Two ex-Microsoft executives are betting that finance teams are ready to retire the “spreadsheet gymnastics” in which they perform. Their startup, Maximor, is now deploying a network of AI agents that automate the close, simplify reconciliations and produce audit-ready workpapers — without teams chasing jammed exports to Excel.

With the goal of serving mid-market and enterprise finance teams with manual spreadsheet workflows, despite massive investments in ERP, CRM and billing platforms, Maximor has raised a $9 million seed round led by Foundation Capital. Early results suggest customers are trimming close cycles and headcount demands, which would imply real operating leverage if fully adopted.

Why Spreadsheets Are Still King in Corporate Finance

Spreadsheets still are the Swiss Army knife of accounting, flexible, transparent and auditor-friendly. APQC and Ventana Research reaffirm that the majority of finance departments continue to rely on spreadsheets as connective tissue among systems, and that it typically takes most organizations a week to 10 days to close out a month-end period.

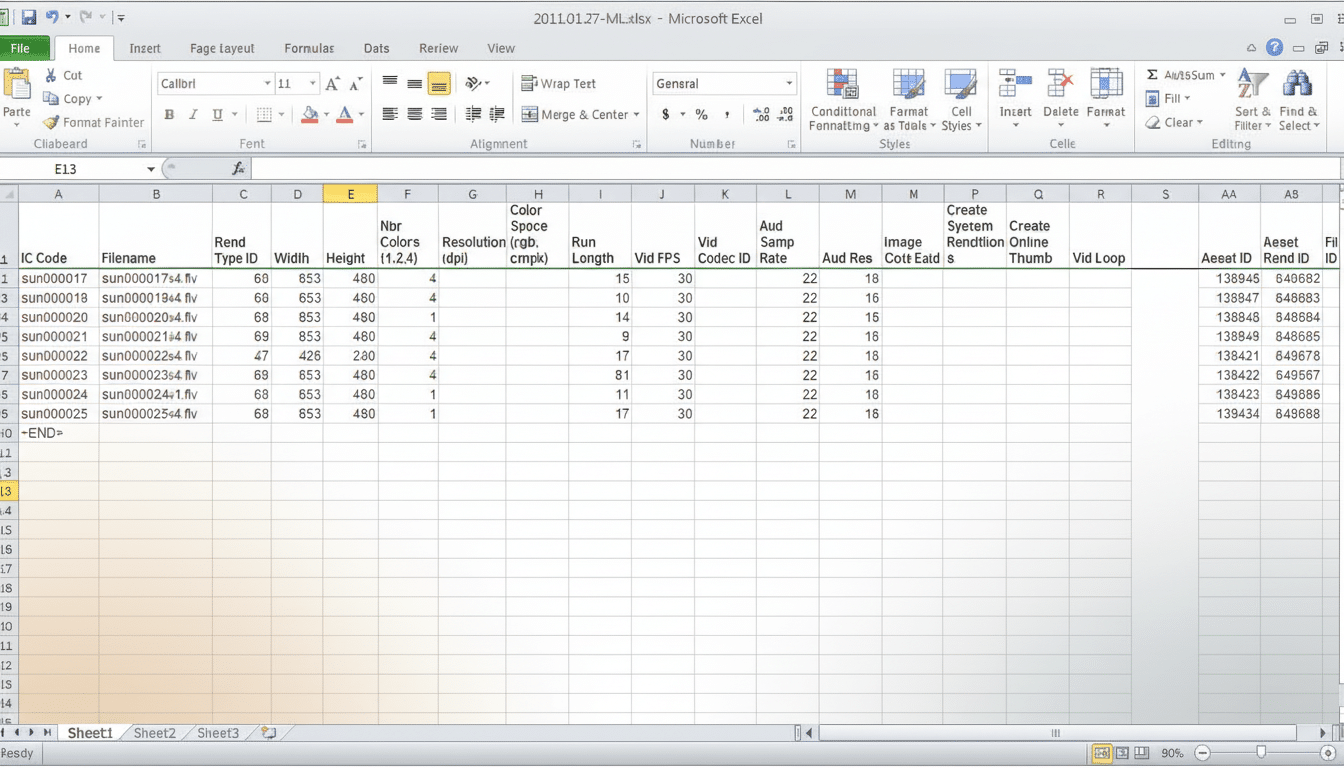

That convenience comes with risk. Recent studies by Professor Raymond Panko, a leader in the spreadsheet risk community, have consistently found that an overwhelming majority of live spreadsheets contain errors. In finance, copy-paste joins and VLOOKUP-laden tie-outs copied out of Excel alongside ad hoc overrides are particularly susceptible to version drift and broken-formula problems that multiply as transaction complexity and entity count grow.

Yet despite those pitfalls, Excel is often the last mile for auditors and controllers. It’s a universal format for sampling, footnotes and tie-outs: one reason “replace Excel” has been a losing battle across history. The second is to cut down the manual labor going into Excel, rather than trying to battle with the format.

