Samsung’s most ambitious foldable yet has cleared the shelves faster than expected. The Galaxy Z TriFold, priced just shy of $3,000, sold out online shortly after its U.S. launch, signaling that demand for ultra-premium foldables is running ahead of supply.

Samsung’s online store is currently listing the device as unavailable with a promise of a restock, but without a firm window. Reporters at CNET who attempted to check out during the initial drop noted that availability flipped to out-of-stock within minutes, suggesting a limited first wave and intense early interest.

- Demand Outpaces Supply as Limited First Wave Vanishes

- What Makes the TriFold Different from Other Foldables

- The $3,000 Question: Who Is This TriFold Really For?

- Likely Drivers Behind the Shortage of TriFold Units

- What Buyers Should Expect Next as Restocks Roll Out

- Why This Launch Matters for the Future of Foldables

Demand Outpaces Supply as Limited First Wave Vanishes

Quick sell-outs can stem from genuine demand, tight inventory, or both. In this case, all signs point to a constrained first batch. Tri-folding hardware is far more complex than single-hinge designs, layering additional flexible OLED panels, hinges, and wiring across multiple folds. Display Supply Chain Consultants has long highlighted how each added fold compounds manufacturing difficulty and can pressure yields, especially in early runs.

Samsung has used staggered availability before on halo devices to manage risk and maintain buzz. The strategy allows the company to monitor real-world reliability, scale panel production more cautiously, and fine-tune logistics for a niche, ultra-high-end form factor.

