The cost of memory is rising quickly, and the real pain could land in consumers’ wallets as soon as next year. Increased pricing of DRAM and NAND is now expected to drive up retail prices for laptops and smartphones in 2026, with some notebooks seeing increases of up to 15% and certain phones up to 10%, according to new projections from TrendForce.

The alert comes as memory kits have already skyrocketed in price, and some are close to 200% higher than during the early summer. The broader industry impact of chipmakers fighting for market share will trickle down to OEMs refreshing offerings and securing contracts for 2026 supply, according to TrendForce.

Smartphone production is now forecast to shrink by 2 percent on an annual basis in 2026, compared to previous expectations of a slightly positive growth. Statista estimates 2024 global smartphone production at around 1.2 billion units, so a 2% pullback represents tens of millions fewer devices rolling off assembly lines.

Why Memory Is More Expensive Now for PCs and Phones

Two forces are driving memory higher: red‑hot demand from AI infrastructure and controlled supply by chipmakers. The DRAM suppliers are allocating high bandwidth memory and server DRAM to support AI buildouts, squeezing off the bit supply to PC and mobile devices. At the same time, the industry is emerging from a deep downturn and reluctant to oversupply by going on a wafer start and capital spending binge in order to maintain margins.

On the storage front, NAND vendors slashed production a couple of quarters in a row to eat into overproduced stocks and pricing has rebounded as supply and demand evens out. And with LPDDR5X/LPDDR6 and DDR5 becoming more common on new phones and PCs, average content per device is increasing, which magnifies the effects of every incremental price move.

TrendForce’s DRAMeXchange has also highlighted capacity changeovers and node migrations as near‑term frictive points. Yield learning on later processes and packaging steps adds cost pressure even as OEMs prep 2026 launches.

How Rising Memory Costs Impact Phones and Notebooks in 2026

Phones first: Budget and midrange models are the most vulnerable. Narrower margins mean there’s less room to absorb higher bills of materials—or vendors may pass the costs along to shoppers, or even trim base memory configurations on the sly. TrendForce says handset prices may increase by up to 10 percent. Smaller brands might have an issue obtaining positive allocations, with rumors of consolidation swamping the market, according to TechPowerUp’s interpretation of data.

