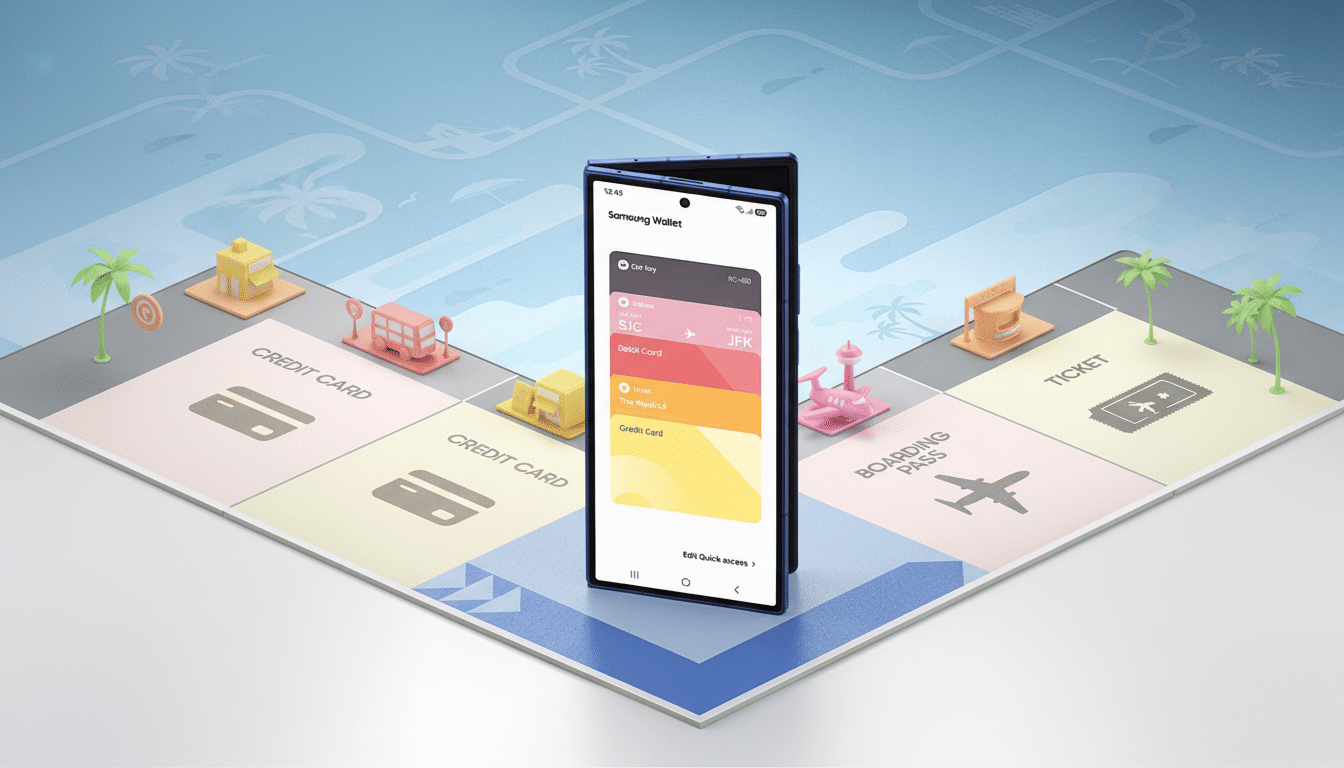

Samsung is also reported to be lining up a U.S. credit card in collaboration with U.K. bank heavyweight Barclays, which will operate on the Visa payment network. The maneuver would cement the world’s biggest Android phone maker as a contender in the fintech competition, making a Samsung-branded card as direct a competitor to Apple Card as there could be, with heavy integration into Samsung Wallet.

What we know so far about Samsung’s U.S. credit card

But, as sources whisper to The Wall Street Journal, discussions are ongoing, and the card in question would exist natively within Samsung Wallet. One early inspiration seems to include rewards, which would translate into savings on Samsung hardware and convert everyday spending into discounted phones, TVs, appliances, or accessories. The card would be based on Visa’s network, providing instant global acceptance as well as tokenization to support in-store and online payments securely, the companies said.

