PayPal said it is hiring Enrique Lores as its next Chief Executive Officer and President, elevating the chair of its board and longtime HP leader to steer the payments company through a reset in execution and growth. Lores succeeds Alex Chriss, with CFO and COO Jamie Miller serving as interim CEO until the transition is complete.

The board framed the change as a response to a pace of transformation that lagged expectations amid a tougher market. The leadership shuffle followed a quarter of weaker-than-anticipated revenue and profit, a downbeat full-year profit outlook, and a sharp investor reaction that sent shares tumbling roughly 18% in early trading.

Lores, who has led HP for more than six years, said PayPal would pair product innovation with quarter-by-quarter operating accountability. His mandate is clear: restore momentum at one of fintech’s most recognized brands as competition intensifies and checkout economics come under pressure.

A Turn to an Operator’s Playbook at PayPal

Lores brings a reputation for disciplined execution. At HP, he drove portfolio reshaping and efficiency efforts through the “Future Ready” program, led the acquisition of Poly to strengthen hybrid-work offerings, and maintained cash generation through cyclical PC and print swings. That operating muscle—budget rigor, product-line focus, and cost control—mirrors what many investors have wanted from PayPal after years of scale-first growth.

The choice of an industry outsider to core payments may look unconventional, but it aligns with a board seeking reliability in delivery. HP’s trajectory under Lores underscores comfort with multiyear transformations, something PayPal needs as it balances its branded checkout franchise with lower-margin unbranded processing.

What It Signals for PayPal’s Strategy and Execution

PayPal processed more than $1.5 trillion in total payment volume in 2023, according to company filings, yet growth has been constrained by take-rate compression, mix shifts toward enterprise processing via Braintree, and intensifying competition from Stripe, Adyen, and platform-native options like Apple Pay and Shop Pay.

