Nvidia is bracing for a lean year in gaming GPUs as memory shortages are expected to restrict output of its GeForce RTX 50 series. Industry chat collated by Wccftech and forum posts over at Board Channels suggest production cuts of perhaps 30–40 percent in the first six months, with the early kibosh rumored to be falling on “mainstream” models.

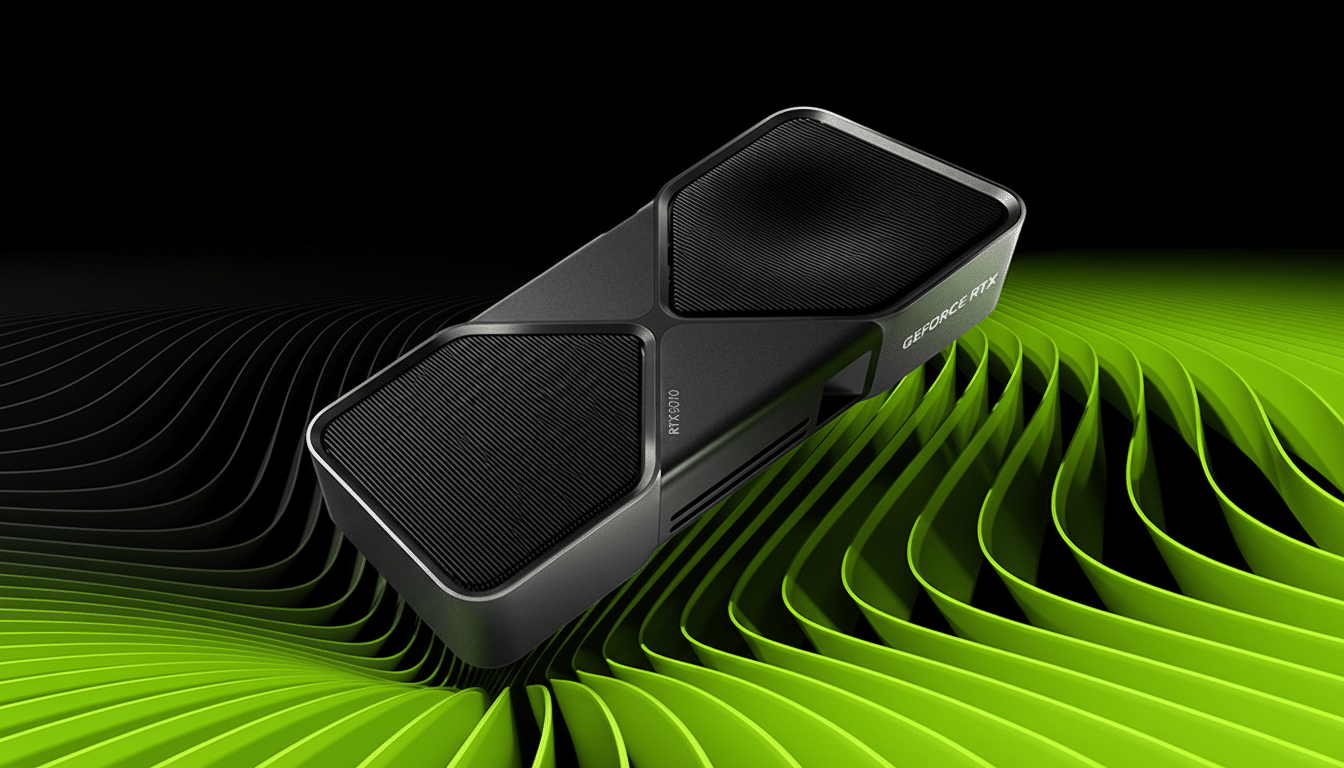

The GeForce RTX 5070 Ti and RTX 5060 Ti 16GB are the first entrants for limited allocation, Benchlife reports. These cards anchor the low end of Nvidia’s lineup of 12GB-and-up models, a range that handles the volume for 1440p gaming and, more and more, for 4K with some upscaler assistance. Any squeeze will be felt by both system builders and retail buyers.

