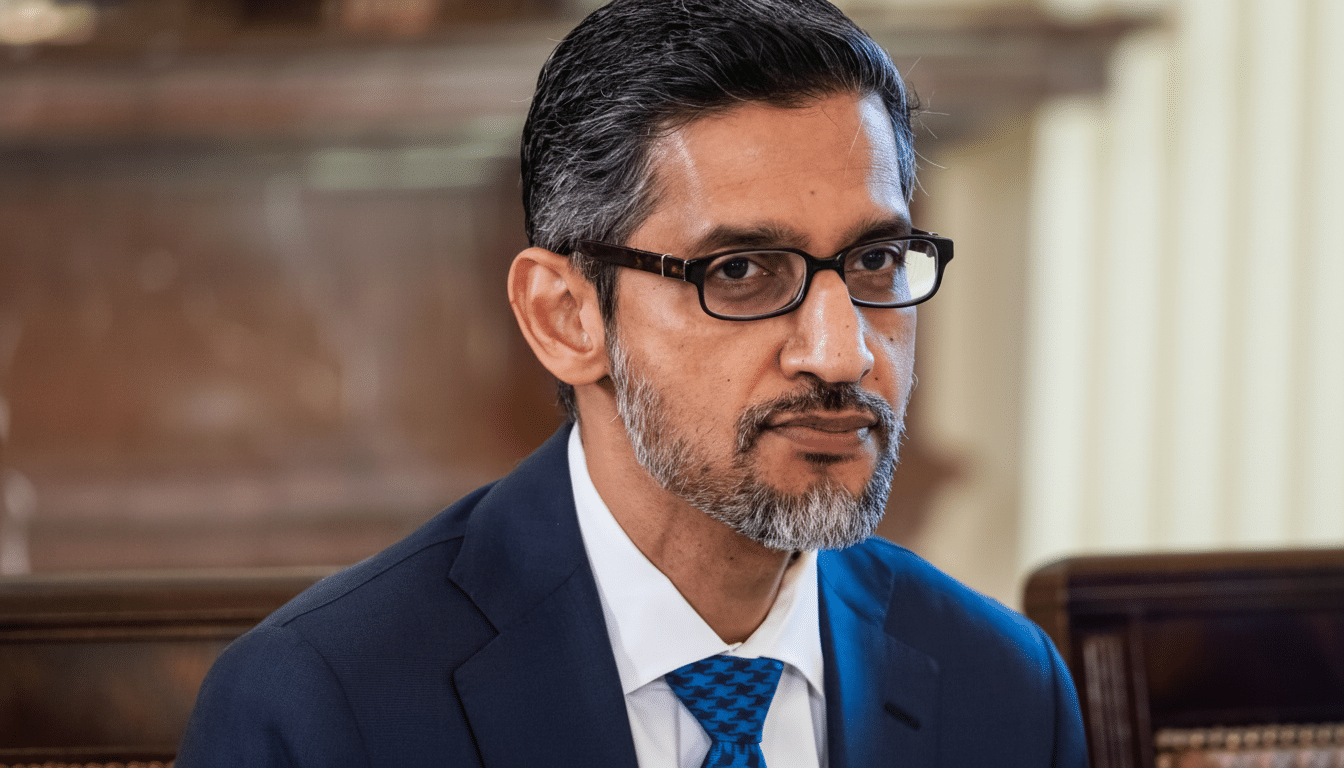

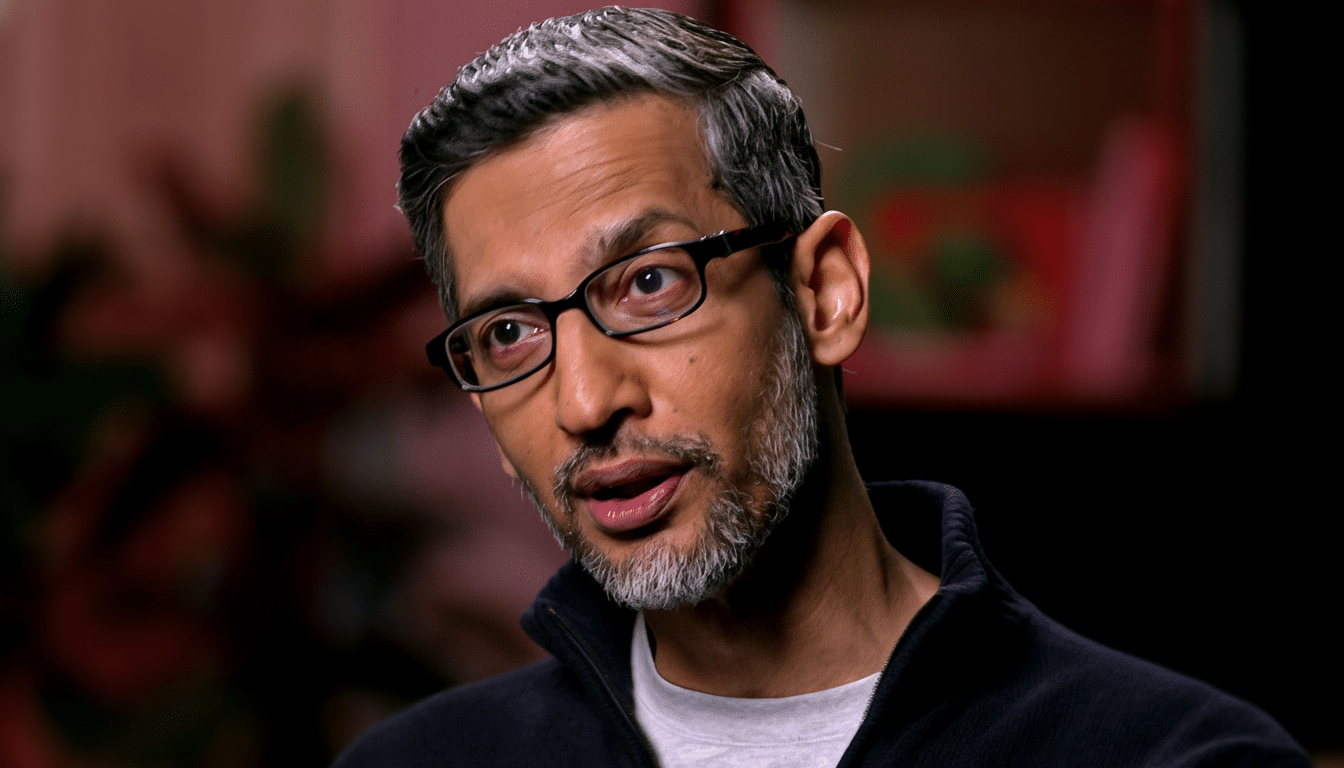

Alphabet Inc. CEO Sundar Pichai is sounding a note of caution on artificial intelligence, warning that the technology could produce negative results if not carefully managed.

Pichai wrote in an opinion piece for the Financial Times that there are “real concerns about the potential negative consequences of AI, from deepfakes to nefarious uses of facial recognition.”

- A familiar hype cycle in technology and capital markets

- Early signs of overheating and concentrated AI risk

- The hard limits confronting AI: energy and compute capacity

- What a reset in the AI economy might realistically look like

- Signals that matter more than hype in assessing AI value

- Pichai’s caution without doom: discipline over retreat

The head of the parent company of Google isn’t urging AI regulation, but did say that governments will likely have to be more involved and that some safeguards are needed.

“As with any new technology,” he said, “it also brings challenges and risks.”

In an extensive interview with the BBC, he admitted that if there is a pop in the AI bubble, it would not leave even the largest players unaffected. What he was saying is obvious: The opportunity here is vast, but so is the potential for excess.

