The United States is quietly having a prepaid wireless moment, taking an increasing share of net adds as postpaid growth wanes. Price fatigue, fewer plan perks and a diminished performance gap between prepaid and postpaid are all gradually nudging consumers to reconsider what they truly need. The issue now is not whether prepaid is growing; it’s whether Verizon, AT&T and T-Mobile should be concerned.

Why Do Consumers Want to Prepay for Wireless Service

Consumers are feeling the squeeze. After years of incremental fee increases, smaller autopay discounts and plan shuffling, the perceived value in postpaid has been eroded. Though headline prices have not skyrocketed, administrative surcharges and revisions to the amount of discounts offered have inched up monthly bills. The inflation data from the Bureau of Labor Statistics makes this point even clearer: expenses for things you must have have gone up pretty noticeably over the last few years, leaving a lower phone bill as low-hanging fruit when it comes to ways to save.

- Why Do Consumers Want to Prepay for Wireless Service

- The Feature Gap Between Prepaid and Postpaid Is Small

- What the Numbers Say About Prepaid Versus Postpaid Growth

- How the Big Three Are Hedging Against Prepaid Momentum

- Should Verizon, AT&T, and T-Mobile Be Scared?

- What Could Shift the Race Between Prepaid and Postpaid

- Bottom Line: Prepaid’s Rise Is Real but Not Existential

Meanwhile, a number of postpaid distinctions have eroded. Device offers are still strong, but the complexity of pricing, throttling rules and in-store experience cuts have made them less compelling. For cost-conscious shoppers and cord cutters piecing together monthly services, prepaid is appealing for its simplicity.

The Feature Gap Between Prepaid and Postpaid Is Small

Today’s prepaid doesn’t have to be second best. Strong MVNOs run on the same nationwide 5G networks, and eSIM has made changing quick and easy. Visible and Total by Verizon, Metro and Mint under T-Mobile, and Cricket for AT&T also deliver strong 5G connectivity options, hotspot choices and cloud-free onboarding. Thanks to multiple network support, Google Fi Wireless has thrown down the gauntlet for international roaming that equals or beats many a postpaid offer.

Network capacity upgrades have been key, too. As the big carriers densified their 5G networks and started to use mid-band spectrum, wholesale partners enjoyed excess capacity at marginal (lower) cost. As analysts at both MoffettNathanson and LightShed Partners have pointed out, this allows MVNOs to price aggressively while still offering a product that for many users feels essentially indistinguishable from postpaid in day-to-day use.

