Oracle has appointed two long-serving presidents as co-chief executives, an attempt to spread responsibilities more evenly at the tech company after its co-founder, Larry Ellison, stepped aside in September as head of the firm’s board. Safra Catz will become executive vice chair of the Oracle board, and is in a position to safeguard continuity at a time when the company is playing up massive compute demand and multi-year partnerships.

Who the co-CEOs are — and why they matter

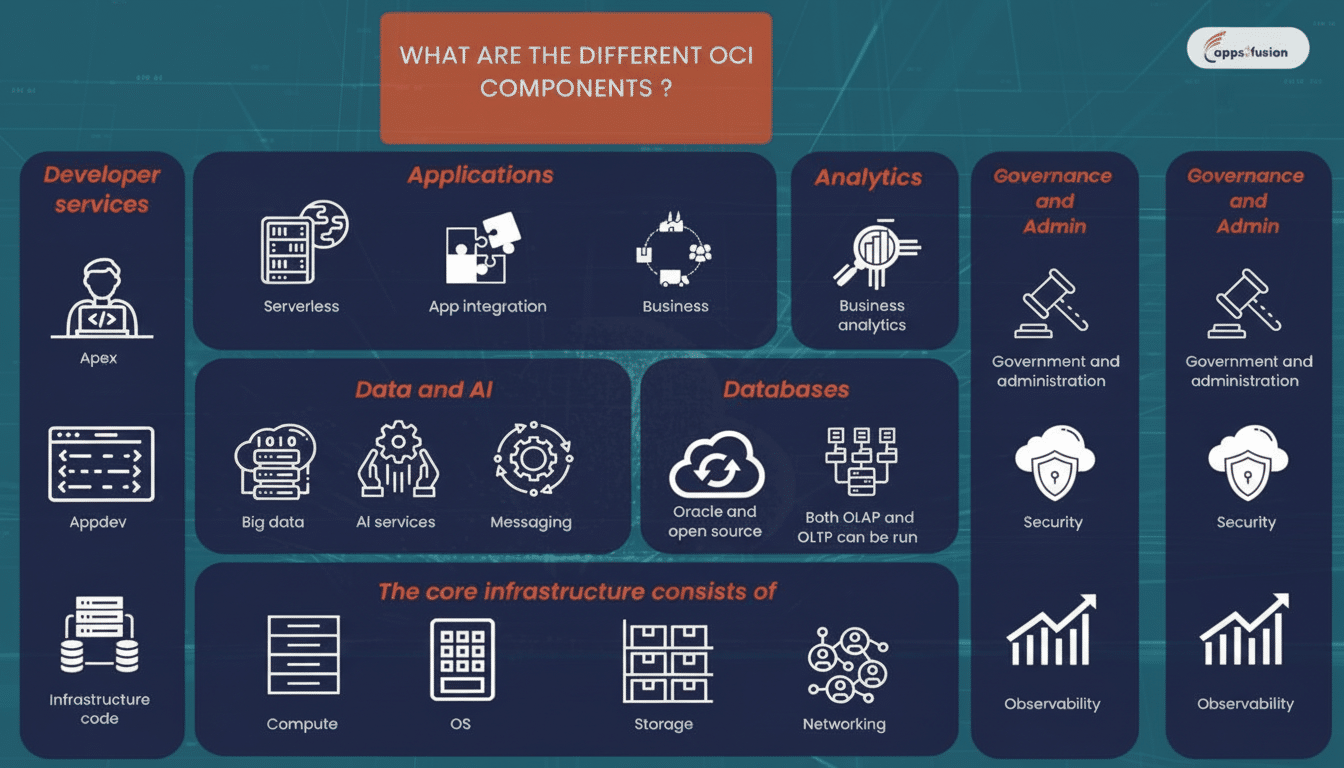

Magouyrk is well-known within the industry for creating Oracle Cloud Infrastructure from scratch upon arrival from Amazon Web Services. He helped design OCI’s high-bandwidth, low-latency fabric and large GPU clusters — capabilities that enable AI training and inference at scale. His promotion makes it clear that Oracle is now coming after the lucrative hyperscale compute market as well, not only the area of databases and applications.

