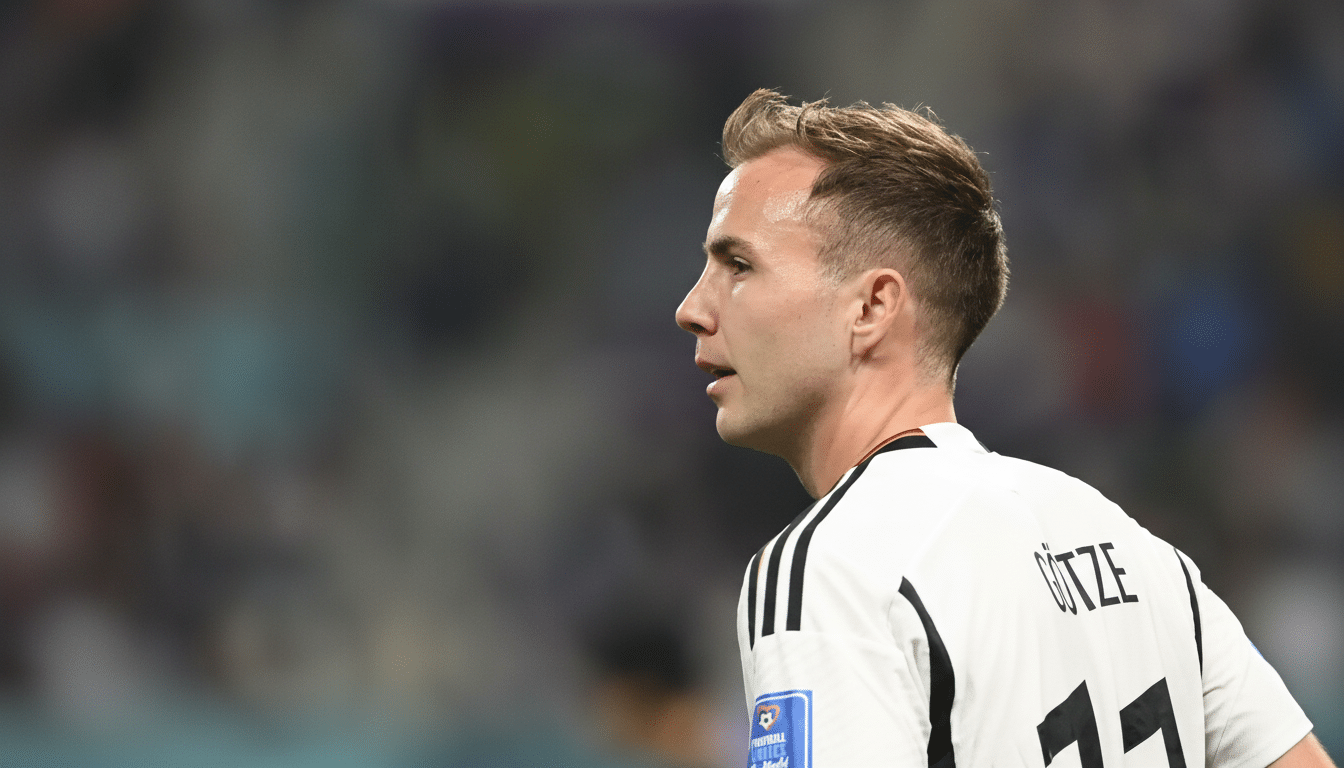

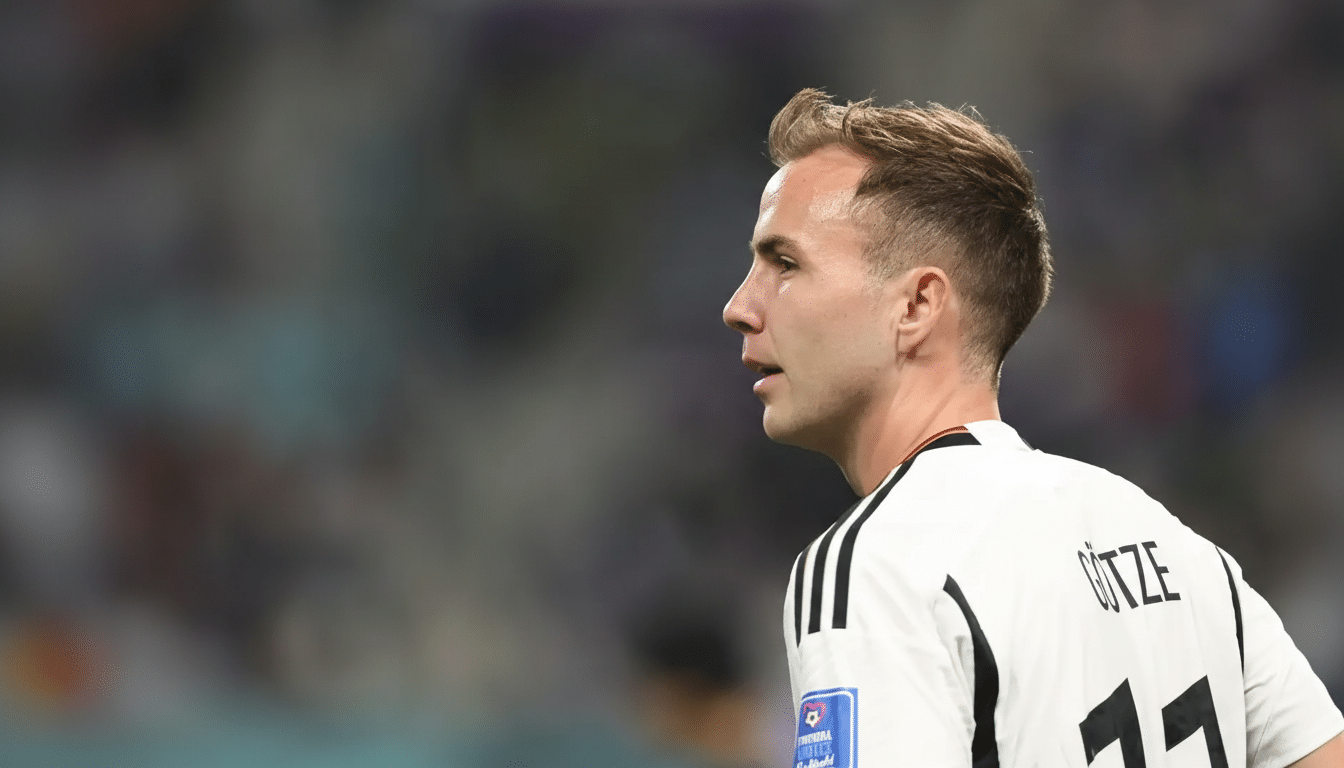

Mario Götze is famous the world over for a World Cup-winning moment, but off the field he has spent years crafting a more disciplined second career as an angel investor. He’s been quietly building a portfolio across Europe and the U.S., supported by venture funds, and honing an investment thesis that resembles more of a specialist’s playbook than a celebrity hobby through a small operation called Companion M.

From pitch icon to a disciplined startup backer

Mr. Götze’s investing runs alongside his day job for Eintracht Frankfurt, so due diligence calls get squeezed between training sessions and visits to doctors around the country. It’s the sort of schedule-hacking that American athlete-investors like Kevin Durant have normalized, and it is now gaining ground in European soccer, where peers including Cristiano Ronaldo and Kylian Mbappé have also thrown their weight behind startups.

What sets Götze apart is the thoughtfulness of his preparation. Instead of spraying checks into consumer apps or sports merchandising, he built a small hands-on team that would find, vet and support deals, while keeping decision making close to home. The point is to create long-lasting know-how as much as returns.

Companion M and a focused early-stage thesis

Companion M focuses on pre-seed and seed rounds, making tickets of €25,000–€50,000 on average. In the early stages, where product-market fit is murky and metrics are sparse, the team relies on its network of experts and narrow sector focus: B2B SaaS, software infrastructure and cybersecurity as well as health and biotech. The last of those also clearly maps to elite performance and wellness, but the focus is on defensible technology rather than sports branding.

The technical bent isn’t accidental. Götze was raised in an engineer’s family, with one parent who taught electrical engineering and had a foot in the American academic ecosystem. That background goes to explain why he’s attracted to founders working on hard problems rather than hype cycles.

A willingness to support unconventional bets

Götze early on made a name for himself by investing in Sanity Group, a German cannabis startup, at a time when most of Europe’s institutional capital shunned the category. Regulatory momentum has since swung the company’s way, and Sanity Group publicly declared that it captures about a 10% share of Germany’s fledgling medical-cannabis market. It’s a case study in contrarianism, underwriting regulatory change and supporting proven operators.