What the Numbers Say About Prepaid Versus Postpaid Growth

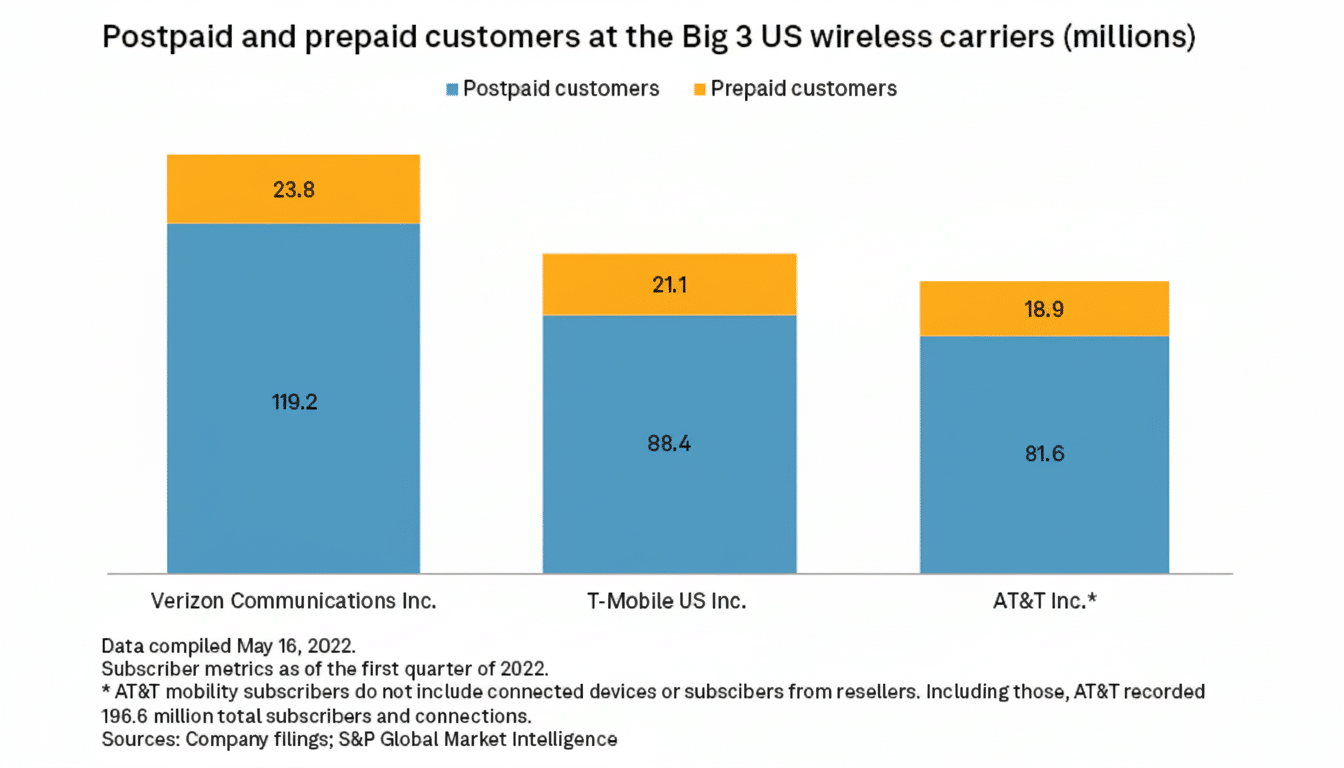

Industry reporting over the last year has indicated that postpaid phone net adds were slowing, with prepaid taking a larger share of the gains. CTIA’s most recent industry snapshot shows a relatively consistent increase in total connections, but the net-adds mix continues to trend toward value segments. Trade-down behavior is for real; carrier earnings calls in 2023–2024 kept flagging trade-down, as prepaid took share among price-sensitive households and single lines.

And critically, prepaid ARPU is still significantly behind postpaid—typically in the 20%–40% range, according to carrier filings. That gap softens the Big Three’s profit pools even if unit share leans prepaid. But it also highlights why carriers are pushing harder on premium upsells, handset financing, and converged offerings like 5G home internet and fiber to protect margins.

How the Big Three Are Hedging Against Prepaid Momentum

The big carriers are not passive observers of prepaid’s ascendancy—they’re its supplier-in-chief. (Verizon acquired TracFone’s suite, which included Straight Talk and Total, and is still promoting Visible online.) T-Mobile completed its acquisition of Mint Mobile and already runs Metro, providing it a two-fisted prepaid strategy with both retail and digital scale. There are still heavyweight MVNOs (think AT&T’s Cricket), though the company has been increasingly pursuing even more MVNO customers with a punchier onboarding experience and wholesale tools featured in recent investor decks.

That kind of ownership and wholesale manipulation changes the calculus. And even if some postpaid customers defect to prepaid, many of them remain within the same owner’s network. By contrast, fixed wireless access (FWA) and fiber are becoming cross-sell engines, as the carriers’ quarterly updates and FCC broadband adoption data illustrate. That convergence helps dull the danger of a sudden revenue cliff.

Should Verizon, AT&T, and T-Mobile Be Scared?

In the short term, not necessarily—but there’s no room for complacency. Postpaid isn’t dying; family plans, enterprise accounts and other premium-device bundles remain robust. But the balance is tilting. In the event of an economic downturn, if trade-down becomes a larger part of the mix, it is possible that postpaid ARPU and upgrade cycles could soften and weigh on profitability despite growing total subscribers.

And there’s the broader strategic risk: If prepaid and MVNO offerings continue to close the experience gap while undercutting price, then perceived demand for high-priced postpaid services erodes. That pushes the Big Three to reinforce differentiation—think genuine bundled value, clear pricing, rewards for loyalty and network-led services like prioritized QoS, integrated security and real international roaming, which prepaid won’t be able to easily replicate.

What Could Shift the Race Between Prepaid and Postpaid

Three levers matter most. One, pricing discipline and fee transparency—shutting down nickel-and-dime moves in favor of trust restoration or brand devotion could reduce churn to the prepaid sector. The second is customer experience—spending on digital care, smarter in-store support and a painless plan. The third is a make-this-up-in-volume strategy—a delicate balance of growing your MVNO base with judicious traffic management so that premium tiers still have perceptible advantages, something pointed out in Opensignal and Ookla’s reports about speed and consistency.

Bottom Line: Prepaid’s Rise Is Real but Not Existential

The rise of prepaid is real, and the momentum has cooled for postpaid, but that doesn’t mean the Big Three are in danger. They run the networks, they control many of the biggest prepaid brands and they are diversifying into home internet and enterprise services. They should not panic—yet. They need to compete smarter, simplify pricing and make premium feel premium again. If they do, prepaid’s rise is less a danger and more of an overdue rebalancing that they can monetize from both ends.