Ramp’s valuation, meanwhile, has skyrocketed to $32 billion following a new $300 million raise that was led by Lightspeed in one of the speediest step-ups this cycle for late-stage fintech. The jump is coming just three months after investors valued the corporate spend platform at $22.5 billion, highlighting how aggressively capital is pouring into modern expense management despite an overall somewhat cautious venture market.

A Funding Sprint, With Strategic Signals

The new primary infusion was accompanied by an employee tender component, a familiar move for high-growth start-ups to relieve some liquidity pressure and hang onto talent. It’s the latest in a rapid succession: a $500 million extension at $22.5 billion, a $200 million round at $16 billion and a $150 million secondary at $13 billion — over a period of weeks or months. By the company’s tracking, it has now raised a total of $2.3 billion in equity financing.

Lightspeed now puts Ramp into the company of repeat backers including Iconiq and Founders Fund, suggesting that the latter’s investor syndicate is betting it has more go-to-market room not just on market share but product breadth as well.

For those later-stage investors who invest at the 11th hour, the pace speaks to an intentional “pre-IPO readiness” playbook: get the balance sheet in good order; broaden ownership of the company and keep momentum as you scale into larger enterprise accounts.

What’s Driving Ramp’s Growth, Products, and Revenue

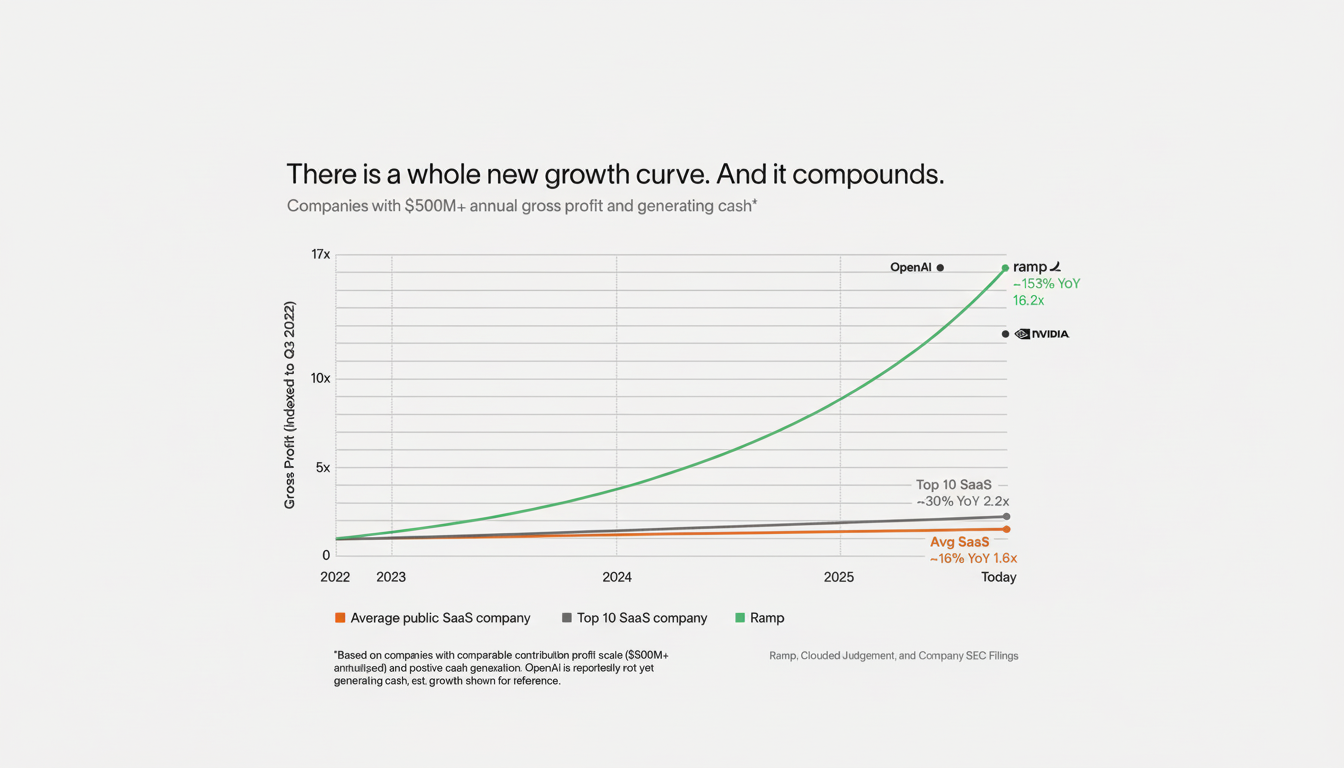

Ramp has said it crossed $1 billion in annualized revenue — a threshold that puts it into an exclusive cohort with a few other private fintechs nearing public-company scale. The platform has since expanded to cover corporate cards, expense management, procurement workflows and integrated travel — an offering stack that lifts attach rates and lowers churn as finance teams consolidate vendors.

The company has more than 50,000 customers, including start-ups and mid-market, as well as larger and larger enterprises over time. Ramp’s card economics rest on interchange while software subscriptions provide durability and an upsell opportunity. That twin engine — revenue driven by transactions coupled with SaaS-like expansion — is a primary reason investors say premium pricing is justified.

Automation is another lever. Ramp has built-in agent-like software to pre-code expenses, flag anomalies and streamline approvals. Though not positioning itself as an AI company, automation on spend and procurement does reduce manual work for finance teams. Analysts at firms such as CB Insights and PitchBook have all highlighted the CFO stack as a marquee area where workflow plus payments make for a defensible moat.

At a $32 billion watermark against a run rate north of $1 billion, Ramp’s implied multiple is in the low 30s.

