Indian space surveillance startup Digantara has raised $50 million in new equity capital to speed its transition into space-based missile detection and tracking beyond its roots in space situational awareness.

The Series B funding round brings the total raised so far to $64.5 million and was joined by new investors 360 ONE Asset, SBI Investment of Japan, and entrepreneur Ronnie Screwvala, as well as existing backers Peak XV Partners and Kalaari Capital.

The business wants to use that capital toward scaling its satellite constellation, expanding its U.S. presence, and accelerating manufacturing in India — a major market for LEO broadband.

Orbit’s Early Warning Is Target for New Capital

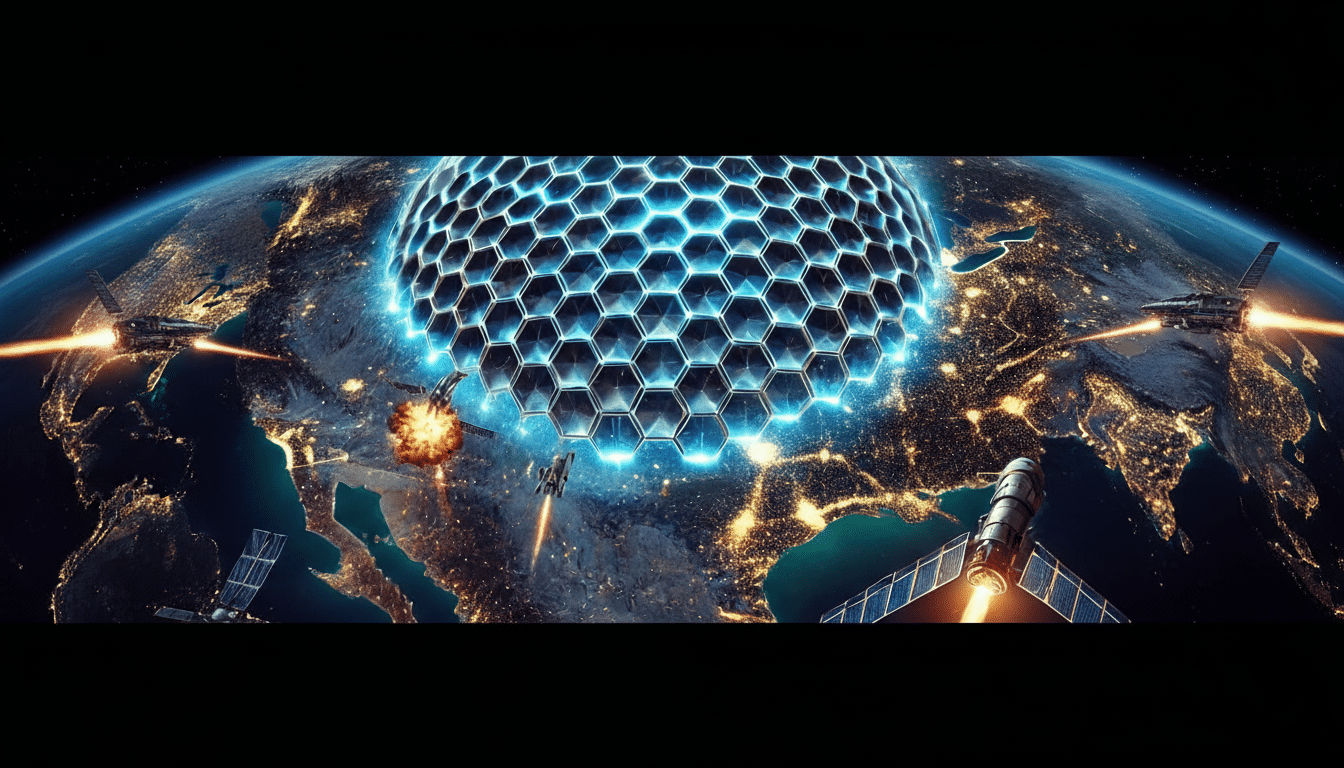

In the case of missile warning, militaries are moving activities to space to ensure they can detect threats that might otherwise be missed — such as those hiding behind the curve of the Earth or using terrain as cover, or denying adversaries advanced notice based on flight profile. From space, infrared sensors in low orbits can detect the hot plume of a launch immediately and track its trajectory without interruption, offering earlier cues for interception and creating surveillance of oceans as well as contested areas.

