Rad Power Bikes, one of North America’s best-known e-bike brands, is in bankruptcy and plans to sell the business.

The company, which said it would maintain operations as it searches for new ownership, has resolved to work to preserve its dealer network, vendor base, and service footprint in a court-supervised process.

- Inside the Chapter 11 filing and the company’s next steps

- From pandemic boom to reset across the e-bike industry

- Safety scrutiny and regulatory headwinds for Rad Power

- What a potential sale of Rad Power Bikes could involve

- Impact on riders, dealers, and suppliers during Chapter 11

- The bottom line on Rad Power’s bankruptcy and sale path

Inside the Chapter 11 filing and the company’s next steps

At the time of its bankruptcy filing, Rad Power Bikes had about $32 million in assets and $73 million in liabilities, according to the filing. The company is challenging, in court documents, more than $8 million of the debt involving unpaid tariffs owed to U.S. Customs and Border Protection. Rad previously said the process would provide the company an opportunity to continue operating its business and support going-concern sales.

The company previously told employees it could close up shop without new funding and said last month that a “very promising” lifeline was no longer an option. In seeking bids for the company and its core assets under Chapter 11, Rad has bought itself time from creditors—amounts owed to lenders, unfunded pensions, as well as other accounts payable.

From pandemic boom to reset across the e-bike industry

The company’s fate reflects a broader micromobility whiplash. Demand for e-bikes skyrocketed during the pandemic as city commuters and new riders turned to cost-effective alternatives to cars and transit. The industry group LEVA said e-bike imports into the U.S. hit more than a million units in 2022, an incredible surge for this category. When supply chains returned to normal and household budgets were squeezed, inventory clogged and acquisition costs climbed—revealing operators scaled for peak growth.

