Scammers are sending out texts offering quick “inflation refunds,” tempting potential victims with a couple of hundred dollars in exchange for bank logins, Social Security numbers and other personal information. The pitch is right on time and officially worded. It isn’t. Government agencies do not send texts to pay out tax refunds or relief money, and legitimate programs will not ask you to click a link to get money.

Consumer protection officials say such messages are on the rise as scammers seize upon headlines about cost-of-living relief. In New York, the state tax department has alerted residents that scam artists are impersonating its tax agency and claiming to be giving recipients “Inflation Refunds.” Even where legitimate relief checks are available, they are sent through the mail if you qualify — with no text or link and no fee.

- How These Fake Inflation Refund Texts Typically Look

- Why This Inflation Refund Scam Seems Believable to Many

- Red Flags to Watch for in Inflation Rebate Texts

- What to Do Next and How to Report These Scam Texts

- What to Know About Legitimate Tax Refunds and Relief

- The Bottom Line on Fake Inflation Refund Text Scams

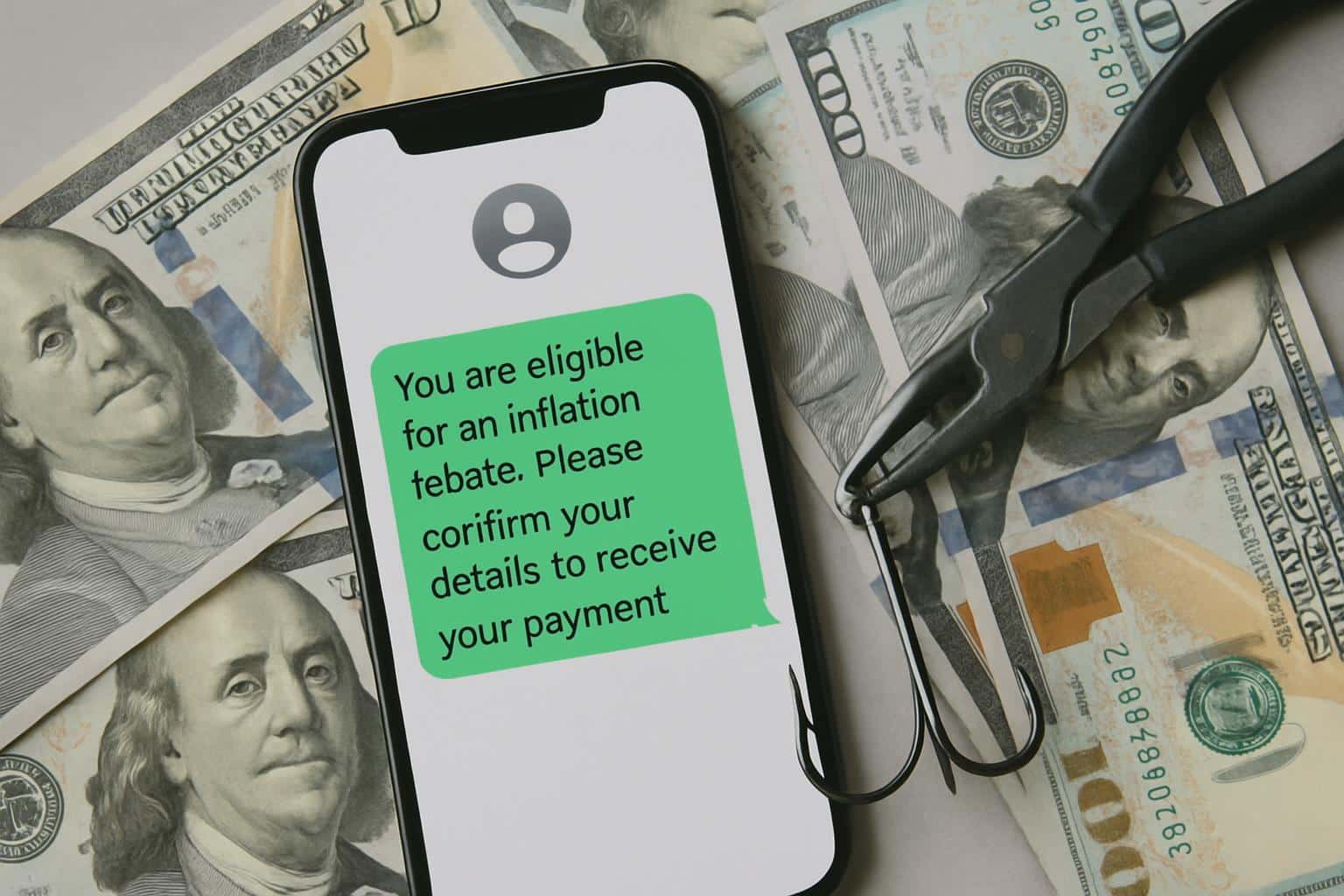

How These Fake Inflation Refund Texts Typically Look

Most of the messages have a formula: authority, urgency and a link. Examples are “You qualify for your Inflation Refund of $258” or “Final Notice: Inflation Relief Available Today Only,” along with a brief, obfuscated URL. Others mimic .gov language but point you to lookalike domains like “ny-tax-refund-gov.com.”

Typical hooks involve instructions to “verify banking details to receive your deposit,” “confirm identity by uploading a driver’s license” or “pay a small processing fee to expedite payment.” If a text message asks for credentials, payment or personal information, it’s a clue that someone is trying to scam you — especially when combined with the presence of a countdown clock or threat that you’ll “lose eligibility” if you don’t act fast.

Why This Inflation Refund Scam Seems Believable to Many

Scammers prey on the familiarity of tax season and trade on economic relief headlines. They spoof caller IDs and sender names, so their calls can appear to be from state agencies or the IRS. The New York State Department of Taxation and Finance has made it clear that if anyone receives a text message from the department asking for additional information to send out refund checks related to inflation, then they are part of a scam.

The strategy is part of a larger pattern. According to the Federal Trade Commission, text messages are one of the most frequent methods scammers use to contact consumers, and losses resulting from fraud through text have been surging in recent years. The Federal Communications Commission has also pointed to record complaints of robotexts. Urgency plus a credible pretext remains a powerful one-two punch.

Red Flags to Watch for in Inflation Rebate Texts

