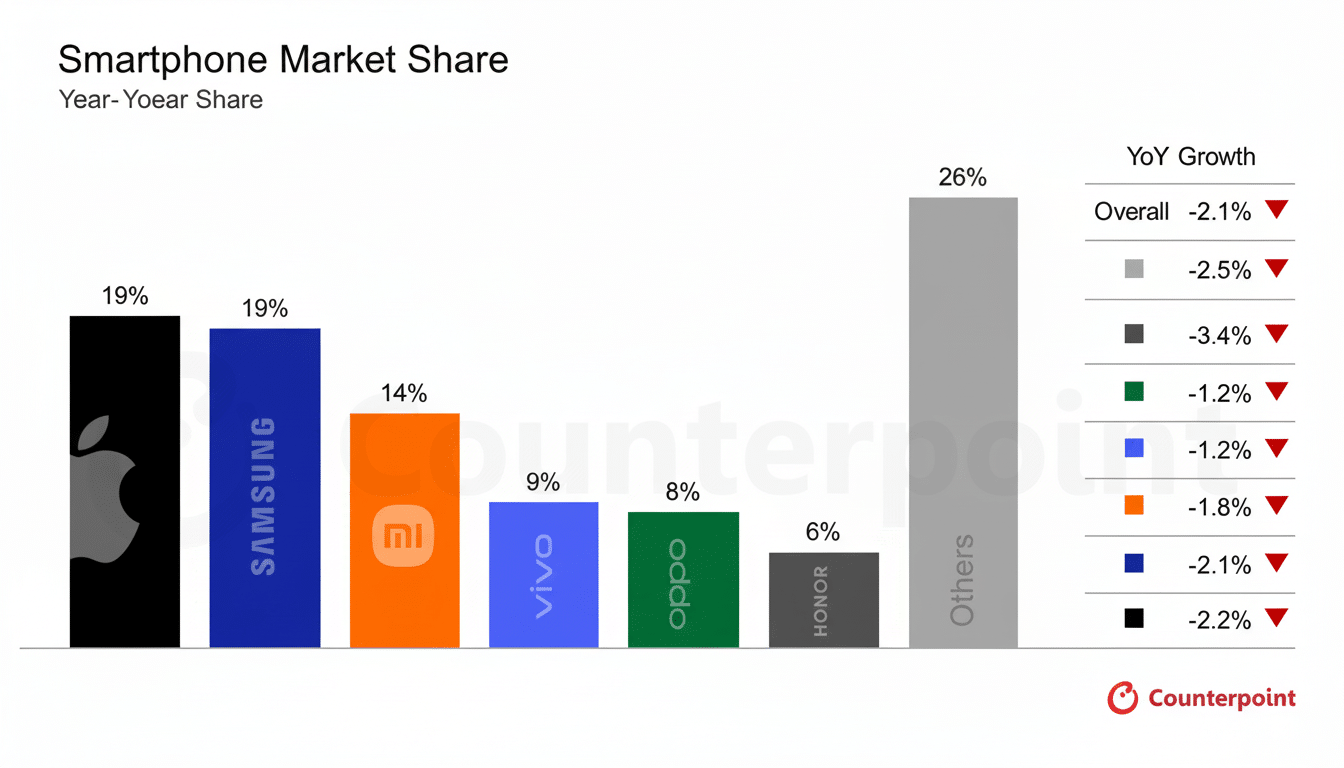

Premium machines can pass along increases in smaller increments — or even upsell customers to higher tiers of memory if it comes to that — than entry-level models. The average selling price of smartphones will rise 6.9% in the next cycle, driven by “cost pass-through” from components, predicts Counterpoint Research. For the cheapest segment, the pain could be even worse: Counterpoint estimates that the bill of materials for sub-$200 phones could rise by as much as 30%.

Manufacturers tend to cut specs, not just prices, when margins are thin. Some budget and midrange devices will probably come with less RAM and storage than these features deserve; slower storage standards in base models; or fewer accessories in the box. Carriers and retailers can counteract that with heavier promotions to lessen the shock of those sticker prices, but those deals don’t change the underlying cost pressure.

- Less RAM and storage in some configurations

- Slower storage standards in base models

- Fewer accessories included in the box

What This Means for Shoppers Planning a Phone Upgrade

If you’re thinking about an upgrade, pay close attention to memory classes. A model that previously offered 256GB as a default configuration could now hold that capacity back under a pricier step-up, returning to 128GB as the base. Similarly, 8GB of RAM could also stage a comeback as the standard in budget series where it had begun to be replaced by 12GB.

Workable tactics like purchasing during the early part of a launch window when promotions have waned, opting for last-gen flagship phones that have already soaked up their initial trimmings, and considering certified refurbished kit can put much the same performance in your pocket but at a significantly lower cost. For power users, higher upfront storage might be a cheaper option than having to pay for cloud services or upgrade before they’re ready to.

The supply outlook for smartphone memory in the near term

Memory prices are likely to stay high at least in the near term as AI infrastructure continues to suck down capacity. Relief hinges on suppliers ramping up additional lines and increasing yields, but a lot of the new capital is still going into AI-focused memory. Phone makers won’t be haggling over a bigger pie until wafer allocation swings back toward mobile DRAM and NAND.

Put simply, the economics are simple: AI wants the memory your phone likes, and it’s winning the bidding war. Put another way: barring a meaningful expansion of supply, the price of that tug-of-war is going to appear on store shelves — in the form of base memory options offered — when your next smartphone lands in your pocket.