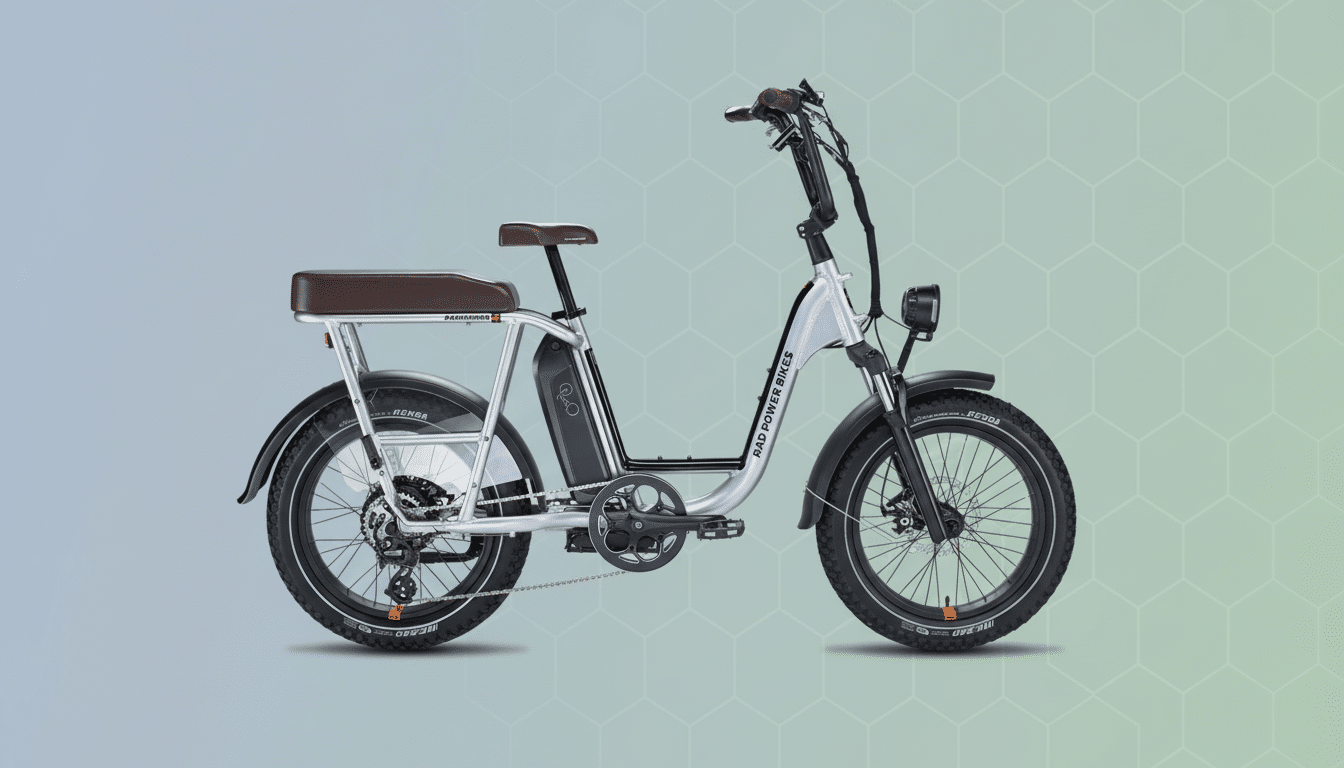

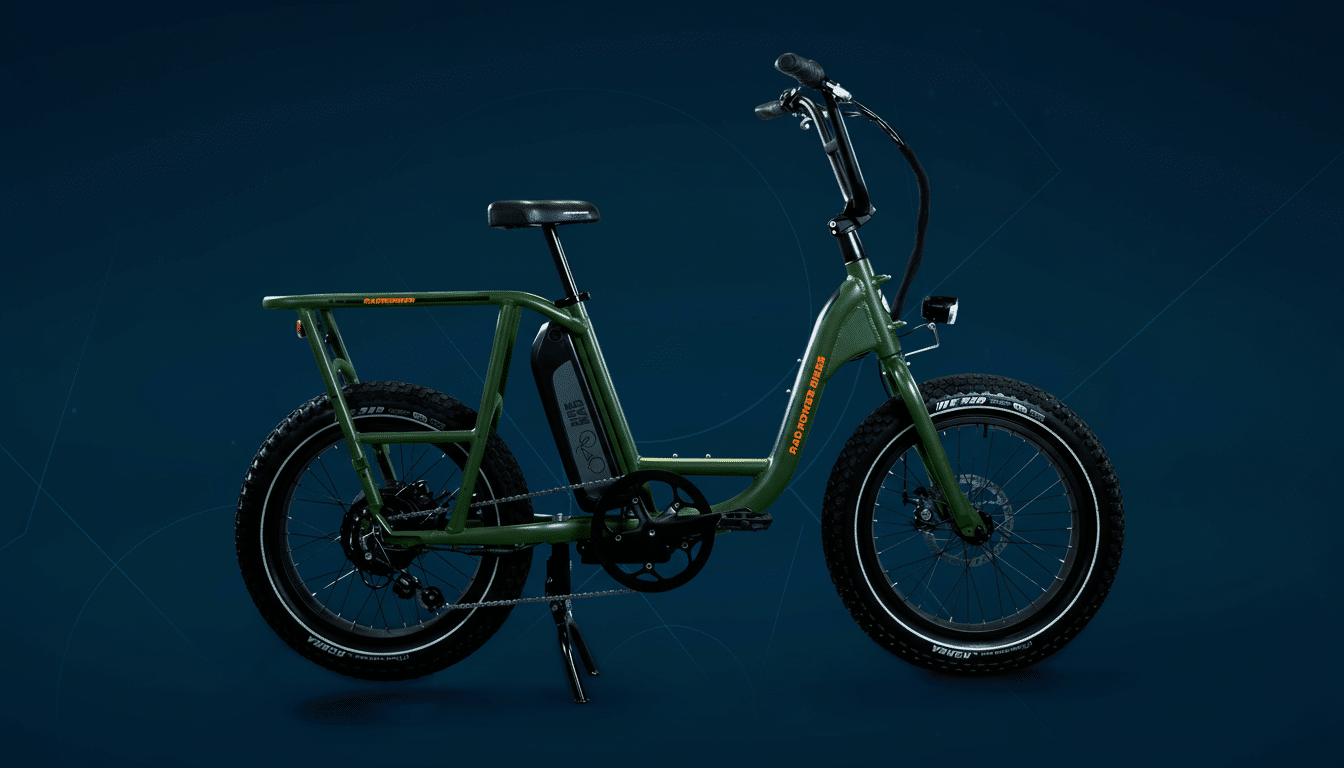

Rad Power conducted several rounds of layoffs and overhauled leadership this year, hiring turnaround specialist Kathi Lentzsch as its chief executive. She began shifting the brand away from the pure direct-to-consumer model—previously a signature of its ascent—to retail partnerships and service-driven relationships meant to increase support and retention. The bankruptcy filing shows that pivot came too late to address cash needs and legacy obligations.

Safety scrutiny and regulatory headwinds for Rad Power

Adding to the financial stress, the Consumer Product Safety Commission recently issued an alert about older Rad Power battery packs as a safety issue after 31 reports of fires. Rad publicly challenged that characterization, but it was clear the company would come under pressure. Fire departments across major cities have noted the risk of lithium-ion batteries, and municipalities like New York City have enacted tighter restrictions around uncertified batteries, prodding brands toward UL-certified systems and stricter quality control.

Tariffs remain another pressure point. Section 301 tariffs on China-made parts and complete e-bikes have been an ongoing cost to consider. That Rad and other micromobility companies are battling over disputed tariff liabilities highlights how trade policy has burdened the sector: Earlier in the cycle, electric skateboard maker Boosted pointed to tariffs as one of the blows before it folded.

What a potential sale of Rad Power Bikes could involve

Rad Power’s brand name, installed base, and parts ecosystem could make it appealing to strategic buyers like established players in the bicycle business, Chinese original equipment manufacturers looking to establish a presence in the United States, or retailers that want to bring servicing under their own roof.

