Lucid Motors had a record quarter, delivering 4,078 vehicles — a figure driven by the increasing handoffs of its Gravity SUV and an 11th-hour push among car shoppers to take advantage of a waning federal electric vehicle incentive. The luxury electric-vehicle maker said the performance is part of a streak that extends for seven quarters of delivery growth — an impressive pivot point for a company that has often spent its public life trying to monetize buzz into scale.

Record Deliveries Powered By Gravity Momentum

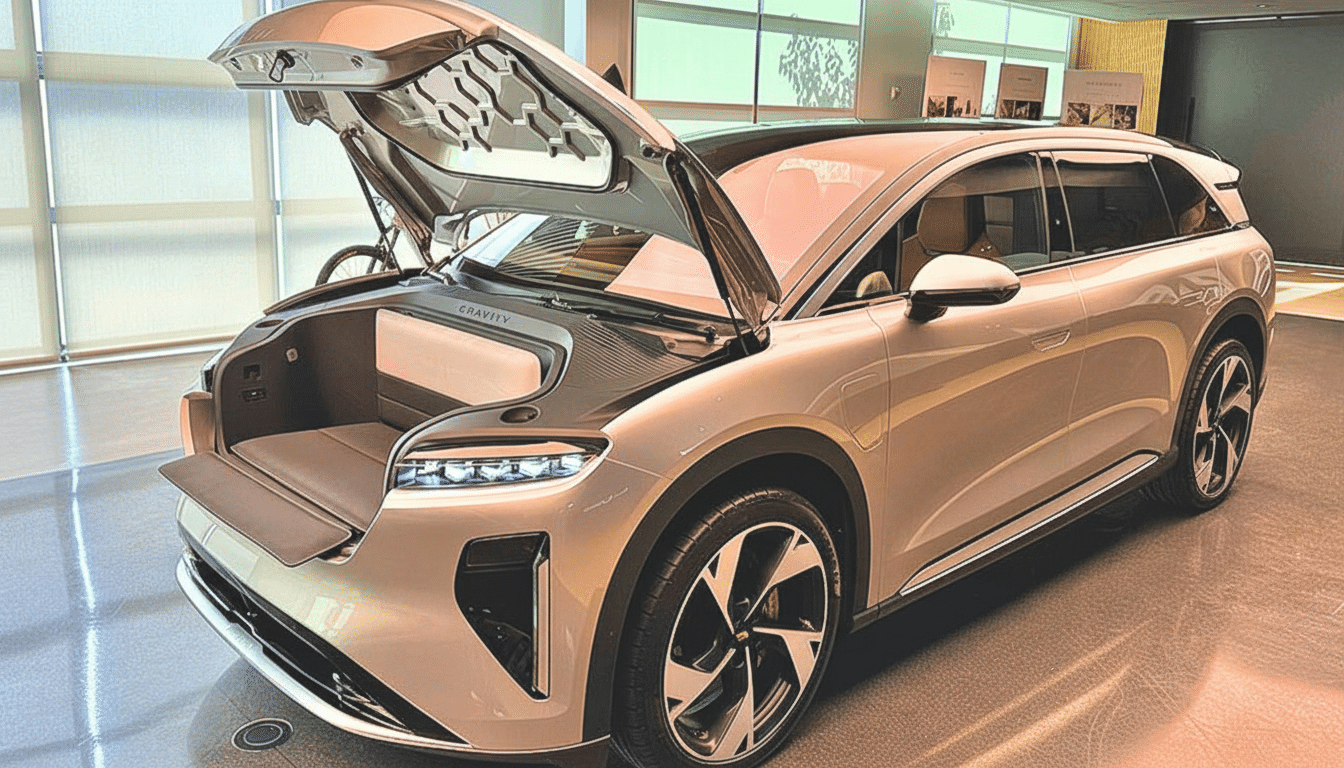

The Gravity SUV is becoming Lucid’s volume entrant, expanding its brand beyond the Air sedan and into a strong-selling premium SUV segment. Although Lucid wouldn’t break down the Gravity and Air mix, dealer chatter and customer forums suggest strong early throughput for the Gravity, with help from wider demo fleets and more cars in transit. SUVs matter in this context because they dominate U.S. EV sales today, at least according to industry watchers such as Cox Automotive.

