Fizz, the anonymous college social app, is moving beyond posts and campus talk to same-day essentials, thanks to grocery delivery from Gopuff, which is being rolled directly into the app. The new “Fizz Store” brings that vision to life by transforming dorm-room cravings and team runs into a few taps, taking curated carts and instant delivery, and putting them in the same feed where students already organize life around campus.

The move capitalizes on Fizz’s existing footprint — more than 620 campuses, and tens of millions of posts — in response to an obvious pattern: Students already use the app’s built-in marketplace to buy, sell and arrange pick-ups. With Gopuff in charge of last‑mile logistics, Fizz can keep activity in‑app and lower the friction between discovery (“we need snacks for study group”) and fulfillment.

Why a social app is venturing into grocery delivery

At most schools, grocery runs are a social calculus: who has a car, who’s in the group chat, who’s going to cover the order. Fizz’s team notes there were already students organizing deliveries and local deals on its marketplace, so a native checkout made sense as the next step. That matches broader social commerce trends; research from companies like McKinsey shows that conversion rates soar when you’re shopping inside communities where the intent and recommendations were already living.

Teaming up with Gopuff makes the model work. Gopuff’s business is built on micro‑fulfillment centers geared for instant needs — energy drinks, pantry staples, toiletries — that also dovetail with college demand. Both target Gen Z and play up speed and convenience, closing the time between a meme about late-night ramen and the ramen arriving.

