Charles Schwab has invested $26.5 million in a Series B round for Singapore-based equity management platform Qapita, and also launched Schwab Private Issuer Equity Services powered by Qapita for U.S. startups.

The tie-up aims at cap table management, stock plan administration, and IPO readiness — terrain long dominated by Carta but challenged by Pulley and Morgan Stanley’s Shareworks.

Why Schwab’s Venturing Into Private Equity Ops

Schwab already operates massive stock plan services for public companies and manages trillions of dollars in client assets. Going further into private-company equity also puts the firm on the map with founders and employees at an earlier stage, essentially setting up a pipeline from first option grant to post-IPO wealth management. For startups, the pitch is a one-stop-shop workflow that ties together equity records, employee portals, and brokerage rails under an in-house brand they are already familiar with.

The approach reflects wider changes in the industry. Morgan Stanley’s 2019 acquisition of Solium (now Shareworks) demonstrated that equity administration could be a strong entry point to advisory and banking relationships. Schwab’s collaboration with Qapita fast-tracks that play into the U.S. private market without having to build everything from scratch.

Behind Qapita’s Platform And Regional Footprint

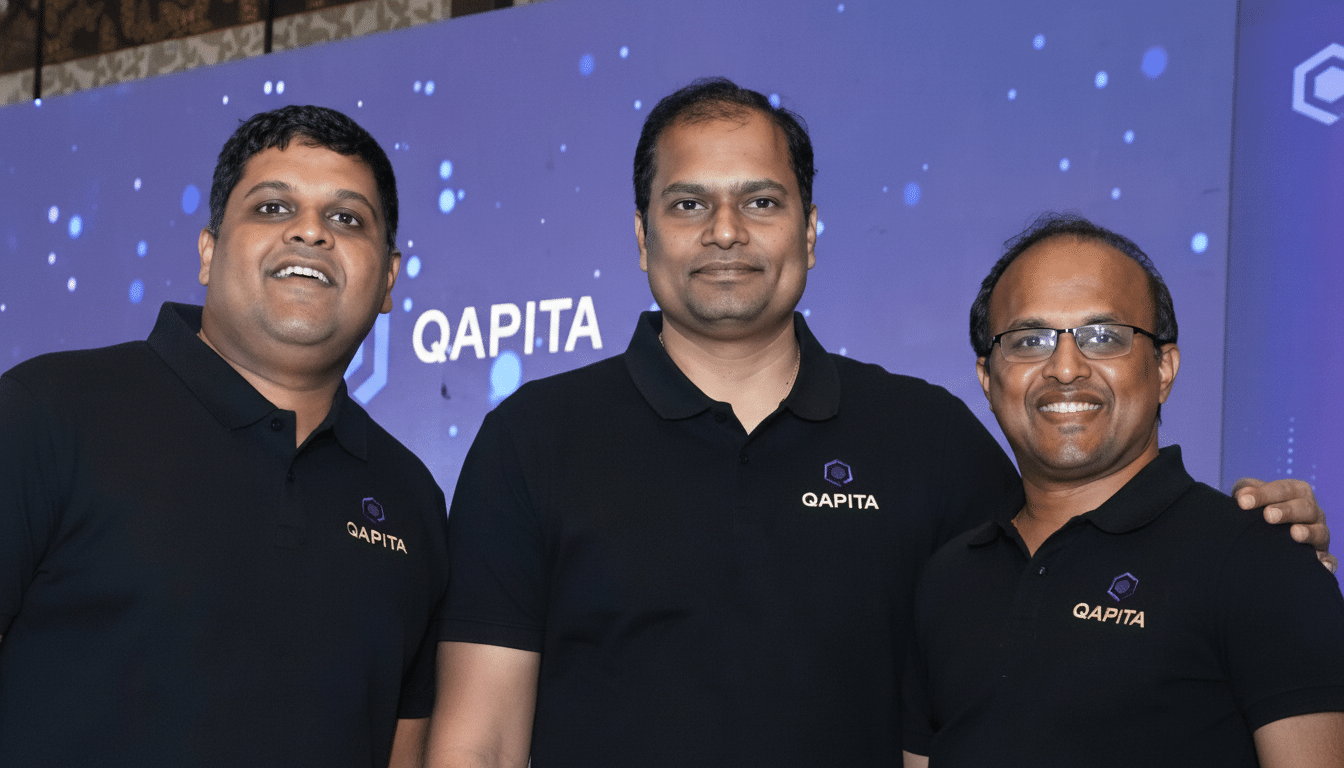

Started in 2019 by former banker Ravi Ravulaparthi (CEO) and joined by Lakshman Gupta (COO) and Vamsee Mohan (CTO), Qapita was conceived as a means to ditch error-prone spreadsheets in favor of data-connected cap tables. It has evolved to a full equity operating system: option and RSU administration, compliance tooling, valuation workflows, support for secondary transactions, and investor reporting.

The company claims about 2,700 businesses now use its software. The company has about 70 percent of its customers in India and another 20 percent in Southeast Asia, including Singapore and Indonesia; the rest are early adopters from the United States. It also helps listed companies in India handle post-IPO equity programs, a tricky space involving buybacks, ESOP top-ups, and ongoing analytics.

Geopolitical tensions in Asia have been a competitive boon. When Carta pulled out of India in 2023, the local demand for ESOP management and secondary liquidity solutions didn’t die; it coalesced. Qapita’s assertion that it serves just under half of India’s unicorns illustrates how regional product depth — taxation edge cases, regulatory filings, investor workflows — can become a long-term moat.

A Tighter Race In U.S. Private Markets For Equity

The U.S. is the prize. Tens of thousands of venture-backed startups are issuing and tracking their equity, and accounting for option expense (ASC 718), Rule 701 limits, and 409A valuations make accuracy table stakes. Volume, per NVCA and PitchBook data, has cooled off from 2021 highs, though equity as a form of compensation is still key in hiring, keeping demand strong for cap table and stock plan tooling.