Even as he is putting big money behind cannabis, sports rules still limit what active athletes can consume, which underscores a significant point in his strategy: Personal interest informs the pipeline but decisions are driven by fundamentals more than celebrity lifestyle alignment.

Portfolio signals extend well beyond sports

Companion M’s portfolio leans towards enterprise and data-oriented companies. Examples include Miami’s Arcee AI, which develops tools for developers focused on unstructured data, and, out of Frankfurt, Qualifyze, a compliance platform for the pharma supply chain. A number of Götze’s investments have raised significant follow-on funding, and one of his earlier investments, KoRo (based in Berlin), made an exit that freed up funds to plough back into new deals.

His brand, too, is staked around fintech. When Götze was named Revolut’s first brand ambassador in Germany, the company cited his startup investing track record—proof that, for athletes with a sound venture strategy, commercial partnerships can augment deal flow as well as personal brand equity.

LP stakes and playing the long venture game

Götze isn’t strictly a direct bettor. Companion M has already invested as a limited partner in over 20 venture funds throughout the UK, and on both sides of the pond, including 20VC, Cherry Ventures, EQT Ventures, Planet A, Merantix, Visionaries Club and World Fund. This LP position enhances his odds of getting information, co-invest opportunities, and access to experts while mitigating the peaks and valleys through market cycles.

It’s a refined structure: Exits replenish dry powder; fund positions balance risk; and the operating model keeps him close to founders without stretching bandwidth too thin. He has said in interviews with outlets including Bloomberg that he plans to become even more aggressive about investing once he hangs up his boots, though the scaffolding is already in place.

Why this disciplined angel investing model works

For athlete-angels, the pitfalls are likewise well-trodden—an overdose of hype, anorexic diligence and scattershot theses. Götze’s solution has been to narrow, formalize and surround himself with domain expertise. Both Dealroom and the investment research platform PitchBook have flagged up the growing trend of athlete-led capital in Europe; those that last do so in part because they work exactly this way—with a repeatable sourcing engine and with clear investment lanes.

The result is a portfolio that reads not like a fan’s fantasy of rides, but more like an operator’s blueprint for a theme park. If the trajectory holds, Götze will no longer simply be associated with a transcendent strike on the global stage—but for one built along a parallel career that grows increasingly hazardous after the final whistle.