Just in time for the holiday crunch, a family-friendly upstart has squeezed ahead of one of gaming’s biggest players. The weekly ranking of toys at retail outlet Circana indicates that the Nex Playground Interactive Gaming System sold more units than the PlayStation 5 during the week ending Nov. 22, trailing only the Nintendo Switch 2 Mario Kart World Bundle. The information, brought to life by Circana analyst Mat Piscatella, offers a reminder of how pre–Black Friday shopping tends to lean more toward approachable, giftable tech.

How a Family Console Beat PlayStation This Week

Short, pre–Black Friday windows tend to reward products that are easy to understand, in stock, and placed near the exits of big-box retailers. Nex Playground nails that trifecta: It’s a motion-controlled console without controllers, it’s aimed squarely at families, and it fits as neatly in the toy aisle as it does among electronics. That mix can mean hasty “add-to-cart” decisions among shoppers as core gamers wait for more substantive Black Friday and Cyber Monday packages to come along on marquee systems.

Price matters, too. Nex Playground starts at $249, cheaper than mainline consoles. By contrast, Nintendo’s Switch 2 has a base price of $449.99; Sony’s PS5 was recently raised to $499.99; and Microsoft’s Xbox Series S is priced at $399.99. For parents hoping to stretch a gift budget between multiple kids, a sub-$300 console with active play hooks is an easy sell.

Licensing also has a soft but potent underbelly. Nex’s software lineup leans heavily on established kids’ brands — Barbie, Bluey, Peppa Pig, Sesame Street, and Teenage Mutant Ninja Turtles among them — furrowing the brow of buyer’s remorse while also making the value proposition clear as day.

