Ouster has agreed to acquire StereoLabs, a pioneer in stereo-vision systems for robots and industrial machines, in a deal valued at $35 million in cash plus 1.8 million Ouster shares. The move tightens the grip of lidar heavyweight Ouster on the broader perception stack and underscores a wave of consolidation sweeping through sensor suppliers serving robotics, automation, and autonomous platforms.

Why StereoLabs Matters for Ouster’s Perception Strategy

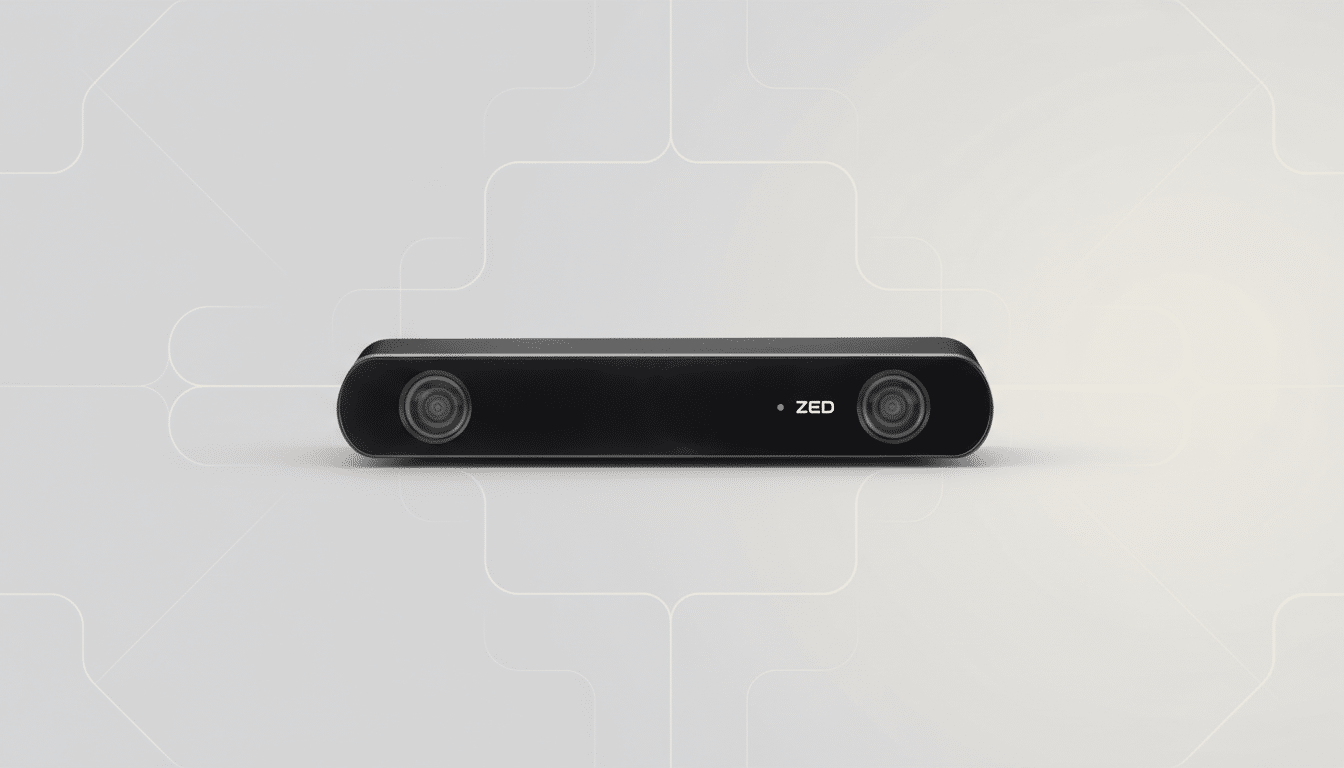

StereoLabs built its reputation with ZED stereo cameras and a software toolkit that turns dual-camera inputs into dense, real-time depth maps on edge compute platforms. The company’s recent work on AI-enhanced depth estimation—effectively a foundational model tuned for stereo perception—can generate robust 3D understanding in varied lighting and texture conditions without cloud connectivity. Pairing that with Ouster’s digital lidar creates complementary redundancy: cameras excel at texture and classification, while lidar delivers precise, absolute range and geometry.

