Nothing is pressing pause on its annual flagship rhythm and shifting attention to the midrange. CEO Carl Pei has confirmed that the brand’s current premium model remains in the top slot for now, while the next device on deck is the Nothing Phone (4a), a more affordable handset positioned to close the gap with high-end rivals.

A Strategic Pause on Flagships to Prioritize Impact

Pei framed the decision as intentional, not reactive. The company doesn’t plan to release a new top-tier phone simply to keep a yearly cadence; instead, it wants upgrades that clearly move the needle. That approach runs counter to the broader industry’s tick-tock habit, but aligns with Nothing’s brand identity: fewer products, sharper differentiation, and a focus on user experience over spec-chasing.

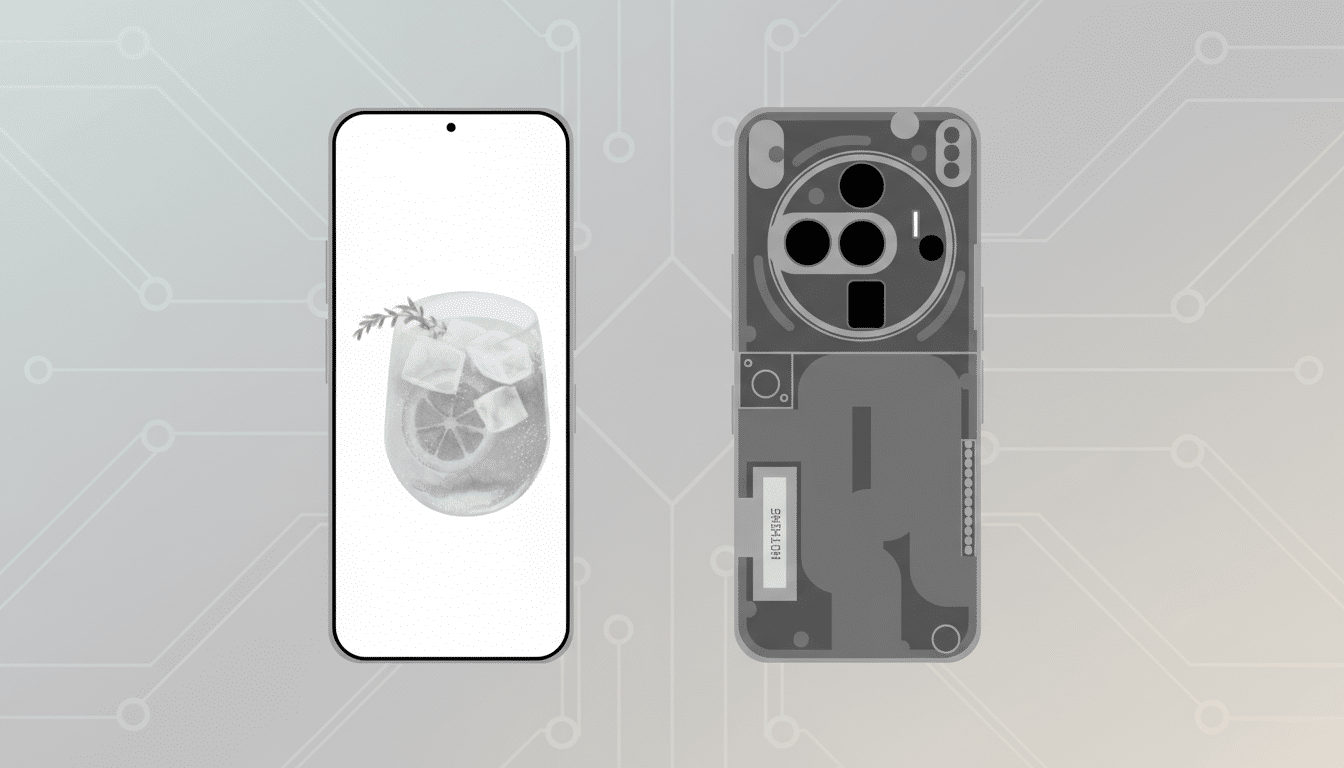

It’s a risky but rational move. Premium buyers have grown savvier about incremental updates, and extending the flagship cycle can prevent fragmentation across software and accessories. It also gives Nothing time to refine its design language and ecosystem, which includes distinctive touches like the transparent aesthetic and glyph lighting.

