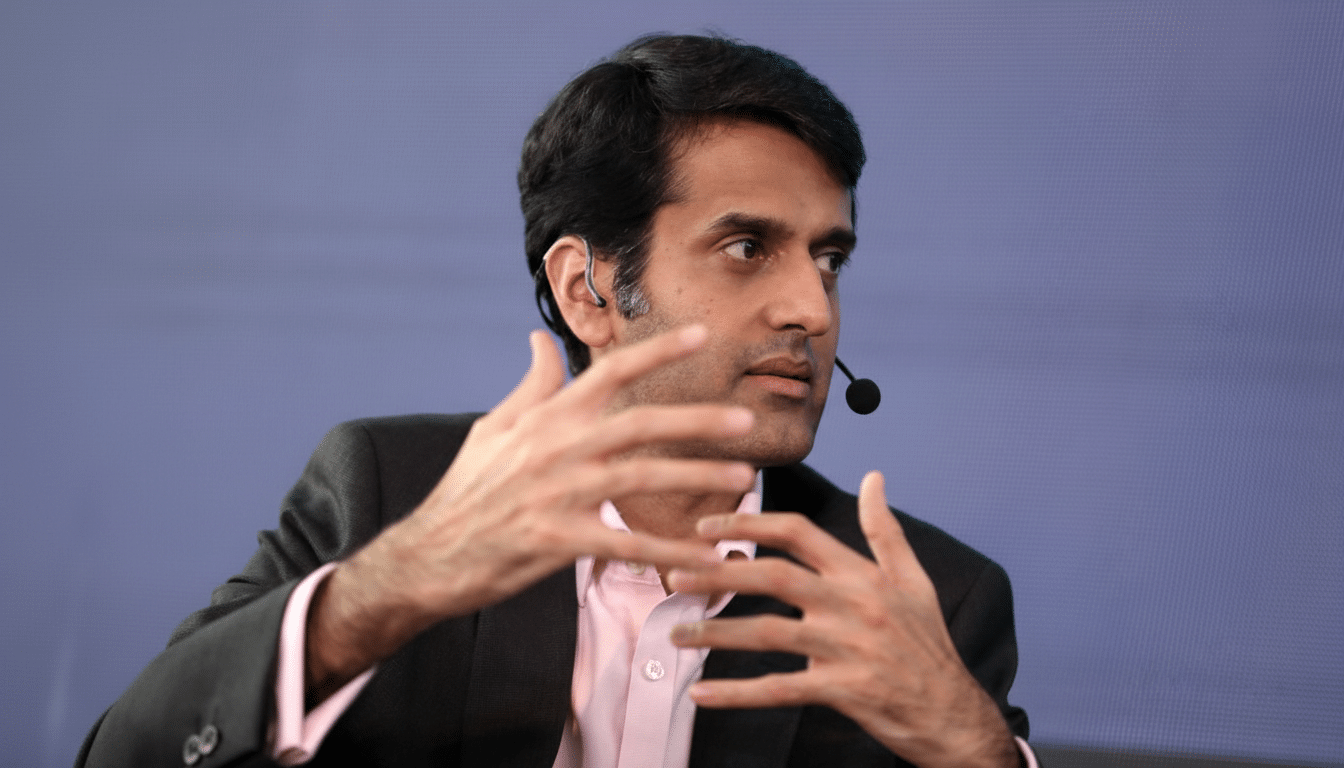

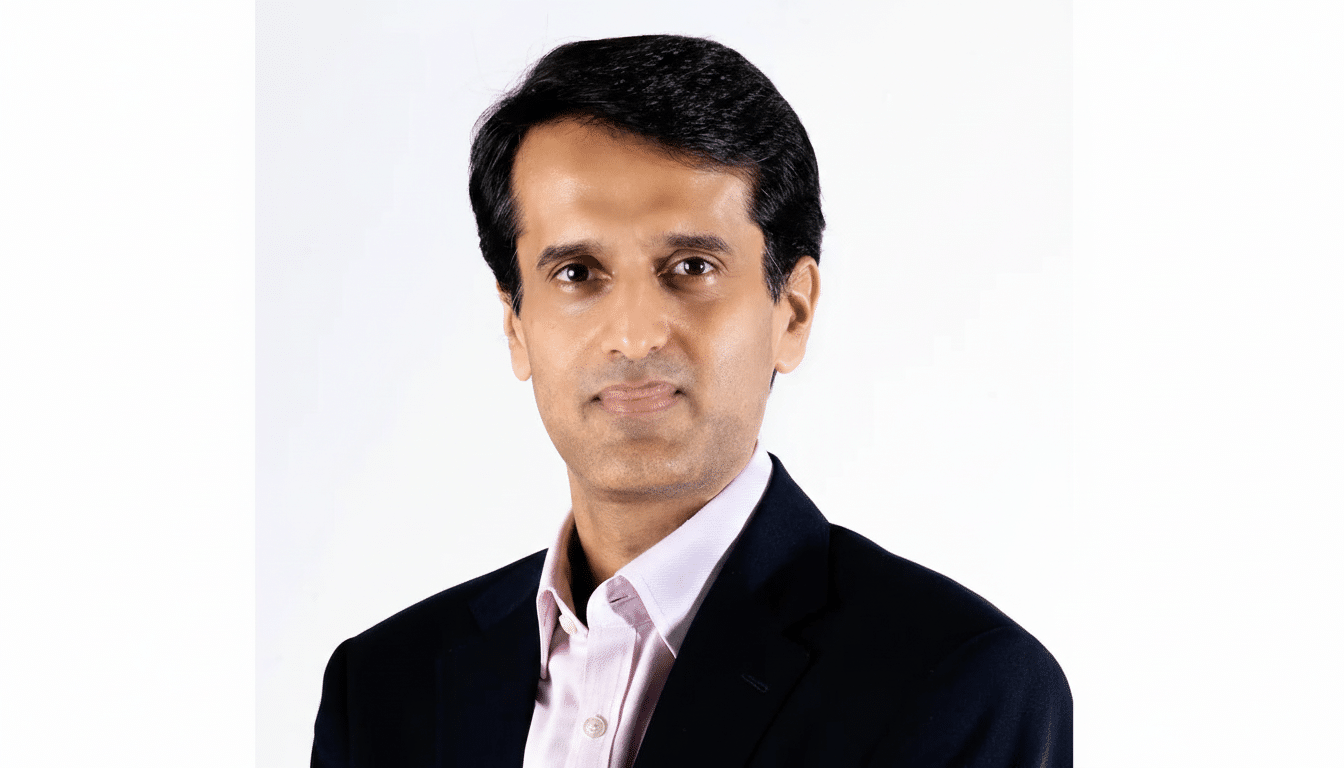

Kabir Narang, a founding partner at B Capital and one of the chief architects of the firm’s Asia strategy, will be leaving to start up a new investment firm, according to people familiar with the matter. Narang, who co-chaired B Capital’s global investment committee, told founders that he will keep backing early-stage startups with personal checks where he usually takes 1% to 2% stakes as he cobbles together the larger vehicle.

His pitch to entrepreneurs homes in on the acceleration opened up by artificial intelligence, as he argues that the distance between an idea and a product is constricting and that pricing power and disciplined unit economics are what will distinguish the sustainable winners. The approach points to thinking about “compounding” companies — businesses that can grow efficiently through cycles rather than chase momentum.

B Capital confirmed his departure, and stressed that the Asia operations would be a continuation of previous efforts. The company, which was co-founded by Eduardo Saverin and Raj Ganguly, has more than $9 billion in assets under management and operates across the U.S. and Asia with portfolio support through its partnership with Boston Consulting Group.

A Veteran of Asia Growth Investing and Key Deals at B Capital

Narang came to B Capital in 2017, co-leading the Asia platform from Singapore at a time when late-stage appetite for Indian and Southeast Asian tech was on the upswing. His deal sheet includes Indian breakout stars Meesho, Khatabook, CredAvenue (now called Yubi), Bounce and Bizongo — companies that came to define the region’s surge into commerce, fintech infrastructure and supply-chain digitization.

At B Capital, he worked on scaling founders through messy middle stages (go-to-market, unit economics and governance).

Before B Capital, he spent nearly nine years at Eight Roads Ventures India, backed by Fidelity. That experience is likely to inform his new platform’s playbook for how to operate, particularly among AI-native startups that require adherence to strict cost discipline alongside real speed of iteration.

Some of Narang’s previous bets have hit notable marks: Meesho has confidentially filed for an IPO and publicly reported profitability in its core India business, Bizongo became a unicorn while pivoting into financing-led SaaS for supply chains, and Yubi has scaled one of India’s largest debt marketplaces. Those trajectories reflect the sort of compounding dynamics he frequently refers to: recurring revenue expansion, contribution margin improvement, and defensible distribution.

