SpaceX is paying about $17 billion for a broad swath of U.S. spectrum from the company EchoStar, a mixture of cash and stock that would turn Starlink’s direct-to-cell ambitions from pilot into power play. This is a bold move in a market where who sets the rules is decided not only by who owns the satellites, but also by who owns the airwaves.

Why spectrum is the choke point

The amount of radio spectrum available for phones and satellites today is finite, heavily licensed and jealously guarded. The Federal Communications Commission has been breaking it into bands and auctioning long-term rights to use it, and the prime midband frequencies in the pipeline have already been promised to carriers and legacy satellite companies. That’s the difference between dictating your roadmap and waiting on someone else’s.

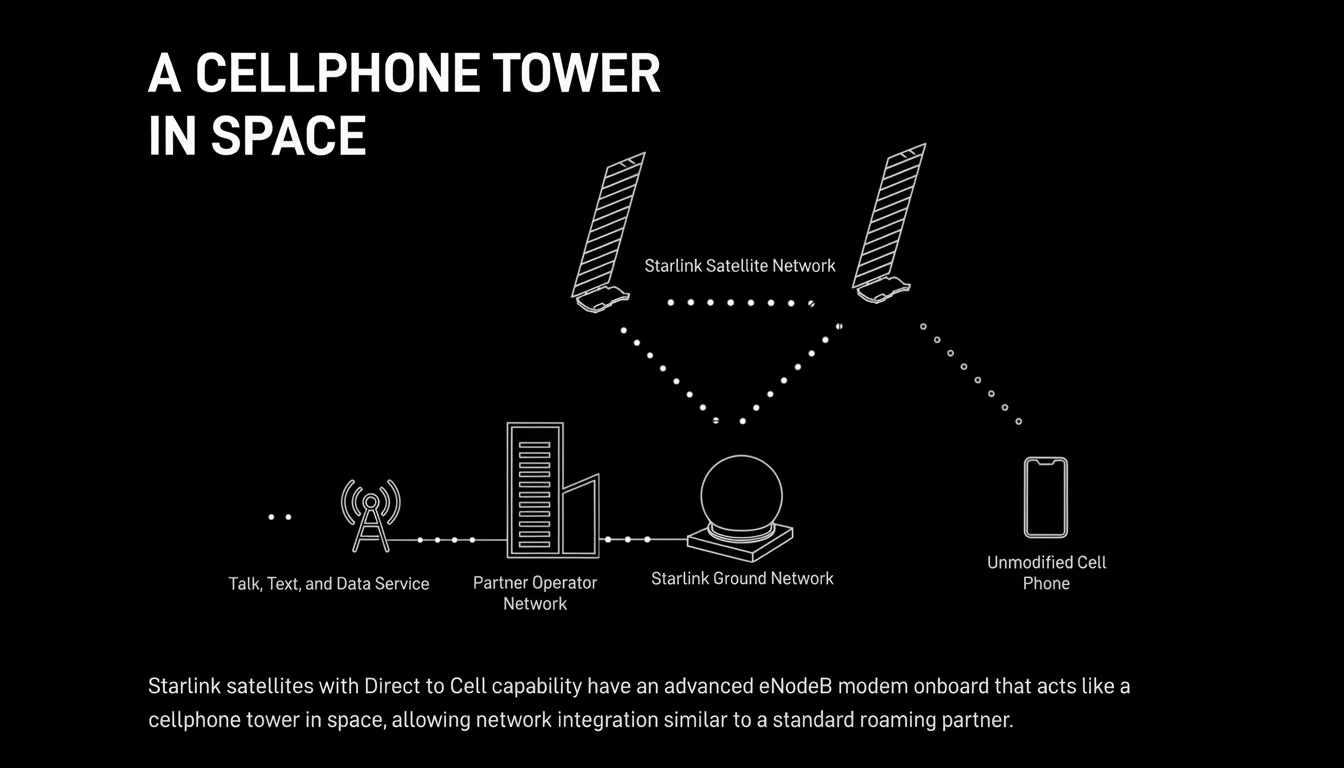

Until now, satellite-to-phone services relied on partnerships. In 2024, the FCC’s Supplemental Coverage from Space framework provided a means for operators to extend terrestrial networks in space in tandem with carriers. The deal with EchoStar is a step beyond cooperation for SpaceX. It becomes the licensee, in control of one of the key inputs that others have to bargain their way to.