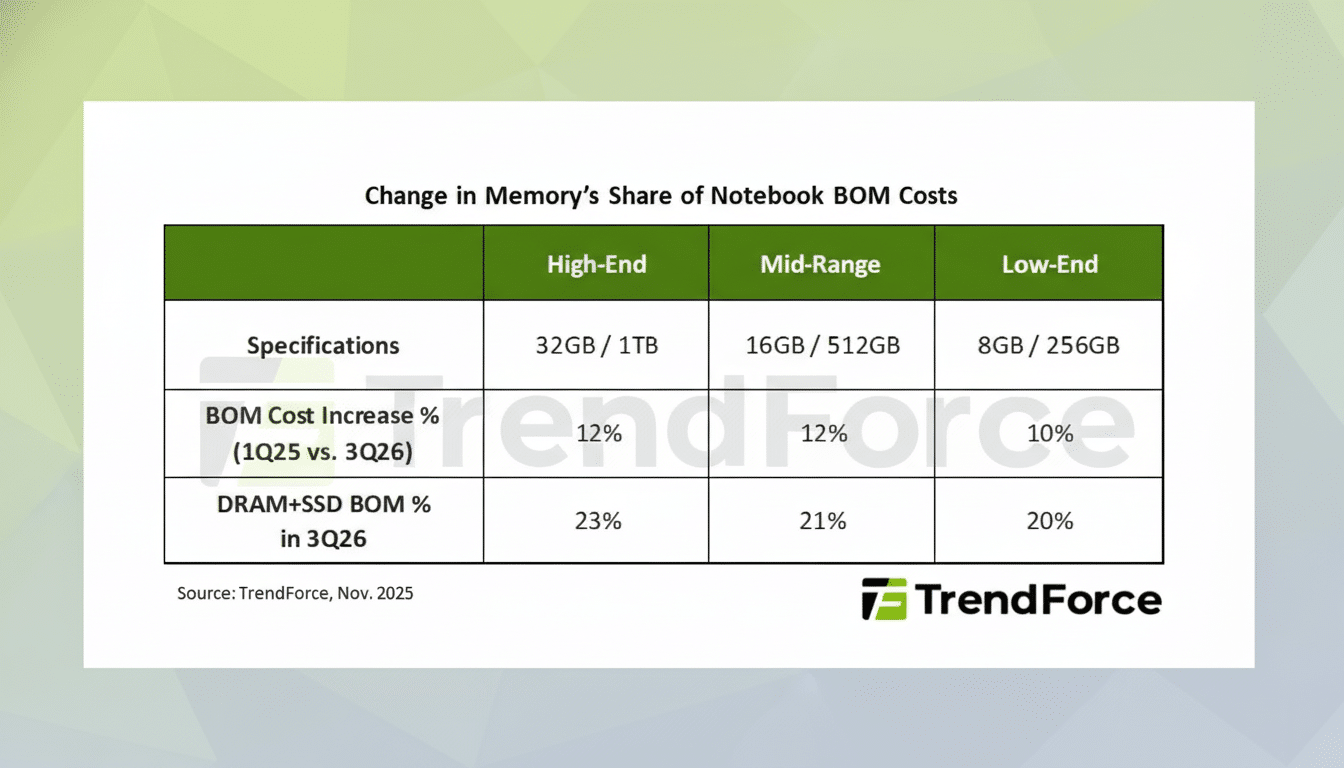

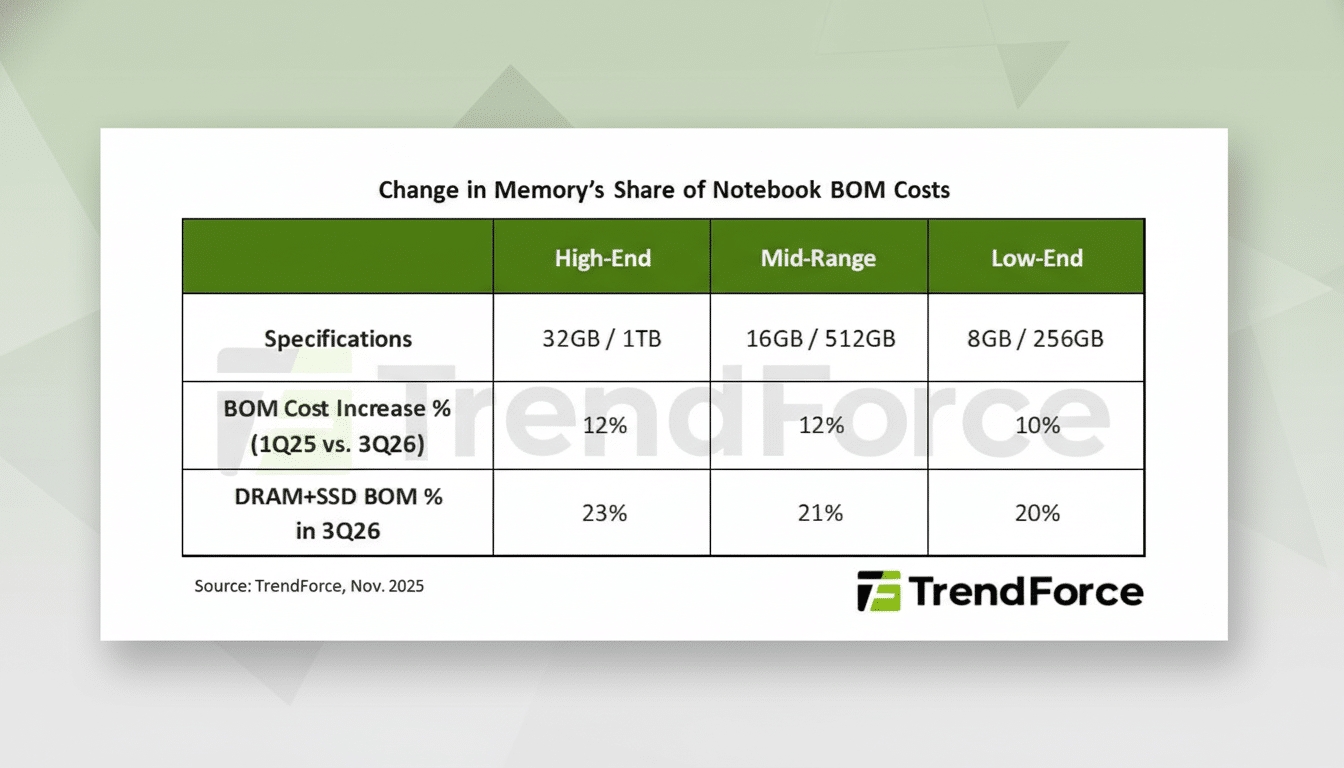

Laptops could face an even steeper impact. Memory/storage usually takes up 10–18% of a notebook’s cost. This slice dragging the total beyond 20%, and pushing stickers up as high as 15% year over year as DRAM and SSD prices continue to rise. The value segment will feel it the most, but premium systems with more RAM and larger SSDs bear the largest absolute dollar hikes.

There are several structural reasons for this difficulty to have been compounded. Upgraded software and new ways to justify your purchases haven’t hurt either (looking at you, Face ID); plus longer device lives—aided by right‑to‑repair momentum, more efficient chips and better batteries—have elongated upgrade cycles. When shoppers buy less frequently, OEMs rely more on the pricing power of each generation. If sticker shock meets wary customers in the middle of a pandemic, the second‑hand market might heat up, driving used prices higher, too.

Ripple Effects Across the PC and Accessory Ecosystem

Besides phones and notebooks, TrendForce forecasts a slight retreat in monitor shipments to be contrasted with an earlier view for marginal growth toward contraction of 0.4% in 2026. Fewer new PCs in use means fewer displays and accessories connected to them purchased. Components pricing dynamics could also push OEMs towards simplifying configurations, reducing SKU sprawl to focus bags of volumes on smaller set of (better‑supplied) parts.

Storage also is part of the story. Already, tight NAND supply has driven up the cost of SSDs, especially those with higher capacities. The higher-priced DRAM–SSD combo leaves less room for deep promotions that could potentially remake back‑to‑school or holiday bundles next year.

What Buyers and Brands Can Do Now to Manage Costs

Consumers decided on making a purchase should concentrate on configurations rather than attempting to follow rock‑bottom prices. If you want 16GB or 32GB of RAM, or a 1TB hard drive, buying the right build outright might actually be cheaper than upgrading down the line with crazier component prices. Desktop owners who can still find sales on DIMMs and SSDs might want to consider an upgrade before other jumps occur.

For OEMs, early allocation deals and multiyear supply contracts can soften the blow of volatile demand. The focus is likely to be even more on value engineering—less low‑volume SKUs, tighter BOM control and more consistent upsell ladders for memory and storage options. Rejuvenated programs and trade‑in incentives also might extend to try retaining budget buyers if entry‑level prices rise.

The bottom line here is straightforward: If the TrendForce path carries (and we see nothing to make that assumption dubious), this upcycle won’t remain a line on a component‑pricing chart forever but will become something you notice at checkout. Phones will not just appear faster in 2026—it seems likely they, and PCs, may look more expensive as well.