Divergent Technologies, which makes specialized military pieces at an advanced manufacturing plant in California, has raised $290 million for its next act as a defense industry parts supplier. First reported by Bloomberg, the round, which consists of $40 million in debt will help the company expand its footprint in Los Angeles and begin construction on a new factory that it is building in Oklahoma. Metal missile airframes are typically its “bread and butter,” CEO and co-founder Lukas Czinger said, according to Bloomberg.

Spurred on by demand from big primes—Lockheed Martin, RTX, and General Dynamics have been among the early adopters—Divergent is perched at the crossroads of two powerful market trends: rearmament-driven supply chain pushback and the maturation of industrial-grade additive manufacturing. The pitch is simple: Get lighter, more advanced parts delivered quicker with fewer suppliers and lightning-fast lead times.

New capital, new capacity

The company will use the funds to scale its proprietary production process in Southern California and break ground on operations in Oklahoma, an emerging aerospace and defense ecosystem – anchored by assets such as Tinker Air Force Base and a deep bench of MRO and machining talent. The new site is designed to provide throughput and geographic diversity for programs across missile structures, airframe components and other low-volume, high-performance parts.

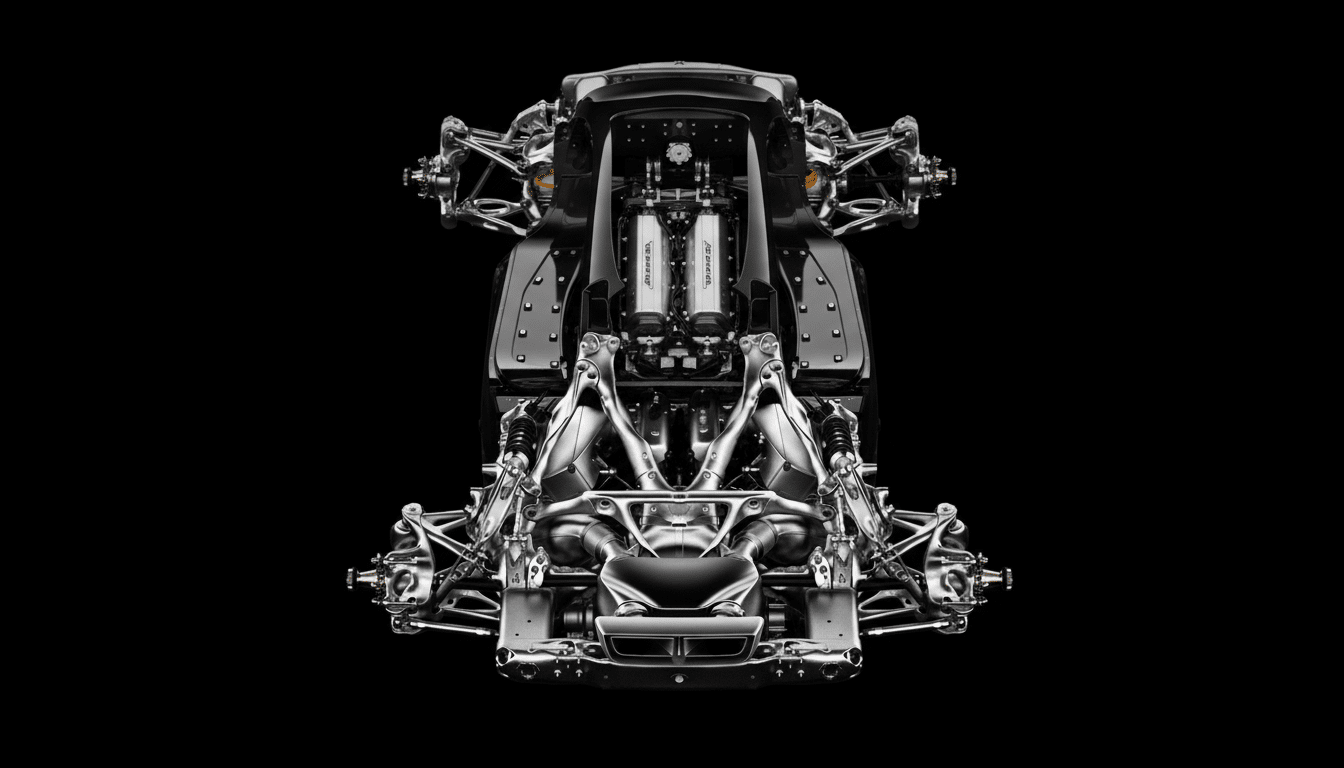

Divergent’s model combines generative design, large-format metal 3D printing and robotic assembly. And its printers can produce hundreds of different, topology-optimized parts that collapse what might have been dozens of castings and machined components into a handful of printable nodes and struts. Now that architecture, honed in the company’s automotive work and in the Czinger 21C hypercar program, is forming a foundation for an expanding defense portfolio.

The economics make sense to defense realities. High-mix, lower-rate production is commonly necessary for missile and advanced airframe programs, where tooling amortization and legacy vendor restrictions force cost and schedule. Additive manufacturing skirts both, allowing for iteration and the kind of field-driven design changes that don’t rip up a supply chain.

Why additive is a fit for missiles and specialized parts

Stay-away for missile airframes and internal structures value stiffness-to-weight, thermal performance, and tightly-looping integration. Additive also opens doors for lattice geometries and internal channels not accessible via machining, resulting in weight reduction and part count consolidation that translates directly to range, maneuverability and reliability. And it enables on-demand spares with a seamless digital thread, essential when inventory is stressed.

Defense industry guidance has pointed in this direction. The Department of Defense’s National Defense Industrial Strategy singles out advanced manufacturing as a lever to harden supply chains and hasten delivery. Munnitions and propulsion bottlenecks have been flagged by Government Accountability Office assessments numerous times; additive manufacturing is one of the only near-term means to de-risk niche suppliers and compress qualification timelines without trading off performance.