Lucid’s expansion also reflects a wider third-quarter surge in the EV market. Tesla had the best quarter in its history, and Ford and General Motors made strong gains with models like the Mustang Mach-E, F-150 Lightning and Cadillac Lyriq. Even Rivian, which had signaled toward a tougher full-year result, enjoyed a quarter-over-quarter bump. Lucid doubtless benefited from category momentum to persuade reservations and close deliveries as the inventory situation improved.

Tax Credit Rush Gives Lucid A Late-Quarter Lift

Another accelerant: a dash to claim a federal EV credit before it lapsed for some deals. Since Lucid’s vehicles are typically priced above the retail price caps ascribed to the consumer clean vehicle credit, a number of purchasers had sought access to incentives under lease structures associated with the commercial clean vehicle credit as contemplated by Treasury and IRS guidance. With those terms set to expire, Lucid rode a late-quarter lease delivery spike that several premium EV brands also rode as customers rushed to secure savings.

It is hard to pinpoint the real impact, as only customers leasing could qualify, and not every lease passes that value through directly to the driver.

“I would put that as a $20 utility.” Yet sales teams throughout the industry experienced a significant pull-forward effect. That might leave a small hole in very near-term orders, but manufacturers have traditionally fought such cliffs with financing deals, loyalty programs or dealer-led incentive stacks.

Saudi Market And Global Footprint Continue To Grow

Lucid’s global strategy is expanding in importance. The company, backed by the Saudi Public Investment Fund, which owns a majority of shares, said it had built more than 1,000 vehicles for the Kingdom as it gears up an assembly factory there but hopes soon to establish a full manufacturing footprint. That two-market strategy is designed to even out demand cycles and put Lucid in a position to take advantage of government fleet purchases and the infrastructure projects associated with the kingdom’s Vision 2030 goals.

The cross-border model also provides logistics flexibility. The vehicles can be split between the U.S. and Middle East based on order cadence, and suppliers receive visibility of higher-volume runs of Gravity components. For a new automaker, that operational redundancy could be worth more than any marketing campaign.

Uber Robotaxi Deal Shows Its New Strategic Path

Outside retail, Lucid has a dedicated fleet path now. (Image: Nuro) Uber said it entered into an agreement to buy at least 20,000 Gravity SUVs over six years and integrate a “purpose-built” autonomous technology from Nuro for operating robotaxis on its platform. If done at scale, the deal would diversify Lucid’s revenue mix, bolster factory utilization and provide a petri dish for software-defined vehicle features and service bundles.

Timelines for self-driving deployment are fuzzy, and regulatory thumbs-up vary by city. But it does mean the structure puts Lucid in bed with one of the largest ride-hailing networks and taps a partner with considerable autonomy expertise. It’s a strategic hedge: Even partial autonomy, or advanced driver-assistance packages as used in commercial fleets, could open high-margin software and maintenance revenue streams.

What To Watch Next For Sustaining Lucid’s Growth

Investors will be looking for three things in Lucid’s upcoming results: the Gravity–Air delivery mix, order intake after the tax credit expiration and gross margin trajectory. Low utilization and high bill-of-materials costs have historically pressured the company’s margins; greater Gravity volumes and supplier scale would likely alleviate this delta. Comments on incentives as a substitute for the lapsed lease benefit will be scrutinized.

Context matters here. EV adoption is still marching up, even as incentives run dry and peak (price parity with traditional vehicles and charging availability are where the real swing factors will arise), according to analysts from BloombergNEF and S&P Global. Lucid’s value proposition — long-range efficiency, high-performance drivetrains, and premium interiors — is soundly set within the luxury tier but it has to turn that differentiation into quarterly throughput.

For now, a record quarter underpinned by Gravity momentum and an unlikely tailwind in the form of tax credits gives Lucid something it has craved for years: evidence that demand can keep pace with supply. The next test is sustaining it without the same incentive backdrop and converting delivery records into durable, margin-accretive growth.