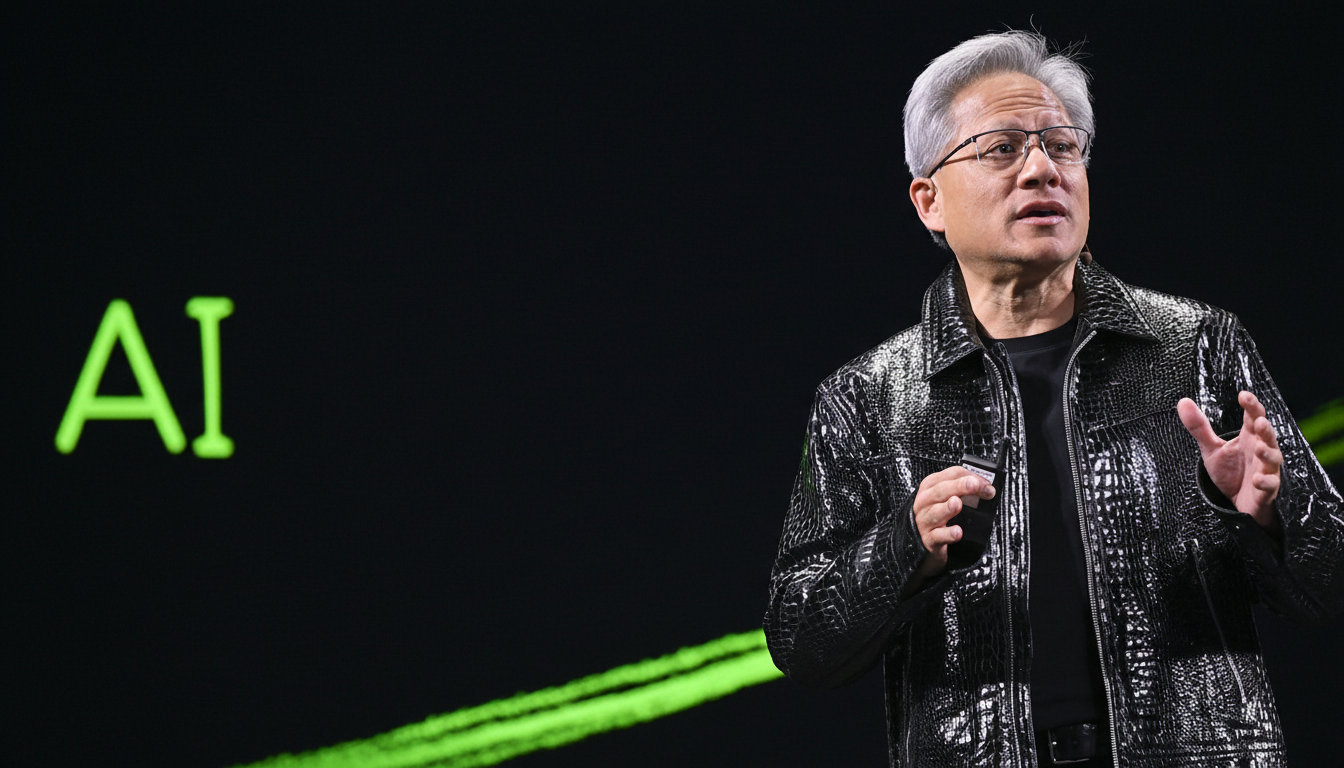

Nvidia CEO Jensen Huang used the company’s GTC gathering in Washington to announce new AI partnerships for telecom, quantum and high-performance computing — propagating a patriotic sales pitch that saluted President Trump and urged more manufacturing anchored in the United States and even more energy development.