Why Launch a New Investment Platform Now in Asia

The timing corresponds with a market reset that has reshaped the risk-reward equation for growth investors. The past several years have seen global venture funding recede from 2021 peaks, according to CB Insights and PitchBook, with late-stage rounds taking the brunt as crossover capital retrenched. In India, research firms like Tracxn noted that 2023 activity dropped off a cliff, even as deal flow remained steady in places like AI, fintech infrastructure and vertical software in 2024.

Against that backdrop, a new platform can be constructed on today’s arguably more rational pricing, a stronger secondary market and clearer paths to profitability. The AI wave has swollen the coffers of fewer, stronger companies, but it has also broadened the aperture for software that automates back-office workflows, modernizes financial rails and embeds intelligence in industry-specific stacks — all areas where Narang has done time.

What the Strategy Might Look Like for AI and Growth

Precursor stakes of 1% to 2% early hint at a barbell approach: writing small, founder-aligned checks now while ramping up an eventual larger, potentially multi-stage vehicle that can follow-on into breakout rounds. Anticipate focus on AI-driven applications with clear ROI, payments and credit infrastructure, SaaS for logistics and manufacturing where pricing power and margin expansion can be orchestrated quarter by quarter.

Situated close to India and Southeast Asia, the platform could borrow a page from cross-border playbooks — aiding regional leaders in expanding into the Middle East or U.S., or importing successful models there along with local tweaks. Investors with Narang’s experience frequently paint in a more concentrated palette, leaner reserves for follow-ons, and hunker down around enterprise sales, procurement cycles and CFO-ready metrics.

What It Means for B Capital and Its Asia Operations

B Capital continues to have a deep bench across both growth and healthcare with a strong in-place pipeline and operating resources through BCG. The firm has renewed its commitment to Asia and its global platform, a reminder that venture franchises are built to outlast partner transitions while funds remain active across their 10-year life cycles.

For founders, the takeaway is twofold:

- B Capital keeps deploying on its core theses.

- A new contender led by a known investor is entering competitive processes — probably with a keener eye toward capital efficiency and AI-driven compounding.

In a market that values discipline over blitzscaling, there’s room for both, providing entrepreneurs with more options on how to finance sustainable growth.