A new wave of robotics start-ups are breaking out, and this time it’s about more than vacuuming up money with an A.I. mop.”>A new wave of robotics start-ups are breaking out, and this time it’s about more than vacuuming up money with an A.I. mop. Less expensive, more capable robots are part of the reason that factory work is coming back to the United States, although these machines are a long way from upending the job market. Capital is following: investors have put billions of dollars into the category recently, according to Crunchbase, making robotics one of the few tech sectors that’s speeding up faster outside the core AI bubble.

What’s new now is that robotics has moved from “promise” to “product.” Reliability is up, deployment times are down and the unit economics finally work for customers who live in the real world.

Beyond AI: the real drivers

However, modern perception and planning models are pretty magical. But the groundwork for this boom is decidedly very physical. Amazon’s purchase of Kiva Systems had shown that robots could revolutionize operations at scale, and an entire class of founders and engineers took those lessons in. That talent base — which is now fluent in manufacturing, supply chains and systems integration — has seeded the cohort today.

The second catalyst is customer pull, rather than vendor push. Worker shortages in logistics, manufacturing and elder care have driven operators to rethink automation. According to the International Federation of Robotics, the annual number of installed robots in industry has more than doubled over that period and now stands at more than half a million units worldwide, suggesting that robot technology has moved from marginal practice to central application.

Hardware tailwinds lower costs, improve capability

Prime parts that used to limit the robot market are now in excess and inexpensive. Solid-state LiDAR has turned from a luxury to a commodity. Palm-sized board performs data center-class inference with Edge AI modules. The energy density and safety of batteries have advanced to such an extent that mobile robots can now operate for longer durations while still meeting stringent facility safety requirements.

And more important, the stack has matured. ROS 2 provides industrial-grade communication and security while simulation platforms such as Nvidia Isaac and Gazebo allow teams to iterate virtually before hitting the factory floor. (Contract manufacturers from Jabil to Foxconn can make low-volume, high-mix hardware without exploding a startup’s bill of materials.)

The upshot: quicker prototyping, less capex per unit and a better sense for how performance would unfold in messy, un-structured environments — the places where automation went to die.

Business models that de-risk adoption

Robotics-as-a-Service has shifted buying behavior. Rather than expensive seven-figure capital outlays followed by extended and arduous integrations, customers could begin with a small fleet on monthly terms, scale it up as usage warrants, and account for the expense as operating rather than capital. Payback periods have shortened to well under two years for many deployments, operators and systems integrators say.

The tooling around the robot matters as well. Fleet orchestration, remote assistance and predictive maintenance are table stakes. Collaborative systems that meet ISO 10218 and ISO 3691-4 tend to be less resistant with insurance adjusters and auditors than those not meeting such standards, reducing friction out on the plant floor. It’s the dull enterprise plumbing — user permissions, uptime SLAs, change management — that turns demos into lasting contracts.

