Samsung keeps shattering sales targets even as its flagship Galaxy updates feel smaller each year. The strategy is clear: prioritize stability, software polish, and massive channel muscle over headline-grabbing hardware leaps. The question is whether this formula can hold as rivals sharpen their edge.

Consumers have rewarded Samsung’s restraint so far. But the gap between what enthusiasts expect and what mainstream buyers actually choose is widening, and that disconnect will define the next few product cycles.

Inside Samsung’s Incremental Galaxy Upgrade Playbook

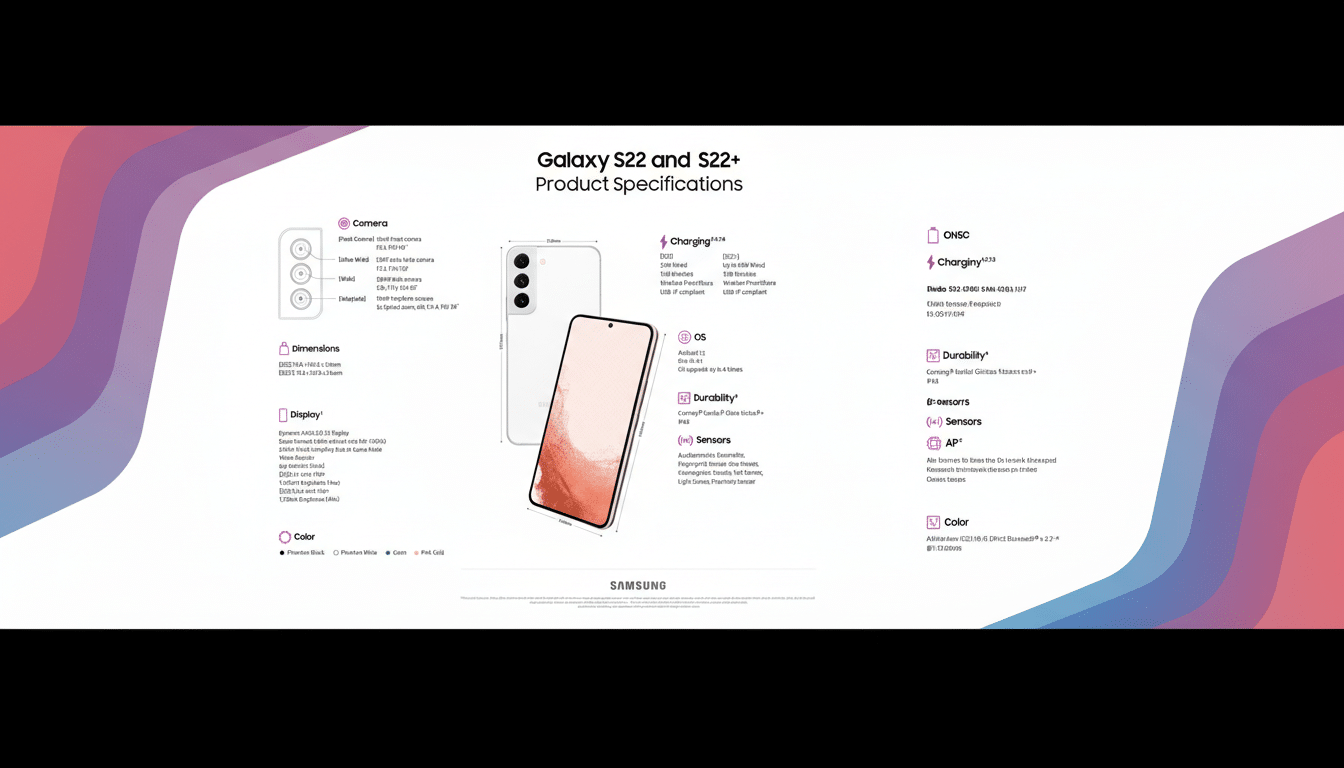

Look across the last few Galaxy S generations and the pattern is unmistakable. Displays stay the same size and resolution, refresh rates peak at familiar numbers, charging remains capped well below the fastest competitors, and base-model cameras recycle sensors that trace back several cycles. Early supply-chain chatter and certification sightings suggest the next wave will continue this theme with only marginal changes.

