Ford and the South Korean company SK On are dismantling their U.S. battery joint venture, unwinding a marquee alliance that was supposed to be central to an $11.4 billion plan for Ford’s next generation of electric cars and trucks. The assets will be divided between the companies, with Ford gaining ownership of the twin battery plants in Kentucky and SK On operating the battery factory at the BlueOval City campus in Tennessee, according to both companies and reporting from Bloomberg.

Nor, for the most part, are the factories being mothballed. They will proceed under separate ownership and supply agreements, a strategic repositioning instead of a retreat from American battery manufacturing.

How The Split Will Impact BlueOval Projects

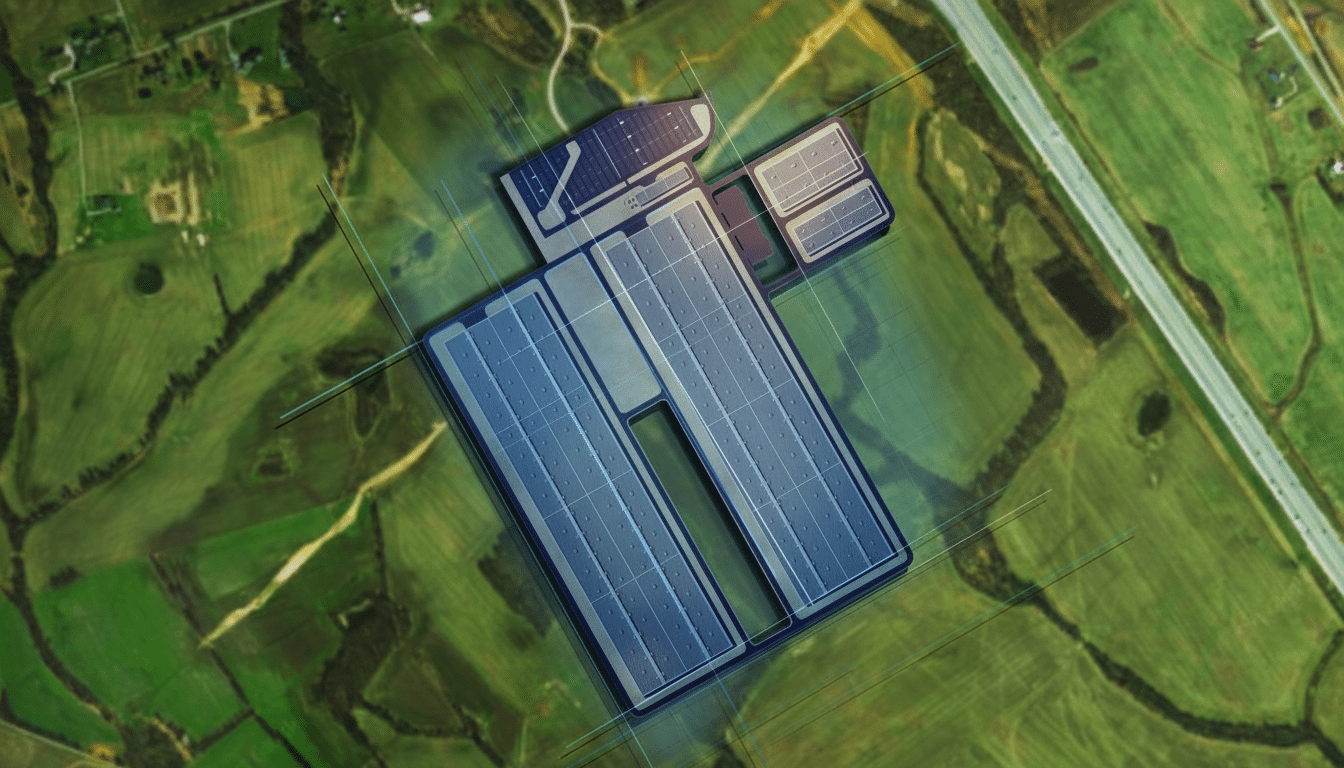

The Kentucky plants in Glendale — referred to as “twin” because they were meant to produce high-volume nickel-rich cells for several Ford vehicles — stemmed from that deepening relationship with the startup. In the new deal, Ford will own and operate those plants itself, gaining a significant level of control over an important piece of its North American EV supply chain.

