Harbinger, a Los Angeles company that builds electric platforms for medium-duty trucks, has just secured $160 million in new funding and is poised to supply chassis for FedEx delivery vehicles, evidence of fresh momentum in part of the commercial sector with far fewer electrified vehicles than passenger transport.

The Series C was co-led by FedEx, with participation from returning investors THOR Industries and Capricorn’s Technology Impact Fund and existing backers Leitmotif, Tiger Global, Maniv Mobility, and Schematic Ventures. As part of the agreement, FedEx has ordered 53 electric truck chassis with delivery scheduled by year-end.

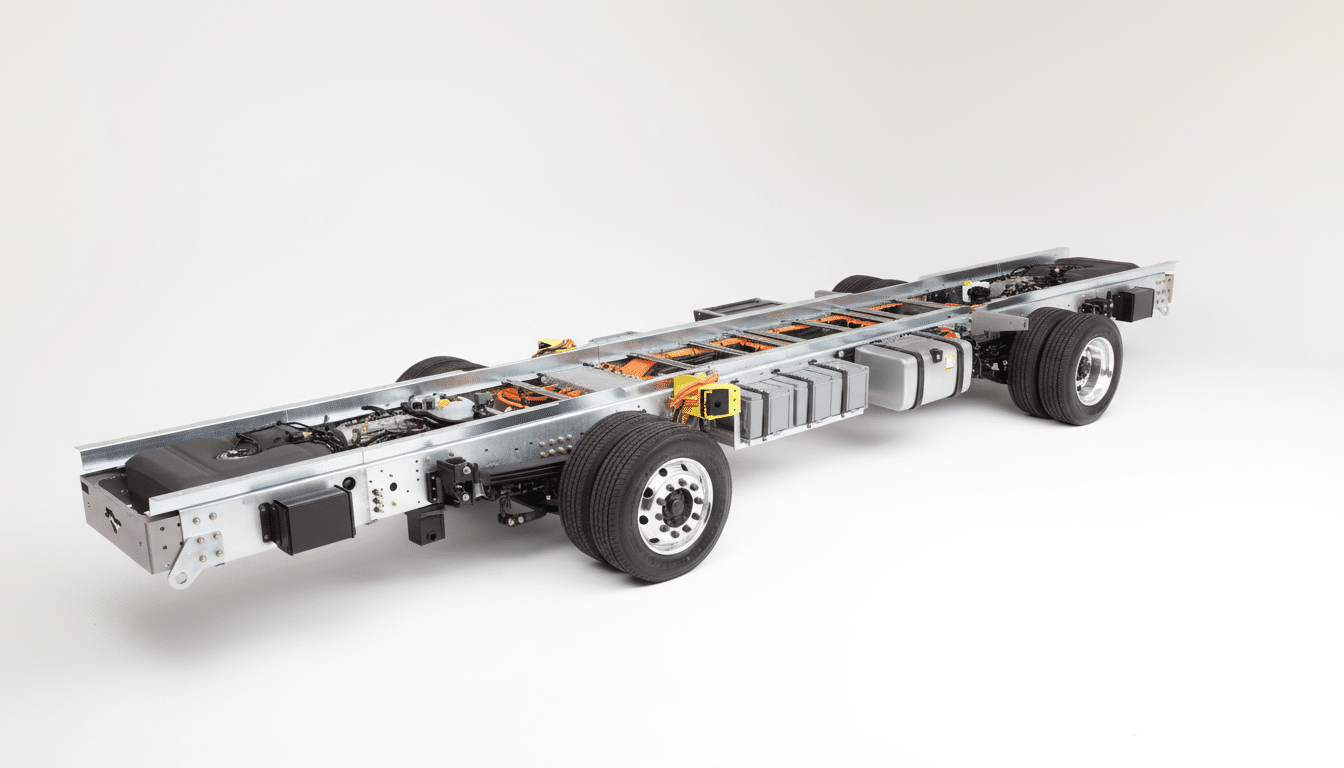

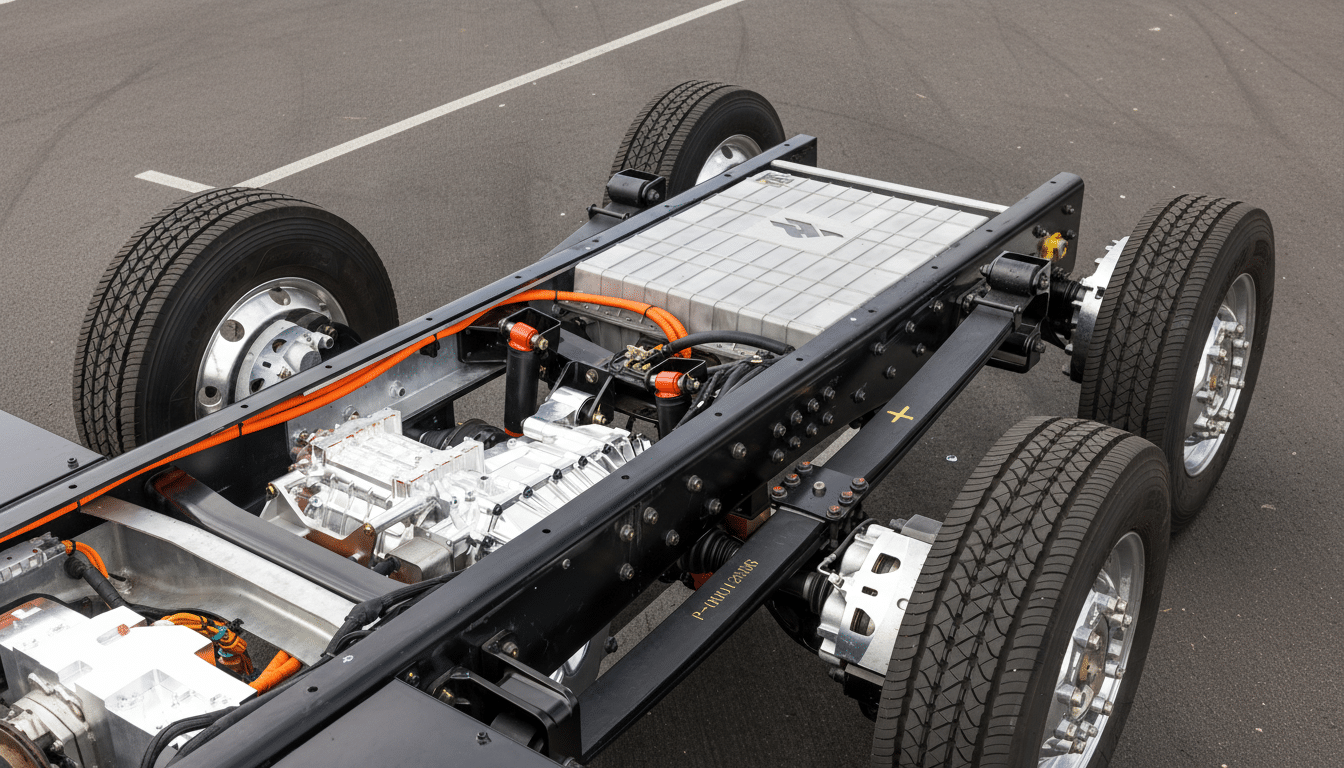

Established in 2022 by Canoo and QuantumScape veterans, Colorado-based Harbinger has been highly focused: purpose-built electric chassis for Classes 4–6. That focus has led to (relatively) quick execution. Earlier this year, the company raised $100 million, started building its platforms, sold more than 200 chassis, and opened up in Canada.

FedEx Bet Points to Practical Scaling Strategies

The dual role of FedEx, as both investor and customer, adds credibility in a category where large fleet operators value reliability and total cost of ownership over hype. The logistics behemoth has tripped over itself before with electrification — its order of 1,000 imported vans from Chanje imploded after that startup folded — so this sort of small, staged batch of orders is a measured on-ramp to deeper deployment.

The shift is in line with FedEx’s announced aspiration to attain carbon-neutral operations by 2040 and ramp the share of all-electric parcel pickup and delivery vehicle purchases toward 100 percent over this decade. For medium-duty routes with more predictable urban and suburban duty cycles, the operational math is increasingly compelling, especially as charging migrates to depot-based methodologies.

Medium-Duty Is Well Positioned For Electrification

Payloads determine the market: Medium-duty trucks tend to follow fixed routes of 70–150 miles per day, have long idle periods overnight at home base — perfect for Level 2 or managed DC charging. Still, predictions by the North American Council for Freight Efficiency suggest that urban and regional delivery trucks may be able to capture significant fuel and maintenance savings from an EV powertrain with oil-free operation, regenerative braking, and a flat per-mile energy cost.

Policy tailwinds help, too. The federal commercial clean vehicle credit can offset up to $40,000 per vehicle for acquisitions (depending on size), and some utility “make-ready” programs are reducing costs of site electrification. Contemporary standards, such as California’s Advanced Clean Fleets (as well as parallel programs in other states), are nudging procurement toward zero-emission vehicles despite ongoing legal and implementation challenges.