What the Nex Playground Console Really Is and Does

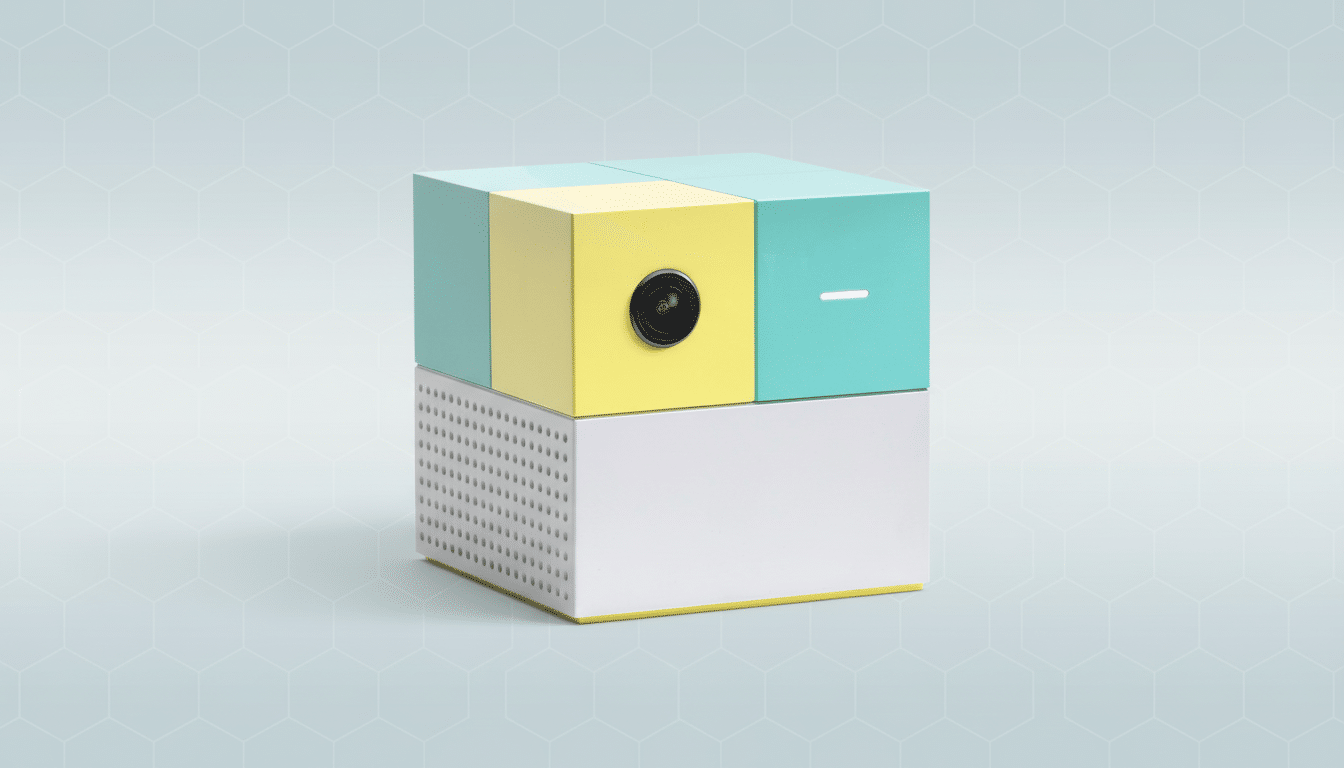

Nex Playground is a camera-based console that turns body movement into playing, no handheld controllers necessary. Think a contemporary version of the experiences that Microsoft’s Kinect and Sony’s EyeToy once popularized. Players slice in Fruit Ninja, dance, draw, and flail their arms for sports such as soccer, basketball, baseball, and archery — games meant to bring children and parents together around the living room.

The console debuted in 2023 and has grown steadily on the back of a simple set-up (power, HDMI, and an area to play), local multiplayer opportunities, and a games library that blends evergreen activity titles with tie-ins from premier children’s franchises. For families who are managing screen time, the “active play” pitch puts it ahead of sit-down gaming and streaming boxes.

The Motion-Control Comeback and Why It Works Now

“MOTION CONTROL IS BACK,” Piscatella joked, referencing the latest ranking, and previous performance says it can rise when access is easy and complexity is low. Nintendo’s Wii made gaming a global phenomenon by opening it up to new audiences, and Kinect even held the Guinness World Record for being the fastest-selling consumer electronics device at launch. Nex’s ascendancy extracts the same rich seam of inclusion — speedy set-up, easy-to-grasp gestures, and games delightedly watched as well as played.

The difference now is focus. Instead of pretending to be the do-everything input for hardcore games, Nex is almost unapologetically targeted at families and younger players. Perhaps it’s that narrower target played to in a retail environment where clarity is currency.

A Snapshot, Not the Whole Story for Holiday Sales

It is important to frame the magnitude of the achievement correctly: Circana’s ranking reflects unit sales for a single week, not revenue, and it largely captures the US retail market. PlayStation is a juggernaut when it comes to overall engagement, software ecosystems, and long-term hardware demand. But a week like this one underscores how diversified the gaming audience has grown — and how holiday momentum can kick in for different kinds of products at different times.

We’ve witnessed similar blips in the past: children’s-focused handhelds, retro mini-consoles, or VR headsets momentarily leapfrogging traditional consoles when promotions and product-market fit fall into place.

The challenge for Nex is whether this burst can turn into prolonged adoption throughout the rest of the season and beyond.

Why Retail Positioning and Content Cadence Matter

On top of that, Nex enjoys considerable distribution in mass among the outlets where holiday volume is heaviest. Shelf placement alongside familiar toys and licensed characters is how it wins mindshare with gift givers who themselves aren’t reading spec sheets or chasing teraflops.

How long momentum will be sustained is anyone’s guess and will largely depend on software cadence — new mini-games, seasonal content drops, and more kid-friendly IP that keeps families returning.

There is a pipeline of recognizable titles, paired with an easy-to-get-enthusiastic-about onboarding process for new players that will decide if Nex can actually turn itself from a pre–Black Friday headline into something that becomes part of daily household routine.

What to Watch Next as Holiday Hardware Sales Unfold

Watch out for the next few Circana reports to see if Nex can hold on to a top-three hardware slot all the way through Black Friday and Cyber Monday. Keep an eye on the big three — Nintendo, Sony, and Microsoft — for bundle activity because another price cut can abruptly shake up the leaderboard.

For the time being, the message is clear: a console that values activity over fidelity and understands that, for many families, the most compelling graphics are the kids in front of the camera will do just fine.