General Motors’ campaign to bring its technology efforts under one communications umbrella is gaining traction as three top leaders in software have left while a wave of new hires arises under the auto giant’s recently installed chief product officer. The restructuring centralizes authority over hardware, software, artificial intelligence and product management in one grouping aimed at pace and accountability across GM’s vehicle portfolio.

Why GM Is Rewiring Its Software Organization Now

GM formulated the chief product officer position to break down long-cemented silos that delineated between vehicle engineering, battery programs and digital services. That remit now belongs to Sterling Anderson, an experienced autonomy and product leader who reports to President Mark Reuss. Anderson’s purview is end-to-end: he’ll ensure that mechanical and electrical engineering work well with cloud services, in-car operating systems, user experience and post-sale software features to enable faster product cycles and cleaner handoffs from one stage of production to another.

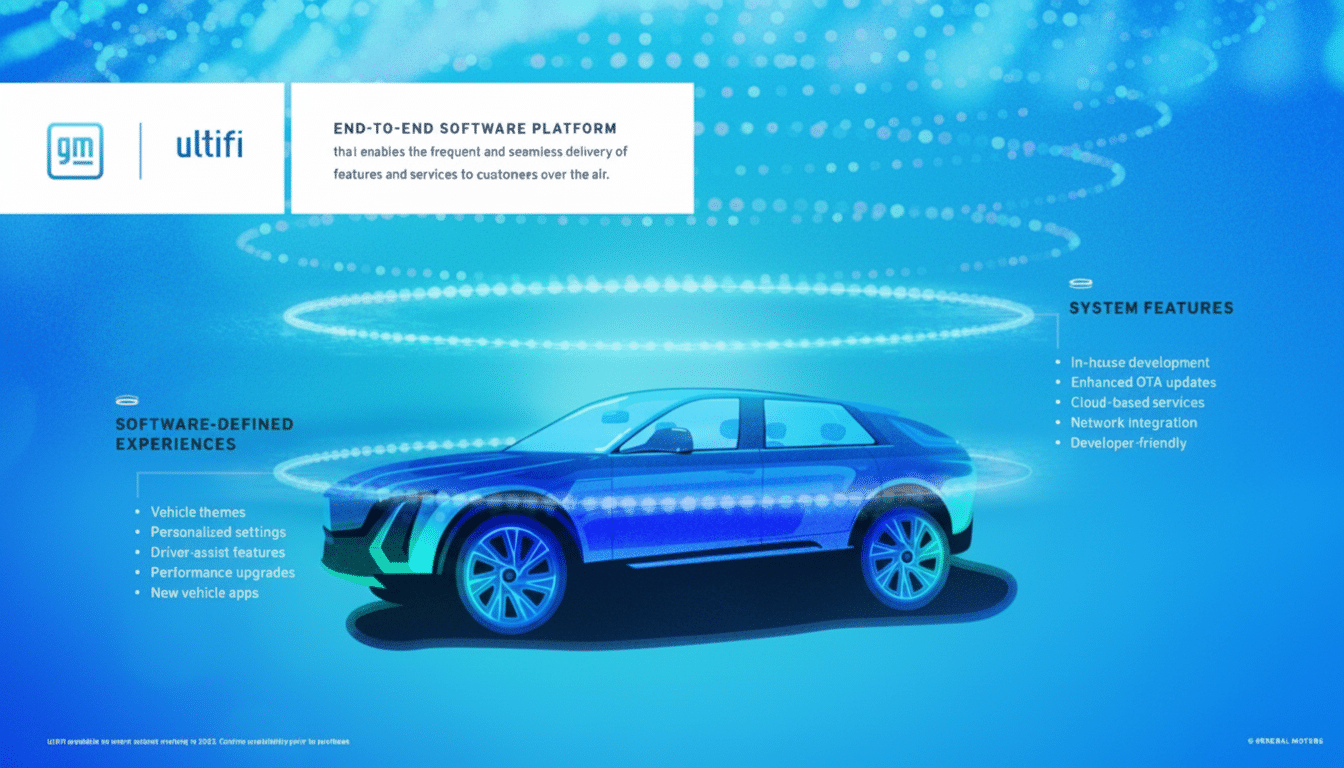

The move is a sign of how a car program today depends as much on computer code as it does on pistons and crankshafts. GM has put money into its Ultifi software platform, advanced driver-assistance systems like Super Cruise and Ultra Cruise, and subscription-based services built on top of connected cars. The company has also communicated to investors that it is aiming for $20–$25 billion in software and services revenue annually by 2030, the kind of number that demands both reliable platforms and a steady stream of feature releases.