A familiar hype cycle in technology and capital markets

Pichai’s diagnosis fits into a familiar tech pattern. It roared in, but like every new era under the internet’s gaze, ended in a painful reset. And still rewired the global economy. He believes AI is on a similar path — revolutionary in the long run, but vulnerable to short-term irrationality as billions of dollars flood into the field and expectations get ahead of reality.

The new market milestones say a lot about the degree of enthusiasm. Alphabet has been rumored at a $3.5 trillion value, OpenAI at around $500 billion in private markets, and Nvidia over $5 trillion thanks to unprecedented demand for AI chips and infrastructure. Those numbers have concentrated risk. When investors price in perfection, even minor disappointments can move whole indexes.

Early signs of overheating and concentrated AI risk

Cracks are visible. Star alumni investors have pared back or exited stakes in AI bellwethers while high-impact short positions targeting AI-related names are testing the overall trend. The pattern is familiar: insiders selling secondary shares, stretched revenue multiples, and premium prices for companies with promising demos but unproven unit economics.

Venture funding has rushed into generative AI at a record clip, according to trackers like PitchBook, which show investors often chasing compute-intensive models lacking clear paths to durable margins. On the public side, the “AI trade” has focused returns in a tight band of mega-caps, a condition that historically leaves markets vulnerable when sentiment shifts.

The hard limits confronting AI: energy and compute capacity

It’s not just about valuation froth.

AI hits physical barriers. The International Energy Agency has sounded the alarm that data center electricity demand could roughly double within a few years, straining grids and making it harder to meet climate goals. Use of water for cooling, and difficulty in siting close to dense load pockets, contribute to the drag. None of this means the AI boom is over — but it can slow deployment and drive up costs.

Compute remains a chokepoint. Advanced chip packaging, networking equipment, and power delivery systems have long lead times. With companies already spending tens of billions on data centers, GPUs, and custom silicon, the cloud providers are trying to continue investing heavily and serve more customers. Returns are going to be squeezed if customer spend lags capacity additions. If inference costs don’t come down fast enough, companies will have tough decisions to make in business models that rely on free offerings or ad-supported usage.

What a reset in the AI economy might realistically look like

If a correction is to come, history tells us we will see a shakeout at the application layer. The least lucky are those startups with undifferentiated data, distribution, or defensible gross margins. Consolidation would come next, with “picks-and-shovels” offerings (semiconductors; power systems; optical networking; and selected cloud services) likely to stay relatively resilient but far from immune.

Regulation is another swing factor. The EU AI Act, continued competition scrutiny in the US and UK, and sector rules for model transparency and safety testing will define cost structures and go-to-market timelines. For operations dependent on scraping web data or implementing frontier models at scale, compliance might become a gating item for expansion.

Signals that matter more than hype in assessing AI value

Investors and operators are watching a few practical indicators to distinguish durable value from hype:

- Productivity lift in actual workflows

- Payback periods on AI deployments

- The rate at which inference costs fall relative to usage growth

Generative AI, McKinsey has estimated, may add trillions of dollars in annual economic value, though the distribution of that value depends on sustained cost curves and adoption beyond pilots.

Watch also for model specialization. Many companies are moving away from one-size-fits-all chatbots and toward smaller, domain-specific models that cost less to operate and are easier to oversee. That bodes well for companies with their own trove of unique data and industry expertise, rather than general-purpose novelty. Gartner and others have observed that the road to scale is less through impressive demos than through integration into existing systems of record.

Pichai’s caution without doom: discipline over retreat

Pichai is not advocating a full-on retreat. His point is that durable platforms sometimes follow periods of excess — and no company, not even Google, can be impervious to the cycle’s downward side. In practical terms, that makes the case for disciplined capital allocation, transparency on AI unit economics, and a clear line from model capability to revenue and margin.

The story of AI isn’t complete yet. Even if the bubble label sticks, history suggests it will be a detour rather than a dead end. The winners will be whichever companies marry technical breakthroughs to business fundamentals — turning curiosity into cash flow while the rest of the market relearns the price of optimism.