Phone (4a) Aims for Near-Flagship Value and Polish

Nothing says the Phone (4a) will be a comprehensive step up over its predecessor, with improvements promised for the display, camera, and overall performance. Expect bolder color options and a continuation of the company’s minimalist hardware philosophy. While specs remain under wraps, the brand’s recent cadence suggests a focus on clean software, fast updates, and a balanced hardware package that feels more premium than its price.

The A-series has already proven there’s room for multiple variants tailored to different budgets, and Nothing has hinted that the (4a) lineup could mirror that strategy. The goal is straightforward: deliver the day-to-day experience people associate with flagships—snappy performance, reliable cameras, strong battery life—without the sticker shock.

Component Costs and the Midrange Math Behind Pricing

One factor shaping pricing is memory. Pei has warned that rising RAM costs will nudge retail prices upward, and Nothing is preparing a shift to UFS 3.1 storage in the A-series for the first time. That change matters: UFS 3.1 can deliver roughly 2,000MB/s sequential reads versus around 1,000–1,200MB/s typical of UFS 2.2, cutting app load times and improving system responsiveness.

Analysts at TrendForce have documented sustained increases in DRAM and NAND pricing across multiple quarters, pressuring margins for device makers that compete aggressively on value. At the same time, firms like Counterpoint Research and IDC continue to highlight midrange volumes as the engine of unit sales in many regions. The math favors a polished, high-volume A-series even if individual components cost more.

Positioning Against Pixel A And Galaxy A

Nothing’s Phone (4a) will enter a crowded field dominated by Google’s Pixel A-series, Samsung’s Galaxy A5x line, and OnePlus Nord devices. Pixel competes with computational photography and long software support; Samsung leans on display quality, battery endurance, and retail presence. Nothing’s counterpunch is design-led hardware, a lightweight OS, and a brand voice that resonates with enthusiasts who want something different.

If Nothing pairs UFS 3.1 with a capable midrange chipset, a stabilized main camera, and a battery tuned for endurance, it can carve out a credible space just below the flagship tier. The company’s track record suggests it will also emphasize thoughtful haptics, clean animations, and restrained bloat—areas where midrange phones often cut corners.

Retail and Audio Build the Ecosystem for Growth

Beyond phones, Nothing says it will double down on over-ear headphones following its first pair, which drew attention for a striking design and solid noise cancellation. Iterating quickly on audio can bolster the brand’s ecosystem story and give customers more reasons to stay within the Nothing universe.

The company is also expanding retail, including its first US store in New York City and plans to secure a location in Tokyo, joining existing physical spaces in London and an upcoming site in Bengaluru. For an emerging phone maker, stores play a crucial role: they showcase hardware, offer hands-on demos, and add after-sales confidence in markets where brand recognition is still growing.

What Buyers Should Expect from Nothing’s Roadmap

For flagship hunters, the message is simple: the current top-end Nothing device remains the premium option for now. Those considering an upgrade in the midrange should keep an eye on the Phone (4a) if they want a near-flagship feel without a four-figure price.

Do anticipate some price creep due to memory components and higher-spec storage, as Pei has cautioned. In return, look for faster app launches, smoother multitasking, and camera gains that make the (4a) a credible everyday phone for most people.

It’s a calculated bet: slow the flagship treadmill, pour energy into a standout midranger, and reinforce the ecosystem with audio and retail touchpoints. If Nothing executes, the (4a) could be the company’s most important phone to date—not the most expensive, but the one most people actually buy.