- Government outreach: The government does not text or call and ask for your banking information; it does not ask you to pay with gift cards or wire payments to have funds released. Genuine tax refunds are never released by a link.

- Links and domains: URLs that have been shortened in any way, as well as domains that include additional words around “.gov” (such as a hyphenated or misspelled version), are dead giveaways. Real government websites use .gov, and agencies take you to official portals — not SMS links.

- Urgency and threats: “Last chance today” or “final notice” countdowns are classic social engineering. Real benefits programs don’t expire by text message after a couple of hours.

- Don’t provide sensitive data: Do not submit your Social Security number, full bank logins, one-time passcodes or document uploads in response to a text. There’s no agency that needs this in order to mail a check.

- Assessments and “processing” fees: Any request for an advance fee or a “verification fee” is a scam.

What to Do Next and How to Report These Scam Texts

- Do not click, respond or return the call. Even responding “STOP” can let them know that your number is active. Delete the message once you report it.

- Capture evidence. Screenshot the texts along with the sender’s number or email. Please indicate the time when you received it and whether there was any link.

- Forward spam text messages to 7726 (SPAM). This number is how most carriers block and investigate scam campaigns.

- Report to the appropriate authorities. Complain to your state tax agency if the text impersonates it, and report it to the Federal Trade Commission. For identity theft attempts, file a report with the FBI Internet Crime Complaint Center. If it’s a scam pretending to be the IRS, forward it to the IRS phishing mailbox.

- Protect your accounts. If you clicked on a link or provided information, call your bank or card issuer right away, change your password, activate two-factor authentication and consider adding a fraud alert to — or even freezing — your credit with the three major credit-reporting bureaus.

- Harden your phone. Update your device software, turn on your carrier’s spam filter and add a good security app that can flag malicious links in messages.

What to Know About Legitimate Tax Refunds and Relief

Some states have authorized limited relief or rebate checks based on tax filing and income thresholds, and a subset of New Yorkers may receive an inflation-linked check by mail if they qualify. Officials stress that eligible taxpayers do not have to text to apply, and they should never share bank or account numbers unless they initiate the conversation. And if you’re in doubt, call your state tax department directly through the phone number or contact information on its official website.

The Bottom Line on Fake Inflation Refund Text Scams

If a text mentions a mysterious alleged “inflation refund” and invites you to click or confirm anything — it’s a scam. Handle it as if it were a pickpocket with a clipboard — assured, insistent and gunning for your wallet. Do not heed the pitch, report it, and trust only information you originate with legitimate institutions.