OpenAI has concluded a whirlwind recapitalization that opens its for-profit operations in a public-benefit corporation controlled by a new nonprofit mothership, cementing a dual-mission structure created to attract huge investments while preserving governance centered on the common good.

The move reconciles years of tension between OpenAI’s nonprofit fundamentals and the capital intensity of developing cutting-edge AI, and puts the company in a position to acquire other companies, build more partnerships and offer its employees more broadly competitive equity packages without being bound by the constraints that plagued its prior arrangement.

- What the new governance and ownership system looks like

- Stake split and implied valuation after restructuring

- Microsoft pact details and AGI safeguards through 2032

- Regulators approve the deal with conditions and oversight

- Legal challenges and pressure from investors persist

- What it means for customers and the broader AI race

What the new governance and ownership system looks like

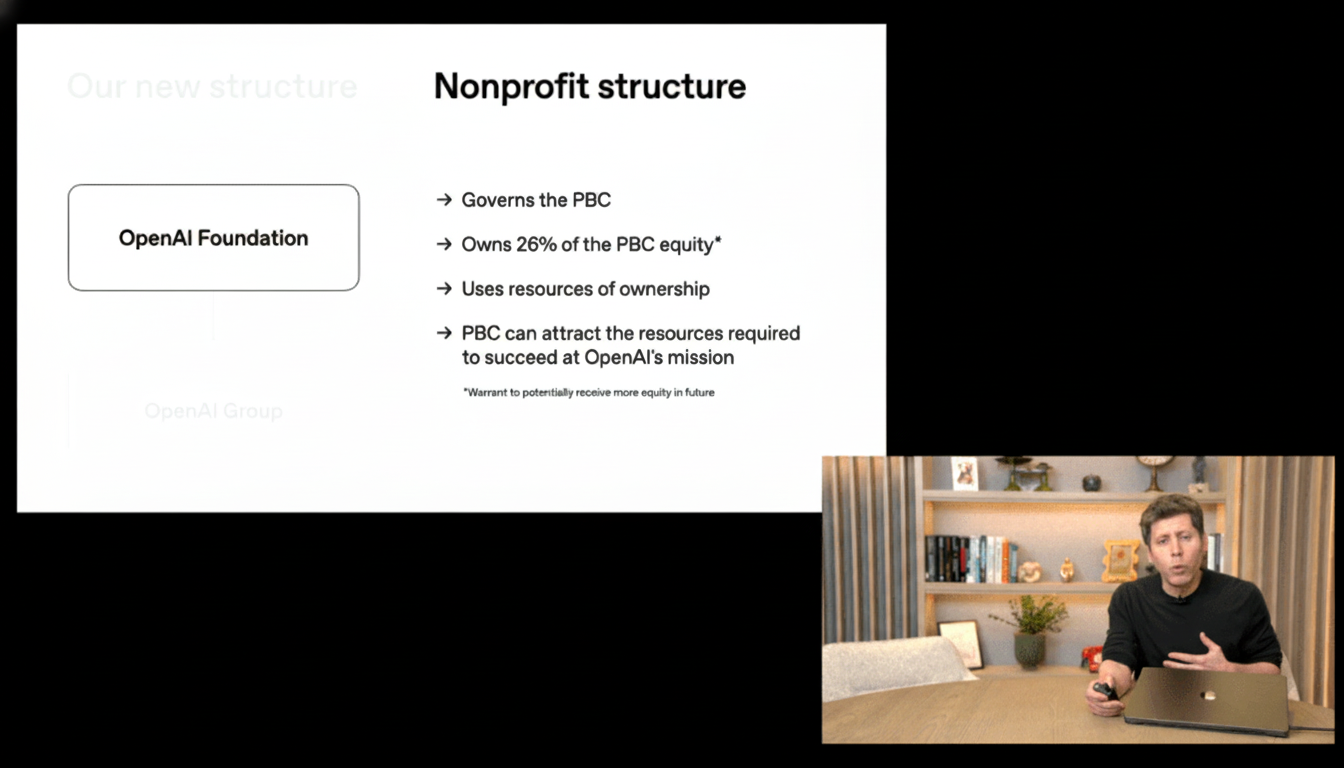

Under the new structure, the OpenAI Foundation oversees the OpenAI Group, which it is calling a public-benefit corporation aimed to balance gains for shareholders with stated public-benefit goals. The Foundation pays for and appoints the board at OpenAI Group and holds a large stake — which would give it ultimate leverage over decisions about strategy and risk.

