Intel has launched a new processor based on its 18A process technology, representing a critical step in the company’s fight to win back some of the process lead and dictate innovation again. The first 18A client chip to make an appearance, codenamed Panther Lake, comes to town as the poster child for the upcoming wave of Intel Core Ultra systems and its server friends are already lined up behind it on the roadmap.

What Intel’s 18A Node Does Under the Hood and Why

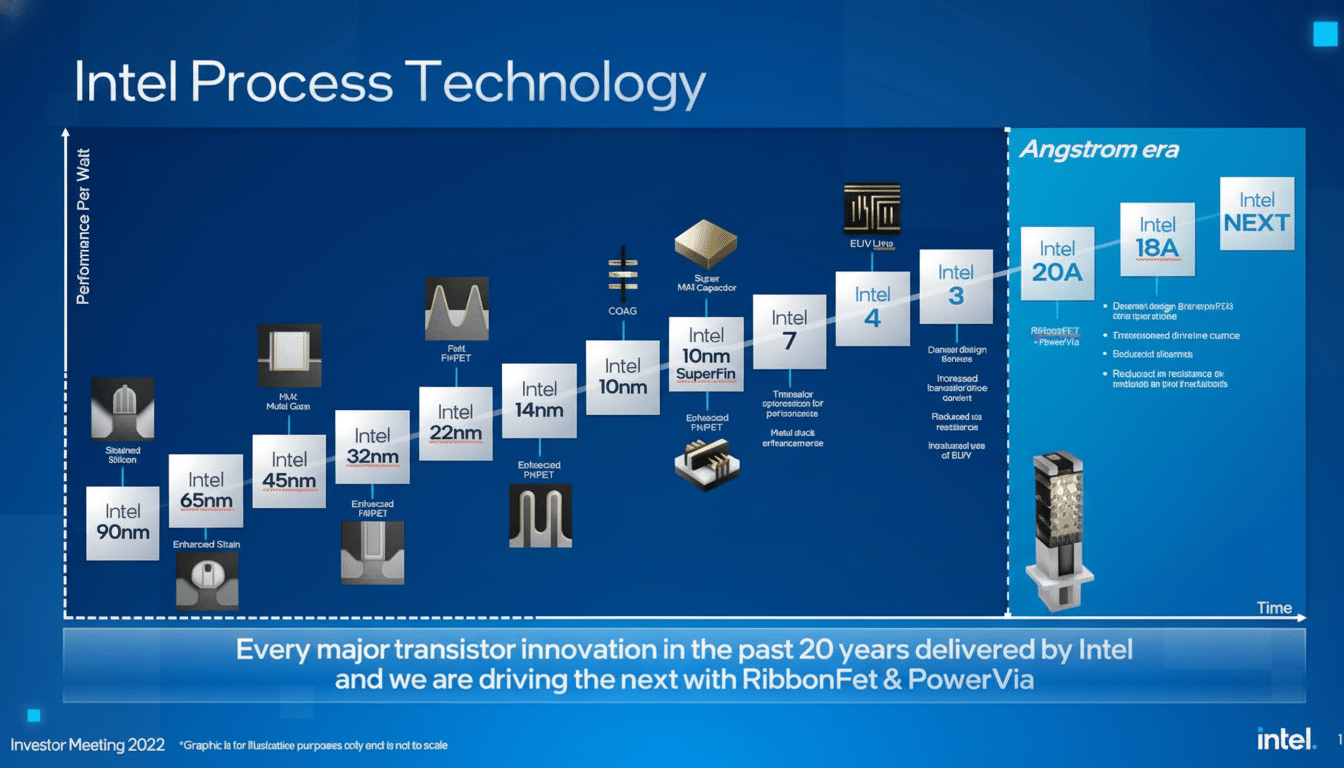

18A is Intel’s most aggressive node in a long time, featuring RibbonFET gate-all-around transistors with PowerVia, the backside power delivery network that shifts power rails to the rear of the wafer. 18A separates power and signal layers to cut down on voltage droop, reduces routing congestion, and also supports higher frequencies at low power. Intel has labeled the generational uplift as a double-digit improvement in performance per watt compared to its previous node.

It has also assigned 18A to be the first of its high-volume nodes benefiting from breakthroughs in next-generation extreme ultraviolet lithography. While chip companies typically manage to keep the details of every single piece of tooling under wraps, Intel has publicly worked with ASML on High-NA EUV and says 18A is designed to take advantage of better patterning precision to shrink features and rein in variability—two elements essential for predictable yields.