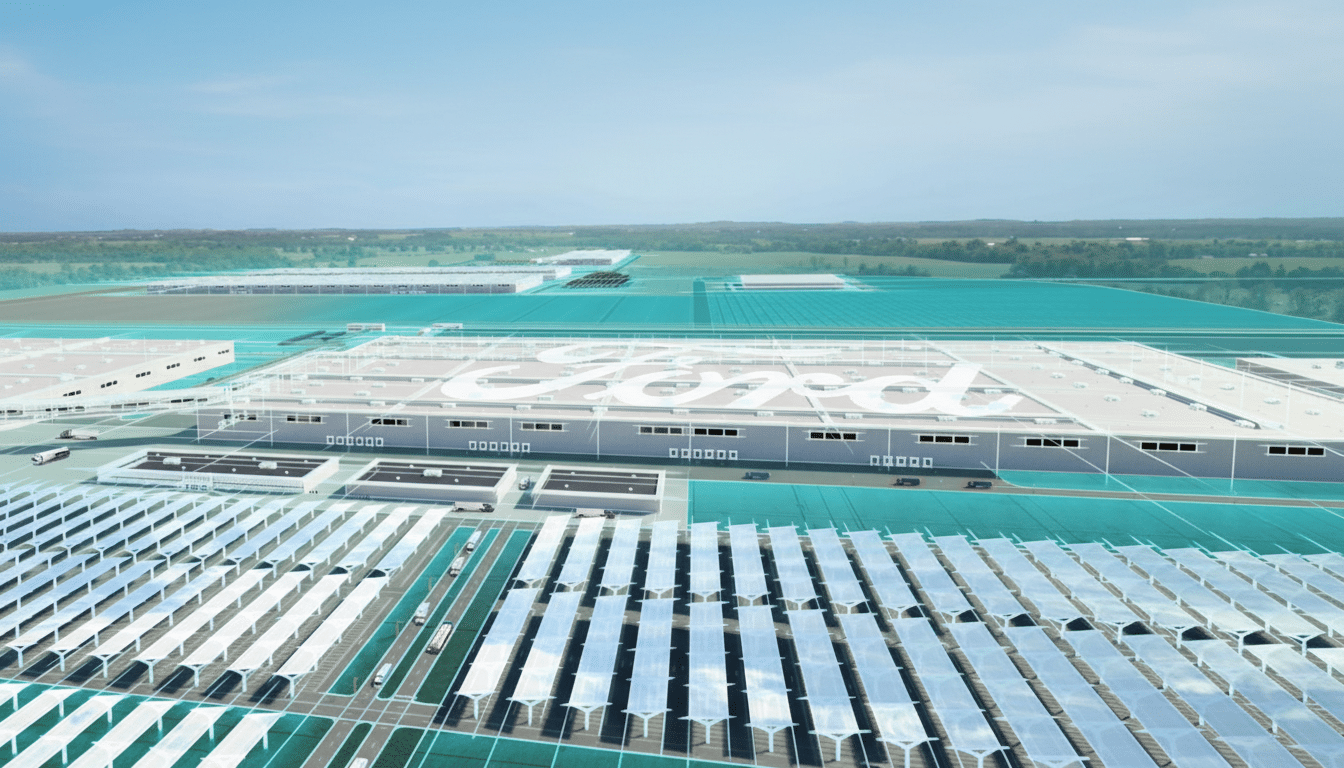

In Tennessee, SK On will operate the battery factory adjacent to Ford’s BlueOval City for vehicle assembly, which will construct Ford’s next-generation electric pickup. Although the joint venture is winding down, both companies say they are still planning to have a strategic partnership focused on that Tennessee plant.

