Street prices on Nvidia’s RTX 5000-series graphics cards are sliding once again, as online retailers offer new discounts and board partners increasingly give in to the reduction phenomenon. The most apparent culls are applied to RTX 5080 and 5070-class models, which now feature multiple listings with pricing at or below launch as the space between MSRP and what shoppers can really pay shrinks.

Price tracking at PCPartPicker and spot checks across Amazon, Best Buy, Newegg, B&H Photo, Walmart and Micro Center see RTX 5080 variants trending $40 to $80 cheaper than a month ago with multiple board designs cycling through even deeper limited-time discounts. Meanwhile, supply of Nvidia’s own Founders Edition has stabilized at the direct-to-company price point, relieving the early-adopter dearth that drove markups at launch.

Retail Promotions Drive Down Key Models

Walmart’s latest GeForce-centric promotion reportedly dragged a PNY RTX 5080 single card down to $929, which comes in under the $999 price many shoppers thought it’d jump off at. The latter seems all but preordained, even as Nvidia’s Founders Edition 5080 languishes at its $999 direct price — a striking departure from months of sellout status on the open market.

Micro Center’s in-store deals benefit shoppers who can get to a location, and there isn’t a strong budget option with the exception of previous shelf pricing: Gigabyte RTX 5080 WINDFORCE SFF for $899 after falling from historical pricing around $1,299. Other in-store tags include the PNY RTX 5070 Ti Triple Fan for $729.99 (from $749), MSI’s RTX 5070 at $479 (down from previous mid-$500s street positions on some partner cards), and an RTX 5060 Ti for as low as $369 versus prior mid-$500s street listings on select models.

It’s competitive pressure on the AMD side, too. The Radeon RX 9070 XT hasn’t moved back to its introductory price band, and we’re seeing floors in the mid-$600s at major e-tailers, a significant shift from last month’s averages.

Why Prices Are Slipping Across RTX 5000 GPUs Now

Two dynamics are at work. First, supply looks materially healthier. PCPartPicker availability and retailer inventory snapshots signal wider, more uniform supply for the RTX 5080 and 5070-tier boards — which weakens the forces that drove premiums in such a short-lived fashion following launch. Second, there’s growing competitive noise in the channel as AIBs vie for share with aggressive cooler/PCB/bundle variations that can support fast tactical price cuts.

Industry watchers also note they are seeing classic mid-cycle behavior: clearing shelves in anticipation of potential refreshes. Nvidia has a track record…for that sort of thing—think newer “Super” or Ti waves—and distributor chatter implies partners desire headroom in the event another SKU lands in those same performance windows. Although there has been no refresh confirmed, the pattern itself is enough to push retailers to promote into risk inventory levels.

On the demand side, new numbers from Jon Peddie Research indicate that add-in board vendors are bouncing back in the past year, but buyers are getting more and more cautious.

That helps to squeeze street prices down toward the most appealing value tiers — namely, where we’re headed today.

What the Value Is Now for RTX 5070 and 5080 Buyers

For high-refresh 1440p or entry-level 4K gaming, the RTX 5080 is now flirting with a new psychological floor at around $900 to $950 when sales events hit, and that’s a meaningful improvement in the cost-per-frame story over last month.

If ray tracing and frame delivery matter most to you, these newly implemented tags put the 5080 in a neater spot than when it sat closer to $1,100 on partner boards in its early days.

The RTX 5070 Ti and 5070 are emerging as the de facto gaming targets for midrange builders looking to upgrade to the 1440p future. Watching many of them land at their stated launch prices, or even drop below with in-store promotional deals, puts them back in the sweet spot where they were originally intended to play. In the meantime, real halo bits continue to be outliers: RTX 5090 cards are still sitting pretty well north of $2,000 with little indication of a discount.

How Low Could They Go During Seasonal Promotions

Short-term, I’d look for weekend and event-driven promos to establish the lows. After the mid-cycle refresh comes out, if inventory remains well-managed and at any point there is a price war which the channel needs to defend against on high trims, 5080 and 5070 class boards may edge slowly down. (Practical near-term floor: high-$800s to low-$900s on select 5080 partner designs during local, in-person events; online pricing a rung higher.)