How Maximor’s Agents Work Across Finance Systems

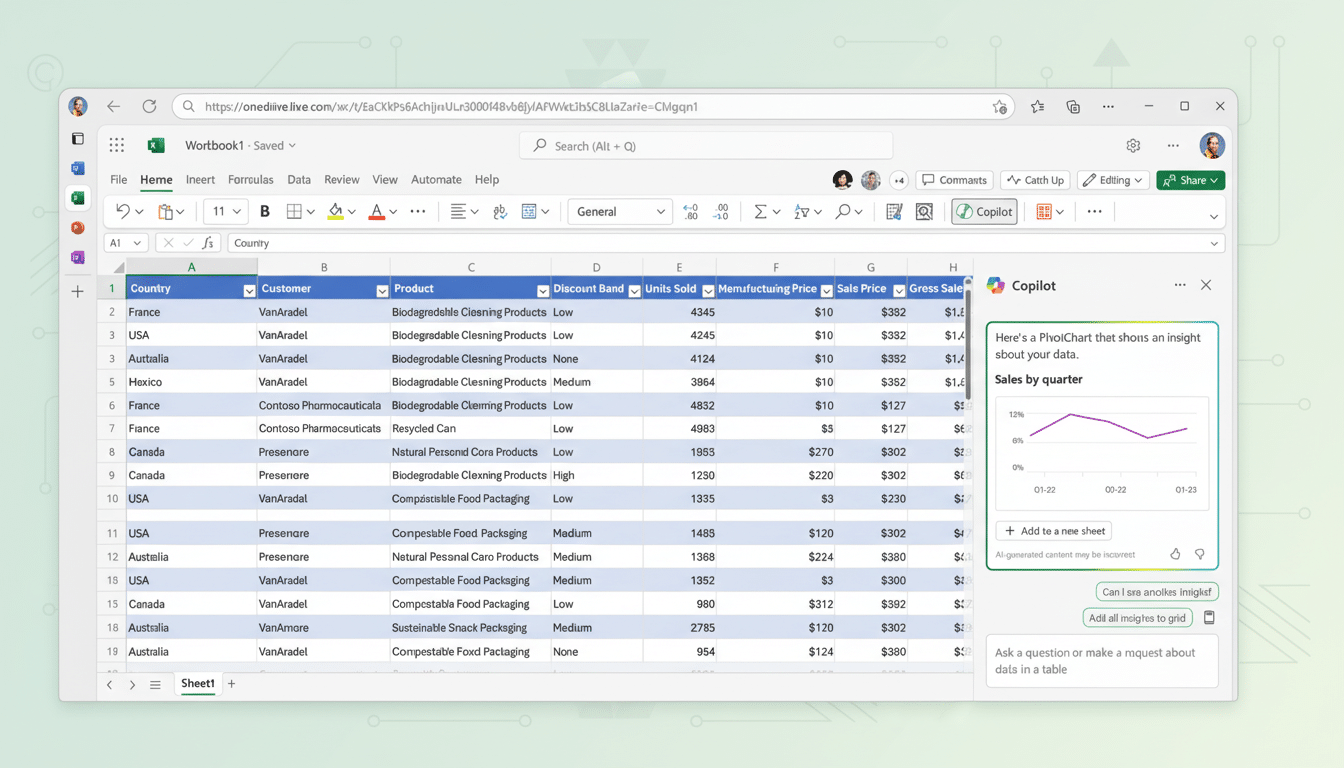

Maximor’s infrastructure links up with ERPs including NetSuite and Sage Intacct, accounting software like QuickBooks and Zoho Books, plus a smorgasbord of payroll, CRM and billing systems. Its agents continually intake transactions, reconcile operating and financial data, and execute rules that alert to discrepancies as well as generate reconciliation reports with reviewer notes and audit trails.

The idea is continuous accounting: subledger-to-GL checks, bank and balance sheet reconciliations, variance explanations throughout the period (as opposed to month-end). Teams can, when required, still export approved schedules to Excel—satisfying auditor requirements without reverting back to all the manual grind.

Maximor is compatible with GAAP and IFRS workflows and includes a human-in-the-loop option. Customers can route items to Maximor’s own accountants for review or outsource parts of the close altogether—an approach that’s meant to increase the confidence in agent output while aiding resource-strapped teams.

One early case study drives the pitch home: Property technology company Rently shortened its monthly close from eight days to four and eliminated two incremental accounting hires after implementing Maximor’s agency platform. The company says almost half of the team’s time was freed up to spend more on analysis and business partnering rather than routine reconciliations.

Funding, Team, and Go-To-Market Strategy and Footprint

Maximor was co-founded by CEO Ramnandan Krishnamurthy and CTO Ajay Krishna Amudan, who worked together at Microsoft on wide-scale finance and data transformations, including internal revenue systems and projects with Fortune 500 clients. The two met at IIT Madras and have been working together for over a decade.

The seed round features investment from Gaia Ventures and Boldcap, as well as finance executives from Ramp, Gusto, MongoDB and Zuora.

Big Four advisors also participated in the recent funding round.