From partner to proprietor

SpaceX started by teaming up with wireless carriers to make Starlink satellites into cell towers in the sky. Now it is acquiring spectrum assets, so that it can operate those services on its own terms. That transition has squeezed negotiation windows, standardised what devices get support and lessened reliance on carrier schedules. It also provides SpaceX with negotiating power when forming roaming, wholesale or handset agreements in the U.S.

The move is a page from SpaceX, which has done this before: vertically integrate the bottlenecks. Reusable rockets cut launch costs. In-house satellite manufacturing sped deployment. Spectrum ownership closes the loop on direct-to-cell, aligning the acts of engineering with control of the business.

Engineering reality and 3GPP NTN

Direct-to-cell rides on standards work baked into 3GPP Release 17 and 18, around “non-terrestrial networks.” Starlink’s newer satellites instead tote huge phased arrays to communicate with garden-variety smartphones to start, first for messaging and emergency services, but ultimately to also enable voice calling and data. Mid-band spectrum is important because it marries into a balance of range, penetration and manageable antennas on both ends.

This is still hard physics. Power budgets are stressed, Doppler shift is nontrivial, and interference has to be choreographed so space signals don’t tromp on terrestrial cells. Having the frequencies in-house makes it easier to coordinate, and lets SpaceX design the network — beam patterns, timing and handoffs — around its constellation rather than around a patchwork of third-party licenses.

The economics and the addressable market

Analysts see the satellite-to-phone opportunity as a multi-billion-dollar opportunity market that extends across coverage extension, disaster resilience, maritime and aviation, as well as low-bandwidth IoT. The GSMA estimates that about 5% of the world’s population is still not covered with mobile broadband, and a much larger “usage gap” lacks consistent service. Direct-to-cell hawks peace of mind in cities and lifelines off-grid.

Unit economics are based on two advantages SpaceX enjoys: manufacturing scale and cheap access to orbit. With an assembly line already churning out thousands of satellites and reuse slashing launch prices, adding incremental capacity is much cheaper for SpaceX than it is for prospective rivals. If thanks to the halo effect, they get 5-10% penetration of even a 100M subscriber base worldwide paying the $X per mo, it’s a $6-12 billion annual high-margin revenue pool for basic satellite before you start tacking on enterprise, government & IoT layers.

The $17 billion price tag purchases long-term rights that can support recurring service revenue. It also further enables SpaceX in bundling — merging together fixed Starlink, mobility and direct-to-cell into a single contract for logistics, energy and public-safety customers.

Competitors and leverage

The field is crowding. Apple’s iPhone emergency texting is built on a long-term relationship with Globalstar, and Apple has invested more than $1.5 billion to enhance satellite capabilities. AST SpaceMobile has proved it can make cellular calls from space, with carrier partners, as has Lynk, which has been focused on a text-first service. Amazon’s Kuiper isn’t handset focused, but it is a broadband challenger that looks pretty formidable.

SpaceX’s spectrum buy shifts the negotiating table.There have been rumors that some of the potential buyers might sell back their spectrum to the government after they prove unprofitable. Carriers can wholesale coverage or roam onto its system without surrendering control of their own bands. Device manufacturers have a central, standardized native space network to address across any region adopting suitable bands. And if SpaceX wants tighter integrations — whether with leading Android OEMs or, more provocatively, with Apple — it’s now coming to the table with spectrum, not just satellites.

Regulatory trench warfare

Spectrum is both a legal and a technical property. For years, SpaceX waged FCC skirmishes with opponents over sharing rules, interference limits and mid-band allocations, notching high-profile small victories in fights over the 12 GHz range. The Commission has initiated proceedings to update the frameworks of satellites sharing, and satellites companies like Starlink and terrestrial rivals have filed thousands of pages of analysis.

Having licensed spectrum cuts out direct-to-cell permissions, and therefore lessens dependency on additional permissions. But it does nothing to settle debates over coexistence with terrestrial networks or coordination under international ITU rules as SpaceX looks to expand across borders.

What success looks like

For the near term, look for a simple rubber-stamp by the FCC of the transfer, slow expansion of message coverage into the voice and basic data markets and roaming agreements that lands the satellite duty bars on major carrier status screens. As 3GPP NTN functionality is pushed further into baseband chipsets, hardware support will grow.

If SpaceX can turn spectrum control into universal device compatibility and reliable service quality, that $17 billion wager starts to feel less like a bet and more like table stakes in the satellite-to-phone era.