For buyers of autonomous mobile robots, inspection drones, and fixed industrial systems, that combination reduces integration friction. It also promises cleaner calibration, unified time-sync and data fusion, and a single software pipeline for mapping, localization, and obstacle avoidance—areas where fragmented, multi-vendor stacks often add latency, cost, and failure modes.

Consolidation Reshapes Sensor Landscape

The Ouster–StereoLabs tie-up lands amid a broader shakeout. Just weeks earlier, MicroVision acquired the lidar assets of Luminar out of bankruptcy for $33 million, a stark turn for a once high-flying player. Ouster has been an active consolidator, merging with Velodyne in 2022 and buying Sense Photonics the year prior. Industry analysts at Yole Group have tracked more than 80 lidar startups over the last decade; today, only a subset ships at automotive or industrial scale, and several have restructured or exited entirely, including Quanergy’s bankruptcy.

The through-line is clear: customers want fewer boxes, fewer suppliers, and guaranteed software support lifecycles. Consolidation concentrates R&D budgets around proven architectures and accelerates cost-downs on optics, lasers, and perception compute. It also reflects a pivot from speculative autonomy timelines to revenue in near-term markets like warehouse automation, mining, logistics yards, and smart infrastructure.

The Strategy Behind Combining Lidar with Cameras

Technical logic drives this deal as much as market pressure. Lidar gives millimeter-level range and consistent performance in low light or glare; stereo vision delivers dense depth with rich semantics and color. Fusing both improves detection of thin objects (wires, pallet forks), reduces false positives from specular surfaces, and stabilizes SLAM in visually repetitive environments. Expect tighter integration across Ouster’s digital lidar portfolio and StereoLabs’ SDK, with native ROS support and optimization for edge platforms like Nvidia Jetson to cut latency and power draw on mobile robots.

Equally important is the software layer. A unified perception stack can standardize calibration, data formats, and model deployment, simplifying safety cases and certification for industrial customers who require predictable maintenance windows and multi-year support. That’s the difference between shipping developer kits and fielding fleets.

Operating Model and Near-Term Impact for Customers

Ouster says StereoLabs will remain a wholly owned subsidiary, preserving product continuity for the ZED ecosystem while aligning roadmaps. The equity component of the deal ties StereoLabs’ team to Ouster’s long-term performance, a common structure in sensor M&A where talent retention is as valuable as IP. In the near term, customers should look for bundled reference designs—pre-calibrated camera–lidar rigs, synchronized drivers, and turnkey mapping or analytics workflows—to shorten pilots and speed up site-wide rollouts.

Physical AI Ambitions Meet Execution Reality

Rising investment in so‑called physical AI—humanoids, dexterous manipulators, autonomous logistics, and inspection—has heightened demand for robust, affordable perception. Yet the deployment curve differs by category. Warehouse AMRs and outdoor inspection robots are scaling now; humanoid generalists will take longer to validate, certify, and harden for real factories. Ouster’s strategy targets the segments buying today, with an eye on becoming a tier-one supplier as higher-autonomy systems graduate from pilots to production.

Competition remains fierce. Automotive lidar leader Hesai is pushing into industrial markets; Innoviz and RoboSense are advancing automotive programs; and vision compute players such as Nvidia and Ambarella are expanding end-to-end perception stacks. The differentiator for Ouster will be how quickly it can prove integration wins—lower total system cost, simpler installs, and measurable improvements in detection and uptime—across dozens of design wins rather than a handful of flagship deals.

What to Watch Next as Ouster Integrates StereoLabs

Key signals over the next few quarters: jointly announced customers in warehouses, ports, and energy; standardized sensor bundles with validated safety cases; and evidence of cost-downs via shared optics and compute. If Ouster converts the StereoLabs acquisition into a truly unified sensing and perception platform, it will be well positioned as the sensor market consolidates from many point providers to a smaller set of full-stack partners.