Schwab’s move adds pressure to incumbents on price, integration depth, and service. Carta popularized modern cap tables; Pulley has product leaders as fans; Shareworks and Fidelity Stock Plan Services have positioned themselves in the bosom of enterprise accounts. Schwab brings distribution and custody power, as well as the expectation of relatively seamless transitions for firms that outgrow being seeds and move on to public markets.

What The New Schwab-Qapita Platform Brings

Schwab Private Issuer Equity Services will automate cap table updates from funding rounds, option grants, and conversions, with dashboards for founders, finance, and boards. Look for native audit-ready reporting support, ASC 718 expense handling, scenario modeling, and workflows that adhere to counsel and auditor standards.

On the people front, employees should have more straightforward portals for grants, vesting, exercises, and tax previews, and brokerage connectivity for liquidity events. Integrations with HRIS, payroll, and accounting systems hope to cut down on reconciliation cycles — a longtime pain point emphasized in CFO surveys by companies such as EY and Deloitte.

Importantly, the platform has been built to connect private-company equity with Schwab’s larger wealth offering, providing a way for founders and employees to manage proceeds from tender offers or initial public offerings without moving ecosystems.

Use Of Funds And The Product Roadmap Ahead

Existing backers Citi and MassMutual Ventures also participated in the Series B. Qapita says it will use the capital to improve its U.S. product, go-to-market and compliance capabilities, as well as launch a multi-market fund administration suite for venture firms and SPVs alongside portfolio companies.

Qapita has raised over $80 million to date, and counts around 300 people among its employees. The company’s near-term focus is on execution: scaling U.S. support, deepening integrations with law firms and auditors, and iterating its secondary liquidity workflows that map to board approvals and investor rights.

What It Means For Startups And Their Workers

For founders and finance teams, more choice usually creates better pricing and the ability to move faster on shipping features. Employees can benefit from the closer tie between equity portals and brokerage accounts, which can make exercises more straightforward and transparent. And for the market, a Schwab-backed entrant sets new standards for reliability and audit-readiness — table stakes for companies seeking to do tender offers or eventually list.

The sizzle: Qapita acquires an able U.S. distribution partner, and Schwab snags some shiny new private-market plumbing.

The upshot: Qapita gets a powerful market access ally in the U.S., and Schwab gets modern-day private-market plumbing.

If execution mirrors ambition, Carta and other incumbents will confront a more competitive — if ultimately more creative — equity software landscape.