Samsung’s latest flagships again look evolutionary, not revolutionary. That’s not a mistake or a stumble. It’s the logical outcome of a scale-driven, risk-averse strategy shaped by supply chains, margins, and market forces. Here’s what’s really behind those modest year-on-year hardware changes.

Scale And Supply Limits Dictate What Ships

Samsung is the largest Android phone maker by volume, and it routinely sits among the top two global vendors in quarterly rankings from IDC and Counterpoint Research. Moving that much hardware means it can’t rely on boutique components that suppliers can only deliver in niche volumes. One-inch camera sensors, premium variable-telephoto modules, or next-gen battery chemistries might be available, but not at the tens of millions of units Samsung requires with consistent yields and global warranty support. When you’re building at this scale, the cutting edge often isn’t manufacturable at the right price, quality, and quantity—so tried-and-true parts win.

- Scale And Supply Limits Dictate What Ships

- Safety And Reliability Still Cast A Long Shadow

- Margins And Deliberate Segmentation Shape Product Lines

- Competition Shapes Risk Appetite Across Markets

- In-House Components Steer The Bill Of Materials

- Software Roadmap Over Spec Sheet Theater

- What To Expect Next From Samsung’s Upgrade Strategy

Safety And Reliability Still Cast A Long Shadow

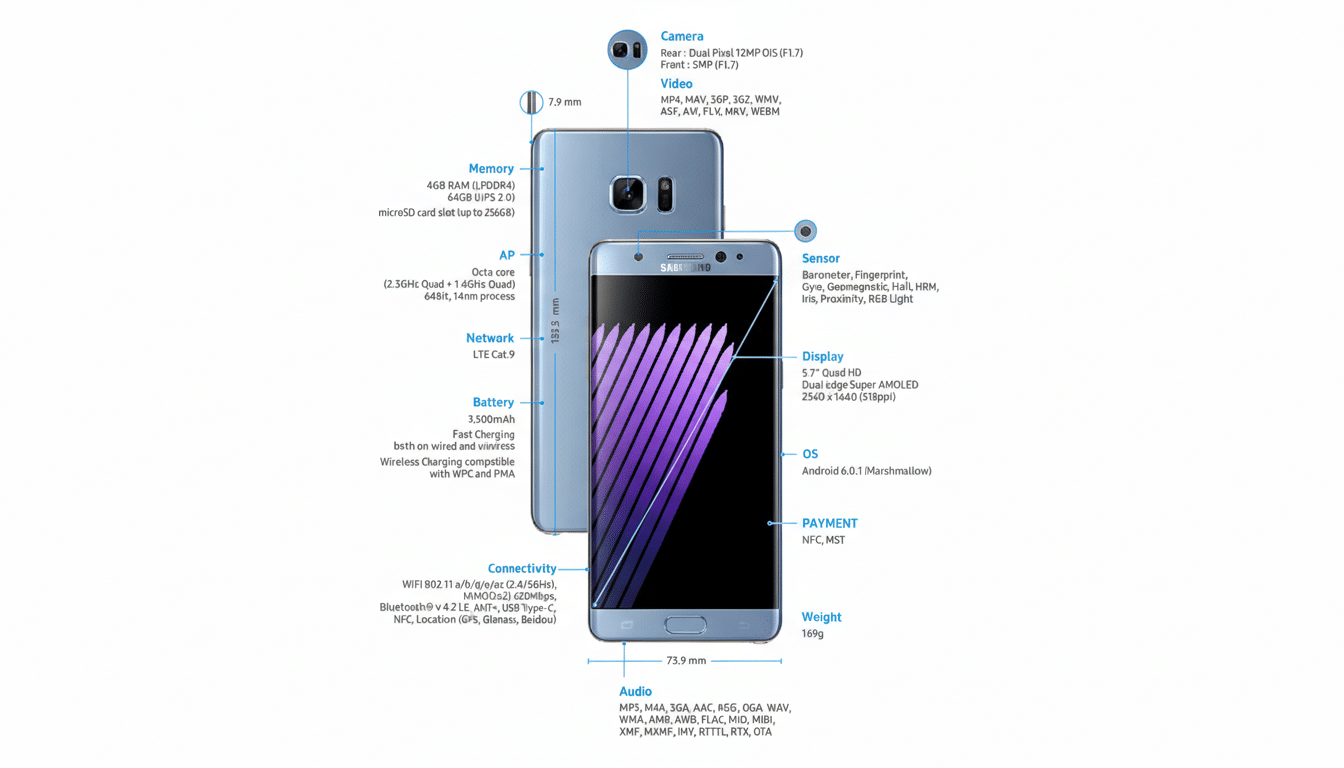

The Galaxy Note 7 recall remains an industry cautionary tale. A multi-billion-dollar hit, regulatory scrutiny, and a global airline ban by aviation authorities hardened Samsung’s appetite for risk. That legacy shows up in batteries: the Galaxy S25 Ultra continues with a 5,000mAh cell, and the base Galaxy S model climbed only modestly from 3,700mAh in the S22 to 4,000mAh in the S25. Meanwhile, several Chinese flagships have leaned into silicon-carbon cells, pushing capacities into the 7,300mAh–7,500mAh range in similar footprints. Those packs can degrade faster and complicate sourcing and safety validation. Samsung’s conservative chemistry choices favor longevity, uniform global certification, and lower recall risk over headline-grabbing specs.

Margins And Deliberate Segmentation Shape Product Lines

Newer parts cost more. That’s textbook hardware economics. By sticking with proven components, Samsung protects gross margins in a category where ASPs and component prices fluctuate. It also uses restraint to defend price tiers. The base Galaxy S model typically lacks 45W charging and premium glass like Gorilla Armor, nudging enthusiasts to the Ultra. On cameras, rivals now ship 3x periscopes with 50MP sensors; the Galaxy S25 and S25 Plus retain a 3x 10MP module that’s getting long in the tooth. In the midrange, skipping telephoto hardware on Galaxy A models steers aspiring shooters toward S-series pricing. None of this is accidental; it’s clean product differentiation.