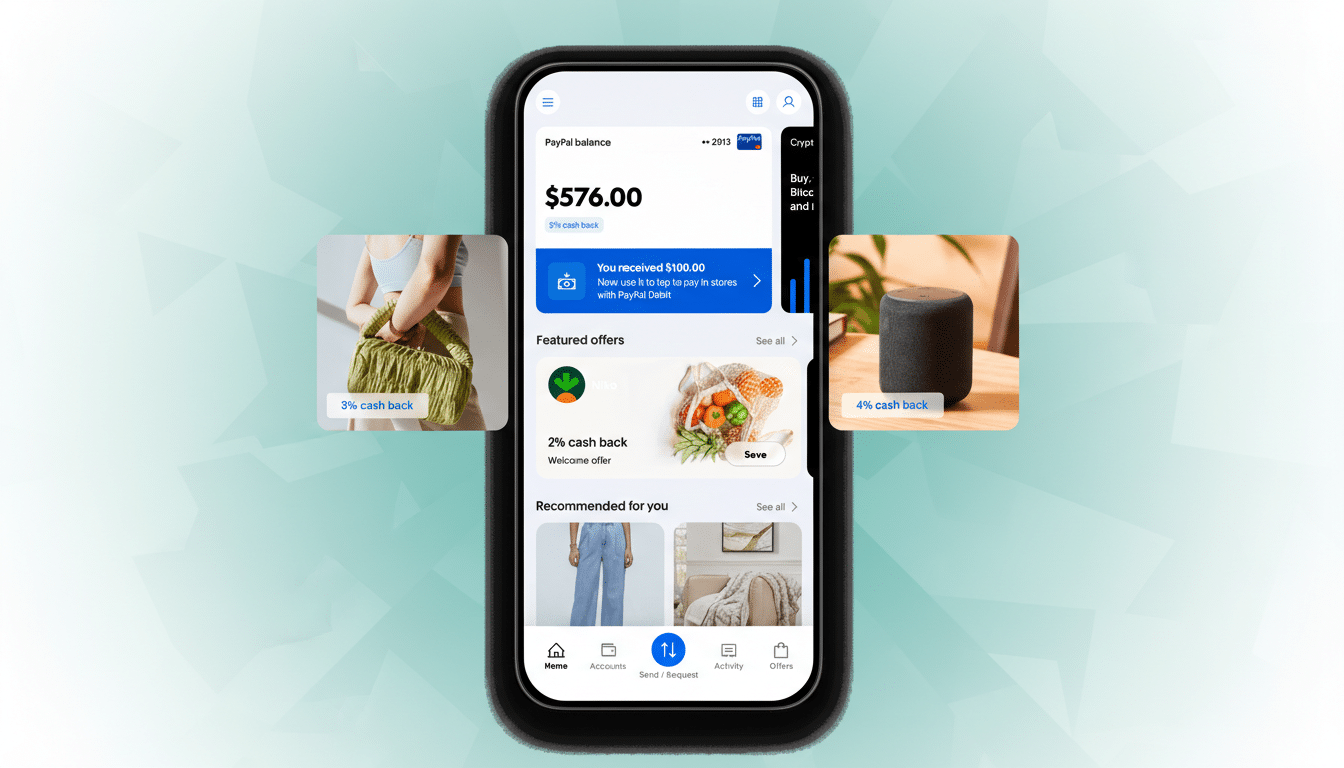

Under Alex Chriss, PayPal emphasized product velocity, unveiling Fastlane one-click checkout, enhanced passkey authentication, and a renewed push for merchant acceptance. Lores is expected to keep that innovation track while imposing sharper prioritization: prune projects that do not clear ROI hurdles, push for higher attach of value-added services (risk tools, payouts, cross-border), and double down on conversion lifts at checkout where even basis-point gains move the needle at PayPal’s scale.

Jamie Miller’s stint as interim CEO aims to ensure continuity around guidance, capital allocation, and cost discipline. Her dual CFO/COO role, and prior experience leading finance at large industrial firms, points to an interim period focused on unit economics and predictable delivery.

Immediate Priorities and Risks for PayPal’s Next Phase

First, stabilize investor confidence. A profit outlook that disappointed the Street will prompt demands for clear cost actions, a renewed margin trajectory, and transparency on where PayPal deploys its balance sheet—whether to buybacks, targeted M&A, or sustained product investment.

Second, protect the core franchise in checkout. On mobile, default wallets and platform-native flows can displace branded buttons. PayPal must keep conversion competitive through tokenization, passkeys, and risk models that cut false declines. Real-world examples matter: major marketplaces and ride-hailing platforms tend to prioritize latency and authorization rates—areas where PayPal’s fraud tooling and network relationships can differentiate if execution is crisp.

Third, lean into AI where it pays. The company already applies machine learning in fraud and authorization; the next frontier is AI-driven seller tools, smarter dispute resolution, and automated onboarding that shortens time-to-first-transaction. With global regulatory scrutiny rising, especially around data use and consumer protections, compliance-by-design will be essential.

Macro uncertainty remains a swing factor. Softer consumer spending and a cooling labor market compress discretionary e-commerce categories, while cross-border volumes are sensitive to currency and logistics costs. Industry trackers such as the Nilson Report continue to show growth in global card purchase volumes, but mix and margin dynamics—not just top-line TPV—will drive PayPal’s earnings path.

Investor Lens and the Road Ahead for PayPal’s Turnaround

Lores’s arrival signals a pivot from ambition to execution: fewer announcements, more measurable cadence in KPIs like branded checkout share, Braintree margin improvement, authorization rates, and operating expense intensity. Expect quarterly updates to emphasize conversion, loss rates, and free cash flow—metrics that can rebuild credibility even if revenue growth is uneven.

PayPal still owns enviable assets—global scale, a massive consumer wallet, deep merchant integrations, and brand ubiquity. The task now is to refocus those assets on profitable growth. If Lores can translate his operator’s toolkit to payments—tight portfolio management, disciplined capital deployment, and relentless simplification—the company has room to re-rate. The board has set the bar; execution will decide whether PayPal clears it.