Google is beefing up its market-tracking game with new Finance beta features on earnings that now stream the latest live calls, produce instant transcripts, and automatically create artificial intelligence summaries to the minute. With stocks still slavering at an intensity of mega-cap tech names, these are moves that will make it easier – and quicker – to cover earnings season for investors.

An updated Google Finance beta adds an Earnings tab to companies on its watchlist and a searchable calendar of market calls. During a call, users can listen and read the real transcripts quickly; AI-driven highlights are designed to pick key points, such as reporting sales and earnings per share (EPS) adjusted compared to the expectation of revenue and EPS at T-0, and how the present quarter compares to the last. They are regularly updated as new information appears—press releases, Q&A moments, or price reactions—so the context changes as the market information changes.

Currently, the Google experience is available in U.S. English for users located in the U.S., as part of a larger overhaul that started earlier in the year and offers better AI and Q&A charting. Earnings season funnels more seller than market attention into a few weeks each quarter. Recent growth, according to S&P Dow Jones Indices, has been sharply focused on a very tiny cluster of mega-cap tech beasts, explaining why individual earnings disclosures can often swing the index price movement. Retail and advanced users can maintain a price advantage that quickly understand the results.

Features include streams, transcripts, and AI highlights

Opening an approaching event from the schedule, or tapping a stock in your watchlist, opens an Earnings tab. First, you can listen to the call stream, browse the transcript as it is rolled out, or read an AI summary bulleting the headline amounts.

- Revenue and EPS versus consensus from large aggregators—Yahoo Finance, FactSet, MarketWatch, and Refinitiv

- Quarter-over-quarter and year-over-year changes

- Notable trends versus past beats and misses

- Guidance shifts, differences versus analyst estimates, and stock price context

When a chipmaker, for example, publishes revenue up twice, the AI notes gross margin guidance down. It also reveals how the guidance shifted, how much it disagreed with analyst estimates, and the stock price context. The aim is not only the numbers; however, the numbers help assess what they are likely to express in sentiments and multiple values.

Even some call coverage and summaries of post-call transcripts are not modern. Bloomberg, FactSet, Refinitiv, and Seeking Alpha have long been behind paywalls. Yahoo Finance and TradingView calendars, quotes, and a few more call-coverage sources support it. Google’s advantage is the millions within a program that billions of people already contact daily, combined with AI summaries launched directly from the home and watchlist method.

Availability and market context for the new Finance tools

Retail power will remain intense, too. Vanda Research estimates that on an active day, individual investors will represent a fifth of U.S. equity trading. Closing the information asymmetry gap can be done without a terminal or a paid transcript service, with tools that bypass the jargon and organize comparisons—what changed, what beat or missed, and what guidance recommends.

In a market obsessed with AI beneficiaries, the gap between narrative and numbers can widen. When expectations are elevated, even a small revenue miss or softer margin outlook can trigger sharp moves. Data from S&P Dow Jones Indices and major brokers show that post-earnings one-day swings have remained elevated for high-multiple names in recent cycles, underscoring the value of rapid context.

Benefits, limitations, and regulatory considerations

If executed well, the integration lowers friction: no hunting for the webcast link, no waiting hours for a transcript, and a standardized view of results versus estimates without jumping between tabs. That convenience can matter when seconds and comprehension count. There are caveats.