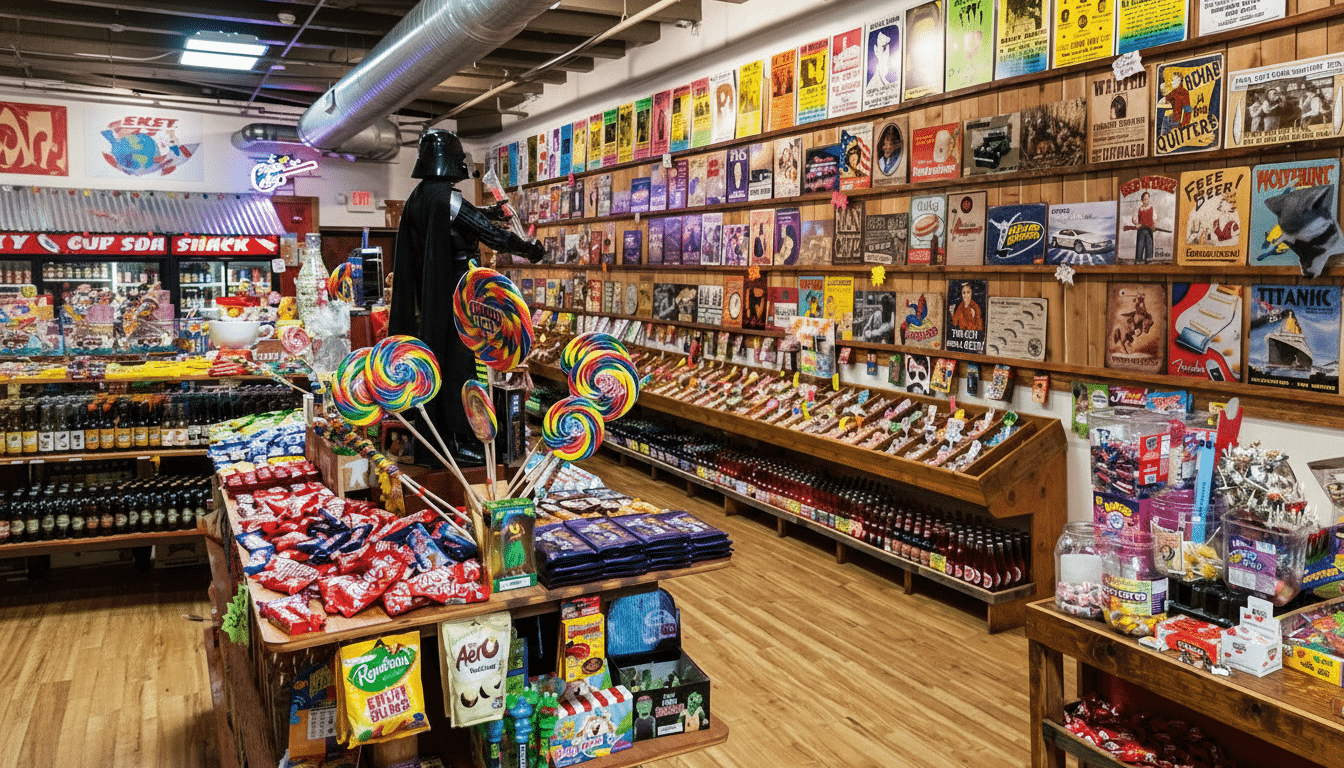

Fizz is also designed to help eliminate decision fatigue. There are pre‑selected collections like “Gym,” “Study Fuel,” and “Rush,” grouping category favorites into one‑tap bags. That playbook runs rampant in fast delivery as it decreases time to checkout, increases average order value, and generates sponsorship inventory for CPG brands during peak campus seasons.

How Integration Works for Students

For students, being able to browse essentials while inside Fizz, and then hand off convenience items for fulfillment to Gopuff, can reduce bouncing between apps. At its best, the promise is context: a thread about a late lab session might be just a swipe away from sponsor-curated “Study Fuel” bags, delivery routed to dorms or off‑campus housing where permitted.

Privacy is important on anonymous network. Purchases aren’t social content, even in an app built around pseudonymous posting. The companies haven’t yet provided specifics about account linkage and payment flow, but the integration is being cast as a transaction-bypassing move designed to optimize ordering while protecting the identity they’ve created for themselves in social from becoming transactional — an important show of trust for campus communities.

Pricing specifics weren’t disclosed. Typically, partners are kept aligned with Gopuff’s core catalog pricing, promotions and membership benefits.” The larger differentiator is discovery and coordination: when you keep impulse, group planning and checkout in a single environment, that tends to drive more usage than the stand-alone delivery apps.

Intensifying competition among campus delivery

Fizz is not diving into an empty lane. Instacart, DoorDash, Uber Eats and local convenience chains are all vying for college spend, and many provide campus‑specific perks. What Fizz does have going for it is in how close it is to the intent point. It is already where the conversations — roommate move‑in lists, club events, tailgate planning — that grocery lists emanate from live.

Industry trackers such as NielsenIQ have observed the strength of “immediate needs” baskets across convenience and quick‑commerce, particularly among younger shoppers who prioritize time‑saving over assortment. By satisfying that demand within a social feed, Fizz can shorten the journey from inspiration to delivery without paid acquisition—something pure‑play delivery rivals must pay dearly for.

Monetization upside—and execution risks

For Fizz, the grocery delivery opens up three pots of gold: a cut of that delivery economics, payola for featured bags and season-long sponsorships around finals, rush or game days. It also deepens retention. When students go beyond Fizz as a place to talk to a place where they transact, daily active use and session length usually grow.

There are risks. Adding commerce can water down a social app’s brand if shopping suddenly feels ad‑heavy or off‑mission. The service is only as reliable as the third‑party network that serves narrow campus delivery windows. And university housing policies differ, further complicating drop‑offs and access. Execution will come down to tight ops, clean fee communications and smart mixing in of transactions without suffocating the feed.

Early momentum and what to watch

According to Fizz, engagement is going through the roof: the company has experienced a four-fold surge in daily active users, expanded to more than 250 additional campuses and completed a record string of sign‑ups. It has raised $41 million to date, and it stresses that the app’s center is still social, with commerce being positioned as an outgrowth of campus life, rather than a pivot.

They include order frequency per active user, adoption of curated bags and whether in‑app delivery lifts retention versus cohorts without the feature. If the model succeeds, look for bundles to grow into wellness and dorm room essentials, more partnerships with local merchants and deeper brand collaborations timed to the academic calendar. For now, Fizz is wagering that the quickest path from campus joke about running out of coffee to a caffeine fix delivered to the door is the one that happens inside the same app.