When the plants were announced in 2021, the three facilities received a combined annual capacity of an estimated 129 GWh — which public estimates show as about 86 GWh at one location in Kentucky and around 43 GWh in Tennessee. The split leaves operational questions unanswered — who does final pack integration, how cell specs will evolve and how supply contracts are organized — but it clarifies responsibility for cost, yield and timing at each site.

Why the JV Went Out of Tune for Ford and SK On

Automakers rushed into battery joint ventures during the last investment cycle to secure technology, workers and materials. Since then, EV demand growth in the U.S. has softened relative to previous projections and model-by-model tax credit eligibility was rejiggered as Treasury’s battery content rules tightened under the Inflation Reduction Act. That brew has transformed production schedules, pricing and capital plans throughout the industry.

SK On, a member of SK Innovation, has been ramping up in North America against margin erosion observed within the battery industry. For its part, Ford has twiddled with EV capacity ramps and rephased some investments and focused on a mixed portfolio of hybrids and EVs to meet consumer uptake. The JV unwind in turn allows both companies more direct control over costs and timeline, while preserving the all-important offtake relationship.

Jobs, Capacity and Local Impact in Kentucky and Tennessee

The investment package was projected to create some 11,000 jobs in Tennessee and Kentucky. State-level training programs and infrastructure buildouts have been in the works for years, and both companies reiterated that launch and construction plans are ongoing. If no longer a two-person industry decision, the ownership change might even streamline hiring and day-to-day operations.

Capacity targets remain critical. U.S. state agencies and industry followers have counted more than 1 TWh of announced lithium-ion manufacturing capacity by decade’s end, but actual ramp rates depend on demand and the time taken to qualify production. By putting Kentucky under Ford and Tennessee under SK On, each OEM can tailor their ramp to specific product roadmaps and customer commitments.

What It Means for Ford’s EV Strategy and Costs

Ford has been pursuing a diversified battery playbook — high-nickel chemistries for trucks and performance, iron-based cells for affordability — as well as a drive to localize supply under IRA rules. Owning the Kentucky plants could enable a more direct line between vehicle design, pack architecture and manufacturing cost — a lever that Ford is pulling as it aims to drive down battery costs per kWh while achieving higher profits on electric trucks and SUVs.

SK On is still a critical supplier. Its Georgia operations already supply cells for Ford’s E-Transit and F-150 Lightning, with the Tennessee plant putting SK On at the heart of Ford’s next-gen pickup program. For SK On, being an operator in Tennessee maintains the volume of production and a prestigious anchor customer while providing operational freedom to maximize technology and sourcing.

The Market Backdrop for EVs and U.S. Battery Capacity

EV sales in the U.S. are still trending upward, but the curve is flattening out from triple-digit growth rates seen earlier. Data from Cox Automotive indicate that EV share is close to high single digits, with inventory dynamics and incentives driving big moves on a monthly basis. Meantime, changing U.S. content rules have restricted which models are eligible for credits, creating complexity for both shoppers and planners.

Battery makers and automakers are responding by rebalancing — honing in on higher-utilization plants, stretching capital and sequencing launches. Analysts at S&P Global Inc. and BloombergNEF have observed a “wide pivot” to modular capacity additions and closer supplier ties — moves that appear in line with Ford and SK On’s decision to dissolve the JV while keeping the production shell holdings in place.

What to Watch Next as Ford and SK On Unwind the JV

Catalyst #5:

- (Possible) Kentucky/Tennessee plant commissioning timelines and next-gen truck cell chemistry disclosures

- Additionally, any adjustments to long-term offtake volumes

- Also keep an eye on how Ford weaves Kentucky operations into its larger battery cost road map, and if SK On broadens customer diversification from the Tennessee base

The headline is breakout, but the practical read is continuity with a much clearer set of lines and chains of command. In a market dominated by rapidly shifting demand, policy filters and cost pressures, that clarity could be more valuable than the joint venture entity it supplants.