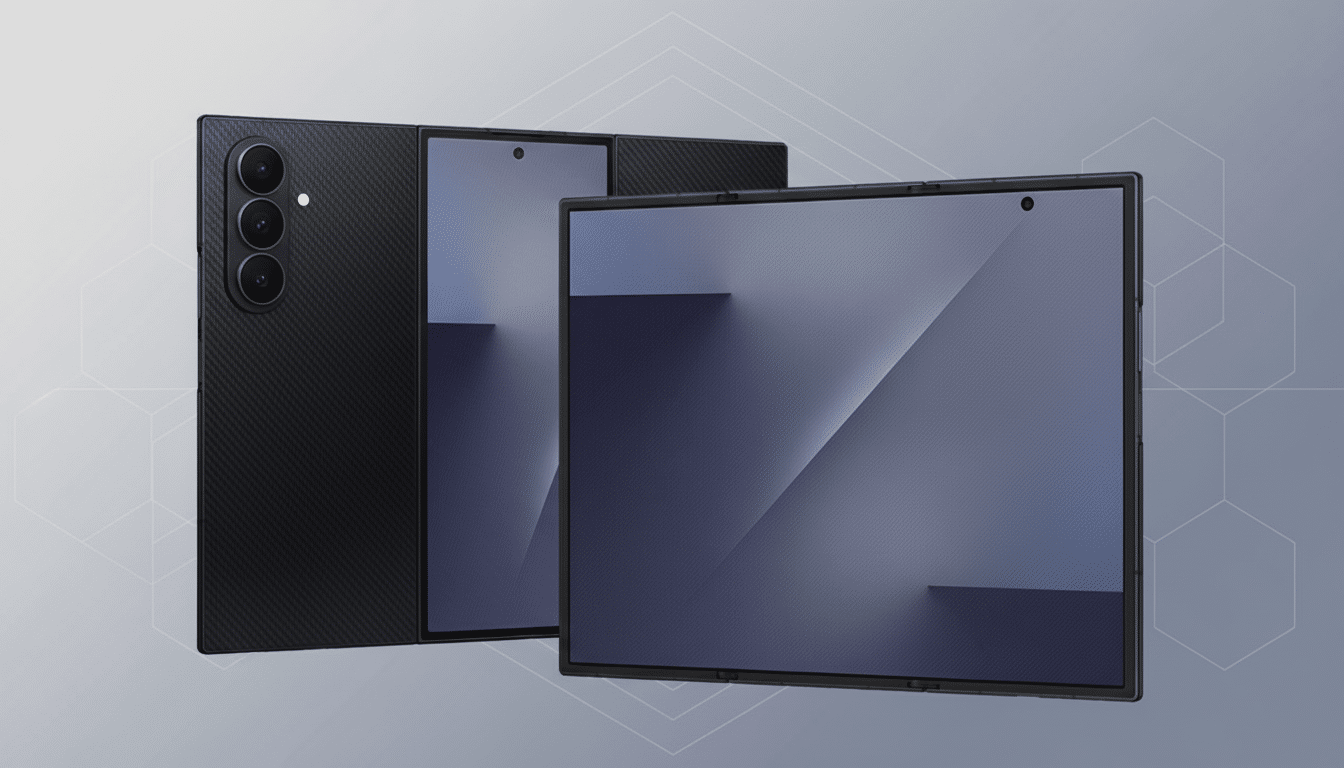

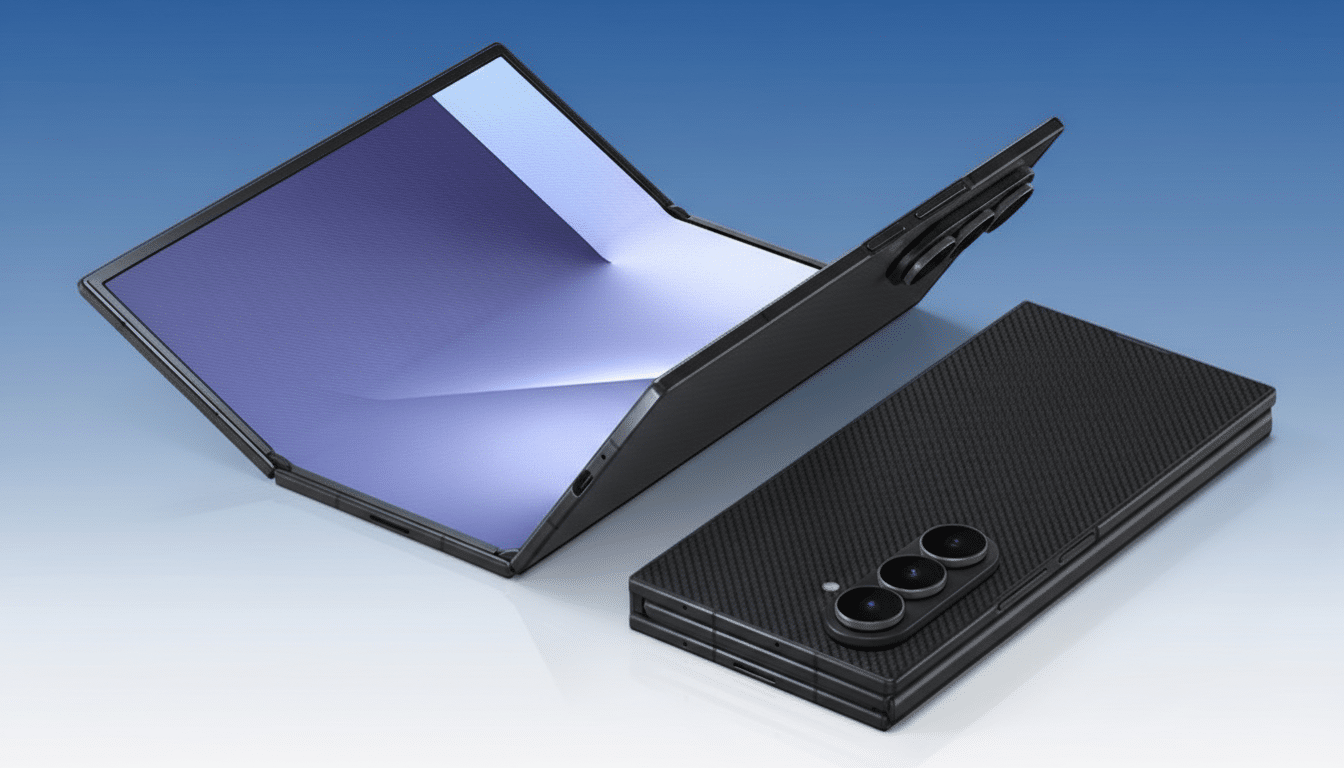

What Makes the TriFold Different from Other Foldables

The TriFold isn’t just a bigger foldable phone; it’s a shape-shifter. With two hinges and three panels, it transitions from a standard handset to a large-screen tablet-like canvas, and it can perch in a mini-laptop posture for typing or video calls. That versatility is the hook: more screen where it matters, without committing to a tablet in your bag.

Samsung’s software experience is central here. App continuity across folds, multi-window layouts, and a desktop-style mode for productivity give the extra glass real purpose. The use cases are easy to imagine: a timeline and preview windows for creators, side-by-side documents for work, or a sprawling gaming HUD. The TriFold form factor amplifies those scenarios beyond what single-fold devices can do.

The $3,000 Question: Who Is This TriFold Really For?

At nearly $3,000, the TriFold sits in a league of its own. For context, Counterpoint Research pegs the average smartphone selling price in the U.S. at a fraction of that figure, and even premium flagships cluster around half the TriFold’s cost. Foldables as a segment have been growing quickly—Counterpoint estimated roughly 20 million foldable shipments globally in 2024 with strong double-digit growth—but they still represent a sliver of the overall market.

That’s why the sell-out matters. Early adopters routinely pay for bleeding-edge tech, but moving a limited batch so quickly suggests a deeper pool of enthusiasts than some expected. It also underscores how a new form factor—not just spec bumps—can justify eye-watering prices for a subset of buyers who prize flexibility and productivity above all else.

Likely Drivers Behind the Shortage of TriFold Units

Beyond raw demand, the bottlenecks are predictable. Multi-fold OLED panels require more intricate lamination, ultra-thin glass processing, and hinge tolerances that are unforgiving at scale. Analysts have noted that foldable panel yields improve significantly over time, but first-generation designs typically start lower and climb with process refinements. A conservative launch run minimizes risk while Samsung tunes the production line.

There’s also a marketing angle. Tight early supply sustains headlines and drives waitlist sign-ups, which Samsung and carrier partners can convert with trade-in credits and financing once inventory stabilizes. The company has used a similar playbook on past foldables, turning scarcity into momentum.

What Buyers Should Expect Next as Restocks Roll Out

Samsung indicates more units are coming, though timing remains unclear. Watch for staggered drops via the company’s online store and potential carrier allocations that roll out regionally. If history is a guide, restocks tend to hit in waves as panel output improves and logistics catch up.

For those on the fence, don’t expect rapid discounts. Ultra-premium folding devices typically hold price in the early months. Trade-in programs and bundles will likely be the most reliable way to soften the blow until broader supply and competition narrow the gap.

Why This Launch Matters for the Future of Foldables

The TriFold’s swift sell-out gives Samsung a high-profile proof point that multi-fold devices can find an audience, even at luxury pricing. It also pressures rivals considering their own multi-panel designs to move faster. If supply scales and software experiences keep pace, the TriFold could mark a turning point for foldables from novelty to a productivity-first category—one that early adopters have already voted for with their wallets.