The for-profit company is 26% owned by the Foundation, with a warrant to purchase additional stock if certain growth targets are met. This arrangement is an attempt to formalize safety and social considerations at the same table as product and revenue decisions — something akin, though not equivalent, to other AI governance experiments like Anthropic’s long-term benefit trust.

Stake split and implied valuation after restructuring

It will make Microsoft the largest outside shareholder in the company, with a stake of around 27% that would be worth about $135 billion. That figure would suggest a post-deal value of close to $500 billion. Other investors and employees hold the remaining 47%, a split that shows that in a fast-changing market, the company has to vie for talent with some real upside.

The recap came after months of capital negotiations, including a conditional $30 billion commitment that SoftBank had made to WeWork and was dependent upon the conversion. That level of funding is in line with the increasing costs of training and deploying frontier models, which demand multibillion-dollar compute budgets and worldwide distribution infrastructure.

Microsoft pact details and AGI safeguards through 2032

As part of the recapitalization, Microsoft revealed that its IP rights to OpenAI models extend through 2032, which mitigates vendor risk for enterprise customers that have standardized on Azure-based AI services. The partners also wrote in a significant governance trigger on artificial general intelligence.

If OpenAI says it has achieved AGI, then the company will submit that assertion to an independent panel of experts for confirmation. The clause is uncommon in the tech industry and reflects a larger push for auditable AI milestones, serving as a guard against shifting goalposts while tilting toward transparent science and safety reviews.

Regulators approve the deal with conditions and oversight

Attorneys general in California and Delaware had reviewed the conversion and allowed it to proceed with conditions specified by their offices. In California, OpenAI committed to preserving and expanding steps designed to reduce disadvantages for teenagers and other vulnerable populations as it continues work on and deploys advanced models.

Leaders at OpenAI described the state-level discussions as productive and said the process helped hone decision-making. The oversight position also reflects broader regulatory expectations around the world, as countries ask for greater accountability from systems that can create realistic cyberspace content, steer online conversations and prompt behavior on a mass scale.

Legal challenges and pressure from investors persist

The recap came with its drama. Legal actions were initiated to try to stop or rework the process, including one from co-founder Elon Musk, who at one point proposed buying out his company for $97.4 billion. In the final judgment, investor demand for the clean cap table—and clarity on governance—prevailed, unlocking committed capital and removing structural friction from future raises.

The result reflects a larger trend in AI: mission-driven oversight with market-grade finance. That’s in contrast to previous capped-return models that made donors feel good — without making it easy for them to be compensated, or track and participate in secondary sales of company shares and late-stage capital.

What it means for customers and the broader AI race

For the enterprise, the extended Microsoft pact and clearer ownership model reduce uncertainty around access to a given model, licensing it, and long-term support horizons. Look for faster product cycles, more aggressive M&A for niche tools and deeper integrations across cloud, security and productivity stacks.

For the industry, this takes OpenAI into an ultra-rare tier at a tacit half-trillion-dollar valuation, expressing investor belief that frontier models monetize across consumer assistants, developer platforms, ad tech, and agentic workflows. It also raises the stakes for competitors, many of which are experimenting with other forms of governance to reassure regulators and talent alike.

OpenAI claims that control and its right to appoint board members mean the Foundation can keep safety and social impacts as a core focus for the company’s growth. Leadership plans a public forum to answer questions about the new structure, an effort to build trust as the organization moves into its next phase of rapid growth.