Deals Of New Deal Cover 6G Quantum And Supercomputers

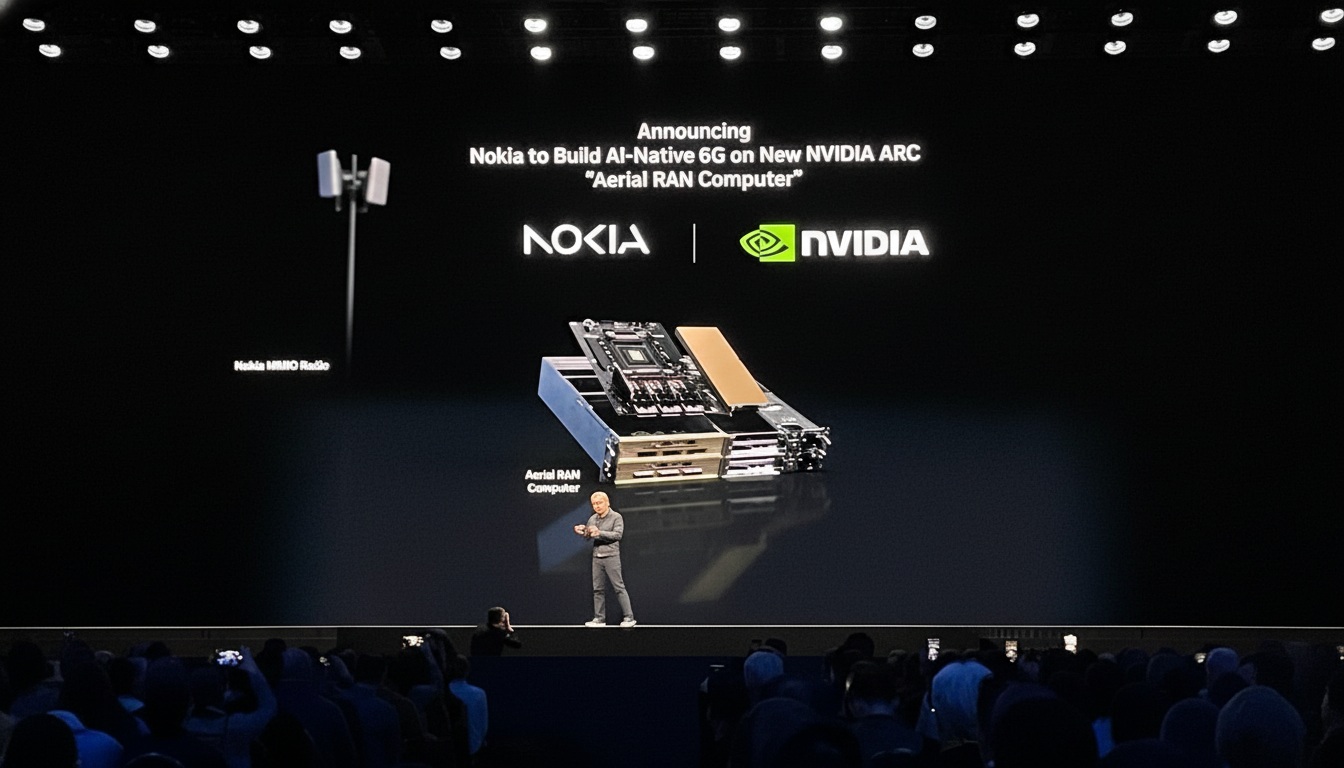

Huang also said that his company had teamed up with Nokia to work on 6G infrastructure, based on a platform he referred to as Arc, which stands for Aerial RAN Computer. Arc will provide software-defined, AI-optimized base stations for next-generation wireless technology, Nvidia said, while Nokia foresees commercial 6G deployment by around 2030. The pitch: applying GPU-accelerated AI to increase the spectral efficiency within radio access networks.

- Deals Of New Deal Cover 6G Quantum And Supercomputers

- A Populist Pitch In Washington By Jensen Huang

- Energy Compute And The Supply Chain Politics

- Hardware Roadmap And Stakes On The Market

- Next Platforms: Robots And Robotaxis Move Closer

- 6G Bets Meet Quantum Ambitions In New Partnerships

- Why It Matters For Policy, Energy, And AI Competition

On quantum, a domain he has previously been circumspect about, Huang said the field has reached an inflection point on qubit stability and error correction. Nvidia’s solution is NVQLink, a system designed to link quantum processing units with GPUs and CPUs while adding error-mitigation pipelines. Eight Department of Energy laboratories will test the stack, and new partnerships will bring seven AI-optimized supercomputers to DOE facilities for basic science, not consumer chatbots, Nvidia said.

