Nvidia is reportedly preparing to shift its consumer GPU production mix toward GeForce RTX 5060 and 5060 Ti units in 2026, a move aimed at keeping shelves stocked as memory and wafer supply remain constrained. Industry forum Board Channels, as relayed by VideoCardz, indicates add-in card partners have been briefed to expect more volume at the midrange while supply of higher-tier RTX 50-series models tightens.

Why Midrange Graphics Cards Take Center Stage

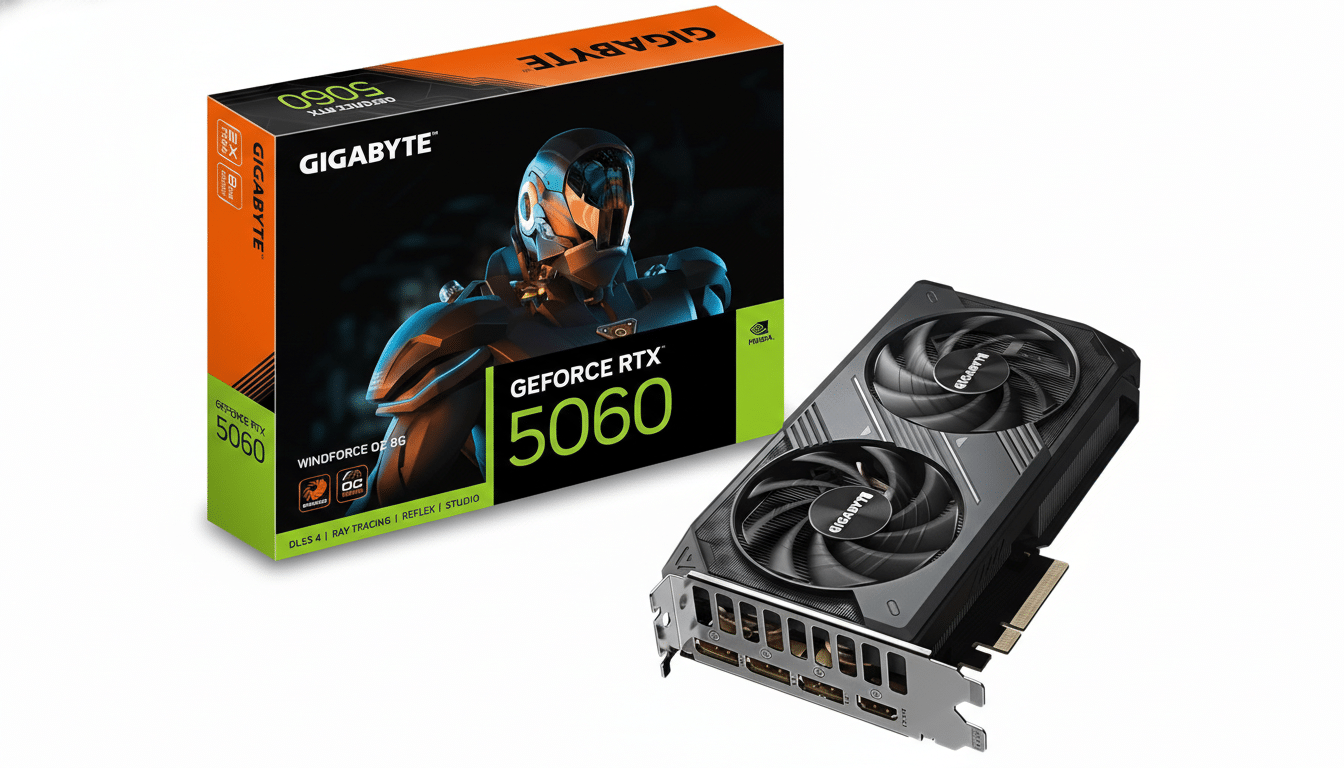

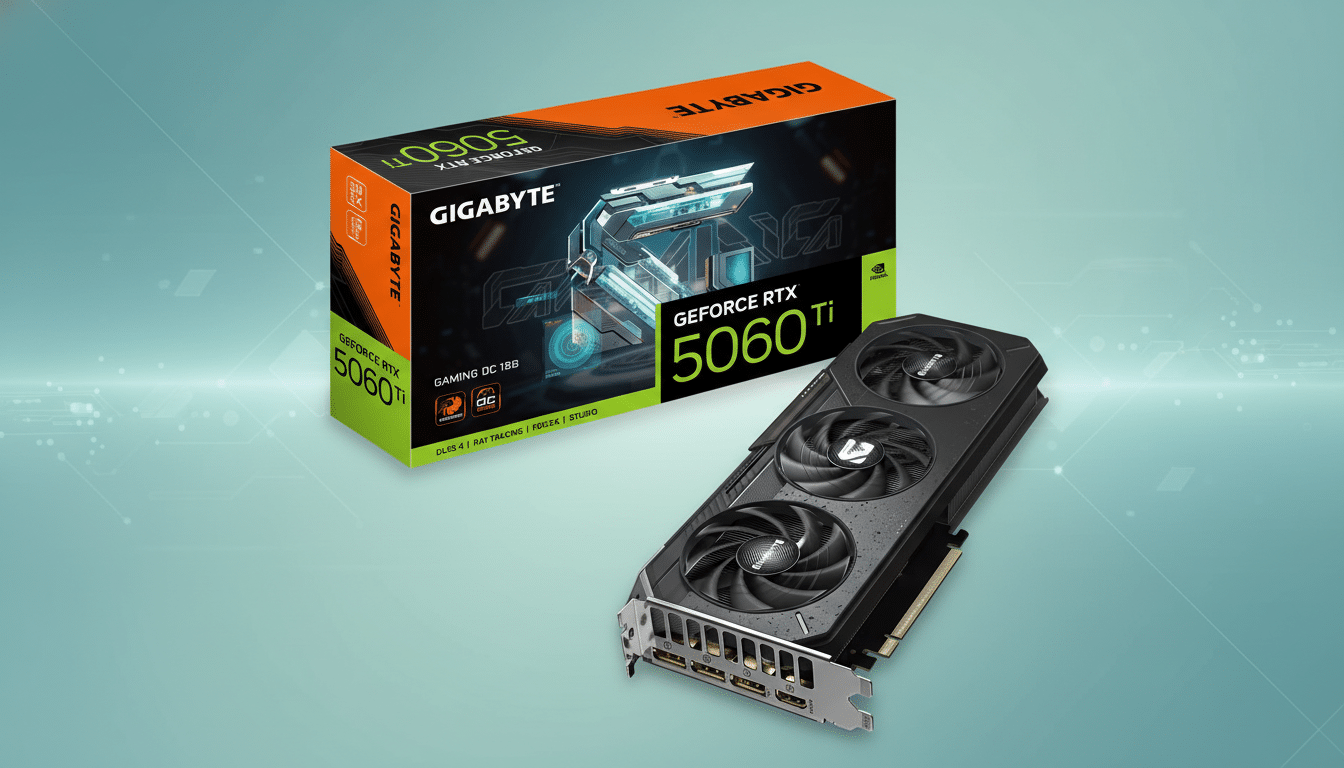

The xx60 class has long been Nvidia’s workhorse for gaming PCs, representing the bulk of unit sales for board partners like Asus, MSI, and Gigabyte. Concentrating on 5060 and 5060 Ti production helps Nvidia meet volume commitments across regions, simplify logistics, and stabilize retail pricing where possible. In practical terms, these SKUs demand fewer memory resources than enthusiast cards and can be built in larger batches without consuming the most constrained components.

Memory Constraints And Surging AI Demand

The backdrop is a memory crunch sharpened by the surge in AI data center deployments. High-bandwidth memory has absorbed massive capacity, and even GDDR lines feel the ripple as fabs prioritize lucrative accelerator orders. TrendForce has documented tight HBM supply and rising capital allocations at memory makers, while foundries like TSMC continue to dedicate leading-edge capacity to AI silicon. That leaves consumer GPUs competing for a smaller pool of memory and wafers than the market wants.

On the component side, GDDR7—touted by Micron and Samsung with speeds up to the 30 Gbps class—will roll out in staggered volumes. Steering limited next-gen memory toward midrange designs with 8GB configurations reduces per-board memory usage and improves overall output for partners, compared with 16GB or larger buffers on premium cards.

What It Means For Pricing And Availability

Expect better shelf presence for RTX 5060 and 5060 Ti, with more models and regional allocations, while higher-tier RTX 50-series cards remain scarce. Price tracking by enthusiast communities has already shown that halo GPUs tend to sell far above MSRP during shortages; when supply pinches, the top-end routinely climbs into multiples of list price. Pushing volume into midrange SKUs is Nvidia’s most direct lever to keep core gaming demand served and retailer relationships intact.

Board Channels also hints at legacy stopgaps, including a potential return of older, lower-memory variants like an 8GB RTX 3060 from previous generations. Reviving mature designs can absorb different supply chains and keep entry-level price points alive when next-gen components are tight.