Notable angels include Perplexity CEO Aravind Srinivas and Zuora CEO Tien Tzuo. Based in New York with an office in Bengaluru, the company has 18 employees across the United States and India and is hiring as it focuses on companies with $50 million or more of annual revenue. The startup has already attracted customers in the U.S., China and India.

Competitive Landscape and Adoption Constraints

Close and reconciliation automation is a crowded space. BlackLine made account reconciliation sexy for the masses; Workiva built a compliance and reporting spine; Oracle’s and SAP’s ERP suites now include native close functionality; while startups like Vic.ai and Trullion aim at AP and/or accounting subdomains. Even Microsoft and Google have been integrating copilots into finance workflows. The main differentiator for Maximor is an agent network optimized to ingest continuously and self-prep evidence that can be audited across many systems.

A fast draw won’t be enough to win the controller’s office. Finance execs also want powerful controls, role-based permissions, immutable audit trails and third-party attestations like SOC 1 and SOC 2. They’ll also inspect data residency, PII handling and how agents’ decisions are logged and explainable to auditors. There is also the matter of change management: teams must be confident that automated reconciliations will not create new blind spots.

What to Watch as AI Finance Agents Seek Adoption

Key proof points will be decreases in days to close, avoided FTEs added, a lower number of post-closes and faster audit cycles. How soon the software can be implemented, the scope of connectors for key mid-market staples such as NetSuite and Intacct, and workpaper output quality are all in play in deciding whether agents end up a daily driver—or just another tool alongside Excel.

If Maximor is able to make reconciliations near-continuous, reduce cycle time by 50% and produce the evidence that auditors will take with little or no rework, it won’t have to “kill” spreadsheets. It will just leave them a clean export at the end of a far more automated process—and, ironically, what finance teams have been asking for.