Nvidia has so far declined to comment on the plan. On a recent earnings call, CEO Jensen Huang spent a significant amount of time explaining long-term supply planning with TSMC and the packaging providers, as well as memory vendors — but let’s face it: the truth is that memory is the chokepoint right now for all high-performance silicon — including gaming.

Why Memory Is the Holdup for GeForce RTX 50 Supply

Two forces are colliding. For one thing, the demand for AI is gorging on high-bandwidth memory. SK hynix, Micron, and Samsung have repurposed capacity to HBM for data center accelerators — where margins are better and customers are on the hook for long-term contracts. Analysts at TrendForce have warned time and time again that HBM output will remain constrained as packaging ramps, and yields increase only slowly.

Secondly, it seems that when it comes to next-gen gaming GPUs, the switch to GDDR7 is less about raw speed and more a matter of supply. Higher-density GDDR7 packages’ early volumes are constrained, and vendors are channeling parts and configurations to top strategic customers. Even if the gaming cards are using GDDR6 or mixed memory stacks, there’s general tightness in DRAM wafer allocations and shortages for advanced substrates across the board.

In other words: AI accelerators suck up HBM and advanced packaging; GDDR demand travels in the same wafer-and-logistics ecosystem; HBM supplies compete for manufacturing time, substrates, and logistics slots. And when cloud compute is going gangbusters, gaming inevitably has to give up some of that pie.

Midrange GPUs First Up on the Chopping Block for Cuts

If the rumors bear fruit, Nvidia pulling back from midrange RTX 50 cards first is a savvy move. These SKUs rely on higher shipment volumes and closer price elasticity. Clipping them redistributes memory and packaging capacity to add-in-board partners making higher-margin data center hardware and premium desktop or laptop GPUs without altering flagship MSRPs publicly.

Timing is also crucial if you are a gamer. 8GB cards aged quickly in the last generation as texture sizes and ray tracing workloads grew. For 1440p, the sweet spot has been 12–16GB, and that’s exactly where cards like the RTX 5070 Ti and RTX 5060 Ti 16GB reside — making a supply shortage even keener at the mainstream level, where most of us are upgrading.

Prices Could Drift, Even If MSRPs Stay in Place

The channel dynamics are often more important than the official pricing. Nvidia does not want to see list price increases, according to Wccftech’s reporting. But AIB partners and merchants under allocation pressure usually adjust their margins, especially if demand remains strong. Street prices might nudge up, repeating what the market observed early in the last cycle, but they would blame memory scarcity rather than crypto mining.

From a competitive standpoint, it’s rumored that AMD could raise the cost of GPUs by roughly 10% as the company continues to pay more for each card that gets made. Assuming both vendors are dealing with reduced memory supply, a higher bill of materials means the net result for buyers will be fewer deals overall and longer wait times to restock on their most popular configurations.

GDDR7 Density and the Super Question for RTX 50 Refresh

One thread I’ve seen in the enthusiast community is that an RTX 50 “Super” refresh might be predicated on being able to land sufficient volumes of higher-density GDDR7, which is often referred — sometimes correctly, sometimes not — to as 3GB-per-chip packages. If those parts are in short supply, Nvidia could pick and choose which designs get the best chips, with an eye on mobile flagships or data-center-adjacent designs that return more per unit of memory. That would obviously slow down any desktop refresh cycle.

None of this precludes smart mitigation. Board partners can massage the PCB to house different memory configurations, and vendors will occasionally cherry-pick GDDR6 or even GDDR7 across levels. But these workarounds involve performance, power, and cost trade-offs that are tough to stomach at volume, midrange card prices.

What to Watch Next as Memory Constraints Hit Gaming GPUs

Watch the DRAM contract price trackers from enterprises like TrendForce, the earnings commentary around GDDR7 and HBM capacity adds, which are all set to change — Micron, SK hynix, and Samsung each noted as much — and whether any other Nvidia board partners update figures. Gaming allotment might recover, though, if AI accelerator supply loosens or HBM yields ramp up quicker than anticipated.

For now, the message is clear: memory, not GPUs per se, represents the limiting reagent. If the 30%–40% alleged cut lands, you can bet that upscale RTX 50 cards will be in even shorter supply, prices staying ever more glue-like in their ascent, and a more stretched-out product cadence — thanks to gaming being forced to fight AI for the same vital organs.