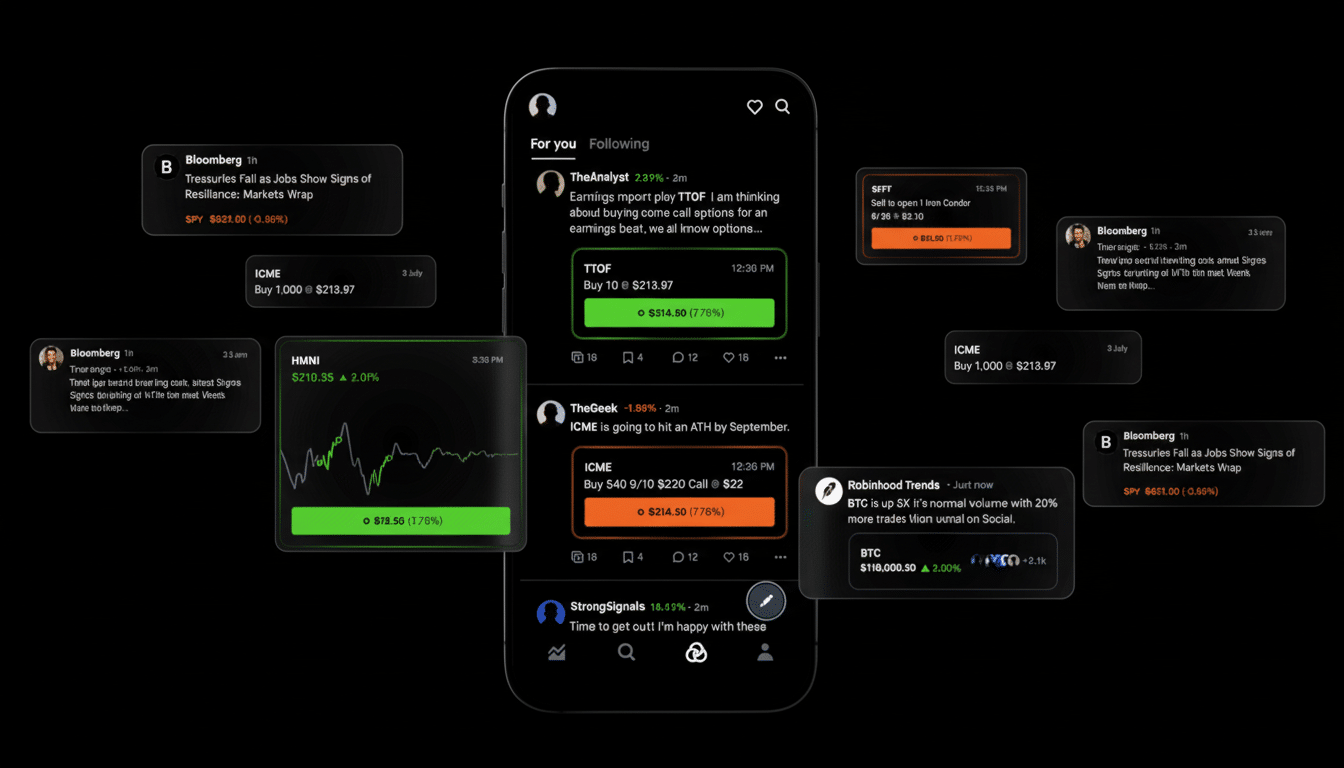

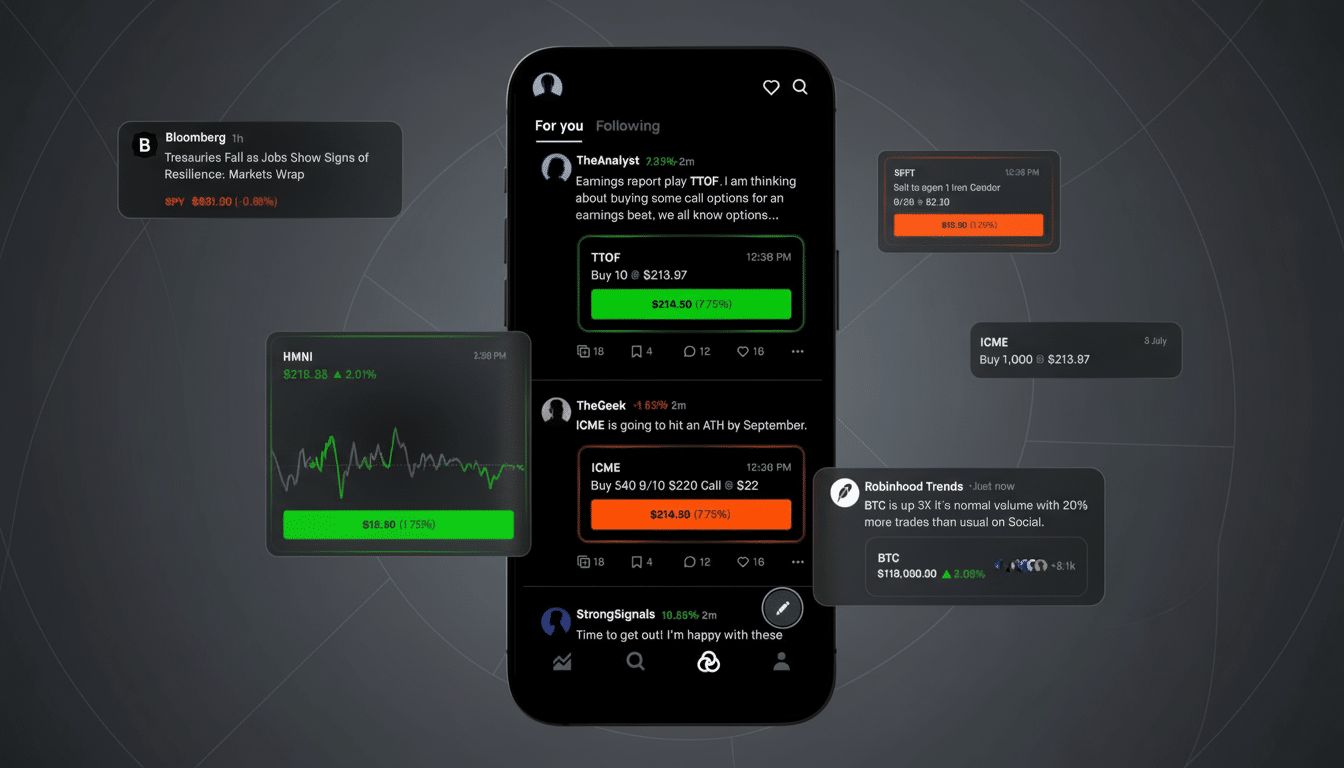

Robinhood is entering copy trading, less than a year after its leadership warned that competitors in the space were walking on thin regulatory ice. The brokerage introduced “Robinhood Social,” a feature that allows users to follow verified investors and to mimic their trades manually, in what is likely a bet that social investing can be conducted under U.S. regulations if it is carefully designed.

The pivot is remarkable coming from Robinhood, which once expressed skepticism toward copy-trading startups and has a history of dialing back anything that could be seen as gamification. Executives previously said that smaller platforms were “below the radar.” Now, Robinhood is effectively saying the rulebook is actually clearer — and the way to meet it begins with leaving execution decisions in the hands of the customer.

The significance of manual mirroring for compliance

In the U.S., much of the regulatory tension in copy trading is straightforward: who is exercising discretion? As soon as a platform replicates on its own the trades of a leader, regulators might view that as investment advice, or even portfolio management, and that can be a fast track to the Investment Advisers Act, requirements that the platform register and other legal responsibilities of acting as a fiduciary. Manually duplicating allows the final click to reside with the user, being more consistent with the broker-dealer model and Reg BI while still permitting social discovery.