That’s rich versus most public software or payments comps but not unheard of for private fintechs with accelerating growth, bundling effects and efficient customer acquisition. The bet: continued share gains and elevated margins as the software mix increases.

Where Ramp Fits In The Spend Management Ecosystem

The market for corporate spend is very competitive; the likes of Brex and Airbase in cards and expense are among those that have been built to help companies manage purchasing and track it; Navan is tackling travel-related spend. On the procurement side, Ramp comes up against suites historically dominated by SAP Concur and Coupa. The strategic endgame is a single platform that completes the full loop from request (or buy) to payment, reconciliation and statutory audit — the complete lifecycle which maximizes data insights and policy compliance.

Customer stories often referenced by industry observers include finance teams unifying several tools into a single policy-based system: one card program, one expense policy engine, one travel workflow, integrated purchase orders associated with budgets. That consolidation can cut down software line items, but the real prize for CFOs is visibility — real-time spend data across teams, vendors and categories.

Risks And Realities On The Other Side Of The Run-Up

But even as the start-ups swell, the risks do, too. As card volumes grow, credit exposure grows with it, necessitating disciplined underwriting and risk controls across the economic cycle. Switching pressure, competitive rewards and fraud are all influencing unit economics. And though automation alleviates hands-on review, control and auditability remain critical for larger organizations with strong compliance requirements.

Investors are also paying for the execution. The valuation implies that Ramp can continue expanding within both procurement and travel, and do so while maintaining best-in-class user experience — not exactly a small ask as product surface area increases. Secondary sales give employees liquidity, but can draw scrutiny if the pricing of late-stage rounds exceeds fundamentals. Nonetheless, the tender is an indication that both retention and internal alignment may be strong.

What to Watch Next for Ramp and Spend Management

Key items to watch in the quarters ahead:

- Continued accelerating revenue vs. operating efficiency

- Larger enterprise penetration

- SW as a % of total revs.

Any step toward public-company readiness — more restrictive GAAP reporting, broader governance and conservative credit metrics — would support investor expectations for a later listing when markets are open.

For the moment at least, Ramp’s $32 billion leap further solidifies spend management as one of the few non-AI categories currently basking in super-sized investor enthusiasm. How effectively the company translates that confidence into sustainable, high-margin growth will decide whether this valuation is a milestone on its way to market dominance or just another peak in an increasingly crowded race.