Where startups are winning first

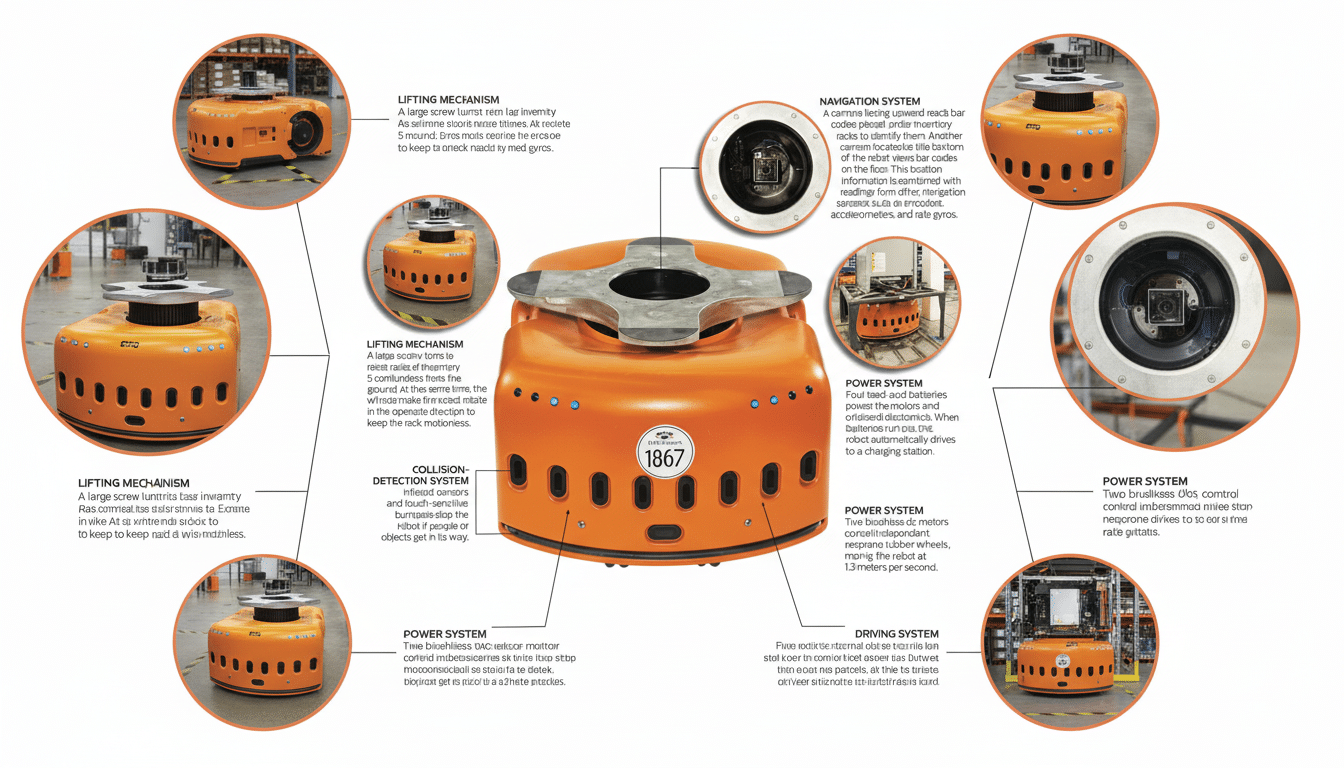

The early revenue leaders have been in verticals where robots are performing repeatable, high-throughput tasks with a clear ROI. In warehouses, warehouse robots wheel merchandise across miles of shelves. Cobots in factories do machine tending, inspection and finishing — meaning that trained workers have time for higher-complexity work.

Building and field robots, which are taking off as computer vision improves and ruggedized platforms endure dust, vibration, rain etc. Healthcare Logistics robots carry supplies and waste in hospitals, surgical robotics has expanded beyond a single dominant platform with the advent of new entrants that offer precision to steal share from other platforms, miniaturization and lower total cost of ownership.

Eldercare and in-home assistance are still early yet powerful. With aging populations and staffing shortfalls as persistent features, imperfect automation that can lift or carry objects, turn on faucets for hand washing or keep tabs both by computer vision and telemetry on occupant status can all hold broad-based value—particularly when teleoperated for edge cases and safety supervision.

Humanoids are flashy; pragmatists get funded

High-profile funding rounds and splashy demos have put humanoids in the spotlight. As aspirational research vehicles and down-the-road wagers, they are exciting platforms. But the near-term commercial wins are with task-specific systems tailored to a vertical: mobile manipulators in warehouses, pipe-inspection crawlers in energy, or agricultural harvesters that work on a single crop.

The bottleneck is not intelligence alone; it’s data and trust. Large language models don’t directly optimize for physical dexterity, and real-world manipulation data is rare, noisy at best. Efforts to construct “world models” for robots — as funded by chipmakers and lab consortia — sound promising, but they will have to be backed by robust sensing, safety and compliance in order to operate next to people at scale.

What to watch next

Interoperability standards and the like, such as VDA 5050 when it comes to fleet control are starting to break down vendor lock-in – which benefits both buyers and integrators.

Anticipate increased partnership between OEMs, software platforms and systems integrators as end users specify multivendor fleets that “just work.”

On the financing end, consider creative structures that combine both equipment finance and usage-based pricing, which will attract traditional lenders in addition to venture capital. As performance data piles up, underwriting risk becomes more manageable and capital becomes cheaper.

Lastly, sustainability and supply chain resilience are becoming competitive stakeholders. Start-ups that design for repairability, battery recycling and local sourcing — while matching ever more stringent factory conditions and data security policies — will win procurement cycles across regulated industries.

The punchline: that golden age is due to compounding breakthroughs in hardware, software, and go-to-market—not AI by itself. The winners are designing robots that perform very particular tasks, earn money fast and slide seamlessly into human workflows. That’s not hype; that’s business.