Industry data supports the pivot. By 2030, as more of the value in an automobile moves from hardware to software code, that market could approach the mid-$400 billion range, McKinsey estimates. That makes for a premium on integrated orgs that can ship secure over-the-air updates, harmonize data pipelines and synchronize AI features across infotainment, autonomy, energy management and safety.

Who Is Leaving and Who Is Stepping In at GM

In the last few weeks, GM’s senior vice president of software and services engineering Dave Richardson and head of AI Barak Turovsky, as well as another technology leader Cetinok, left GM.

Richardson and Cetinok came to the automaker in 2023, each with a pedigree from major tech companies like Apple and Google. Earlier this year, Turovsky had been brought on board to help GM level up its AI stack across products and operations.

The resignations come as Anderson reorganizes and makes a new round of appointments. GM hired Behrad Toghi, who had worked at Apple before, to oversee AI and tie together the development and deployment of car models with those in the cloud. The company also named Rashed Haq as vice president of autonomous vehicles, drawing on his experience managing AI and robotics at Cruise, the self-driving vehicle unit GM had bought and then folded. In a milestone for the automaker, Cristian Mori was tapped to lead robotics, a new position that focuses automation strategy beyond the production line and into future mobility platforms.

Together, the changes indicate GM is centralizing authority even as it selectively backfills with executives who have shipped complex, safety-critical software and scaled AI systems. It’s part of an effort to minimize overlap between teams, make sure mandates are clear, and to influence execution on a roadmap that spans from core vehicle controllers down to consumer-facing apps.

What It Means for GM’s Software Roadmap

In the short term, removal of organizations can slow down delivery as teams adjust to new reporting lines and priorities. In the longer term, a single line of command from battery management to infotainment to autonomy can cut out duplicated architectures, integration defects and streamline over-the-air feature rollouts. That’s a big deal for everything from energy optimization and diagnostics to driver-assistance reliability and in-cabin experiences.

The hiring of a robotics chief suggests that GM plans to treat automation as a core capability, not just a way to burnish its plants’ floors. Anticipate those investments in sim, perception and controls will be leveraged across the assembly, logistics and on-vehicle systems. Meanwhile, the hiring of AI leadership with big-tech and autonomy backgrounds signals GM is betting on in-house model development and deployment frameworks—which are crucial for scaling features safely while meeting regulatory scrutiny.

Execution risk remains. Keeping senior technical talent is a problem throughout the industry, and GM is operating in a market where consumers compare the pace of innovation to smartphone-like update cycles. The winners will be the companies that can standardize vehicle software platforms, ensure data flows are protected and monetizable, and do all of this without jeopardizing safety or quality.

How GM’s Overhaul Compares With Rival Automakers

GM is far from the only one retooling for software-defined vehicles. Ford combined digital and hardware development in one cross-functional product group headed by seasoned tech operators. Volkswagen has been reworking its Cariad unit for years after software snags hobbled core models. Tesla’s vertically integrated approach is still out in front as a model for fast updates and close coupling of hardware with software.

The lesson from these attempts seems to be that governance and architecture matter as much as headcount. Centralizing platform teams, monolithic codebases and strong safety cases all reduce friction and rework. GM’s recent actions—focusing leadership, acquiring more AI and robotics depth, and aligning product ownership—are in service of delivering those advantages at scale.

With three high-profile departures and a revamped bench of technical leaders, GM’s software strategy is being tested in the proverbial crucible. If one company can turn vision into a swifter, stable development pipeline, that’s a meaningful payoff—not just in subscription revenue, but in quality and safety and (not least) customer trust through millions of vehicles.