Samsung is cautioning that a supply squeeze for memory chips is already spilling over into higher electronics prices, with much of the world’s DRAM and storage output being gobbled up by artificial intelligence data centers. Speaking alongside industry peers at CES, Samsung executive Wonjin Lee told Bloomberg that the squeeze is real and Samsung is considering repricing products as costs go up.

The point of pain is clear: AI training clusters and inference servers demand copious amounts of high-bandwidth memory as well as conventional DRAM, along with mountains of NAND for storage. That hunger is sucking up consumer categories from phones and laptops to smart TVs and appliances, where memory accounts for a meaningful chunk of the bill of materials.

AI Data Centers Are Draining DRAM and NAND

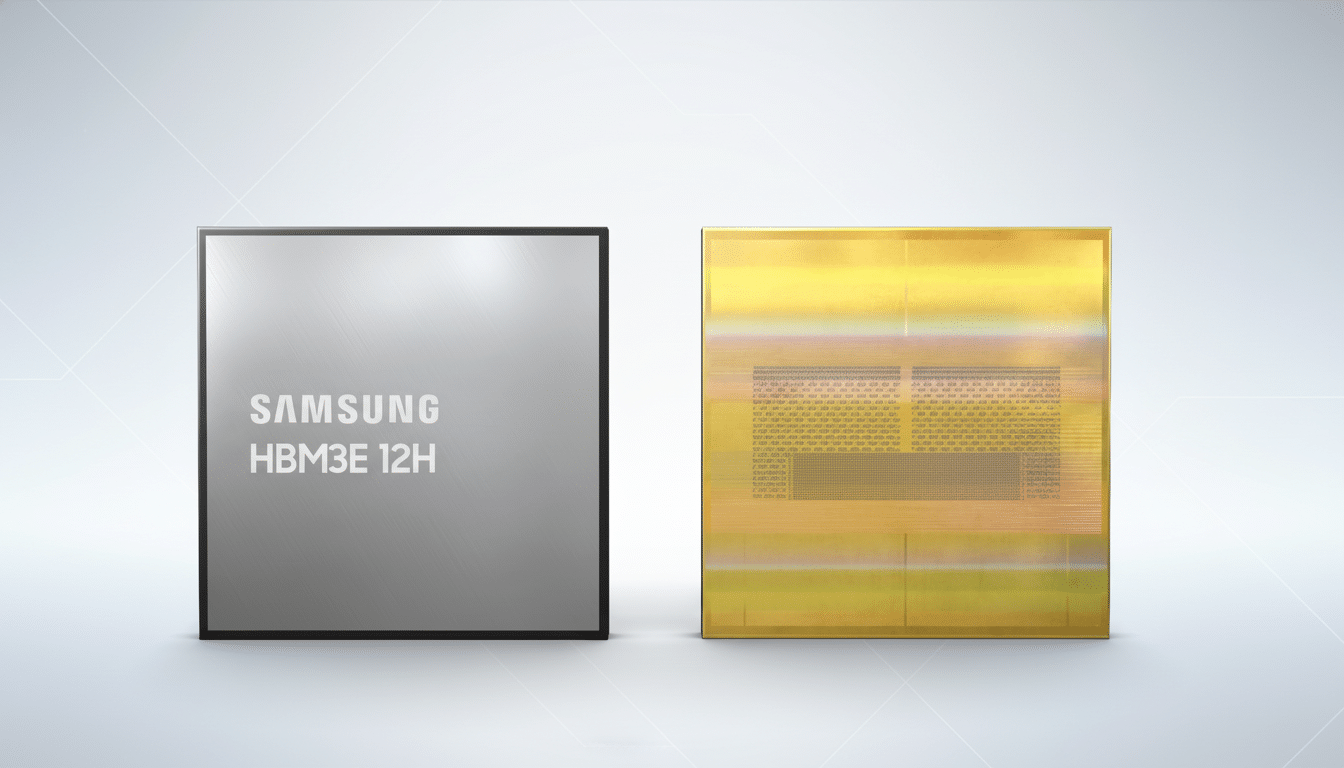

Modern AI servers can stuff multiple accelerators with their stacks of HBM3E, and nodes climb into the hundreds of gigabytes of DDR5 in addition to the fast SSDs for feeding data. When hyperscalers decide to construct entire regions of the infrastructure, they order enormous amounts of memory months in advance, tying up the supply that manufacturers might have otherwise allocated on a trickle-down basis for consumer products.

Production can’t pivot overnight. HBM needs intense stacking and packaging while even “regular” DRAM and NAND roll off state-of-the-art process nodes with slow equipment lead times. Packaging volume for complex modules is also a bottleneck, compounding the delays before more units reach the market.

Early Signs Emerging in the Global Memory Supply Chain

Signs of a tightening market have been mounting for months. Samsung raised some of its memory contract prices by as much as 60% late last year when inventories were near rock bottom and demand from AI boomed, Reuters reported. Market watchers, including TrendForce and IDC, have also sounded alerts on the general recovery in both DRAM and NAND prices following extended price slumps.

PC makers have begun to pass costs on to customers. Executives at Dell, Lenovo and Asus have warned that their higher component costs will pass through to new model cycles, especially for those featuring more RAM or larger SSDs. And smartphones aren’t exempt either: memory is among the most sensitive line items a brand grapples with when projecting specs into the bill of materials—it’s what decides whether you get 8GB or 12GB of RAM, or 256GB or 512GB of storage as the default.

Samsung’s own lineup might mirror the trend. Rumors of modest price shifts have been swirling in the regions for flagship phones to come, as well as unchanged—or changeless—pricing in other areas. Though companies can temper some costs with promotions or trade-in deals, stubborn component inflation has a way of ballooning onto retail tags or abridged baseline specs.

What It Means for Shoppers and Brands Facing Memory Costs

And if memory does remain less abundant, shoppers may see fewer deep discounts for high-RAM or high-storage versions of phones and PCs, and perhaps more aggressive suggestions to sign up for cloud services. OEMs could even produce ‘value’ SKUs with smaller memory footprints, leaving fatter configs for the upper echelons.

Enterprises will feel it too. Server refreshes may also get more expensive as DDR5 and enterprise SSD pricing increases, and lead times extend for AI-ready builds. In some instances, buyers are making longer-term deals and buying earlier than usual to line up their supply—a strategy that both helps control costs but also moves inventory risk onto the buyer.

How Long Might the Memory Supply Squeeze Last?

Analysts widely anticipate that relief will be slow to come. Constructing new memory or retooling lines for HBM is capital- and time-prohibitive, and HBM ramps require parallel investment. Industry research groups have suggested a return to meaningful balance may not happen until 2027, depending on how quickly hyperscaler demand changes and the pace at which suppliers like Samsung, SK hynix and Micron bring new lines online.

For now, the trajectory is clear: AI is redefining how we understand the allocation and pricing of memory in real time. Samsung’s admission that it might reprice goods underscores how upstream limitations have shifted from theoretical to those now affecting cost structures. Fueling the frenzy has been a years-long climb in memory and storage prices—for spacious flash-based drives as well as the chips responsible for storing your phone’s streaming content or small-business server data. If you’re shopping for a flagship phone, gaming laptop or other device in any of these categories, prepare to see memory be the line item that sets the tone on final price.