Digantara’s method combines information from space- and ground-based infrared sensors through software analytics to correlate data, enabling the system to identify launches and cut down on false positives. The company claims there’s a growing desire among customers for commercially delivered analytics-as-a-service that can fit into existing command-and-control systems, as opposed to custom hardware-only buys.

From Space Debris to Missile Detection and Tracking

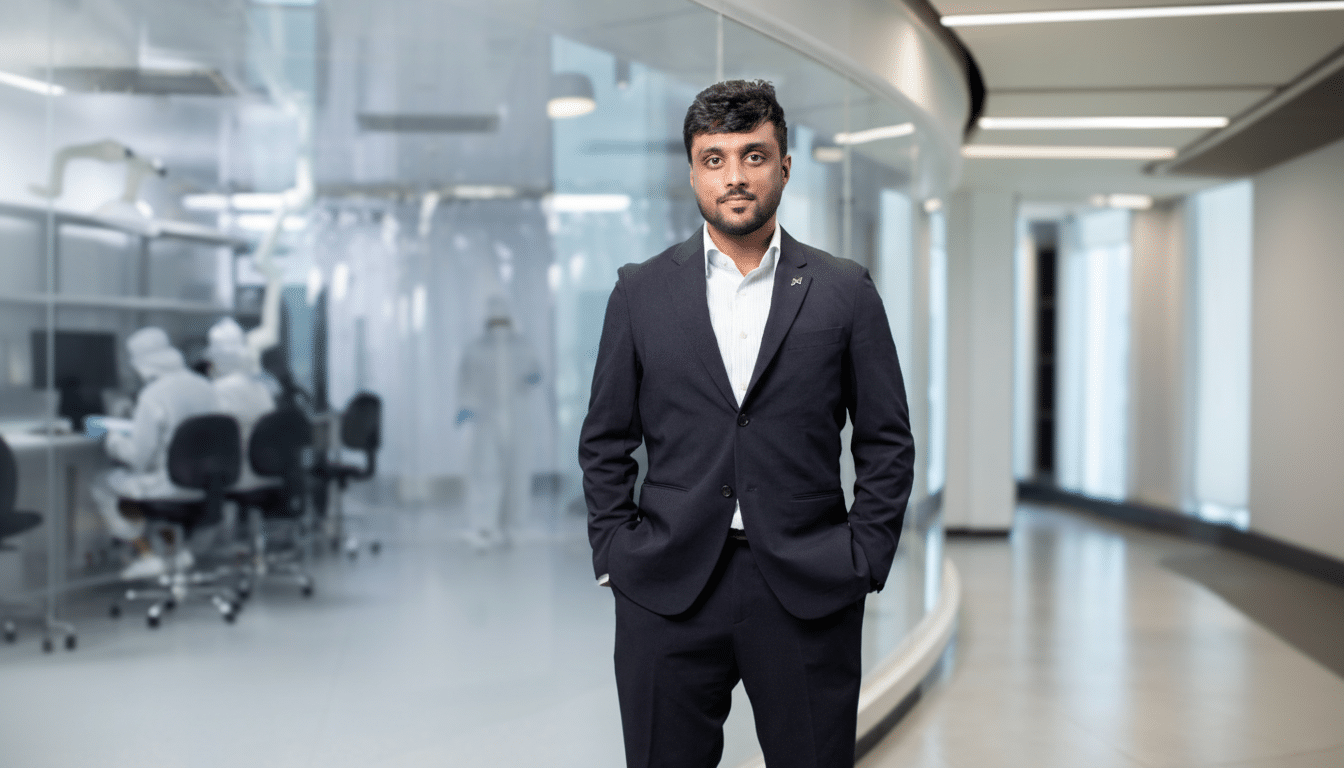

Launched in Bengaluru, Digantara began with space situational awareness, mapping debris and tracking satellites to avoid collisions. A ride-sharing mission hauled the agency’s first dedicated Space Surveillance Satellite, “a Small Camera for Object Tracking in Space.” This dedicated facility, SOCRATES, was well-suited to improve its abilities at cataloging and determining paths of objects.

Those abilities are now being used for missile detection. In addition to infrared payloads, the roadmap also sketches out electro-optical and LiDAR satellites that would supplement object identification and tracking. The company is also looking alongside the Office of Naval Research at potential applications for its LiDAR and laser expertise in future interceptor support concepts, an indicator it views benefits in end-to-end sensing-to-shooting timelines.

U.S.–India Dual-Track Strategy for Defense and SSA

To comply with requirements of national security and export controls, Digantara has divided work across geographies. This is the company’s second international expansion, and in the U.S., the firm has Colorado Springs operations, targeting defense programs, having won analytics contracts from U.S. Space Command along with being named to the Missile Defense Agency’s SHIELD contract vehicle dedicated to next-gen missile defense.

At the same time, India holds the torch for analytics and data processing as well as space situational awareness (SSA) solutions. The U.S. side largely concerns itself with developing larger 100-kilogram-class spacecraft for American defense needs, while India’s teams contribute software, advanced processing, and mission operations that can be gradually localized for Indian procurement.

Manufacturing Capacity and Launch Roadmap Ahead

In India, Digantara operates a 25,000-square-foot facility that can handle as many as five satellites at a time and envisions a significant expansion. A memorandum of understanding with the Andhra Pradesh state government is supporting plans for a new site that can produce 30 satellites — or possibly even more — at once.

