Rivian now expects to sell no more than 43,500 vehicles in 2025, a best-case scenario that suggests a drop of about 16% from last year’s tally of 51,579 vehicles. The altered guidance illustrates how policy changes, the unevenness of demand and a product transition year are all combining to converge on one of the most closely watched pure-play EV makers.

Guidance Narrows As Deliveries Rebound

The company has tightened its full-year delivery outlook to a range of 41,500 to 43,500 units after having told investors it’s on pace for 46,000 to 51,000 vehicles. This optimism dimmed by midyear as management cut estimates in the face of trade and policy uncertainty, before brightening once more with the latest update.

Operationally, Rivian’s quarterly cadence continued to get better: the company delivered 13,201 vehicles in its latest quarter, compared with 10,661 and 8,640 in the previous two quarters. Production, though, amounted to 10,720 vehicles in total, suggesting that Rivian was able to satisfy demand in part by depleting some of that inventory. The blend indicates the pipeline will move, but that continued production growth is necessary to maintain deliveries on track into year-end.

Policy And Demand Headwinds Muddy The Picture

And management has blamed a host of things, from evolving trade regulations, tariffs and changing emissions requirements, as drags on sentiment and pricing. Increasingly, this shift in policy environment has also made planning difficult for automakers that are dependent on stable incentives and supply chains, including those for batteries and the critical minerals needed to make them. Industry analysts including Cox Automotive and BloombergNEF have also reported a tougher retail environment with higher inventories and heavier discounting, as well as a widening of the spread between EV and ICE incentives.

A surge of buyers at other brands reportedly accelerated purchases before the phase-out of the federal $7,500 EV tax credit, contributing to inflated third-quarter sales elsewhere. Rivian did not benefit as much from that surge, because its vehicles were largely eligible only by being leased rather than purchased outright. That nuance makes a difference in a cost-conscious market where point-of-sale affordability is everything.

R2 Strategy Overshadows Nearer-Term Sales

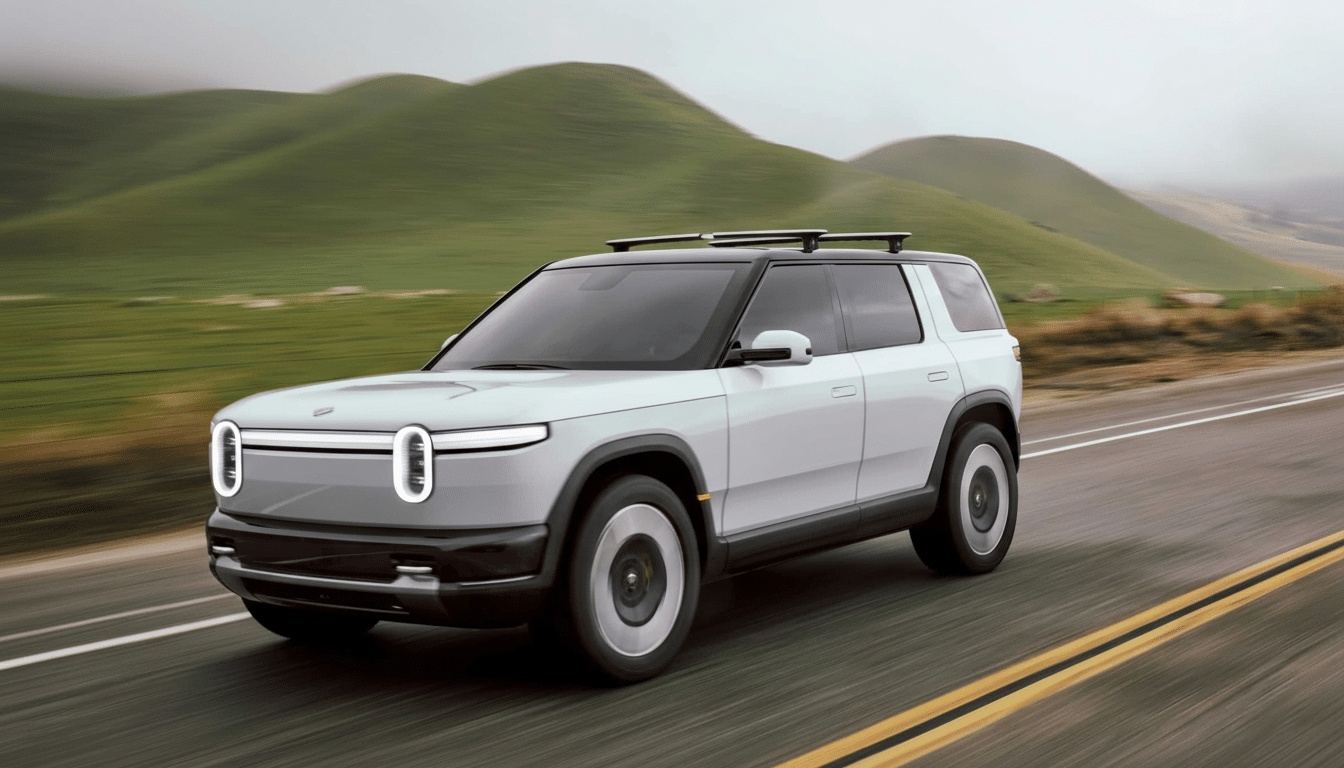

The softer 2025 outlook also signals a transition year before Rivian’s next-generation R2 SUV, intended to be cheaper and lead the brand into higher-volume territory. The company has gone on to upgrade its Normal, Illinois plant and broken ground for another in Georgia that will eventually produce R2-family vehicles and, hypothetically, the R3.

Rivian has also tipped ambitions that R2 could sell in the hundreds of thousands annually over time, and this will require disciplined ramp execution (and suppliers who are ready) as well as tight cost control. Such a capital-intensive build-out can put pressure on margins before it generates scale advantages, something the company has admitted in earnings calls and SEC filings as it works to reduce bill-of-materials costs and logistics costs.

Competitive Landscape Could Thin But Will Not Disappear

Other traditional automakers have pushed back or scaled down their plans to add EVs and are backing a weaker emissions standard, leaving an uneven playing field. But the picture is not binary: Hyundai-Kia, GM and Ford are still flexing to defend share by managing pricing and trim complexity, while Tesla remains robust on cost and software-led value.

Rivian leadership has made the argument, including in comments to InsideEVs, that as subsidies wane and compliance-driven models retreat, pure-play EV makers focused solely on electrification can attain relative advantage. It will be tested against consumer affordability, charging accessibility and how quickly rivals retool to make money selling EVs.

What The Outlook Means For Investors And Buyers

A delivery cap of 43,500 sets a realistic bar but increases the importance of the execution levers: stabilizing order intake for R1 models, maintaining production rhythm without excess inventory and conserving cash for the R2 launch. Analysts will closely watch unit economics, particularly progress on costs for materials and manufacturing hours per vehicle and efficiencies in logistics that can push gross margins toward breakeven.

For buyers, that means model availability is still robust and lease structures will potentially offer the most attractive economics while policy levers remain in flux. For Rivian, the near-term tumble is less about demand collapse and more about steering through policy muddle and bridging to the next product cycle.

Bottom Line: What Rivian’s Latest Outlook Signifies

Rivian’s best-case scenario for 43,500 deliveries suggests a down year versus 2024 despite quarterly momentum.