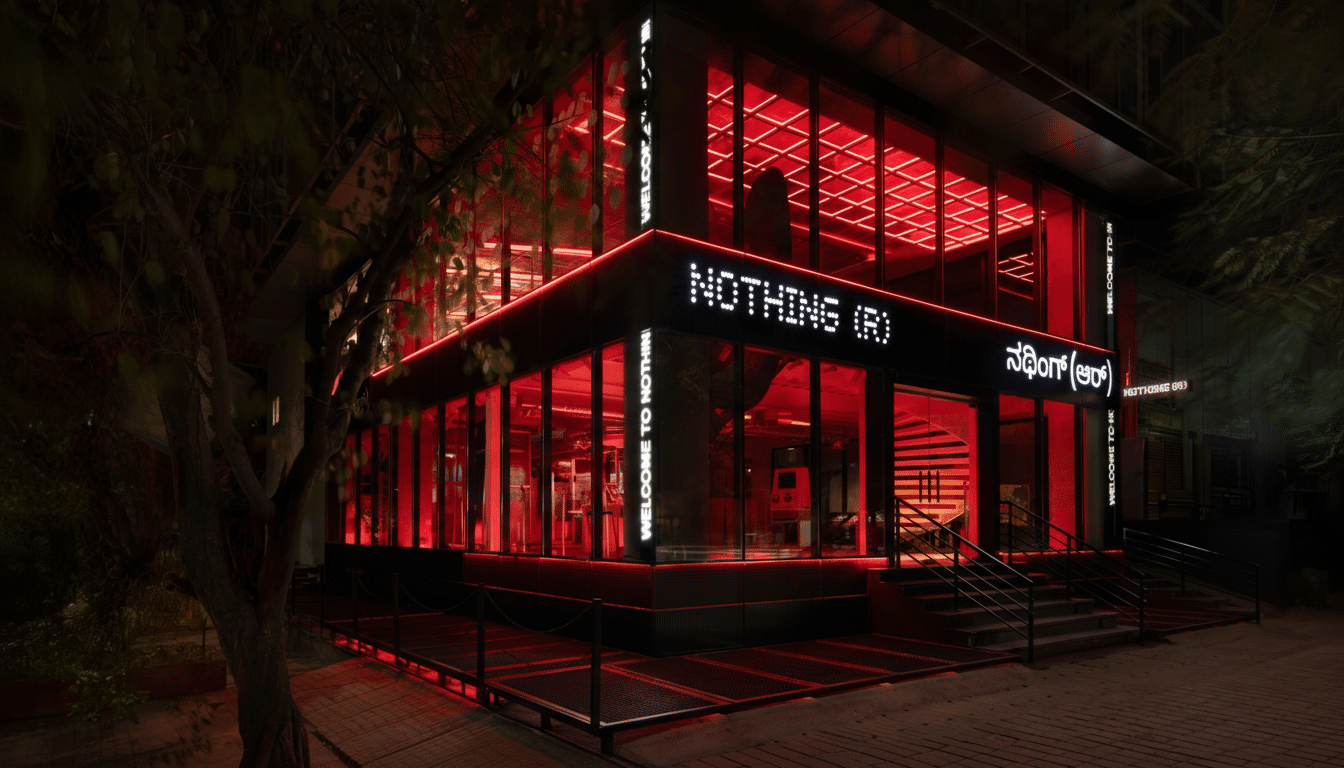

Nothing has opened its first retail store in India, selecting Bengaluru as the launchpad for a brick-and-mortar push in its largest market. The two-level space doubles as an immersive brand showcase, reflecting the company’s bet that hands-on experiences and thoughtful design can lift sales and loyalty amid India’s intensifying premium smartphone race.

Why Bengaluru Was the Obvious First Step

Bengaluru isn’t just a tech hub; it’s one of Nothing’s densest user clusters in India. Opening a flagship there puts the brand in front of early adopters and design-forward consumers who influenced Nothing’s word-of-mouth lift since the launch of its transparent hardware aesthetic. IDC ranks India as the world’s second-largest smartphone market by shipments, and Counterpoint Research has repeatedly noted that offline retail remains pivotal for brand discovery and premium upgrades—especially in metros like Bengaluru.

That calculus mirrors moves by rivals. Samsung’s Opera House in Bengaluru pioneered the “experience-first” concept years ago, while Apple is expanding a network of architectural flagship locations, including a new store planned in Mumbai’s Borivali neighborhood. In short, India’s top brands aren’t just selling boxes; they’re selling belonging—and stores are the stage.

Inside the Experiential Store in Bengaluru

Nothing’s new space is designed to feel like a working lab. The company says visitors will see elements inspired by production lines and testing rigs—think stations that echo durability checks such as port wear and water resistance. Beyond browsing, customers can buy devices, branded merchandise, and personalize select items, turning a typical purchase into a small ritual.

Crucially, the store carries both Nothing and CMF, the company’s accessible sub-brand. Displaying the full portfolio under one roof lets staff steer customers along clear price and feature ladders. That helps Nothing reach design-conscious buyers at multiple budgets without blurring brand identities.

CMF’s India-First Advantage in the Value Segment

CMF is headquartered in India and operates a joint venture with Optiemus, a local original design manufacturer. That footprint does more than shorten supply lines—it anchors CMF in India’s fast-moving value segment while aligning with New Delhi’s push for deeper local participation in electronics. Analysts at Counterpoint have highlighted how India’s “premiumization” trend coexists with robust demand below the flagship tier; CMF gives Nothing a credible on-ramp to that mass market without diluting its core brand’s positioning.

The differentiation is deliberate: Nothing focuses on higher-priced, design-led devices for a niche audience; CMF addresses mainstream shoppers seeking well-finished hardware that still feels considered. With both lines present in-store, the company can meet walk-in demand across segments while reinforcing that thoughtful design scales beyond a single price band.

Betting On Offline As India’s Mix Evolves

India’s online channels surged in recent years, yet offline continues to command a slight majority of smartphone sales, according to industry estimates. That balance matters. Shoppers still want to feel weight, test haptics, and judge display quality—areas where Nothing differentiates through materials, lighting, and a recognizable see-through language. A store provides the controlled environment to translate those cues into conversions.

It also opens room for community. Live demos, limited editions, and service-style interactions can raise repeat footfall and net promoter scores—metrics that typically correlate with higher attachment rates for accessories and extended services. For a young brand, the compounding effect of in-person advocacy can be outsized.

Funding Firepower and Global Expansion Hints

Nothing has the capital to scale its retail experiments. The company raised $200 million in a Series C at a $1.3 billion valuation, led by Tiger Global, and has secured $450 million to date from investors including GV, Highland Europe, EQT, Latitude, I2BF, and Tapestry. While this Bengaluru flagship is its first in India and its first outside London, the company has flagged Tokyo and New York as next candidates—signals that a small constellation of high-impact stores, rather than a broad network, is the near-term plan.

If that strategy holds, expect locations chosen as much for influence as for footfall: neighborhoods where design culture, creator communities, and premium buyers overlap. For a brand built on visibility—literally, in the way its products reveal their internals—sensorily rich stores can be the most persuasive ad unit money can buy.

What to Watch Next for Nothing’s India Retail Bet

Success in Bengaluru will be measured less by weekend queues and more by leading indicators: higher conversion for flagship phones, improved attach on audio wearables and accessories, and rising awareness for CMF outside online-first circles. With India already Nothing’s biggest market, a strong showing here could set the tone for its global retail footprint—and prove that in the age of one-click checkout, the showroom still matters.