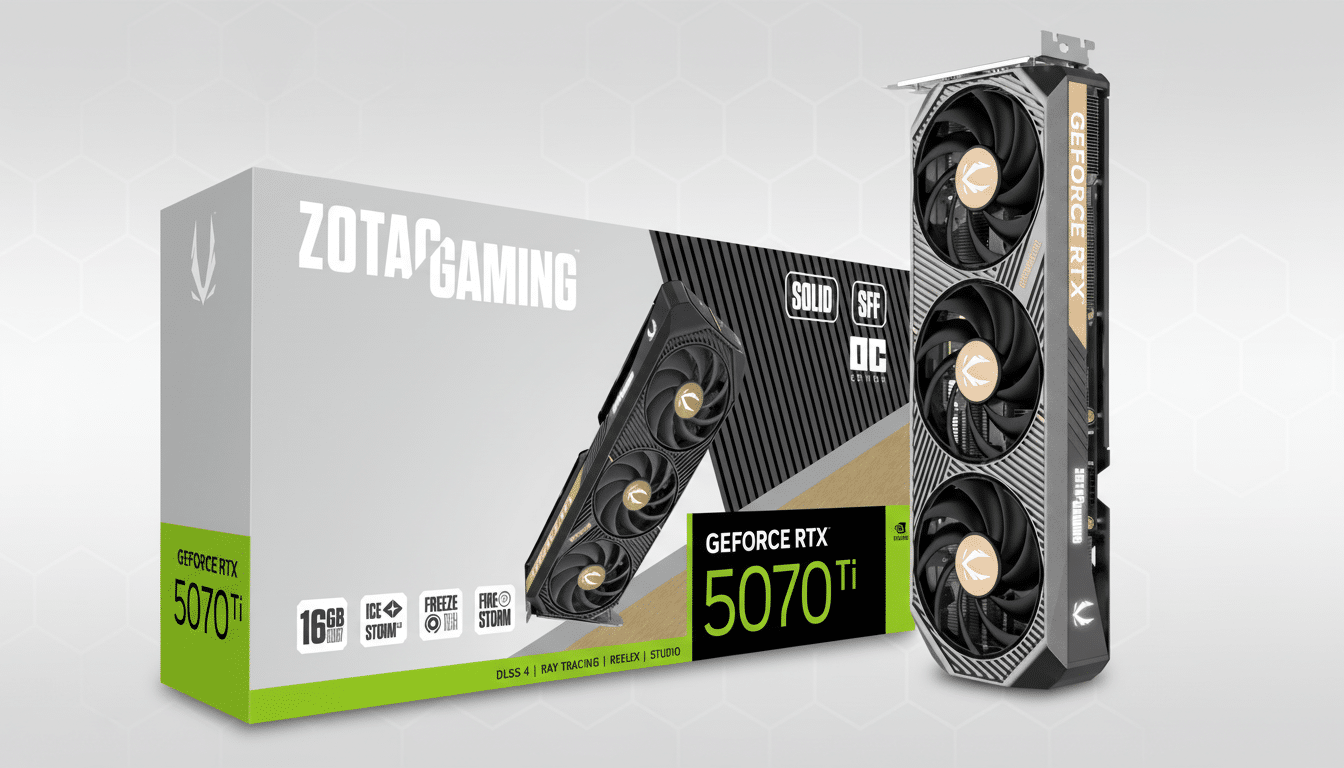

One caveat: the most eye-popping tags only pertain to certain SKUs with smaller coolers and fewer display outputs or trimmed-back factory overclocks. As always, sanity-check any cooler design, power delivery, and warranty coverage before pouncing on a bargain.

Tips for Buyers Based on Data and Price History

Utilize price history tools such as PCPartPicker to verify that a discount is really low and not just part of the cycle. You’d be mad not to compare cost-per-frame in a review, from a quality third-party source where possible, and consider an RTX 5070/5070 Ti with whatever sales prices end up on a discounted RX 9070 XT in your desired games and resolutions. Finally, consider total build cost: PSU headroom/case airflow for triple-fan models, and the premium some compact “SFF” designs command.

Bottom line: The RTX 5000 market is behaving like the ho-hum traditional GPU cycle again, with real competition in the mid-to-high-end and prices that reward patient shoppers. If you’ve been holding back, hoping for the volatility to diminish and for investing conditions to become a bit more predictable, these discounts from retailers are as big a signal as any that the right deal might be a click of your cart away.