It’s possible that private equity will hover around the asset if a cost reset and clear product roadmap can bring margins back. Recent history provides a template: European e-bike manufacturers VanMoof and Cake both maneuvered bankruptcy processes to new owners via courts and kept core businesses intact with new operational strategies.

Central to the bidding will be questions like warranty exposure, battery replacement programs, channel mix, and the profitability of after-sales service. The next owner could benefit from a slimmed-down lineup with certified batteries, tighter supplier controls, a more retail-service tilt—and a focus on rebuilding trust and securing recurring revenue.

Impact on riders, dealers, and suppliers during Chapter 11

Rad says it plans to continue serving riders during the process. Customers should look for the company’s announcements regarding guidance on parts availability, battery safety notices, and warranty support in Chapter 11. Dealers and service partners will monitor whether payments continue to flow and whether inventory continues following the court’s approval of ordinary-course operations, but timetables can change with bids coming in as they are reconciled against claims.

For suppliers, the filing period is often when they can finally see clearly: schedules provide specifics on who is owed what, and a sale plan can make clear whether contracts are assumed, assigned, or rejected. Vendors with essential parts are going to have a lot of leverage if they can guarantee that the in-service fleet will have continual support.

The bottom line on Rad Power’s bankruptcy and sale path

Rad Power Bikes’ Chapter 11 filing and expected sale represent a landmark moment for a category leader that did much to popularize e-bikes in North America. With over $30 million in assets and more than $70 million in liabilities, not to mention heightened scrutiny over battery safety and tariffs, the next owner will need to value the brand and be prepared for a tough turnaround. If the process results in a capable buyer willing to invest time and operational discipline, Rad could potentially emerge leaner, safer, and even more closely aligned with the people who made it famous.