Proof that PowerVia functions as promised has been making its way through engineering forums and technical papers. In Intel’s test silicon, revealed at conferences like the IEEE International Electron Devices Meeting, backside power sliced IR droop roughly by a third and provided measurable frequency headroom without consuming extra power. Those are the sort of gains that translate directly into snappier laptops and denser, more efficient servers.

The First 18A Client Chip Arrives: Panther Lake

Panther Lake is the next-gen on Intel’s Core Ultra platform. Look forward to a rejiggered compute tile along with a brawnier NPU and refreshed integrated graphics, all pieced together with Intel’s Foveros 3D packaging and high-end packaging technologies. The immediate goal is a no-brainer: get more performance in smaller thermal envelopes while boosting on-device AI throughput to meet OEM desires.

For people shopping for a PC, the most noticeable differences should come in responsiveness and battery life. With PowerVia reducing power noise and RibbonFET easing transistor control, the CPU can live in turbo states more of the time without a spike in power draw. It’s that equilibrium, balanced performance at lower voltages, that thin-and-light designs have been missing in many ways, and that’s the number reviewers are going to pore over when independent benchmarks come in.

Server Roadmap and AI Era Demands for Efficiency

Intel also teased Clearwater Forest, a Xeon 6+ offering that delivers 18A to the data center with an efficiency-first design for cloud-native workloads. With hyperscalers having invested heavily in accelerators, CPUs win via orchestrating more microservices per rack while keeping AI pipelines fed without leaking watts. This move to 18A, Intel has said, will allow for additional core density and greater performance per watt—critical to total cost of ownership (TCO) in large fleets.

That’s why it matters. A couple of independent barometers show why efficiency is important: both IDC and Gartner analysts are finding power and cooling are becoming key decision factors alongside traditional, unalloyed performance as AI machines proliferate out of the video card–exclusive ghetto into general-purpose clusters. One potential way for 18A to pay off its efficiency claims (at least on Xeon 6+) is to help ensure Intel doesn’t get overmatched in the face of competitive pressure from a slew of market threats—from AMD, Arm-based vendors, and custom silicon—all competing for sockets.

A Bid to Regain Semiconductor Process Leadership

Yet it’s about more than product names—18A is also a litmus test for Intel’s manufacturing comeback. And the company is not just targeting 18A for its own chips, but offering it to external customers through Intel Foundry. Earlier disclosures have featured partnerships with Arm on mobile IP at 18A and a pledge from one major cloud customer for advanced-node production, suggesting Intel wants to go toe-to-toe with TSMC’s N2 and Samsung’s SF2.

Process leadership is gained in three areas: performance, yield, and time-to-market. So long as wafers aren’t shipping at scale wedded to competitive costs, technical wins like PowerVia don’t amount to much. That is why the 18A transition is being orchestrated with advanced packaging capacity—EMIB and Foveros, in particular—to produce modular designs with the right mix of CPU, GPU, and NPU tiles. ASML’s newest lithography tools and a more mature EUV supply chain are cornerstones of that strategy.

Domestic Manufacturing and Supply Chain Implications

Intel says Panther Lake is being manufactured in the United States, including at Intel’s Fab 52 in Chandler, Arizona, using advanced packaging flows that are supported by internal factories. Policymakers have put more domestic capacity into play with the CHIPS and Science Act, and the U.S. Department of Commerce has unveiled huge proposed funding for leading-edge fabs. The Semiconductor Industry Association has regularly made the case that manufacturing critical nodes closer to home mitigates risk and shortens supply lines for high-value products.

For PC makers and corporate purchasers, that domestic footprint can mean more predictable lead times and a diversified supply chain—advantages that have been made eminently clear in recent global hiccups. The calculus is a mix of technology roadmap and economic geography.

What to Watch Next for Intel’s 18A and Panther Lake

The upcoming checkpoints range from the third-party benchmarking of Panther Lake systems, performance benchmarks under sustained workloads, and early customer disclosure of 18A foundry wins. Look for OEM design counts, throughput numbers from AI NPUs, and battery-life gains as measured in industry-standard tests. On the server side, expect power-per-rack improvements and cloud-native performance on containerized microservices.

If Intel can turn its 18A engineering fairy tale into shipping volume with good yields, it doesn’t just get a faster processor—it gets a manufacturing platform that will support the company’s client, data center, and foundry ambitions for years to come.