This isn’t conjecture in a vacuum. For the non-Ultra models, the main and ultrawide sensors have largely marched forward unchanged since the Galaxy S22 era, while rivals have jumped to larger sensors and more aggressive optics. Charging remains in the 25–45W bracket as Chinese flagships normalize 80–120W and beyond. None of this makes Galaxy phones bad; it makes them predictable.

What has changed is the marketing story. Samsung has shifted the spotlight to on-device AI, with features like Circle to Search, Live Translate, and Note Assist doing the heavy lifting in ads. These are useful and increasingly cohesive within One UI, but they’re software differentiators that can often be backported to recent devices. For buyers who equate “new” with “noticeable hardware,” the excitement curve has flattened.

Why Buyers Still Say Yes to Samsung’s Approach

Scale and distribution are Samsung’s superpowers. Between deep carrier partnerships, aggressive trade-in credits, and seasonal bundles, the effective price of a new Galaxy often undercuts spec-sheet warriors. For many shoppers, a flagship that costs hundreds less at checkout beats theoretical advantages they may never feel day to day.

The sales data backs this up. Industry trackers and Korean carrier reports indicate the Galaxy S25 family hit roughly one million units in about three weeks, the fastest early run for the line. Counterpoint Research estimates the series cleared around 20 million units by midyear, about 12.2% ahead of its predecessor over a comparable window. IDC and Canalys have repeatedly placed Samsung at or near the top of global share, buoyed by premium mix and strong promotional cadence.

There’s also real substance behind the steady approach. Seven years of OS and security updates on recent models, robust after-sales support, and conservative thermal and battery management appeal to risk-averse buyers. One UI has matured into a consistent, polished layer that enterprises and families understand. Reliability isn’t flashy, but it’s sticky.

Competitive Pressure on Samsung’s Galaxy Is Mounting

The rest of the field isn’t standing still. Xiaomi, Oppo, and Honor have normalized 1-inch-class camera sensors, ultra-fast charging, and ambitious periscope zooms on mainstream flagships. Google’s Pixel line keeps turning AI into visible camera wins with smarter segmentation, video processing, and semantic edits. Apple’s annual silicon advances quietly raise performance and efficiency ceilings even when the exterior barely budges.

Two additional headwinds loom. First, AI is rapidly commoditizing: once-exclusive features are spreading across brands through shared models, cloud services, and chipset NPUs. Second, regulation could force design shifts that reward agility—European battery rules and repairability requirements will pressure phone makers to rethink internals in ways that favor those willing to re-engineer, not iterate.

The Breaking Point for Samsung’s Incremental Strategy

Samsung can keep “doing so little” as long as three conditions hold: promotions keep pricing irresistible, rivals lack equal carrier reach, and the real-world experience gap remains narrow for non-enthusiasts. Crack any of those, and the incremental playbook looks less like discipline and more like drift.

Watch a few metrics. If trade-in values soften and carrier subsidies tighten, buyers will compare spec-for-dollar more aggressively. If camera differentials become undeniable in social, video, and low light—areas normal users notice—perception will swing. If a competitor secures similar update commitments and distribution in North America and Europe, Samsung’s defensive moat shrinks.

What Would Reassure Buyers About Future Galaxy Upgrades

Samsung doesn’t need to chase every spec war to re-energize the line. It needs visible, periodic step-changes: a substantive camera sensor overhaul for the non-Ultra tiers, faster and smarter charging without battery health compromises, and clearer differentiation between models beyond screen size. Pair that with continued AI progress that produces obvious, everyday wins in photos, messaging, and productivity—and isn’t just a bullet point.

The company’s brand, updates policy, and channel muscle have earned it runway for another cycle or two. But consumer patience is not infinite. If Samsung wants to keep breaking records, it will eventually have to break the pattern.