A Populist Pitch In Washington By Jensen Huang

Huang’s keynote had mixed a product road show with policy rhetoric, arguing that U.S. networks rely too much upon foreign technology and saying that needed to change. He framed AI as an economic flywheel — “AI is work,” not merely a tool — from which profitability purchases more compute, which in turn generates more productivity. That framing works in a capital that is tuned in to industrial policy and national competition.

The political tone intensified as Huang lauded the administration’s energy stance and specifically thanked President Trump, with “make America great again” type rhetoric prompting applause. It was a moment of particular note for the CEO of a company at the very center of global AI build-outs and supply chains stretching from Hsinchu to Silicon Valley.

Energy Compute And The Supply Chain Politics

AI’s rise is megawatt-thirsty, and Huang leaned into that fact. That is putting pressure on policy and grids, as a global data center thirst for electricity is projected to nearly double by 2026, according to analysts at the International Energy Agency. In that context, Huang linked Nvidia’s growth with U.S. energy resources and manufacturing arrangements for advanced systems within the United States.

He said Blackwell-generation hardware is now fully in production in Arizona, with manufacturing partners including TSMC, SK Hynix and Foxconn. Though Huang credited Trump with calling for a return of manufacturing, the revival also depends on the Chips and Science Act, which was passed in 2022 and directed tens of billions of dollars in incentives to chip fabs and memory plants operated by those same suppliers.

Hardware Roadmap And Stakes On The Market

Nvidia’s short-term growth driver remains its data center business. Huang highlighted the Grace Blackwell NVL72 as a leap forward in training and inference efficiency with SemiAnalysis measurements of some 10x better performance per dollar, per watt compared to the previous H200 NVL8 design. The Vera Rubin platform, available in the near future (as of this writing), will further reduce cost-per-token and latency, he added.

Nvidia is estimating $500 billion in sales for Grace Blackwell and Vera Rubin from 2025 through 2026, marking the chip maker’s confidence that spending on AI is entering a multiyear build cycle. The AI factory-building concept — the digital twin of data centers and industrial endeavors that Omniverse powers — is the company’s pitch for how customers turn capital into something with tangible value.

Next Platforms: Robots And Robotaxis Move Closer

Huang also described humanoid and service robots coming up as a new consumer category, name-checking initiatives such as Tesla’s Optimus or Disney’s experimental BDX droid. So while consumer robots are still aspirational, Nvidia is banking on multimodal foundation models and simulation to speed up the demo-to-deployment timeline.

Cars that drive themselves are getting closer to the money. Huang said the Drive AGX Hyperion stack is in development for making vehicles “robotaxi-ready,” with partners including Stellantis, Mercedes-Benz and Lucid. Uber hopes to build a robotaxi fleet that would scale from 2027 toward 100,000 units — with an initial order of 5,000 vehicles signed with Stellantis — while keeping ongoing pilots in place with Waymo and with Lucid and its automation partner Nuro.

6G Bets Meet Quantum Ambitions In New Partnerships

The Nokia deal puts Nvidia in the middle of the 6G debate as bodies such as 3GPP and ITU move to establish IMT‑2030 frameworks. If Arc can deliver AI-operated RANs with economically significant levels of spectral efficiency per bit, it has the potential to reshape not just carrier economics, but also global geopolitics in terms of which country owns the world’s wireless stack.

Meantime, NVQLink is an effort to weave today’s GPU-based AI into tomorrow’s quantum accelerators. DOE’s participation is a sign that the first killer apps are expected to be in solid-state physics, materials development, and climate modeling rather than consumer AI — a kind of R&D track whose payoffs include breakthroughs when classical compute faces an upper bound.

Why It Matters For Policy, Energy, And AI Competition

In Washington, product news and policy theater are intermixed. Huang’s pronouncements help widen Nvidia’s technology moat, and the government audience he seems to be courting controls standards, subsidies and the grid. The MAGA-tinged rhetoric may be headline bait, but the larger story is one of strategy: lock in U.S.-based capacity, ally with public-sector science and present AI as critical infrastructure — before rivals or regulators force a redefinition.