Performance Context And Growing VRAM Concerns

The tradeoff is clear: 8GB cards are well-suited to 1080p gaming—the most common resolution in the Steam Hardware Survey—but modern titles increasingly push beyond that memory footprint at higher settings or resolutions. Games such as Alan Wake 2, The Last of Us Part I, and recent open-world releases can exceed 8GB with high textures at 1440p, forcing settings tweaks or reliance on upscalers.

Nvidia’s software stack helps soften the blow. DLSS upscaling and Frame Generation can preserve smooth frame rates on midrange GPUs, and features like RTX Video HDR and Super Resolution improve perceived quality for media and games. Still, creators and competitive players targeting 1440p or 4K may prefer 12GB–16GB buffers, which could remain hard to find if production tilts toward 8GB models for much of the year.

Impact On Enthusiast Graphics Cards And Supply

Reports suggest supply of RTX 5070 and 5070 Ti will be thinner than originally planned, while halo models like RTX 5080 and RTX 5090 continue to see price volatility. This mirrors prior cycles where enthusiast GPUs became status products during component shortages. Jon Peddie Research has previously noted that overall add-in board revenues can rise even as units fluctuate—largely because ASPs spike at the top end. That dynamic likely persists if availability stays uneven.

Outlook For Board Partners And PC Builders

For system integrators and DIY builders, the near-term strategy looks pragmatic: plan around 1080p–1440p targets with the 5060 or 5060 Ti, lean on DLSS, and budget for faster system memory and SSDs to reduce bottlenecks. Watch for occasional small-batch drops of higher-memory variants; partners sometimes split lines mid-cycle when supply improves. Retailers in North America and Europe typically get staggered allocations, so regional price swings may persist.

For Nvidia and its partners, prioritizing the xx60 tier is a defensive play to protect market share and maintain steady sell-through while AI absorbs premium components. If memory availability loosens—whether through additional GDDR7 output, packaging gains, or more wafer starts—expect a gradual rebalancing toward 12GB–16GB cards. Until then, the midrange will carry the GeForce brand’s day-to-day load.

Bottom line: barring a swift easing in memory and foundry capacity, gamers should anticipate strong availability of RTX 5060 and 5060 Ti in 2026, with sporadic and expensive top-end drops. The smart buys will be midrange cards paired with modern upscalers, while 8GB limits may require mindful settings tweaks in the latest AAA releases.