- What we know so far about Samsung’s U.S. credit card

- Samsung’s credit card would be a direct shot at Apple Card

- Why Visa and Barclays are a strong match for Samsung

- What a Samsung credit card might realistically provide

- The market context for a new Samsung-branded card

- Consumer upside and caveats for prospective cardholders

- What to watch next as Samsung advances its card plans

Barclays’ U.S. arm is a veteran co-brand issuer with airlines, travel groups, and major consumer brands. That experience is important: Co-branded programs rely on finely balanced rewards economics, risk models, and marketing pipelines—capabilities Barclays already executes at scale.

Samsung’s credit card would be a direct shot at Apple Card

Apple established the template for tech-led cards: instant issuance, in-app controls, and plain rewards. Its Daily Cash model—up to 3 percent at Apple and certain partners—revealed how a card could be well integrated with a phone ecosystem. For Samsung, it’s the same playbook but with an Android spin: a card that onboards in minutes within Samsung Wallet; provides real-time spend analysis; and makes rewards tangible value for Galaxy owners.

There’s history here. Samsung has introduced co-branded credit cards in South Korea and India, and it debuted Samsung Money by SoFi (a debit product) in the U.S. According to reporting, it even considered a U.S. credit card as early as 2018 before momentum stalled. The timing—and the customer base—is different now: mobile wallets have transitioned from novelty to habit, making ecosystem-linked finance less experimental and more routine.

Why Visa and Barclays are a strong match for Samsung

Visa also adds ubiquity and fraud claims, but it gets network-level products like tokenization and network tokens—crucial for secure one-click checkouts and subscriptions. For Samsung’s part, that equates to instant traction and the capacity to back features such as virtual card numbers, as well as device-level security elements of which it has already made a point in Samsung Wallet.

Barclays has expertise in co-brand partnerships where the brand drives—not the bank. That’s attractive for a consumer electronics behemoth that wants it to be Samsung-first. You can expect the bank to manage underwriting, servicing, dispute resolution, and compliance, while Samsung controls the front-end experience and ecosystem value.

What a Samsung credit card might realistically provide

The details are not yet final, but a competitive package would likely include:

- Instant issuance to Samsung Wallet with tap-to-pay and card controls (freeze, category insights, spend alerts).

- Elevated rewards on Samsung.com, Galaxy Store, and authorized partners, as well as statement credits on device purchases or for repairs.

- Financing available for large appliances and accessories up to $5,000, with interest-free plans available.

- Visa Signature or other perks such as purchase protection, extended warranty, and travel insurance.

More crucially, the rewards currency has to be something in which we feel invested. And turning cold, hard cash back into discounts on a new phone or TV might create a virtuous cycle between spending and upgrading—one that Apple’s ecosystem has proven out.

The market context for a new Samsung-branded card

Americans are still swiping. The New York Fed says credit card balances exceed $1.1 trillion, even as delinquencies rise for younger borrowers. And that combination makes risk management the top priority for any new issuer partnership—but also underscores just how central cards are to household budgets.

Mobile wallets, meanwhile, have become the norm. Analyses from companies such as FIS cite digital wallets as the most popular e-commerce payment method around the world and an expanding force at the point of sale. A Samsung card added to Wallet would be able to take advantage of that trend with tighter security, faster provisioning, and fewer steps for checking out.

Consumer upside and caveats for prospective cardholders

For Galaxy device owners, one of these Samsung-branded cards might just make life a little easier: one-stop rewards, easier financing at checkout, and a single app to monitor payments, gather receipts, and care for devices. And if Samsung follows the trend and mirrors the transparency—clear APRs, fee-light structures, intuitive statements—it will be music to cardholders worn out from gotchas.

But consumers should read the fine print to compare variable APRs, late fees, and foreign transaction fees, and how rewards can be redeemed. Privacy will be scrutinized, too. Any data related to payments, shopping, and device ownership must conform with U.S. privacy norms and guidelines set by regulators like the Consumer Financial Protection Bureau.

What to watch next as Samsung advances its card plans

Three signs will tell us just how intense this push becomes:

- A publicly announced partnership with Barclays

- Mentions of benefits offered at Visa Signature or Infinite tiers

- Entrances visible within Samsung Wallet (for example, pre-enrollment prompts for Galaxy owners)

Should Samsung introduce a reward system that actually mitigates the expense of upgrading hardware, the card will do more than take cues from Apple—it will potentially define how Android adherents pony up for their gizmos.