In contrast, Sicilia has managed Oracle’s industries business, which covers healthcare, financial services, communications, manufacturing, hospitality and public sector (and more). He joined through Oracle’s acquisition of Primavera Systems, and has since focused on vertical cloud solutions and regulated workloads. His appointment highlights go-to-market execution in industries requiring ever more sovereign, compliant AI.

A leadership change that fits the AI land grab

Oracle has been repositioning itself to be the go-to source for GPU-laden capacity and ultra-scale networking called upon by frontier models. Industry sources have pegged the company as a member of the multi-hundred-billion-dollar Stargate Project with OpenAI and SoftBank to fund AI data center capacity buildout in the U.S. Reuters (and others) have also reported out significant multi-year compute contracts with OpenAI and Meta, further pointing to a strategy of measured contracted demand over long durations.

The shift comes as spending on cloud services continues to be strong. Gartner has forecast that public cloud will continue double‑digit growth, fueled largely by AI services and infrastructure. IDC has pointed out that accelerated computing—specifically, GPU‑accelerated clusters for training and inference—is now the fastest‑growing piece of data center targeting. The Oracle special sauce is dense GPU offerings, RDMA networking, easier procurement and more predictable egress pricing compared to rivals.

What is different for Safra Catz, and what remains the same

Catz becomes the executive vice chair, a job that allows her to maintain influence on strategy and capital allocation while ceding day‑to‑day control to the new co-CEOs. Her tenure has been defined by a strict focus on costs, sustained operating leverage, and an ongoing transition from revenue derived mainly through licenses toward cloud subscriptions. Look for her to be retained as an important voice on big partnerships, M&A and governance at the board level. Larry Ellison remains its chairman and chief technology officer, a setup that pairs tech vision with operating experience.

Co-CEOs: a well-trod model with visible lanes

Oracle has successfully operated under a dual-CEO structure in the past, pairing complementary operators to divide-and-conquer thorny portfolios of business. The approach is hardly unheard of in tech — Netflix, Salesforce and SAP have all employed variants when scaling across products and regions. It is a formula that works when responsibilities are unambiguous, and spans of control are sharp.

Magouyrk is likely to be responsible for cloud infrastructure, capacity planning, GPU supply, network design and hyperscaler‑to‑hyperscaler deals such as cross-cloud integrations. Sicilia may invest in industry clouds, global go‑to‑market, channel ecosystems, compliance and the application stack that converts raw compute into sector‑specific outcomes. In practice, that looks like pairing OCI’s multivendor base with solutions that sound familiar in hospitals, banks, telcos and government offices.

Impact on customers, partners and investors

For the AI builders, the headline figure is capacity and time‑to‑cluster: quicker access to GPUs and high‑bandwidth networking can mean shorter training schedules (or just getting a larger volume in), which in turn equates to reduced total cost of ownership. Oracle has led with fast “region” builds, and dedicated, sovereign and customer‑operated regions — a definite edge for organizations with data residency or compliance issues.

Partners should expect broader integration across databases, data platforms and inference services, as well as “even greater” interoperability with external clouds via cross-cloud initiatives. For investors, the big signals will be booked-and-billed compute commitments, OCI region expansion, capex cadence and margins as AI workloads ramp. Analysts believe that AI infrastructure capex across the major providers will stay high for several years to come, with power and supply chain, more than demand, acting as the gating function.

Near-term checklist for Oracle’s new co-CEOs

- Clear swim lanes between infrastructure and industry applications to minimize execution drag while accelerating decision‑making.

- Scale the GPU capacity and power as well as advanced networking to meet the AI demand, contracted and delivered consumption without impacting the unit economics.

- Further vertically integrated solutions that transform raw compute into outcomes — think model hosting for clinical coding, fraud detection, or network optimization.

- Keep up cross‑cloud momentum so customers can put Oracle databases next to app and AI stacks wherever they run.

Bottom line: promoting Magouyrk and Sicilia formalizes a divide‑and‑conquer strategy at a time when AI infrastructure choices are determining the next 10 years of enterprise computing. The move combines OCI’s technical scale with industry‑savvy execution — and is a statement by Oracle that it will strive to be the default destination for training, inference, and the regulated workloads that sit on top of them.