Divergent takes this a step further by incorporating design, printing and assembly into a closed-loop system. That digital continuity — design to powder bed to metrology — can help streamline qualification and repeatability, two longstanding barriers to 3D-printed metal parts. For primes, having that stack brought under one roof cuts down on integration work and simplifies configuration management across variations.

Customers, competitors and the supply chain reset

The company’s customer roster includes top-tier primes that have already invested heavily in additive. Lockheed Martin and RTX both have published case studies on printed brackets, ducts, propulsion; General Dynamics has also explored use-cases in land systems as well as aerospace. The benefit for Divergent is not the one-off printed parts, it’s serial, end-use structures — particularly in programs where legacy tooling would be expensive or lead times off of castings and forgings are measured in quarters.

The timing is favorable. Pentagon officials are seeking multiyear contracts to increase munitions output, and NATO partners are ferrying in new supplies. Policymakers in the industrial base have pressed for reshoring critical inputs, from powders to heat treatment. Amid that backdrop, a factory in Oklahoma offers geographic diversification and proximity to key defense corridors in the central U.S. to go along with the company’s Los Angeles capacity.

This is not the first strategic interest raised in Divergent, with industrial software leader Hexagon also contributing significant capital to the company, and highlighting that metrology and process control will be crucial in scaling printed metal production. The latest funding is an indication of broader investor confidence in the thesis that digital-first manufacturing can bridge long-standing holes in the defense supply chain.

What to watch next

Certification and quality control remain gating factors. Airframes and Load-Bearing Structures for missiles will have to pass stringent Non – Destructive Testing, Fatigue, Environmental tests standards with acceptable documentations that meet ITAR and cyber – security requirements. How fast Divergent can industrialize these repeatable qualifiable processes, and at speed, that will determine how quickly its parts move from prototyping to long run production lots.

Key checkpoints will see a groundbreaking in Oklahoma, initial production targets achieved – Oklahoma missile v. airframe mix entering serial production, POWD supply relationships established and disclosed, printer fleet size data revealed…post-processing capacity advertised as we go forward in the programs. If Divergent can turn that financing into certified throughput, it will prove a template much of defense manufacturing is scrambling to replicate: software-led design, additive at the center and a supply chain built with speed in mind rather than scale alone.