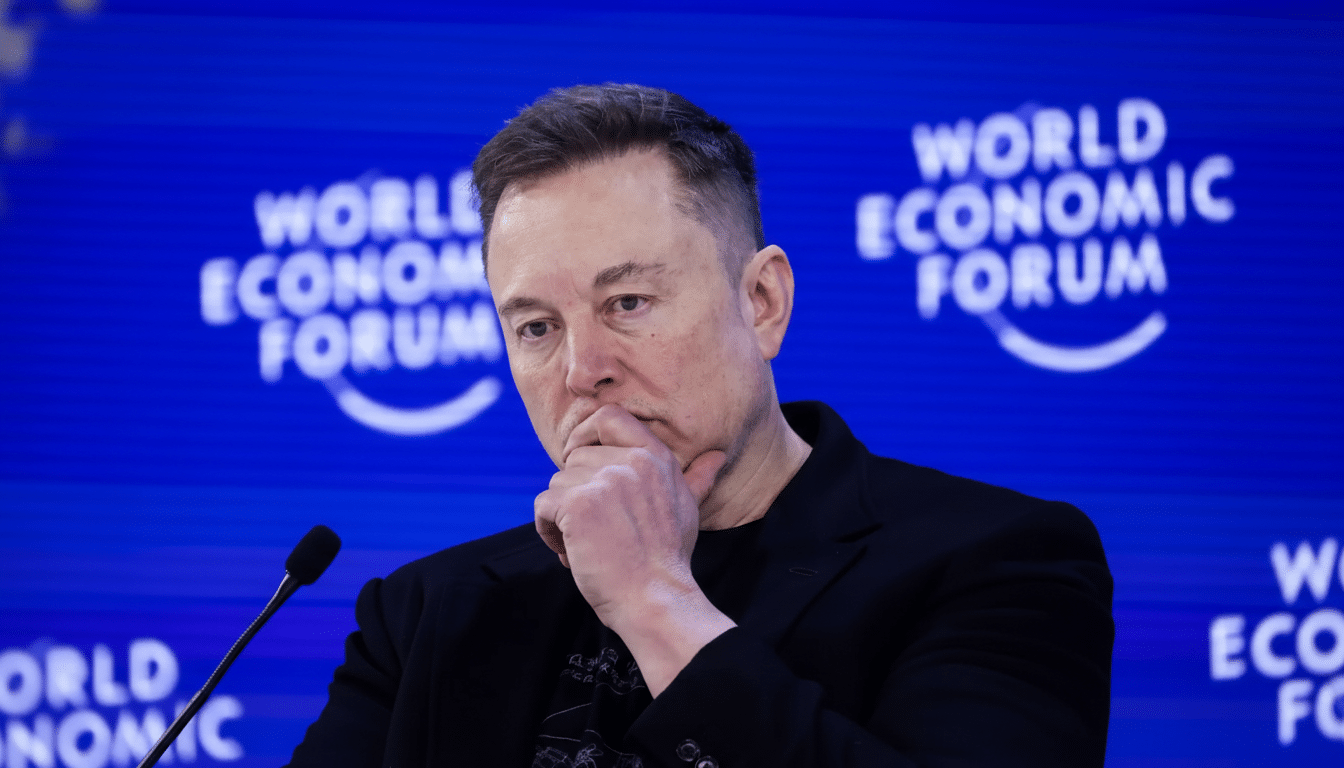

Elon Musk is exploring a June debut for a SpaceX initial public offering, aiming to time the listing with his birthday and a rare alignment of Mercury, Venus, and Jupiter, according to a report from the Financial Times. The offering under discussion would seek at least $50 billion at a roughly $1.5 trillion valuation, the FT noted, while cautioning that the figures and timing remain fluid.

If executed as described, the deal would instantly rank among the largest in market history. It would also mark a defining moment for the commercial space sector, transforming SpaceX from the most valuable U.S. startup into one of the most closely watched public companies on Earth.

Why the June Listing Date and Celestial Timing Matter

SpaceX has never been shy about spectacle, and an IPO pegged to both a personal milestone and a celestial event would fit a familiar Musk playbook. Symbolic timing has often served as a narrative amplifier for his ventures, helping generate attention beyond core financial audiences. A planetary alignment visible to skywatchers in early June would provide a made-for-headlines backdrop.

Beyond theatrics, June is traditionally an active window for listings once markets have stabilized after the first quarter. If volatility is contained and investor risk appetite holds, a high-profile offering can attract global capital and set the tone for the rest of the year’s issuance.

The Financial Scale and Current Market Context for the IPO

Targeting a raise of $50 billion at a $1.5 trillion valuation would eclipse the scale of previous mega-IPOs. By comparison, the largest offerings on record—Alibaba and Saudi Aramco—each raised under $35 billion. A SpaceX float at the FT’s indicated range would be unprecedented for a technology-led enterprise.

Private trades late last year reportedly implied an $800 billion valuation for SpaceX, suggesting public markets would be asked to underwrite a dramatic step-up. The appetite may be there: investors have been willing to pay premiums for companies seen as owning critical infrastructure—cloud, AI compute, and increasingly, space-based connectivity.

Revenue momentum could help the case. Bloomberg and The Information have reported that SpaceX’s sales have surged on the back of an expanded launch manifest and rapid adoption of Starlink, which now serves millions of customers globally. Profitability remains tied to execution on manufacturing scale, launch cadence, and satellite refresh cycles.

What the Cash From a Potential SpaceX IPO Would Fuel

Starship is the centerpiece. The fully reusable system is designed to carry massive payloads to orbit and beyond, enabling lunar missions and, ultimately, Mars ambitions. Multiple flight tests have progressively demonstrated ascent, stage separation, and controlled splashdowns, but full reusability at scale remains the unlock for material cost reductions.

On the network side, Starlink requires sustained capital to add satellites, upgrade ground infrastructure, and expand enterprise services. The constellation’s economics improve as launch costs drop, which is why SpaceX’s record reuse of Falcon boosters—and future Starship reusability—are central to any long-term margin story.

The company also supports high-value government work, including NASA programs and national security launches. Winning slots in new procurement rounds can stabilize cash flows and justify ongoing capex in factories, engines, and launch sites.

Structure and Control Are Open Questions

Investors will scrutinize how SpaceX chooses to list. A full-company IPO would bundle launch, Starship, and Starlink into one entity, while a partial listing—historically discussed around Starlink—could ring-fence cash flows and create a clearer valuation benchmark for the broadband business.

Governance will be another focal point. Musk has favored strong founder control at other companies; a dual-class share structure or limited free float could preserve strategic flexibility but might constrain index inclusion and reduce liquidity. Underwriters will also need to navigate regulatory reviews and a quiet period under SEC rules, with detailed risk disclosures around launch reliability, regulatory approvals, and satellite interference concerns.

What to Watch Next as a Possible SpaceX IPO Approaches

An initial registration filing would be the tell. Expect investors to look for the following:

- Audited financials that break out launch services and Starlink

- Capex plans for Starship

- Sensitivity analyses on launch cadence and satellite replacement rates

Any update on reusability milestones—engine life cycles, heat shield refurbishment times, and booster turnaround—will feed into margin models.

The FT’s reporting underscores how SpaceX continues to blend spectacle with operational execution. If the stars align in June—literally and figuratively—this IPO could reset expectations for how frontier-technology companies access public markets and finance multi-decade ambitions.