The environmental upside is significant. And while medium- and heavy-duty trucks are a small part of the overall vehicle population on the road, the Environmental Protection Agency credits the category with large shares of transportation greenhouse gases and nitrogen oxides — so every electric step in fleet operations is outsized when it comes to impact.

A Market in Flux Presents Openings for Specialists

Commercial EVs have hit the rocks. General Motors abandoned the spinoff approach for BrightDrop by folding it back into the parent company when early momentum waned. Ford’s E-Transit has been selling unevenly, and Rivian has delivered about 25,000 vans to Amazon while building up additional large customers. That turbulence has created room for specialists who focus on specific weight classes and duty cycles.

Harbinger’s argument is that a clean-sheet chassis designed for medium-duty duty cycles — not retrofitted from passenger car platforms — can take complexity out of the equation for body builders and fleets. By focusing on chassis and having partners focus on boxes, walk-in bodies, or RV applications (THOR is a prominent collaborator), the company will be able to scale with lower capex intensity than typical full-vehicle startups.

How the Money Will Be Spent to Scale Operations

The new capital will be used to bring forward production tooling, supplier capacity, and field support infrastructure, the company says. It’s everything from service training, parts logistics, and telematics that are as critical to fleet uptime as range or payload specs. And expect a focus on quality systems and process control — something where early commercial EV programs have not gone well.

Investors are wagering the industry is moving from pilots to mass adoption. An early investor in Tesla, Capricorn’s Technology Impact Fund described FedEx’s participation as evidence that medium-duty fleets are ready to operate outside of the demonstration volume realm. If Harbinger can deliver on cost, reliability, and vehicle integration, it could become a preferred vendor as fleets phase in new vehicles over several years.

What to Watch Next as Harbinger Scales Deliveries

There are three ways to know whether this inflection sticks:

- Repeat orders from FedEx and other blue-chip fleets

- On-time delivery against the 53 chassis commitment

- Evidence that depot charging and service networks scale without bottlenecks

The practical limits to watch are battery supply, the capacity of the electricity grid to absorb and transmit solar energy when it’s being generated (which can vary according to location), and training for technicians.

For now, the infusion of new capital and a marquee customer gives Harbinger a chance to lead the medium-sized transition into electric vehicles — a segment in which it is operational realities, not showroom floor appeal, that ultimately determine who survives.