The pace is picking up: another satellite is set to fly in March, and other missions are scheduled for June and October (including several spacecraft on the last one). Over the next two years, the company hopes to launch about 15 satellites. Headcount is close to 125, with about two-thirds in engineering positions.

Business Plan and Market Outlook for Growth and Sales

Digantara hopes the latest round will finance launches and help the business expand internationally. Management has set aside funds of $7–$10 million for the United States and $2–$3 million to launch in Europe, with the balance allocated toward scaling Indian manufacturing and delivery capabilities.

The company claims that revenue has grown over 10x in the past two years and is setting its sights on reaching $25–$30 million in annual run rate within the next 18 months as defense programs begin to ramp. Demand drivers do not stop at missile warning, with the European Space Agency calculating over 36,000 trackable debris objects in orbit, meaning there is a desire for persistent, high-fidelity surveillance that feeds into custody and threat-detection algorithms.

Competitive Landscape & Security Implications

Digantara explicitly spans the intersection of commercial agility and defense- and military-grade reliability. It dovetails with government efforts in early warning headed up by incumbents and competes with specialized commercial companies for space domain awareness. Policy reforms in India, which have sought more play for the private sector along with a greater focus on domestic production, have provided opportunities for startups to supply defense and promote compliance technologies for export.

The strategic stakes are high. Independent analyses conducted by defense think tanks have observed a consistent drumbeat of ballistic and hypersonic testing around the world, as well as increased risks to satellites from jamming and kinetic debris. Throughout the 21st century and beyond, a network of resilient space sensors with multiple paths to detect threats — reinforced with advanced analytics — could cut time between detection and tracking, enhance precision in missile tracking, and help deter adversaries. With this boost, Digantara is investigating whether it can provide those capabilities at a commercial pace of work — in line with how modern missile defense increasingly relies on space.