Competition Shapes Risk Appetite Across Markets

Competitive intensity matters. The U.S. smartphone market is concentrated around a few brands and carriers, with limited carrier-backed alternatives from Chinese OEMs. Internationally, U.S. sanctions kneecapped Huawei—once a relentless rival that popularized periscope zoom and dedicated AI silicon. Without Huawei clawing at share in Europe, the Middle East, and Africa, Samsung faces less pressure to move first on bleeding-edge hardware. Put simply, when the fiercest challenger exits, the calculus for taking expensive risks changes.

In-House Components Steer The Bill Of Materials

Samsung is not just a phone brand; it’s a parts powerhouse. Displays, memory, storage, camera sensors, and processors often come from within the conglomerate. That integration can stabilize supply and cost—but it can also narrow choices. The company frequently opts for ISOCELL sensors even when alternatives exist, and it sells Exynos-powered variants in regions like EMEA while Snapdragon models dominate elsewhere. Independent testing over multiple generations has shown Exynos chips to trail comparable Snapdragons in efficiency and thermals, a gap observers often attribute to manufacturing differences at Samsung Foundry versus TSMC. Prioritizing the internal ecosystem can mean leaving some best-in-class third‑party options on the table.

Software Roadmap Over Spec Sheet Theater

There’s also a strategic pivot from hardware fireworks to long-term value. Samsung now promises extended software support on its flagships—up to seven years on recent models—bringing parity with the industry’s best. Layer in on-device and cloud-assisted AI features, security enhancements, and ecosystem services, and the proposition shifts: stability, support, and smart features over massive component overhauls. Consumer research from firms like Counterpoint has repeatedly shown that buyers rank battery life, durability, brand trust, and price above niche hardware specs. If that’s where demand sits, heavy R&D on marquee components delivers diminishing returns.

What To Expect Next From Samsung’s Upgrade Strategy

Don’t expect annual leaps in sensors, batteries, or charging speeds across the entire lineup. Expect selective big bets—often reserved for the Ultra or foldables—while the mainstream models prioritize dependable parts, efficient production, and software value. If supply scales for next‑gen components and rivals convert flashy specs into meaningful daily benefits, Samsung will follow. Until then, the smaller upgrades aren’t a lack of ambition; they’re the byproduct of scale, safety, and a spreadsheet that says steady sells.