The SEC’s Testimonial Rule and FINRA’s communications and supervision rules still apply. That includes verified performance, conspicuous risk disclosures, histories of promotional content and safeguards against misleading leaderboards. In Europe, however, the line has always been more rigid: FCA and ESMA have classified auto-copy as portfolio management, subject to authorisation and tailored protections. Robinhood’s manual-first strategy appears designed to dodge the most clear tripwires.

How “Robinhood Social” works

Robinhood says the feature will feature verified traders, such as popular investors and public officials. Unlike the informal copy trading platform that abounds on social media, the company will require identity verification and confirmation of real positions before an account is surfaced for others to follow. Users will see trader activity and be able to mirror positions themselves, although there is no automated copy at launch.

Limited availability to an initial group of about 10,000 users will be followed by a wider rollout. The focus on verification and manual execution seems aimed at two enduring problems in social finance: fake “gurus” promoting unverified returns, and the regulatory leap from inspiration to advice. It is also a response to lessons of the past; the company took down celebratory confetti and has already been hit with significant regulatory fines, with a stiff reminder that it needs to put up guardrails first.

A changing market and competitive tableau

Robinhood isn’t first. eToro has sold its CopyTrader product for years, with U.S. residents generally limited to copying only fellow investors in the U.S. because of regulatory constraints. Its most recent U.S. IPO, raising about $310 million, skyrocketed nearly 30% on its public debut, indicating public-market appetite for social investing models. In a less registered vein, upstart Dub brought automatic portfolio copying to the pay model and into a debate regarding the extent to which user-friendliness could edge into unregistered advice.

Scale is Robinhood’s advantage. With tens of millions of funded accounts and more than $100 billion in assets held in custody, according to recent filings, it can mainstream behaviors that smaller apps have proven in small, niche communities. And it straddles two trends: the proliferation of “finfluencers,” and enduring interest in “Congress trades,” data on which is monitored by independent research shops under the STOCK Act’s disclosure regime. If that interest were integrated natively and put users in control of execution, it might be a big draw.

How the regulatory approach changed

The atmosphere itself hasn’t gone soft; it has just gotten to know us. The modernized Marketing Rule of the SEC clarified how platforms can use performance data, endorsements and social proof — provided they are supplying balanced disclosures and keeping records. FINRA has issued enhanced guidance around influencer partnerships and firm supervision over social channels. For copy trading in particular, the message from those regulators has been predictable: eschew discretionary control, eschew implied personalised advice, oversee communications, substantiate claims. Robinhood’s design decisions come off as a direct rejoinder.

Investor benefits — and the fine print

Curated transparency can clear and surface the real strategies, rather than the noise, for retail traders. Verifying position sizes, holding periods and drawdowns from a verified account is better than chasing screenshots. But herding risk is real. That means when followers all pile in to the same names, execution quality can slip, slippage can widen, and performance can differ radically from what leaders report. There is also an incentive risk: If “popular investors” are rewarded with visibility, they may be inclined to lean into attention-getting trades.

Academic research on social trading yields mixed results; some copiers outperform in the short term by following the trades of disciplined leaders, but losses from crowded trades and turnover tend to erode gains. ESMA has also repeatedly observed that a high percent of retail accounts lose money in leveraged products — a different category, but a reminder that transparency is no substitute for risk management. Sensible practices still pertain: diversify, size positions carefully and look at track records over full cycles, not just hot streaks.

What to watch next

Three questions will determine whether this takes off. First, does Robinhood maintain the feature as being purely manual or does it enable optional auto-copy in an advisory capacity? Second, how strong are the verification, performance reporting and conflict-of-interest disclosures, particularly if the creators are paid or promoted? Third, how will the SEC and FINRA respond to gray areas—specifically, whether prominent calls to “follow and replicate” could be deemed that you are making recommendations under Reg BI.

If Robinhood threads the needle, copy trading may go from the margins to the mainstream in the United States. If not, expect swift scrutiny. Either way, the company has flipped its previous warning into a bet that careful product design — not avoidance — will drive the next iteration of social investing.