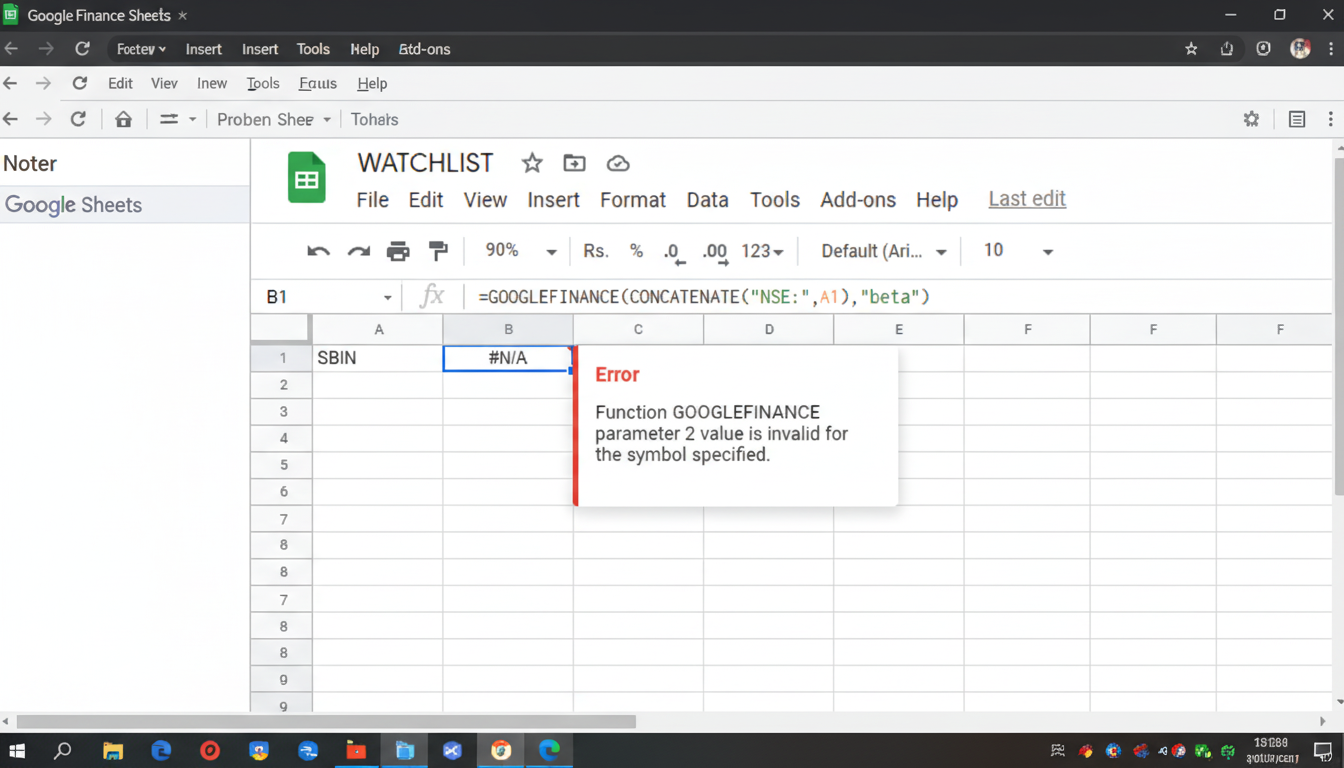

- AI can misread context, especially when companies mix GAAP and non-GAAP metrics, adjust for one-time items, or alter segment reporting.

- Consensus figures vary by source, and the definition of “beat” can differ.

- Investors should cross-check summaries against the official press release, 8-K filings, and the company’s guidance language.

- Under SEC Regulation FD, material information must be disclosed broadly; public webcasts and filings meet that standard.

- Summaries enhance access but do not replace primary sources and are not investment advice; treat them as a fast first read, not a final verdict.

Outlook for broader support and deeper integration

Google’s list is not a panacea for outperformance. However, it narrows the gap between the raw call and the already solid opinion. For many investors, that is enough: less noise, fast signal, a simple way to find out if history suits the scorecard.

The industry should anticipate broader language support and deeper alerts, as well as closer ties between summaries, graphs, and investment tools. If Google simplifies the tracking of standardized guidance and multi-quarter trend charts, Finance could go from an hourly check to a quarterly earnings control panel. Meanwhile, if you track earnings, you can listen, read, and digest it in one go—and do it in time to be relevant.